1/30/25 Roundup: Fed Pauses & China Surprises

Onramp Weekly Roundup

Written By Brian Cubellis

Before we get started…

Onramp Hiring Update: Over the past several months, Onramp has experienced rapid growth in our client base and overall business, reflecting the increasing demand for our bitcoin-focused financial services. In tandem with this momentum, we’re excited to announce three new opportunities within our team—marking the first time we’ve publicly posted positions rather than leveraging inbound or word-of-mouth referrals. Full job descriptions linked below:

Interested candidates can apply to these roles via our LinkedIn page. To accelerate the review of your application, reach out directly to hello@onrampbitcoin.com and include a short video on why you are a good fit for this role.

And now, for the weekly roundup…

Fed Pauses & China Surprises

More Noise from the Fed

The Federal Open Market Committee’s unanimous decision this week to hold the target federal funds rate at 4.25%-4.50% ended a streak of three consecutive rate cuts dating back to September. Markets had all but priced in the “pause,” with a 99.5% implied probability, so the immediate reaction was muted: the S&P 500 maintained a small loss, and 10-year Treasury yields ticked up by a couple of basis points. Notably, the Fed’s statement dropped any mention of inflation making “progress,” instead cautioning that it remains “somewhat elevated.”

From our vantage point, this is more of the same: short-term signals from central banks do little to address the core structural issue—massive public and private debt burdens. Eventually, that debt weighs heavily enough to require further monetary expansion and currency debasement. A single pause in rate cuts does not alter this trajectory. In our view, these incremental tweaks are ultimately noise, while the persistent inevitability of debasement remains the deeper signal.

Bitcoin’s Transparent Monetary Policy

In stark contrast, bitcoin’s issuance schedule is entirely transparent and immutable, free from the political calculus of central banks. That clarity continues to attract investors and institutions looking for a monetary system unhampered by ballooning national debt and shifting inflation targets. Over the long term, predictability in the face of global policy uncertainty is precisely what fuels bitcoin’s growth story—regardless of what the Federal Reserve might say this month or next.

AI Disruption & Deflationary Tech

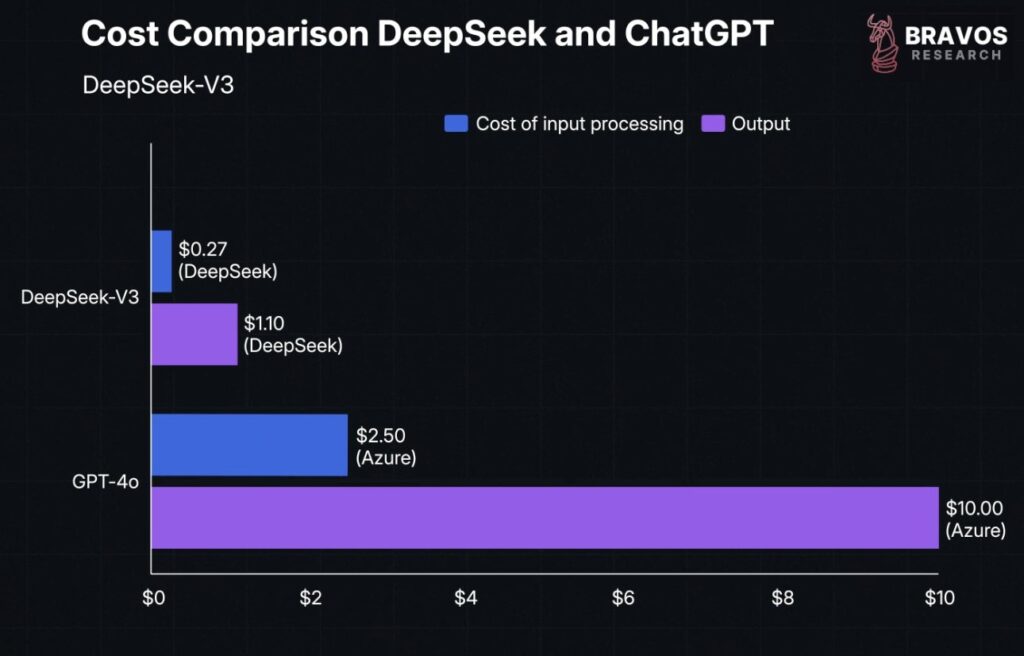

Shifting away from macro policy, markets were roiled this week by China’s release of “DeepSeek,” a Large Language Model (LLM) that reportedly matches or exceeds the performance of leading Western AI solutions—developed at a fraction of the multibillion-dollar budgets fueling AI ventures in the United States. Even if its purported ~$6 million development cost is off by an order of magnitude, DeepSeek highlights a broader truth: disruptive, deflationary technologies can emerge swiftly and from unexpected places.

U.S. equities tied to AI infrastructure took a hit, reflecting investor concerns that heavily funded Western AI ventures might not hold an insurmountable lead. It’s a stark reminder of the deflationary principle: new tech lets us “do more with less,” often displacing incumbents overnight. Just as DeepSeek’s creators turned scarcity of GPUs and capital into an efficiency advantage, bitcoin’s finite supply compels disciplined resource allocation from individuals and entities which utilize the asset as their unit of account. Indeed, constraints breed creativity.

source: Early Riders

Constraints as Catalysts for Efficiency

DeepSeek’s development under financial and resource constraints underlines how innovative leaps can materialize outside conventional power centers. This should prompt a reevaluation among investors relying on U.S. equities as a long-term store of value—particularly in sectors that can be disrupted by leaner competitors.

Equities are subject to execution risk and competitive threats, whether from new AI models or other technological leaps. By contrast, bitcoin’s value doesn’t hinge on a single corporate strategy or operational roadmap; it’s rooted in a decentralized monetary protocol designed to be incorruptible and finite.

Executive Order on Digital Assets

As highlighted in last week’s Roundup, there was anticipation of further executive actions beyond President Trump’s pardon of Ross Ulbricht. At the end of last week, the White House delivered an “Executive Order to Establish United States Leadership in Digital Financial Technology.” Here’s an overview:

On January 23, 2025, President Donald J. Trump signed an Executive Order aimed at securing America’s position as the global leader in the digital asset economy. This directive creates a Presidential Working Group on Digital Asset Markets, chaired by the White House AI & Crypto Czar and including the Secretary of the Treasury, the Chair of the SEC, and other key officials. The Working Group will craft a federal regulatory framework for digital assets—covering stablecoins and the potential establishment of a national digital asset stockpile—while agencies are instructed to identify and revise any regulations hindering innovation. Crucially, the order prohibits the creation or use of central bank digital currencies (CBDCs) and revokes the previous administration’s digital asset policies that allegedly suppressed the sector. By explicitly safeguarding Americans’ right to develop, mine, and transact on public blockchains, the Executive Order seeks to halt aggressive enforcement actions, provide regulatory clarity, and preserve economic liberty, positioning the United States to become the “crypto capital of the planet.

Some in the bitcoin community lamented the order’s use of broad “digital asset” terminology rather than a direct reference to bitcoin. However, it’s not entirely surprising: the administration holds other digital assets from prior seizures, and it’s prioritizing U.S. dollar stablecoins to maintain dollar hegemony. Regardless, the order fundamentally signals an openness to innovation and acknowledges the role of public blockchains—especially bitcoin—in the evolving financial landscape.

Bitcoin is the Long-Term Signal

Whether it’s a Fed pause that does little to alter the trajectory of debt-driven inflation, an AI disruption that reminds us no traditional store-of-value is a guaranteed safe haven, or a new federal policy framework that highlights a pivot toward supportive regulation, bitcoin remains the core signal. Its transparent, finite, and globally accessible nature stands in stark contrast to both central banking maneuvers and tech companies that can stumble under competition or shifting market winds.

In a world increasingly defined by rapid innovation—and the subsequent risks and opportunities—bitcoin’s unyielding monetary schedule offers a stable foundation for long-term value preservation.

Chart of the Week

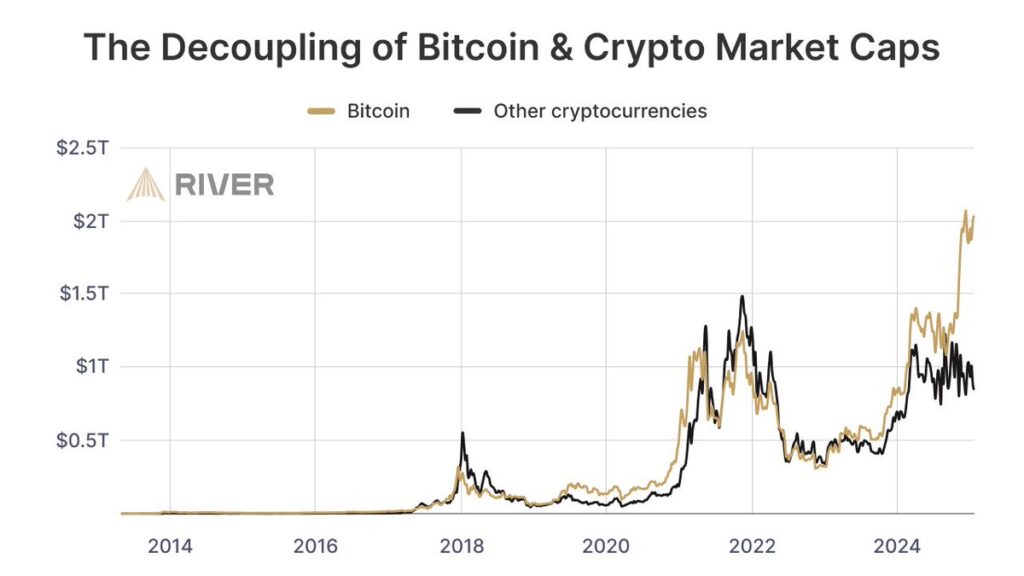

“The truth is, there is no more alt season. The sooner you accept that, the sooner you can still build up a meaningful bitcoin position. You’re not too late. You’re among the first 1-2% of people to get into bitcoin.”

Quote of the Week

“I believe that bitcoin is more and more perceived as a standard asset and expect other central banks to follow suit. The Czech National Bank (CNB) has many times proven its role as a front runner, be it inflation targeting or macro-prudential frameworks.”

— David Havrlant, Chief Economist for the Czech Republic at ING, in response to CNB governor Aleš Michl floating the idea of his country becoming the first in Western Europe to hold some of its reserves in bitcoin, suggesting the CNB could hold up to 5% of its €140 billion ($145.6 billion) in reserves in the asset.

Podcasts of the Week

Bitcoin Treasuries with Acropolis | Chase Palmieri & Tim Kotzman | TLT-083

In this episode of The Last Trade, Chase Palmieri, Co-founder & CEO of Acropolis, & Tim Kotzman, host of the Bitcoin Treasuries Podcast, join to discuss inauguration week insights, executive order headlines, Acropolis & bitcoin treasury adoption, accretive financing, bitcoin custody considerations, & more!

Constraints Breed Creativity | Liam Nelson | FS-019

In this episode of Final Settlement, Liam Nelson, new Partner at Early Riders, joins to discuss his journey to joining Early Riders, navigating TradFi skepticism, DeepSeek & deflationary tech, constraints breeding creativity, Trump administration tailwinds, & more!

Onramp Institutional Series | James Lavish & David Foley

In this inaugural session of the Onramp Institutional Series, we’re joined by James Lavish & David Foley of the Bitcoin Opportunity Fund to discuss the macro backdrop, tailwinds for bitcoin in 2025, and institutional allocation strategies.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Brian Cubellis