1/18/24 Roundup: Overview of On-Chain Sentiment

Onramp Weekly Roundup

Written By Zack Morris

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

And now, for the weekly roundup…

Looking At On-Chain Technicals To Gauge Investor Sentiment

In a small burst of euphoria, bitcoin jumped to a two-year high last Thursday as spot bitcoin ETFs began trading in the US, with the price briefly crossing $49k.

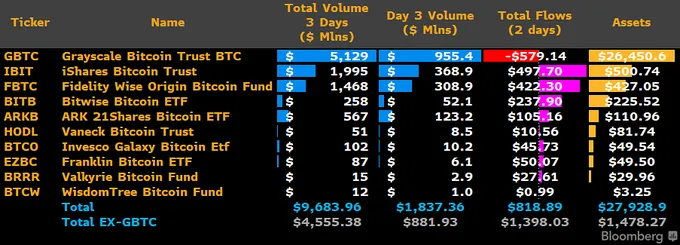

However, traders quickly reversed course and decided to sell the news, with the price quickly falling about 15% in the space of 24 hours to below $42k, despite ETF products taking in $819 billion in net flows over their first two days of trading:

source: Bloomberg, courtesy of James Seyffart

As investors tussle with fear and greed, it can be useful to look at on-chain metrics as sentiment indicators and to better gauge where we might be in the near- and long-term cycle, relative to historical cycles.

The Bitcoin blockchain, being open-source, public, transparent and auditable in real-time, affords insights into investor psychology that were never available before its invention in the form of certain on-chain metrics.

But now, for the first time we can see our fear and greed on-chain.

Market Value to Realized Value (MVRV) Ratio

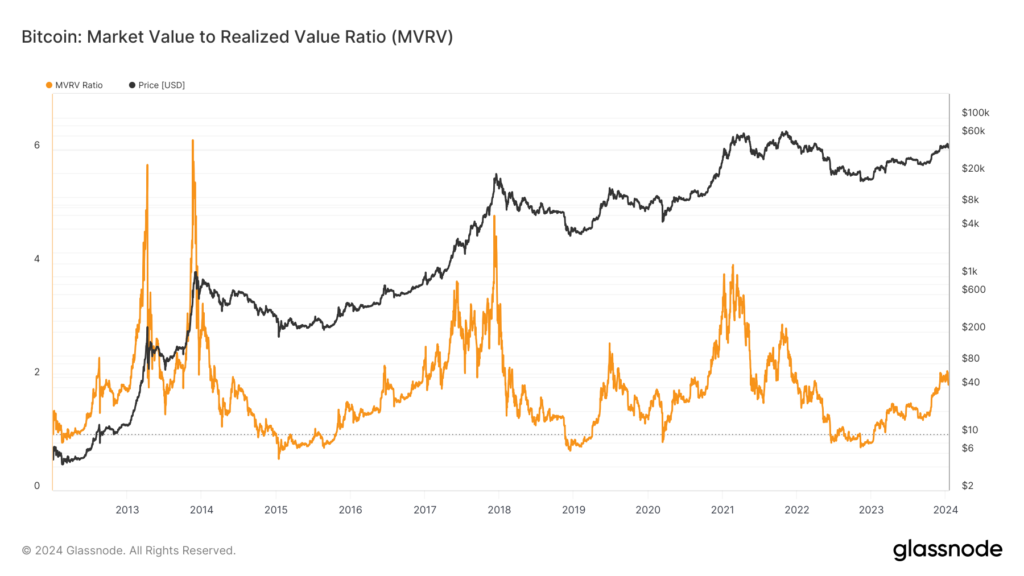

MVRV is a measure of the current market cap of bitcoin (market value) relative to the aggregate cost basis of all bitcoins (realized value). When this metric falls below one, it means bitcoin holders in aggregate are underwater and has historically indicated major market bottoms. On the other hand, spikes above 4 have historically coincided with market tops.

