11/16/23 Roundup: Inflation Data, Fed Outlook, & Bitcoin Derivatives

Onramp Weekly Roundup

Written By Dylan LeClair

Hi all,

This is Dylan LeClair, presenting this week’s Onramp Weekly Roundup.

Before we get started… If you’re a HNWI or Institution looking for the best way to get exposure to bitcoin, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

And now, here’s the weekly roundup…

Inflation Eases, Fed Rate Hike Outlook Shifts

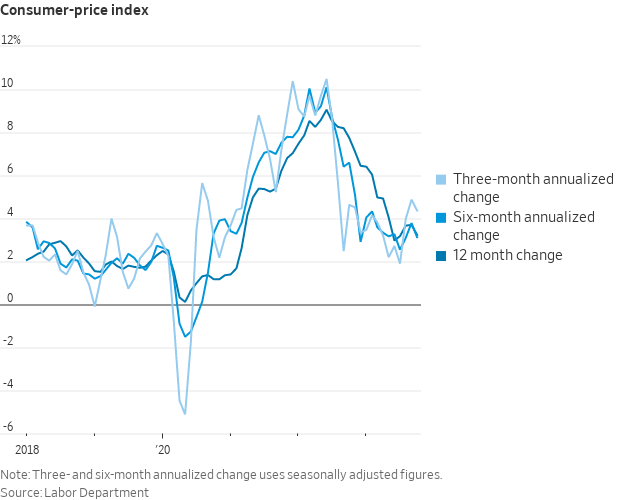

The US Consumer Price Index (CPI) for October showed a noteworthy stall this Tuesday, coming in at 3.2% year-over-year against expectations of 3.3% year-over year, marking a pivotal moment in the ongoing inflation saga.

Meanwhile core CPI, excluding food and energy, rose just 0.23% month-over-month – the smallest annual increase in two years. This decline is further evidenced by a decrease in the 3-month annualized core inflation rate to 3.4% from September’s 3.1%, and a drop in the 6-month annualized rate to 3.2% from 3.6%.

In response to these figures, there was a notable shift in market expectations regarding expectations for Fed monetary policy. The likelihood of further interest rate hikes, has all but disappeared for the rest of the year. Given this repricing on the back of the cooler than expected inflation reading, stocks and bonds spurred off their most positive one day combined percentage move since November of 2022.

Late Longs Get Wiped

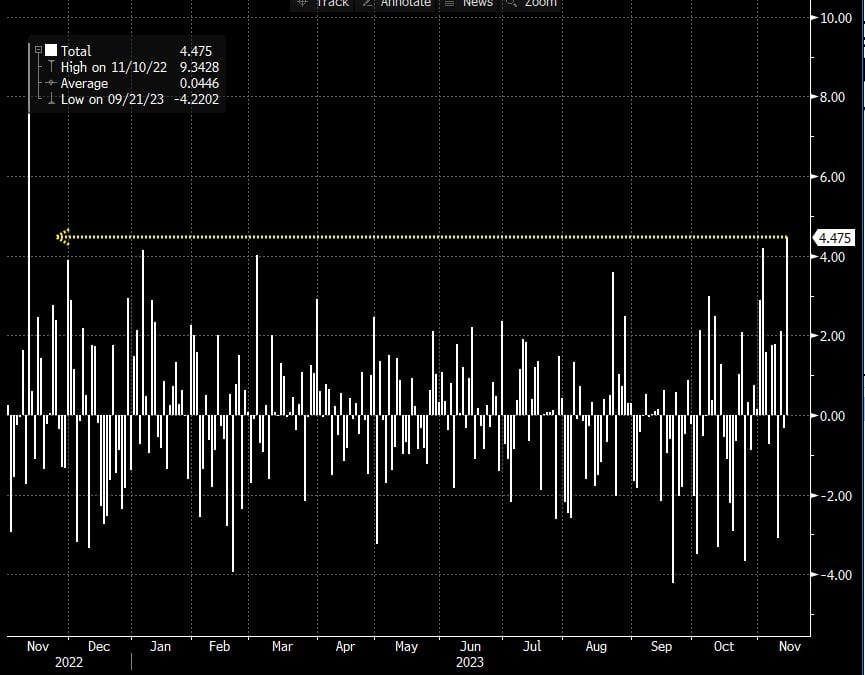

On Tuesday, bitcoin briefly dipped from its local highs near $38,000, triggering a wave of liquidations in the futures market during a broader rally in global risk assets. The event saw $87 million in long futures positions auto-liquidated, along with a larger number of manually closed leveraged long positions. Marking the second largest long liquidation of 2023, this was predominantly a derivative-driven phenomenon. However, prices quickly bounced back as spot market buyers jumped in, seizing the opportunity from the drop and effectively catching the falling knife.

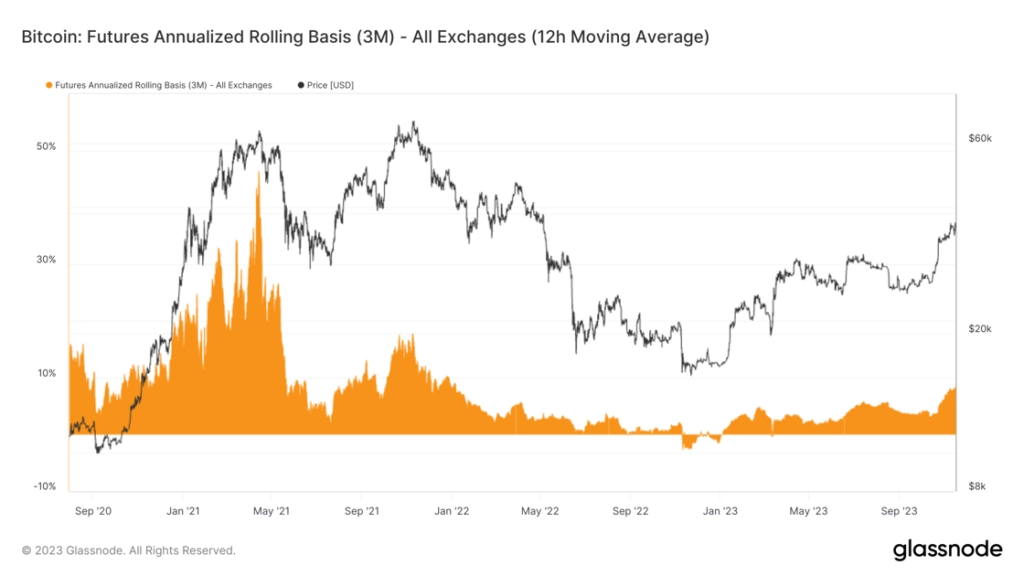

On a similar note, there seems to be a structural shift unfolding in the futures market, bringing with it a mix of excitement and a slight lean towards long-biased speculation. As highlighted previously, CME futures is now relatively larger than ever compared to the rest of the offshore futures market. Moreover, the futures basis — observed through the three-month forward futures contract relative to the spot market price — has reached levels unseen since early 2022. While some might interpret this as a sign of an overheating market, the institutional nature of CME futures traders suggests a different perspective. We consider this a proxy for anticipated demand for bitcoin, possibly driven by potential spot ETF approvals among other factors. It also indicates that the implicit bearish bias among speculators and shorter-term investors has begun to dissipate.

Podcast of the Week

E025: Deep Dive on Bitcoin’s Full Potential Valuation with Dylan LeClair

In this week’s episode of The Last Trade, I teamed up with the regular hosts for an awesome discussion. We delved into the latest bitcoin price movements, explored the buzz around potential ETFs and their likely effects, and took a deep dive into Jesse Myers’ insightful report on Bitcoin’s Full Potential Valuation. The episode wraps up with a lighthearted conversation about the concept and label of ‘Bitcoin Maximalism.’

Don’t miss the full discussion — check out the entire episode here.

Check out the full episode here.

Closing Note

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair