11/2/23 Roundup: Fiscal Concerns & Bitcoin as a Flight to Safety

Hi all,

This is Dylan LeClair, presenting this week’s Onramp Weekly Roundup.

Before we get started… If you’re a HNWI or Institution looking for the best way to get exposure to bitcoin, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

And now, here’s the weekly roundup…

Fiscal Foresight: Druckenmiller's Warning

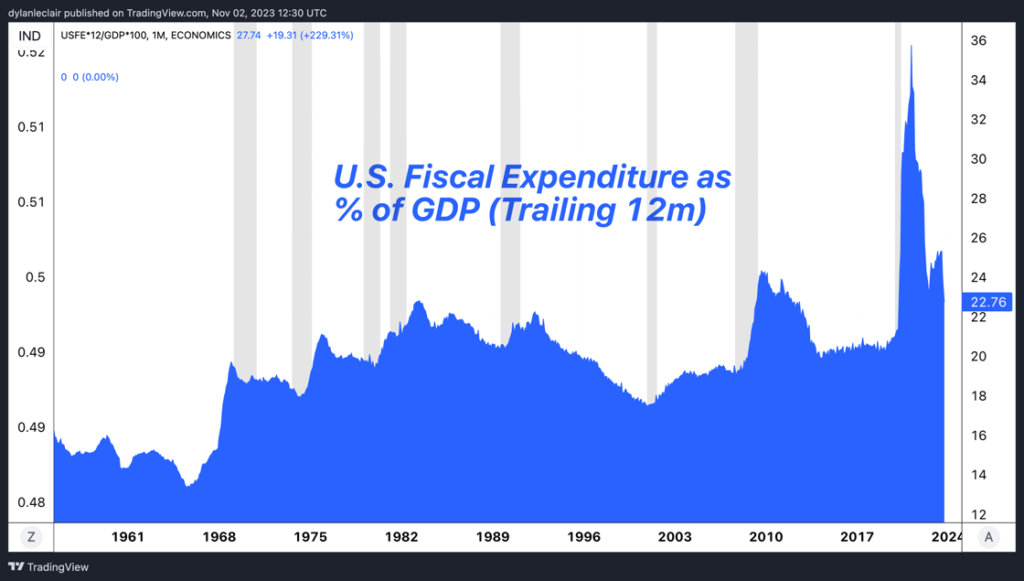

Billionaire investor Stanley Druckenmiller has vocalized a stark warning for the U.S. fiscal future. Highlighting the federal government’s “drunken sailor” spending habits, Druckenmiller underscores the steep rise in government spending to GDP—from 20% pre-Covid to 25% currently. He warns of a challenging path ahead, proposing potential cuts to Social Security looming as one remedy to the burgeoning debt, albeit with plenty of skepticism.

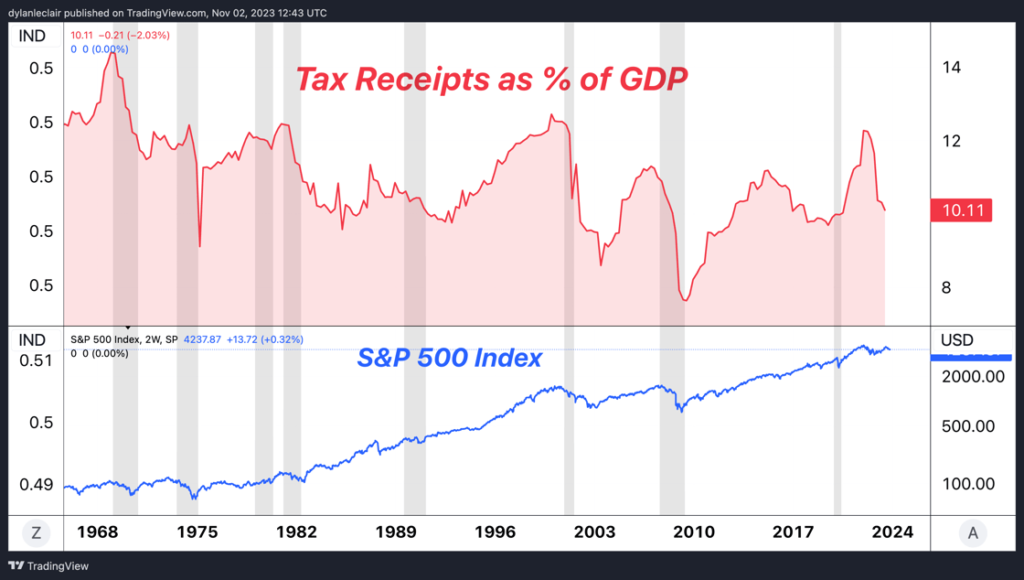

Druckenmiller’s sentiments come on the heels of the federal government concluding its fiscal year with a nearly $1.7 trillion deficit, contributing to a national debt approaching $34 trillion. His view is a testament to the precarious state of the U.S. fiscal situation, with tax receipts declining as a percentage of GDP, signaling a clear disconnect between current administration spending and economic reality.

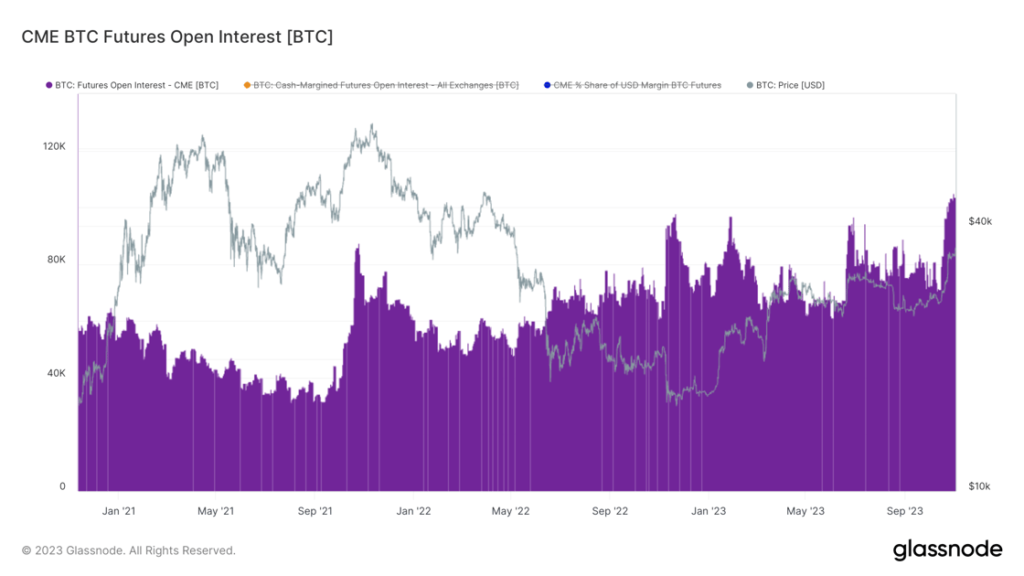

Bitcoin’s Institutional Beacon: CME Futures Interest Soars

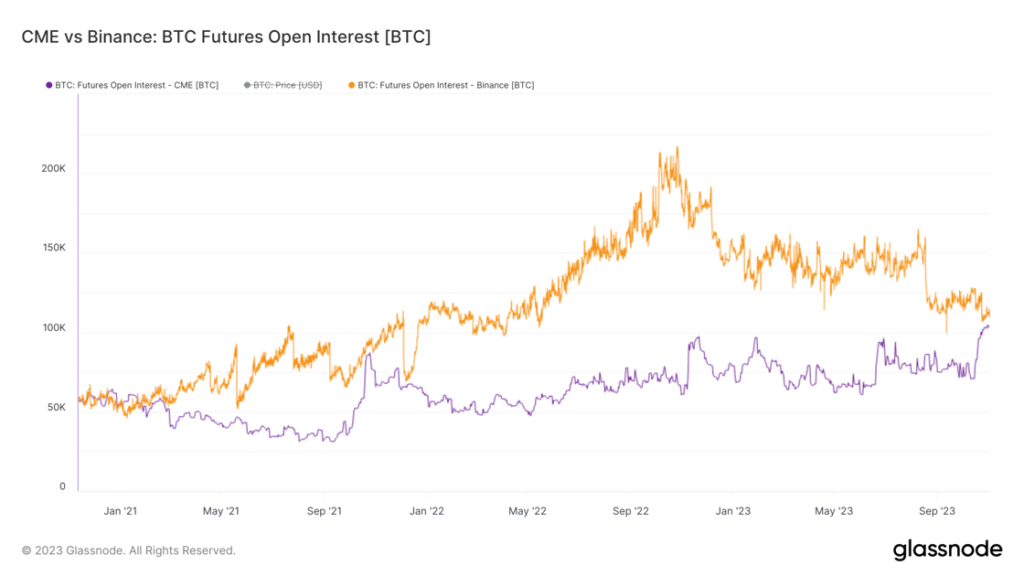

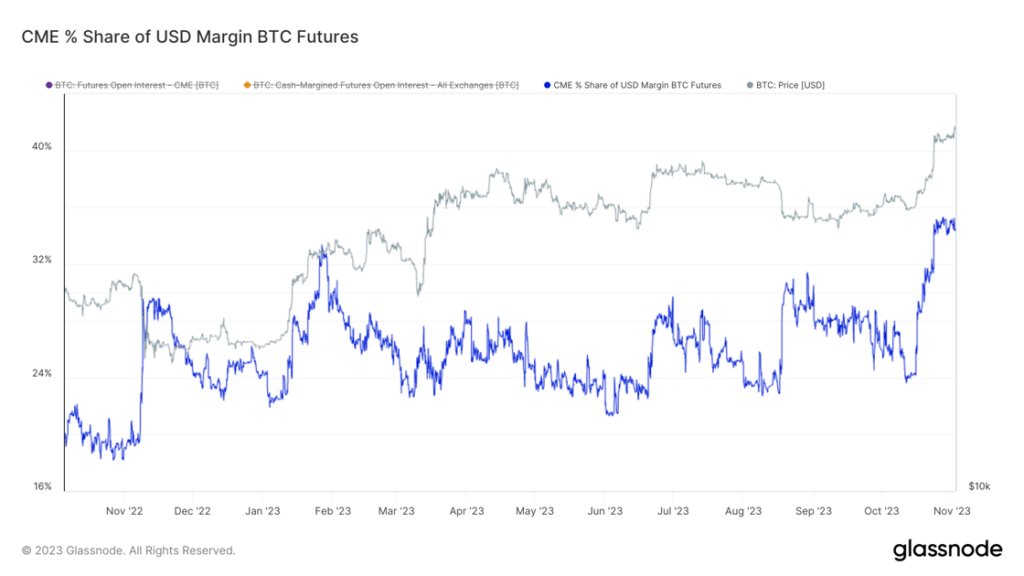

Turning our eyes to bitcoin, institutional interest is unmistakably on the rise. The Chicago Mercantile Exchange (CME) has witnessed a surge in bitcion futures open interest, with figures approaching the total interest on Binance, the leading crypto exchange. This shift is indicative of a changing demographic in bitcoin market participants.