A year ago as we entered 2023 the MVRV sat at 0.84, indicating oversold conditions. After the rally of the last year, MVRV crossed over 2 for the first time in the new cycle just over a month ago on 12/5/2023, and currently sits at 1.9:

In examining this chart, we can see that the MVRV crossing 2 has historically indicated price may be a bit extended in the short-run, with significant bull market corrections after MVRV crested 2 occurring in 2012, 2016, and 2019.

Ultimately, though, these were just pullbacks and not the start of a new bear market, as MVRV has crested at least 4 in all previous major market tops, marking a state of market euphoria.

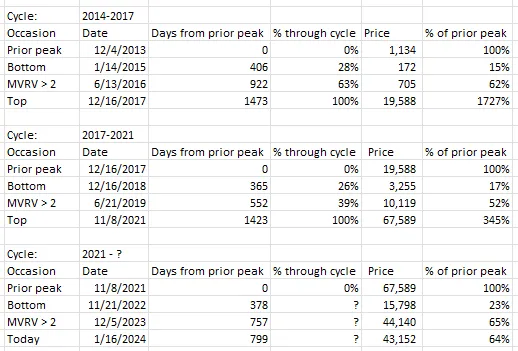

As far as timing in the cycle, the MVRV crossing 2 for the first time coming out of a bear market has historically indicated we are somewhere between 1/3rd and 2/3rds of the way into the new cycle — 39% – 63% to be precise:

source: Glassnode

So far, the current cycle seems to be mirroring previous cycles quite closely, with MVRV emerging above 2 about half-way through what we would expect the current cycle to be if it matches the duration of previous cycles.

If history holds this cycle would run through Q4 2025.

Long-Term Holder Supply

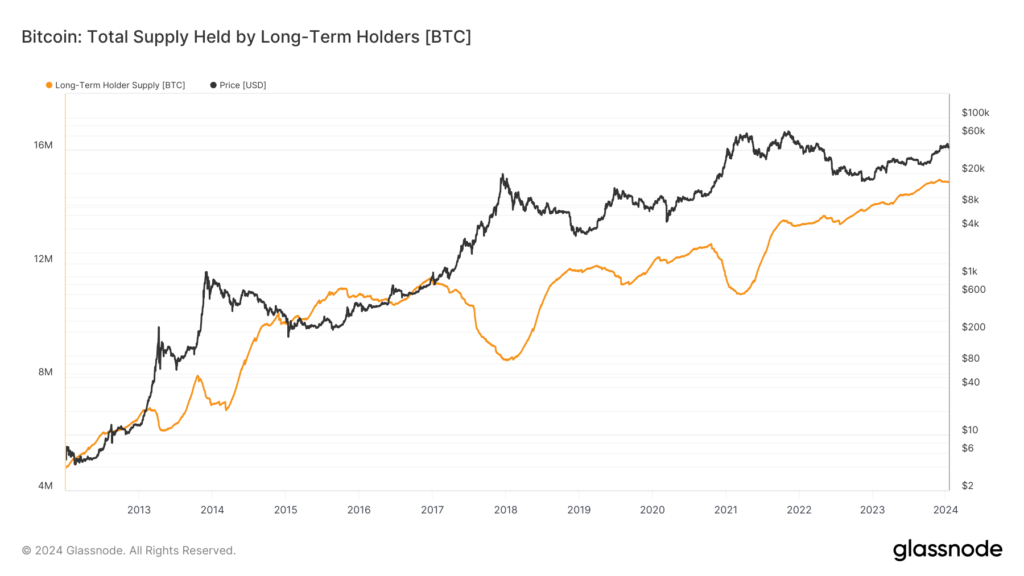

Another aspect of current on-chain behavior that rhymes with previous cycles is the increase in long-term holder supply throughout the early stages of a new bull market.

Long-term holder supply measures the absolute number of coins that haven’t been moved in the last ~155 days and currently sits near an all-time high at 14.89 million BTC, or 76% of total circulating supply:

As in previous cycles, long-term holder supply has steadily increased through the bear market and the early stages of the new bull. Long-term holders have historically timed the market pretty well, with the large drawdowns in long-term holder supply in the chart above coinciding with major market tops.

This is somewhat of a self-fulfilling prophecy, as those dips in long-term holder supply represent profit-taking; however, it is still a valuable on-chain indicator as historically price has remained firm unless and until long-term holders begin distributing coins in a more serious manner than they are today.

As it stands today, long-term holder supply has just rolled over slightly from its peak about a month ago. This metric bears monitoring as we progress through the cycle as a deeper drawdown in long-term holder supply may indicate we are again near a market top.

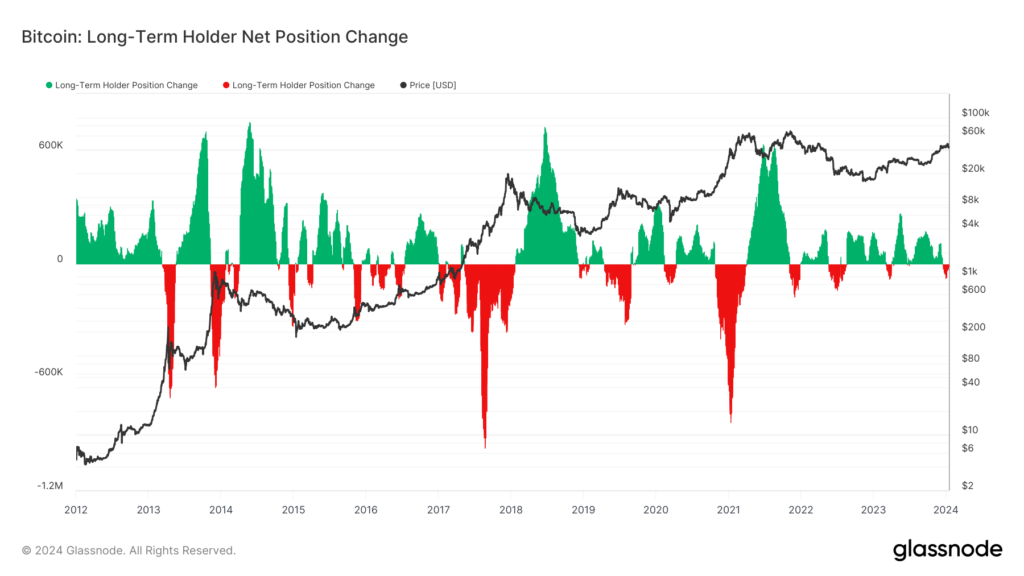

Long-term holder net position change measures the change in long-term holder supply over the past 30 days. Drawdowns of >500k BTC have historically indicated we are near cycle peaks.

Today’s reading of just -12k BTC is still relatively benign.

While every market cycle is different and this one will surely be full of surprises, the public, global, open, and immutable nature of bitcoin affords us clues into the psychology of investors and a helpful blueprint for navigating whatever market environment we find ourselves in.

Podcasts of the Week

The Last Trade EMERGENCY POD: ETFs Live! with Alex Thorn

This podcast episode delves into the highly anticipated launch of Bitcoin ETFs in the US. Featuring Alex Thorn, Head of Research at Galaxy Digital, the conversation covers the implications and significance of Bitcoin ETFs, the intricacies of Bitcoin asset management, and the potential shifts in the landscape of Bitcoin investment and custody.

The Last Trade E033: Wall Street’s Bitcoin Blindspot with Larry Lepard & David Foley

In this episode, we delve into the significant milestone of Bitcoin ETFs and their potential impact on financial markets. Our guests, David Foley and Larry Lepard, join us to discuss the implications of this new financial product for investors, institutions, and the future of Bitcoin. We explore the macroeconomic landscape, the potential for a black swan event, and the shifting tides of investment strategy in the face of unprecedented monetary policy.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris