10/31/24 Roundup: Persistent Inflation & Bond Deterioration

Onramp Weekly Roundup

Written By Mark Connors & Brian Cubellis

Before we get started…

Earlier this week, we announced the launch of the industry’s first Bitcoin IRA product with Multi-Institution Custody. Assets are secured by three independent custodians with full on-chain transparency, offering unparalleled peace of mind for retirement investors.

Learn more and join the waitlist if you’re interested in securing your retirement assets with best-in-class custody, with no single points of failure, and no need for hardware devices.

If you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations — connect with Onramp.

And now, for the weekly roundup…

Mark Connors’ Macro Corner…

- Persistent Inflation & Bond Deterioration

Chart of the Week…

- MSTR plans to raise $42 billion to buy BTC

Quote of the Week…

- Chamath on bitcoin as THE inflation hedge

Podcasts of the Week…

- The Last Trade / Wake Up Call

Persistent Inflation & Bond Deterioration

It’s T-5 until election day in the U.S., but forget all the presidential polls.

Each of 538, Economist/Columbia Poll, and Polymarket have bias, sample size, and margin of error limitations that reduce efficacy. Especially if you are looking for market insights.

Instead, we look at one of the largest data samples where holders are polled every day. The U.S.Treasury market.

Based on price and volatility, it looks like a growing portion of holders have soured on the $28.5 Trillion in treasury securities outstanding across the duration stack.

The Abject Failure of US Treasuries

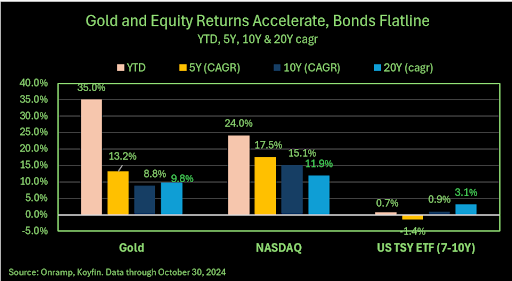

As shown below, the short, medium and longer dated U.S. Treasury ETFs total returns are all deteriorating…with the intermediate dated ETF (7-10Y), posting negligible returns (+/- 1%) YTD and over the past 5 and 10 years.

The intermediate treasury ETF barely beat even the questionably low average CPI over the last 20 years of 2.5%. Good store of value? Not if you are saving for college or a house — both having posted annualized gains of 4-6% over the past 20 years.

Moreover, these 20 year returns had the tailwinds of declining rates, before the sharp interruption of the March 2022 rate hikes that markets are still absorbing (chart below shows data since 1997).

We expect a volatile market next week, but suggest investors focus on the longer running (and we think persistent) market patterns discussed below.

Stubborn Inflation Traps an Indebted U.S. and Exacerbates the Growing Wealth Divide

Today’s higher than expected Personal Consumption Expenditure (PCE) print at 2.7% was led by the costs of housing, healthcare and other services.

We wrote about the risk of a widening wealth gap from rising shelter costs that are compounding at ~2x the reported CPI rates (+4.9% vs. 2.4%) as of the last CPI print on October 10th. This benefits homeowners as housing prices rise, but erodes savings from renters.

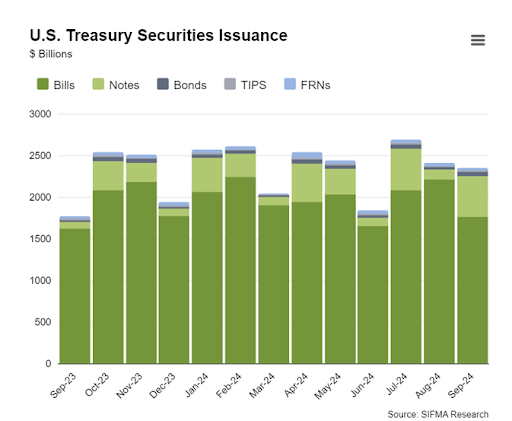

The persistence of inflation also validates investor concerns about the growing U.S. deficit, limiting appetite for longer dated treasuries (which will decline more if interest rates rise), forcing Treasury Secretary Yellen and team to issue MORE bills (less than 1 year) over the past several years relative to longer dated treasuries as shown in the below graphic.

Even with the reduced longer term debt issuance, U.S. Treasury volatility has been persistently elevated as shown below. Note the pick up in volatility in October, to over 130, which in our estimation is equivalent to a VIX reading above 35.

So markets are more concerned about treasury bonds than equity or high yield credit risk (not shown) which we noted in our October 17th Roundup. In that report, we shared that the US HY credit index was trading at just 171 basis points above investment grade debt, the tightest since June 2007.

Equity Market Reverberations Ahead of the Election

Elevated equity valuations will persist through 2025, as equities garner ‘monetary premium’ from investors shifting OUT of bonds and cash. Goldman and Fidelity have spoken about the lower return regime for equities they expect over the next decade. We agree, but do not think it starts until after 2025.

And of course, we deem bitcoin as the most efficient instrument to store value. Even industry leader Microsoft has slotted a shareholder vote to allow bitcoin to be purchased and held on the balance sheet.

Today’s inflation print reversed last night’s lift in Microsoft’s stock after their better than expected EPS release, down -5.8%. This puts MSFT in the red for the month and for the last three months.

MSFT’s price action is in contrast to MicroStrategy, (MSTR), a company that did NOT meet EPS expectations and traded DOWN -3% in after market hours after last night’s release. Instead of being punished this morning like Microsoft and NVDA (-4.3%), MSTR’s -2.7% decline today is an IMPROVEMENT from last night’s after hours decline.

MSTR’s outperformance relative to other tech names is a direct function of its bitcoin treasury strategy, whereby MSTR purchases bitcoin by issuing shares, converts and bonds. Apparently Microsoft has taken notice and given today’s price action, may adopt a similar strategy in December’s shareholder vote, or at least add bitcoin to the balance sheet to weather these inflationary times.

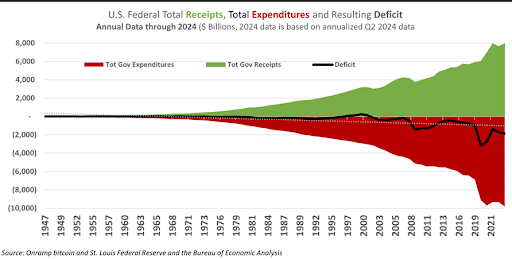

Why will these patterns persist? Because the acceleration in debt and deficits (black line shown below) in the U.S. and across G-7 countries is approaching 10%.

So investors will continue to allocate to BTC, gold and equities to maintain buying power, as it follows that you must at least make 10% to offset the ill effects of USD debasement.

Bonds have failed to do that, reducing REAL buying power for investors.

Not shown is the U.S. debt-to-GDP that has grown from 80% pre 2008 GFC to over 122% today. The resulting interest expense has climbed to the second largest line item in the government budget. We think that the mounting interest expense is a major headwind to any attempt to reduce the pace of debt issuance. One reason we say the best days for bonds are in the rear view mirror.

Against this backdrop of increasing US sovereign debt and deficits, we note bitcoin’s price has appreciated with adoption as measured by active wallets and U.S.spot BTC flows (see Onramp Terminal).

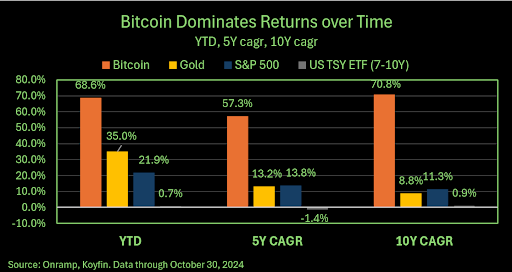

Bitcoin has dominated all asset classes over time. This is one reason our recently released 45 page report demonstrating how BTC increases returns while dampening risk in a traditional 60/40 portfolio is getting attention.

And then there is the election.

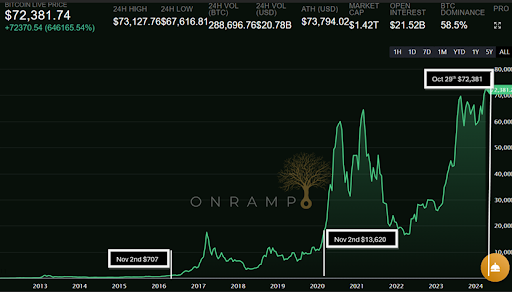

We note that bitcoin’s 4 year halving cycles (2012, 2016, 2020, 2024) occur in close proximity to the U.S. Presidential four year election cycle.

Prices noted above in boxes were the day before the U.S. Election, save for next month’s election in 2024, where we used October 29th’s price.

Yes, earnings season has been good, and YTD returns for NON Magnificent 7 stocks like WMT (+57%), JPM (+35%), GE (+75%) Citi (+28.9%) and Alcoa (+20%) have performed close to or better than the S&P 500, but the likely persistence of higher rates will chip away at this year’s broad boost for equities from rate cut hopes.

Remember, Citibank’s equity price ($64.50) is still lower today than it was in 1993. Yes, you clipped some nice dividends along the way, but that makes Citi a utility, or worse, a bond with risk.

The additional headwind of elevated credit card debt and defaults announced by banks is not fully priced in, and may impair the bulwark of US GDP, consumer spending.

Lastly we see the election outcome having ZERO impact on the trajectory of debt and deficit pending…so above performance patterns will persist post November 5th.

In finance, we often have disclaimers that state, past performance is not indicative of future results. Fair enough.

But when it comes to politicians and fiscal policy, we think a new disclaimer is necessary.

When in doubt, assume we will take the easy road, expediency over necessity.

So expect more deficit funding that solves immediate needs, while distorting asset valuations further, leaving an inevitable resolution to the next administration.

Chart of the Week

“MicroStrategy announces $42 billion capital plan including $21 billion ATM equity offering and a target of raising $21 billion in fixed-income securities. “

Quote of the Week

“Bitcoin looks like it’s going to be the resounding inflation hedge asset for the next 50 or 100 years…so that die has been cast. I think you’re seeing the last vestiges of people using gold as a rational economic insurance policy, but I think the future is specifically bitcoin, on that dimension.”

Podcasts of the Week

The Last Trade E071: Bitcoin’s Hidden Portfolio Power with Mark Connors

In this episode of The Last Trade, Mark Connors, Onramp’s Head of Global Macro, joins to discuss our recently published report detailing the data-driven case for bitcoin allocations in traditional portfolios.

Wake Up Call (10.28.24): Jennifer Murphy, CEO & Founder of Runa Digital Assets

In this episode of Wake Up Call, hosts Rich Kerr & Mark Connors are joined by Jennifer Murphy, CEO & Founder of Runa Digital Assets, to discuss bitcoin’s transformative potential & the need for new frameworks as institutional interest grows.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Mark Connors & Brian Cubellis