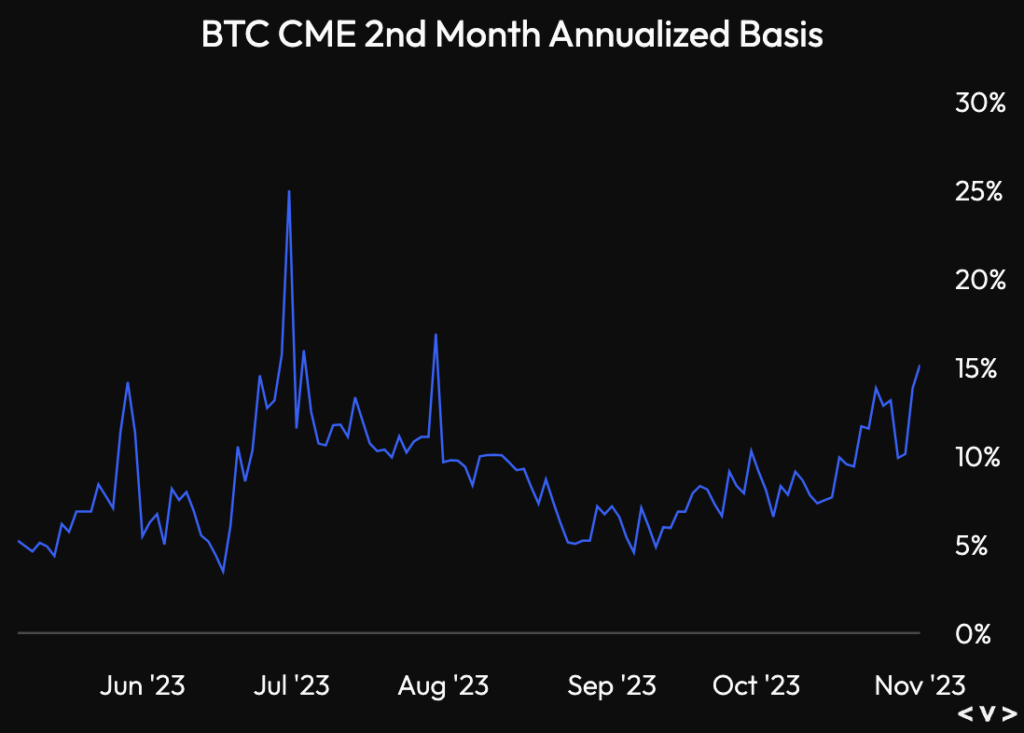

The optimism in the futures market is also mitigated by a common phenomenon in commodities futures trading known as contango—a situation where futures prices are higher than the spot price. For bitcoin, this leads to an unfavorable scenario for holders of futures contracts: as these contracts roll over, the cost of maintaining a position increases, potentially diminishing returns when denominated in bitcoin.

The existence of contango in bitcoin futures markets underscores the need for better suited institutional products, with many excited about the potential for a potential spot ETF approval.

While the market’s pulse quickens at the thought of a spot ETF, savvy participants recognize that this, too, comes with its own set of constraints. True, it aligns more closely with bitcoin’s immediate market price than futures, sidestepping the intricate dance of futures roll costs. Yet, it stops short of fully capturing the essence of bitcoin’s full potential, failing to leverage it’s native attributes that make it such a unique monetary asset in the first place.

These native attributes are central to bitcoin’s identity, not mere add-ons. As investors look to integrate bitcoin into traditional portfolios, it’s worth considering how well these new financial products capture and leverage bitcoin’s foundational principles.

Traditional Finance Warms Up to Bitcoin

The financial community’s view of bitcoin is undergoing a significant transformation in 2023. Prominent investor Stanley Druckenmiller has openly recognized bitcoin’s value, expressing a nuanced regret for not having included it in his portfolio. “I don’t own any bitcoin to be frank but I should,” he has stated, underlining a shifting sentiment among market veterans.

Complementing Druckenmiller’s perspective is Mohamed El-Erian, Chief Economic Advisor for Allianz, a German financial services company with $2 trillion under management. He highlights an emerging narrative where, against a backdrop of global economic uncertainty and diminishing faith in government bonds, bitcoin and equities are increasingly being categorized as ‘safe assets.’

“It is fascinating that in discussions about what is a ‘safe asset,’ bitcoin is increasingly entering the conversation, and that’s a significant change,” El-Erian observed.

Together, these insights from two large investors in the financial world signals a notable pivot in attitude towards bitcoin. Their recognition of bitcoin as a potential haven mirrors broader market concerns over escalating debt and macroeconomic instability, amplifying bitcoin’s legitimacy and prospective stability as an asset class.

Podcast of the Week

E023: A Peer-to-Peer Electronic Cash System with BitGo & Coincover

In this week’s episode of The Last Trade, Marty and Michael were joined by members of BitGo & Coincover to explore the intricacies of institutional custody solutions, focusing on transparency and the evolution of bitcoin-centric financial products. They tackle the significance of preparing for the trillions poised to potentially enter the market, reflecting a shared bullish sentiment on the future of institutional bitcoin adoption.

Check out the full episode here.

Closing Note

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair