Trust-Minimized Ownership vs Centralized Price Exposure

Brian Cubellis | Chief Strategy Officer

Mar 26, 2024

This week, we wanted to take the opportunity to resurface a report written by Onramp co-founder & COO Jesse Myers roughly nine months ago. The report dissects the structure of BlackRock’s spot bitcoin ETF vehicle (still a proposal at the time of writing) and compares it to Onramp’s offering.

BlackRock Creates Bitcoin Vehicle: Half Good, Half Terrible

In the wake of the early success of spot bitcoin ETFs in the US, which have collectively amassed over 200k BTC in just over two months, it’s important to reiterate the principles on which Onramp was founded.

Onramp provides trust-minimized ownership of actual bitcoin, while ETFs provide a centralized form of price exposure.

Please take a moment to read the report linked above or continue below for our current thoughts on the themes introduced therein.

Why Onramp Exists

Put most simply, we believe there is a better way for individuals and institutional allocators to obtain exposure to bitcoin. The first product we brought to market nearly a year ago, the Onramp Bitcoin Trust, represents a differentiated alternative to the ETFs which provides security-like exposure to bitcoin with a few key advantages.

In contrast with the ETFs, the Onramp Bitcoin Trust:

- Allows for in-kind creation & redemption, with no taxable event

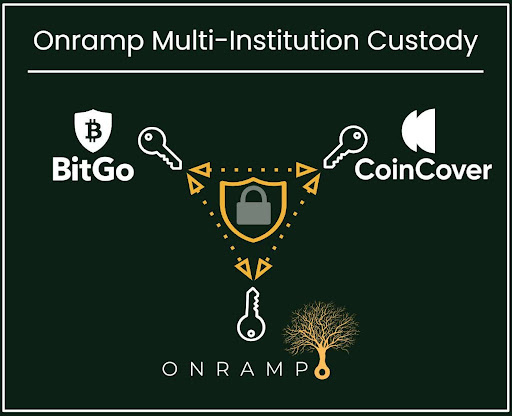

- Utilizes Onramp’s Multi-Institution Custody Solution to distribute counterparty risk across 3 distinct entities, eliminating single points of failure

Furthermore, unlike the slew of ETF issuers that exist today, Onramp is singularly focused on bitcoin, and bitcoin only. Education is a foundational component of our strategy; we aim to help investors understand the significance of bitcoin and cut through the noise of the broader digital asset space, enabling them to build long-term conviction in the asset.

A core element of bitcoin’s value proposition is its decentralized nature – it is our view that parking massive amounts of bitcoin with a single centralized custodian infringes upon this pillar of the bitcoin thesis.

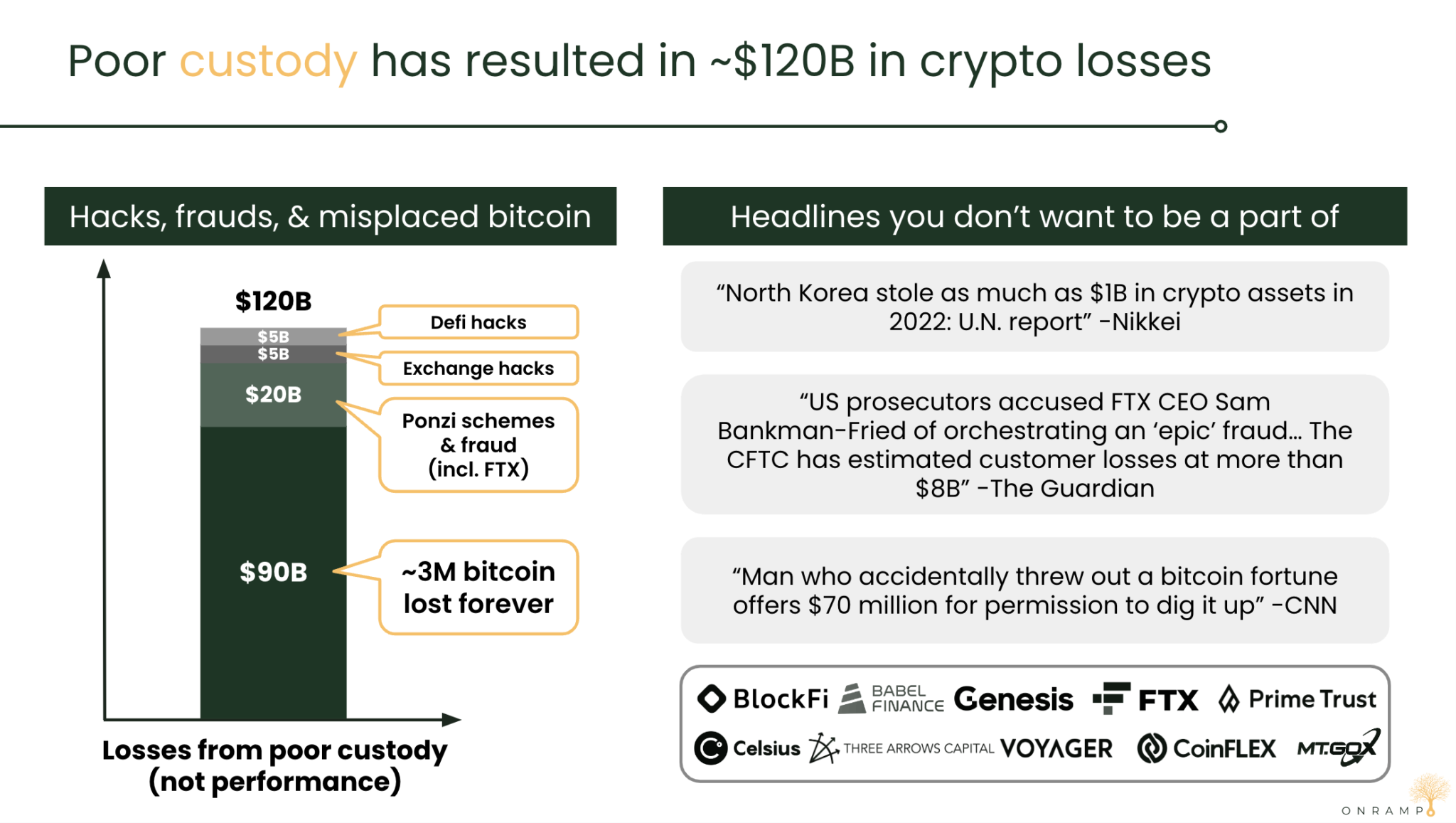

This notion is not purely forward looking. Historically speaking, the main pitfall of bitcoin ownership in its first fifteen years of existence has been the failure, either through negligence or malfeasance, of centralized custodians (from Mt. Gox to FTX, and many others in between).

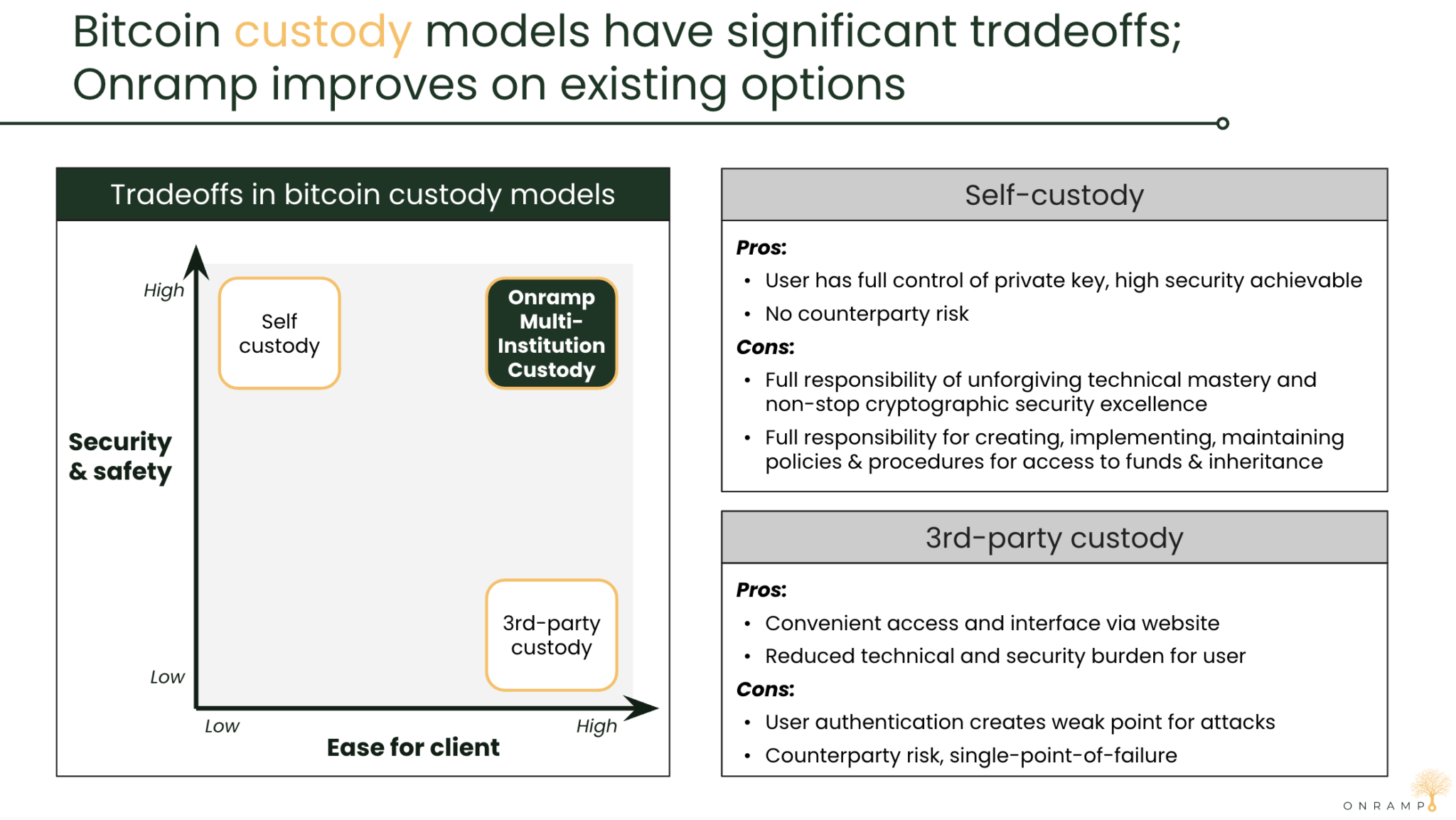

Onramp proposes a different model of custody – one that leverages the native properties of the bitcoin protocol, namely multi-sig, to distribute counterparty risk and eliminate single points of failure.

With Onramp Multi-Institution Custody, assets live in a multi-sig vault controlled by three distinct entities, none of which have unilateral control. Instead of trusting a single counterparty, Onramp clients can always audit their funds on-chain and withdraw assets in-kind if they choose.

Our Focus on Custody is a Function of Conviction

At Onramp, we believe bitcoin is the best form of money humans have ever encountered. While bitcoin is still quite early in its trajectory of global adoption, the network’s fundamentals are strengthening and knowledge of the asset’s merit is proliferating.

Having a high degree of conviction in the long-term path of bitcoin adoption, and forthcoming price appreciation, necessitates the critical consideration of the asset’s custodial properties. If bitcoin is to continue on its path towards acceptance as global money, private key management is going to become paramount to functioning economies.

The amount of value that is going to be stored on this global, permissionless settlement layer is going to be tremendously large and matter deeply to everyone on earth, from individuals suffering from financial repression in emerging markets to institutional allocators in the US, politicians, and nation states. If this is true, the most critical points of failure in an economy will become the private keys that secure bitcoin.

It is for this reason – and our immense conviction in the continued proliferation of this asset and network – that we have focused our efforts on creating the most secure form of bitcoin custody that can scale to the masses. In doing so, we aim to honor the ethos on which bitcoin was founded and take steps to minimize the trust required to properly secure the asset.

As early members of the bitcoin community, we need to begin distributing trust and control of these keys or we may be headed down a potentially frightening path where highly centralized honeypots control the keys to an increasingly large portion of society’s wealth.

Onramp Multi-Institution Custody fixes this.

At Onramp, we want to live in a future world where we can still trust institutions. Bitcoin isn’t about eliminating trust entirely, but minimizing trust to the greatest extent possible and maintaining the optionality to take possession of a digital bearer instrument. By distributing custody across three distinct entities, none of which have unilateral control, we can construct a trust-minimized arrangement without a single point of failure. This fosters an environment where trust is earned, not granted. Custodians are incentivized to fulfill their obligations to participate in a signature quorum and are unable to singularly compromise the arrangement.

Moreover, if bitcoin is money, its owners deserve access to the underlying. This is not possible with shares of an ETF, as you can only create and redeem shares in cash. Onramp provides products and services that honor our clients ownership and control of the underlying asset. Whether via the Onramp Bitcoin Trust or our direct custody solution, our clients always maintain ownership and control of their bitcoin, and can take possession of their assets at any time.