Assessing Different Forms of Bitcoin Custody

For large bitcoin holdings, there are multiple custody types, including multi-institution custody, multi-signature wallets, and more. Learn the pros and cons of each.

Leaving your Bitcoin on an Exchange like Coinbase or Gemini

When considering the right way to secure your bitcoin, many people look at an exchange like Coinbase or Gemini as a safe spot. Since Coinbase is a public company, you’re guaranteed to have access to your bitcoin, right? Here’s what Coinbase has to say about insurance and protecting your bitcoin:

Coinbase carries crime insurance that protects a portion of digital currencies held across our storage systems against losses from theft, including cybersecurity breaches. However, our policy does not cover any losses resulting from unauthorized access to your personal Coinbase or Coinbase Pro account(s) due to a breach or loss of your credentials.

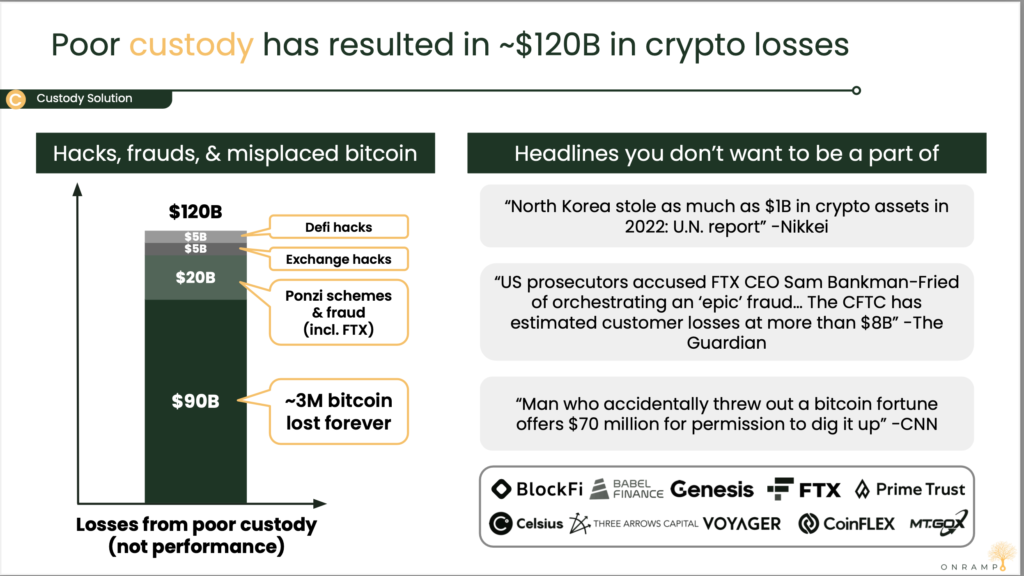

At first glance, exchanges offer ease of access, fast buying/selling capabilities, and a suite of advanced trading functionalities. We’re all used to web-based applications and online banking, so an exchange seems as safe as your online stock brokerage. In reality, this is far from the truth when it comes to an exchange. Yes, legally, that bitcoin is yours, but as we saw with the FTX collapse, it can become complicated. With an exchange, you have minimal ways to verify the bitcoin is actually being held for you.

A key problem to consider with an Exchange is that bitcoin is not like a stock or a mutual fund. If the bitcoin is sent from an Exchange account to a wallet, there is no chargeback or reversal like in the fiat banking world. When a bitcoin transaction is sent, it’s final. If someone hacks into your account on an Exchange and sends the bitcoin to themselves, there are no “takebacks.” The bitcoin is gone.

Let’s look at the pros and cons of leaving your Bitcoin on an exchange.

Pros:

- Convenience: Easy access to your assets for trading or selling

- Speed: Quick transactions, especially important for taking advantage of market fluctuations

- Features: Access to various tools and services offered by the exchange, like trading pairs and leverage options

Cons:

- Security Risks: Exchanges are high-profile targets for hackers

- Control: You don’t have control over your private keys, which means the exchange has custody of your assets

- Regulatory Risks: Exchanges can be subject to sudden regulatory changes or geo-specific rules, potentially affecting access to your bitcoin

Single Hardware Signing Devices like Trezor, Coldcard, or Ledger

For safeguarding your bitcoin, using a single hardware wallet is often a strategy that those just getting started with bitcoin tend to use. Single hardware signing devices come with some distinct strengths and inherent risks. You have physical control of the device and the seed phrase (assuming you secured it) to recreate the key. With that seed phrase, you’re in total control of your bitcoin. Depending on your perspective, that is either a huge bonus or a major concern. You’re in total control of your bitcoin, but if you lose access to both your hardware signing device and the seed phrase, the bitcoin is gone. You are also more susceptible to a $5 wrench attack where someone can force you to give up your bitcoin at the threat of violence, and you can sign a transaction almost immediately.

When it comes to physical custody of your bitcoin, a single hardware signing device is incredibly risky compared to a multi-signature wallet.

Pros:

- Physical Custody: You are immune to an FTX situation where an exchange fails

- Portability: You can memorize your seed phrase and travel with your bitcoin in your head

Cons:

- Risk of Loss: If you lose your hardware wallet (or it becomes damaged during a firmware upgrade or natural disaster) and your seed phrase, your bitcoin is gone for good.

- Physical Risk: Your bitcoin is gone if someone steals your seed phrase. You are under the threat of physical violence with a $5 wrench attack as well.

- Inheritance Concerns: A single-signature wallet is a disaster waiting to happen from an inheritance and estate planning concern. Generational wealth should not be control by a single hardware device or a single pass phrase. The bitcoin can be easily lost, stolen, or tied up in probate.

Collaborative Custody with Unchained, Casa, Theya, Nunchuk etc

Compared to single wallets, collaborative custody from firms like Unchained, Casa, Theya, Nunchuk, etc are incredible upgrades. You’ll have two hardware signing devices (and two seed phrase backups) and security through a distributed approval mechanism from the collaborative custody partner’s third key. The strategy involves keeping one set of hardware signing devices and the seed phrase in your primary residence while segregating the other set in a separate location. You only need one of your keys to sign a transaction, as Unchained can also sign transactions. These wallets are set up as 2 of 3 multi-signature wallets.

The major downside of a multi-signature wallet is the technical expertise required. UTXO management, key checks, and firmware upgrades are all skills that you’ll need to learn. You’ll need to have a strong technical acumen to ensure your bitcoin is safe for generations to come. Many of the solutions rely on Apple’s iCloud and Google’s Drive service to store a software key. As the value of bitcoin continues to grow, do you really want a key stored in iCloud or in your shoebox? Even in a collaborative custody model, are you ready to manage cryptographic material like seed phrases and plastic hardware devices for the most important asset that your family will own? Ultimately, even in this model, you have full control over the asset, and that comes with full ability to lose funds that are not recoverable.

Pros:

- Strong Security: Requires multiple keys to sign transactions

- Backup Key: Firms like Unchained can act as a backup key if you lose one of your devices

Cons:

- Complex Setup: This setup may present a steep learning curve for individuals who are new to bitcoin and unfamiliar with multi-signature wallets

- Transaction Delays: The need for multiple approvals can slow down signing speed

- Technical Hurdles: Ongoing technical maintenance will be needed for UTXO management, key checks, and firmware upgrades. How long do you expect hardware devices to be supported? Do you know how to upgrade to a new hardware signing device? These are all questions you’ll need to find answers to.

- Device Rot: Hardware signing keys are not conducive to long-term asset and inheritance planning. Will USB-C, Micro-SD, and Micro-USB be around in 30 years? Do you and your heirs know how to rebuild a wallet from a JSON file (or even know what a JSON file is?) in case the firm you leverage for collaborative custody is no longer available?

- Challenges with Inheritance: In a situation where at least one physical hardware key or a seed phrase is required, collaborative custody is ripe with concerns about inheritance from a legal and technical perspective.

Multi-Institution Custody with Onramp, BitGo, & Coincover

Multi-institution custody merges the security benefits of multi-signature wallets with an enhanced layer of oversight involving several independent firms in the bitcoin custody process. This approach diversifies risk and integrates a system of checks and balances with robust key partners, ensuring a high-security standard that allows your bitcoin to stayed secured as a generational asset.

By leveraging the native properties of the bitcoin multi-signature protocol, which allows you to distribute access and control over a bitcoin address across multiple participants (i.e., multi-signature), multi-institution custody can reduce the counterparty risk associated with third-party custody by order of magnitude.

Instead, the private keys are distributed across entirely distinct financial service entities. It allows you, with minimal technical know-how, to secure your bitcoin via a multi-signature vault managed by multiple institutional key holders, each with its own security processes and procedures, none of which have unilateral control over the asset.

This arrangement eliminates any single point of failure, distributes counterparty risk, and minimizes required trust, all while providing far greater assurances that a client’s bitcoin is secure and auditable on-chain. For large amounts of bitcoin holdings, multi-institution custody is the safest and most secure way to hold your bitcoin.

Pros:

- Superior Security: Distributed risk through multiple custodians across multiple countries; since the customer cannot sign transactions themselves, it lowers the chance of losing your bitcoin through the threat of violence or technical error

- Checks and Balances: Enhanced oversight from independent entities, none of which have unilateral control over the assets

- Resilience: Improved recovery mechanisms in case of key loss, without the customer needing technical expertise

- Secures bitcoin as an Inheritance Asset: Onramp offers a holistic approach to estate planning, seamlessly integrating your bitcoin into a comprehensive legacy strategy.

Cons:

- Trust in Partners: Dependency on the reliability of external custodians