Onramp Case Study: Selection by Leading UK Pension Plan

Brian Cubellis | Chief Strategy Officer

Jul 31, 2024

Selection by Leading UK Pension Plan

We are proud to share a case study which details the due diligence process of a leading UK pension plan that recently chose Onramp as their partner in providing underlying pension clients with bitcoin exposure.

To learn more about Onramp’s offering, including our onshore and offshore investment fund vehicles which utilize Multi-Institution Custody, please reach out and connect with our team.

Onramp: Trust-Minimized Bitcoin Asset Management

Case Study: Selection by a Leading UK Pension Plan

Selecting a bitcoin asset manager requires a rigorous due diligence process that diverges significantly from traditional asset management evaluations. For institutional investors, such as pension plans, and their investment advisors, this process is particularly challenging due to the unique characteristics and risks associated with bitcoin and digital assets.

This case study examines the comprehensive criteria used in the selection process by Cartwright, a prominent UK investment consulting firm, that provides investment consulting services to pension schemes, charities, funeral trusts, corporate treasuries, family offices and other institutional investor types. The research highlights why Onramp was chosen as the preferred asset manager and custodian to provide their clients with bitcoin exposure over numerous other asset managers.

Typical Hurdles for Pension Plans

For pension plans looking to allocate to bitcoin, the challenges are multifaceted:

- Understanding the Asset: Bitcoin’s volatility and unique attributes require a deep understanding and conviction, which is often lacking in traditional asset management contexts.

- Regulatory Concerns: The regulatory landscape for bitcoin is evolving, creating uncertainty and potential risks for institutional investors.

- Security Risks: Ensuring the secure custody of bitcoin is paramount, as the asset’s digital nature makes it susceptible to hacking and theft.

Challenges for Investment Consultants

Investment consultants face significant hurdles in recommending bitcoin to pension plans:

- Establishing Trust: Consultants need to identify asset managers who can be trusted with the secure custody and management of bitcoin.

- Demonstrating Competence: The asset manager must demonstrate a high level of expertise in bitcoin, which includes understanding its technology, market dynamics, and regulatory environment.

- Providing Transparency: Transparency in reporting and operations is crucial to gain the confidence of both the consultants and the pension plans.

Challenges of Choosing a Bitcoin Asset Manager

The due diligence process for selecting a bitcoin asset manager is intricate and demanding. Unlike traditional asset management, where the criteria are well-established and the risks are relatively understood, the bitcoin and digital asset space presents a new set of challenges. Institutional investors must navigate a landscape marked by volatility, regulatory uncertainties, and a lack of standardized evaluation metrics.

The selection process was detailed and exhaustive, with the UK pension plan assessing asset managers across several critical criteria. Each main criterion was broken down into specific metrics to ensure a comprehensive evaluation:

Criteria for Selecting a Bitcoin Fund Manager

I. Bitcoin Only Fund Manager

- Description: This criterion evaluates whether the fund manager focuses exclusively on bitcoin, ensuring specialized expertise and depth of knowledge.

- Onramp’s Strengths: Onramp exclusively focuses on bitcoin, allowing it to develop deep expertise and tailor its strategies specifically for bitcoin. Unlike other fund managers who might diversify their focus across multiple cryptocurrencies, Onramp’s singular focus ensures that all resources and knowledge are dedicated to understanding and optimizing bitcoin investments.

- Comparison: Many competitors manage a range of digital assets, diluting their expertise and strategic focus on bitcoin. Onramp’s dedicated approach provides a higher level of specialization and insight into bitcoin’s market dynamics.

II. Custodial Security

II.A. Native Multisig

- Description: Uses bitcoin’s native multi-signature technology to secure assets.

- Onramp’s Strengths: Onramp utilizes bitcoin’s native multisig, which requires multiple private keys to authorize a transaction. This reduces the risk of unauthorized access and ensures higher security.

- Comparison: Competitors typically use Multi-Party Computation (MPC) or other methods that add complexity and potential vulnerabilities. Onramp’s use of multisig is directly integrated into bitcoin’s protocol, providing a more secure and transparent solution. Undermining bitcoin’s native multi-signature security would necessitate resources and logistics beyond the reach of even nation state attackers, highlighting a stark security contrast with MPC setups.

II.B. Multi-Institution Custody

- Description: Distributes bitcoin keys across multiple regulated entities to minimize risk.

- Onramp’s Strengths: Onramp distributes bitcoin keys across three independent, regulated entities, ensuring no single entity has unilateral control over the fund’s assets. This significantly reduces the risk of loss, theft and mismanagement.

- Comparison: Competitors typically centralize key management, creating single points of failure. Onramp’s approach aligns with bitcoin’s decentralized ethos, enhancing security. By deliberately separating key custody across entities without unilateral control over the assets, this approach enforces a system of checks and balances, virtually eliminating the risk of collusion or unilateral malfeasance, protecting the fund’s assets from both internal and external threats.

II.C. Multi-Jurisdictional Custody

- Description: Geographical distribution of custodial entities to mitigate jurisdictional risks.

- Onramp’s Strengths: By spreading custodial entities across different jurisdictions, Onramp mitigates risks associated with regulatory changes, jurisdiction-specific threats and political interference.

- Comparison: Competitors that operate within a single jurisdiction are more vulnerable to local regulatory changes and risks. Onramp’s multi-jurisdictional strategy provides additional security and regulatory resilience.

II.D. Greater than 5% Hot Storage

- Description: Proportion of assets kept in hot storage versus cold storage. The 5% limit is a fundamental risk control metric strategically set to fulfill withdrawal and transaction requirements without jeopardizing the fund’s security by keeping the bulk of the fund’s assets stored offline.

- Onramp’s Strengths: Onramp maintains less than 5% of assets in hot storage, keeping over 95% of assets in cold storage (offline and secure). This reduces exposure to hacking and online threats.

- Comparison: Typically competitors keep a higher percentage of assets in hot storage, increasing vulnerability to cyberattacks. Onramp’s strategy minimizes this risk.

II.E. Individual Client Bitcoin Addresses for Transparency

- Description: Provision of unique bitcoin cold storage addresses for each client to ensure transparency, security, and accountability.

- Onramp’s Strengths: Each client is provided with a unique bitcoin address, enabling transparent tracking and auditing of their assets. This fosters trust and accountability, and prevents rehypothecation. This protects clients from risks associated with “paper” bitcoin, where the holdings are not backed by actual bitcoin in custody.

- Comparison: Competitors typically pool client assets into shared addresses, reducing transparency. This approach prevents investors from confirming the authenticity of their bitcoin holdings. Onramp’s approach ensures clients can independently verify their holdings on the blockchain. Aso, it significantly reduces the risk of widespread impact from potential security breaches.

III. Operational Excellence

III.A. In-Kind Redemptions

- Description: Ability to offer in-kind redemptions, allowing clients to receive actual bitcoin rather than cash equivalents.

- Onramp’s Strengths: Onramp offers in-kind redemptions, preserving the value and integrity of bitcoin investments. This approach also accommodates changes in the clients strategy or service needs based on performance, security, and other factors. Also, facilitating in-kind redemptions acts as a continuous check on the fund manager’s practices and the availability of the bitcoin held in custody.

- Comparison: Most competitors may only offer cash redemptions, which could trigger tax events and reduce investment flexibility. Onramp’s approach provides greater client control.

III.B. Client Discretion in the Event of a Hardfork

- Description: Policies allowing client discretion during bitcoin hard forks. A hard fork is a significant change to the blockchain protocol that makes previously invalid blocks/transactions valid (or vice-versa), requiring all users to upgrade to the latest version of the protocol software.

- Onramp’s Strengths: Onramp’s policies allow clients to decide how to handle their assets during hard forks, whether to support the new chain, retain the original, or split their assets. This allows for alignment in terms of client strategic, ethical, and philosophical preferences, independent of the fund manager’s decision.

- Comparison: Competitors typically have predefined policies that limit client options. Onramp provides greater flexibility and client autonomy. This prevents clients from being locked into a path not of their choosing.

III.C. Gating Provisions

- Description: Restrictions on asset withdrawals during market disruptions. Such restrictions can severely limit the investor’s control over their assets and their ability to access liquidity during critical market events.

- Onramp’s Strengths: Onramp has no restrictions on asset withdrawals during market disruptions, ensuring clients can access their assets when needed.

- Comparison: Typically, competitors impose strict gating provisions that limit client access during volatile periods. Onramp’s approach balances security with accessibility. This ensures that the fund management practices align with the principles of flexibility and responsiveness, essential for navigating the dynamic and sometimes unpredictable landscape of bitcoin investment.

III.D. Bail-In Provisions

- Description: Level of protections against the use of client assets for firm liabilities. Custodian insolvencies can lead to an automatic stay on assets, delaying access and requiring costly and lengthy litigation for recovery.

- Onramp’s Strengths: Onramp’s policies and legally sound agreements protect client assets from being used to cover firm liabilities, ensuring asset integrity. Also, the distribution of asset custody across multiple entities reduces insolvency risk exposure. Onramp enables in-kind redemptions, allowing investors direct control over their assets and the ability to withdraw their holdings independently.

- Comparison: Competitors typically do not have such strong protections, exposing client assets to firm risks and single points of failure. Onramp’s policies ensure more control over the asset, higher security, and minimize counterparty risk.

III.E. Possibility of Rehypothecation Excluded

- Description: Policies excluding rehypothecation of client assets. Re-hypothecation presents a higher level of risk, which is more pronounced with a volatile asset like bitcoin.

- Onramp’s Strengths: Onramp does not engage in rehypothecation, meaning client assets are not used as collateral for the firm’s own transactions. It also does not commingle investor assets which restricts the possibility of re-hypothecation. In addition, the enablement of in-kind redemptions fortifies against re-hypothecation by allowing clients to withdraw their investments as bitcoin, ensuring assets are readily available.

- Comparison: Competitors might use client assets for their own purposes, increasing risk. Onramp’s exclusion of rehypothecation preserves asset security.

III.F. Performance Fee Only Option

- Description: Availability of a performance-based fee structure. This model ensures that the fund manager’s earnings are directly tied to the fund’s success, creating an alignment of interest between the fund manager and the investors.

- Onramp’s Strengths: Onramp offers performance-based fees, aligning the manager’s interests with those of the clients, motivating the manager to prioritize actions that safeguard the asset over assets under management for fee collection.

- Comparison: Competitors typically do not have fixed fee structures that do not align as closely with client performance. Onramp’s fee structure incentivizes optimal performance and alignment between the manager and the investor.

Summary

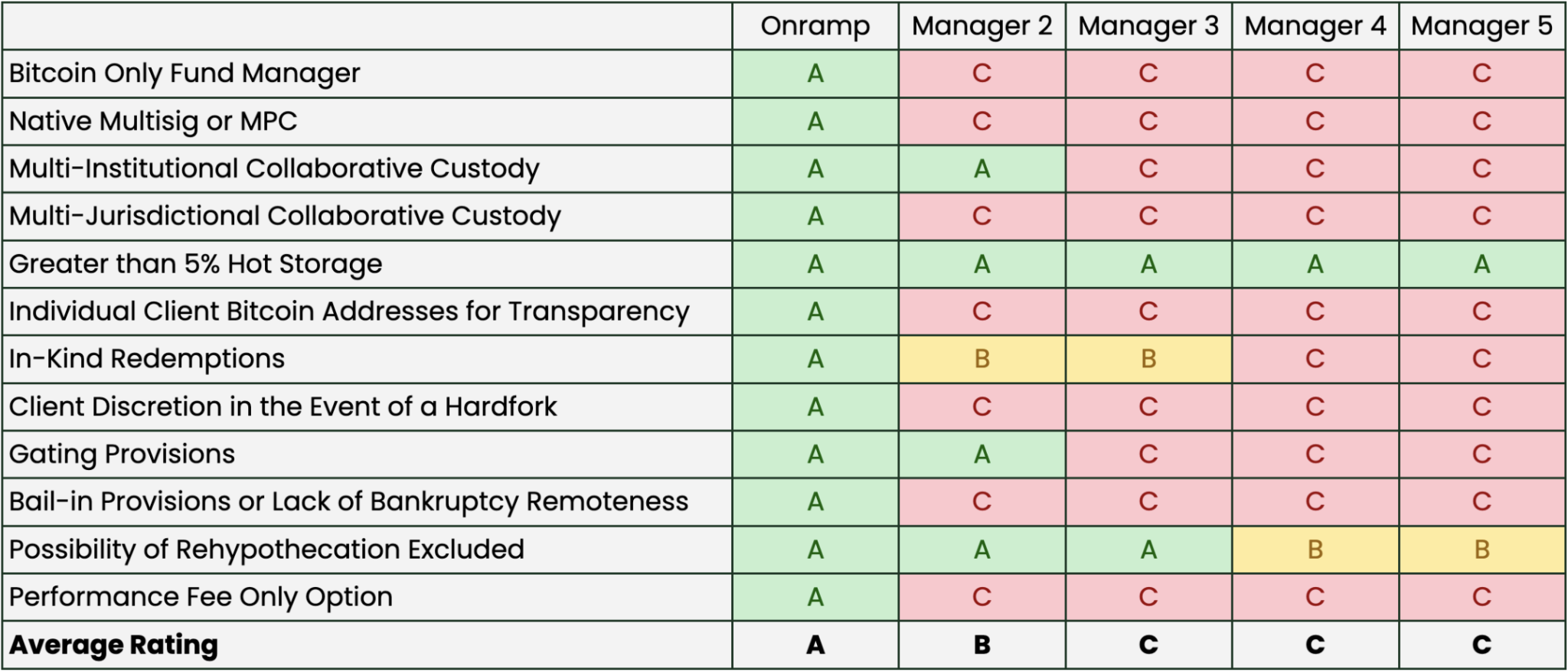

In a comprehensive search managed by the consulting firm Cartwright, a total of 69 asset managers, including Onramp, were evaluated for their ability to manage bitcoin investments for a leading UK pension plan. The evaluation involved an extensive and rigorous due diligence process, assessing each manager across the above criteria. Onramp outperformed its competitors due to its specialized focus on bitcoin, robust custodial security measures, and operational excellence. This exceptional performance across all categories led to Onramp being selected as the preferred bitcoin asset manager.

Onramp’s ratings show that it consistently meets the highest standards across all criteria, making it the leading choice for bitcoin asset management. This detailed assessment highlights why Onramp was the top choice for managing bitcoin investments for the UK pension plan, providing robust security, transparency, and strategic alignment with client goals.