Security-like Bitcoin exposure

Onramp Bitcoin Trust

Vaulted by Multi-Institution Custody. In-kind creations/redemptions.

Optional withdrawal to self-custody.

The Trust is designed for:

- U.S.-based family offices and RIAs needing a qualified investment vehicle.

- ERISA-sensitive & pension-adjacent clients who prefer a clearly structured vehicle over direct Bitcoin custody.

- Institutional investors seeking Bitcoin exposure through a U.S.-domiciled legal wrapper.

- Investors who want trust units rather than physical custody or exchange-traded products.

Advantages of a Trust Structure

You can subscribe or redeem using Bitcoin or USD, depending on your jurisdiction and operational setup. Both methods are structured for institutional clarity and regulatory alignment.

Bitcoin Exposure with Structural Simplicity

- Gain exposure to Bitcoin without setting up and securing cold wallets.

- No need to manage multisig keys or coordinate third-party custodians.

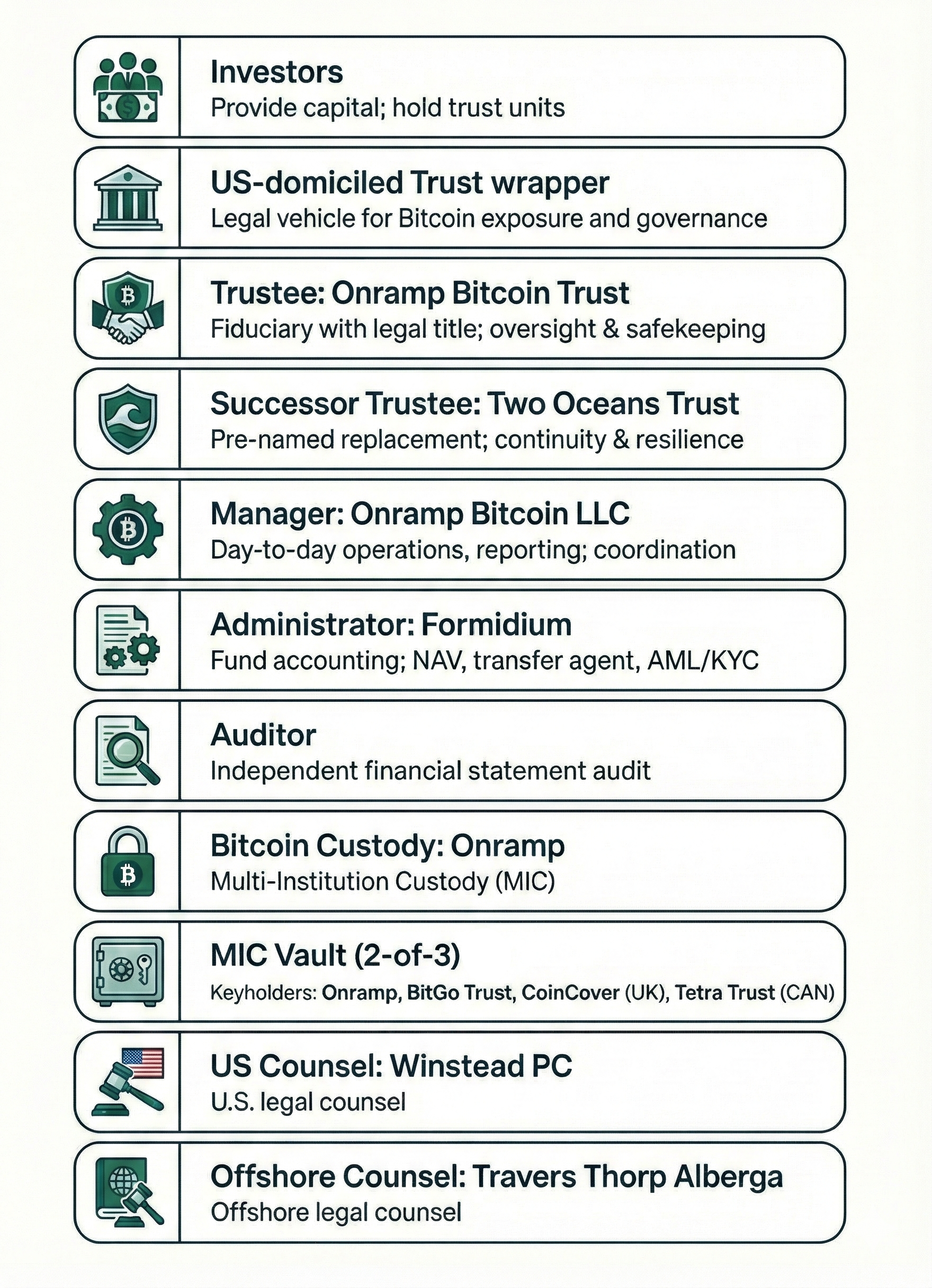

Multi-Institution Custody Vault

- Underlying bitcoin is held in multi-institution custody (MIC) vaults.

- 2-of-3 multisig structure across separate regulated custodians.

- Key security without single-point-of-failure risk.

In-Kind Subscription and Redemption

- Subscribe and redeem in bitcoin or USD - no forced conversions.

- Full flexibility for capital deployment, rotation, or rebalancing.

Fiduciary-Ready

- Trust structure provides a clean, auditable path for fiduciaries

- Independent trustee, manager, and future successor trustee

- Designed to pass institutional due diligence and compliance screens

Bitcoin only

The Trust invests in spot Bitcoin only, with no leverage, no derivatives.

A unique and differentiated solution

The world's best performing asset, stored in the world's best custody solution, made for institutional needs.

Governance and Controls

Access the Docs

The following investor materials are available only upon request and subject to eligibility. To request these materials, please contact our institutional team. All documents are provided on a confidential basis, subject to verification of investor status and acknowledgment of non-disclosure terms.

Confidential Private Placement Memorandum( PPM)

In-Kind Contribution Agreement

Amended and Restated Trust Agreement

In-Kind Redemption Agreement

Investor Letter: Institutional Updates

Subscription Docs (including AML/KYC instructions, W-9/W-8 forms, accredited investor verification, etc.)

Next Steps

Schedule a Consultation with our team to discuss how the Trust fits your investment strategy. Compare Access Options if your'e still evaluating between direct custody, the Trust, or offshore funds.