Roundup: Predicting the Timing of Major Currency Devaluations

Zack Morris | Research Analyst

Feb 8, 2024

Debt to GDP

With the U.S. on its current unsustainable fiscal path, a number of possible solutions have been proposed by pundits:

- productivity miracle growing the GDP

- slashing entitlements such as social security

- various taxes on wealth

- politicians suddenly finding religion when it comes to spending.

One less talked about, but historically more often used, solution is to implement a one-fell-swoop currency devaluation.

This type of action effectively represents a debt default, although the Treasury and the Fed would never label it as such, seeing as all government debts get nominally paid.

The mechanism today would be as follows: in the accounting manual for the Fed there is a paragraph that states that the Treasury can instruct the Fed to “remonetize” the country’s gold reserves. Just simply write the value of the gold up to whatever U.S. dollar price they want.

The accounting treatment of such an action would be to credit the Treasury General Account with the increase in the price of gold, multiplied by the United States’ 261 million ounces of gold.

I first learned of this arcane Treasury accounting trick in this interview with Luke Gromen at the 1:03:00 mark.

So, for example, for every $4,000 the Treasury instructs the Fed to write up the price of gold, ~$1 trillion goes into the U.S. Treasury.

The Treasury could, in theory:

- Write up the price of gold by $20,000 (currently $2,050/oz)

- Receive $5 trillion free of debt

- Use that to reduce debt-to-GDP either by:

- Reducing debt (buyback $5 trillion of U.S. treasuries)

- Growing GDP (infrastructure spending)

Crazy? Well, it’s already been done twice before!

The two times in U.S. history this has occurred was in 1934 with the passage of the Gold Reserve Act, when President Franklin Roosevelt devalued the USD by revaluing gold from $20.67/oz to $35/oz, defaulting on the U.S.’s promise to accept USD for gold at the rate of $20.67/oz.

Officially, this $35/oz conversion rate held until 1971, when President Nixon took the USD off the gold standard and ended the dollar’s convertibility to gold all together.

Is it possible to predict when the government and the Fed might be inclined to take such drastic action?

Stocks, Bonds, and Currency Devaluations: Correlation or Causation?

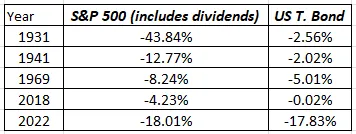

Only five times since 1928 have U.S. stocks and bonds, as represented by the S&P 500 and 10-year US treasury bonds, both declined in the same year (source).

Care to guess?

Two of the five historical occurrences preceded the 1934 and 1971 official currency devaluations by 2-3 years.

A third occurrence, 2018, preceded an unofficial currency devaluation in 2020 with the Fed expanding its balance sheet from $4 trillion to $9 trillion, although we must acknowledge that this was a monetary response to a global pandemic. Alas, a currency devaluation is always a monetary response to something — economic depression, war, pandemic, etc.

A fourth occurrence was during WWII, when the U.S. debt-to-GDP rose from 44% at the beginning of the war to 122% by the end of it.

And a fifth, and by far the most devastating occurrence from both an economy-wide asset depreciation standpoint and a traditional 60/40 stock/bond portfolio, with stocks and bonds both losing 18%, was in 2022.

If we extrapolate previous historical occurrences, this would suggest that a significant monetary debasement of one kind or another is in the cards for the 2024-2025 time frame.

What might this mean for asset prices?

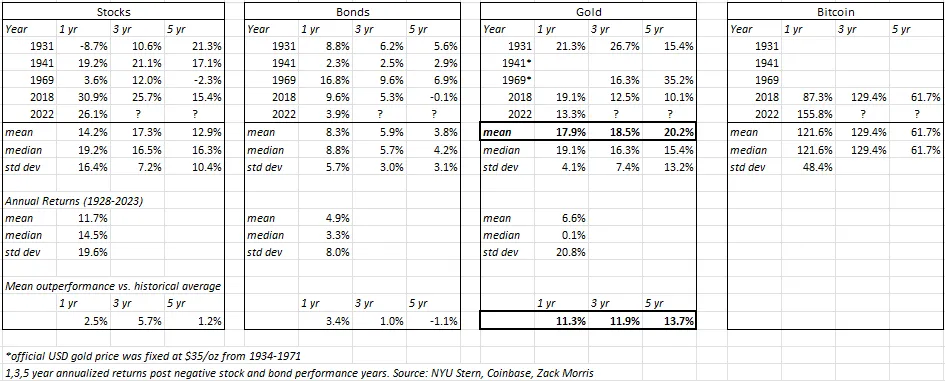

Here are the 1-, 3-, and 5-year annualized returns for stocks, bonds, gold, and bitcoin after each occurrence:

Takeaways:

- Of traditional assets, gold has been the best performing asset class of the three in each of the 1-, 3-, and 5-year periods following years which had negative returns for both stocks and bonds. These periods have historically been associated with significant monetary debasement and/or fiscal spending.

- Both stocks and gold have outperformed their historical average annual returns during these periods; gold significantly so.

- Bonds have outperformed their historical average on 1- and 3-year periods (performance bounceback?), but have underperformed in the 5-year period.

- Bitcoin has outperformed all other assets with 61.7% annualized returns in the 5-year period spanning 2018-2023. However, as a novel monetary asset in the process of monetizing from zero, bitcoin has significant other factors at play, and it might be more instructive to look at the performance of gold during historical periods of monetary debasement for clues to the performance of bitcoin in any future such periods.

Intuitively, this all makes sense.

While all assets show positive nominal returns, gold, as the alternative monetary asset, catches a bid as investors look to escape their debasing currency.

Perhaps the bigger takeaway, though, is that in a highly leveraged financial system, the value of the collateral underpinning all the leverage simply cannot be allowed to fall in nominal terms, or else the whole system collapses in a deleveraging.

As such, when the value of the collateral (stocks and bonds) falls, the Treasury and Fed have historically resorted to currency debasement to prop nominal asset prices back up.

We are currently in one such period.

So far, in the period since 2022 the Fed has been in a restrictive monetary policy regime, characterized by raising interest rates and reducing the size of their balance sheet. Indeed, the stock and bond market routes of 2022 can be seen to have been caused by these restrictive policy measures.

Only time will tell how the rest of the period will play out.

History suggests more monetary debasement on the horizon.

Podcasts of the Week

The Last Trade E036: Beyond the Fiscal Facade with Gary Brode

The latest episode of The Last Trade provides a deep dive into the current state of the economy and financial markets, featuring an insightful discussion with Gary Brode, founder of Deep Knowledge Investing. We tackle the contrasting narratives in the market, explore the implications of recent economic data, and investigate the potential for a re-emerging banking crisis. Additionally, we discuss the role of bitcoin in today’s financial landscape and the impact of ETF approvals on its accessibility.

Scarce Assets E003: Macro Masterclass with Lyn Alden

In the third episode of Scarce Assets, co-hosts Andy Edstrom and Jesse Myers welcome macro analyst and investor Lyn Alden to discuss the fundamental economic drivers of scarcity and the role of bitcoin as the scarcest asset. Lyn, known for her entrepreneurial spirit and deep understanding of global monetary systems, shares insights from her book “Broken Money” and discusses various topics including money creation, inflation, and the future of bitcoin.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris