11/7/24 Roundup: Trump Wins, Buffett Loses, & Bitcoin Hits ATH

Onramp Weekly Roundup

Written By Mark Connors & Brian Cubellis

Before we get started…

Last week, we announced the launch the industry’s first Bitcoin IRA product with Multi-Institution Custody. Assets are secured by three independent custodians with full on-chain transparency, offering unparalleled peace of mind for retirement investors.

Learn more and join the waitlist if you’re interested securing your retirement assets with best-in-class custody, with no single points of failure, and no need for hardware devices.

If you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations — connect with Onramp.

And now, for the weekly roundup…

Mark Connors’ Macro Corner…

- Trump Wins, Buffett Loses, & Bitcoin Hits ATH

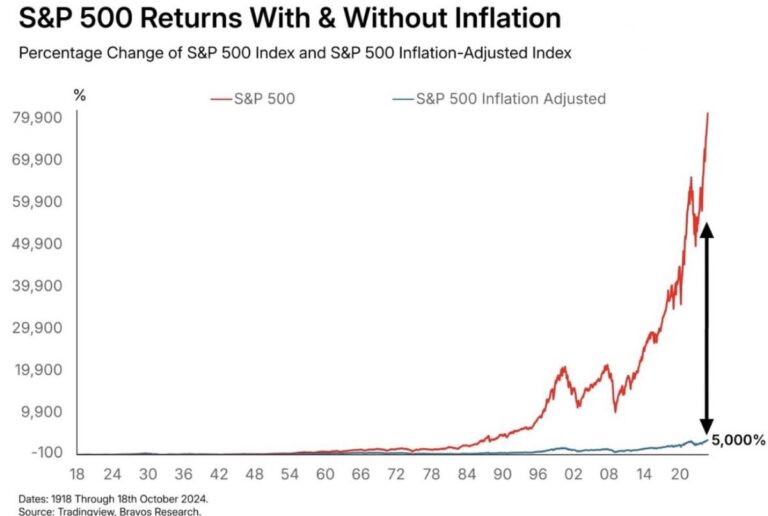

Chart of the Week…

- Inflation-Adjusted S&P500 Returns

Quote of the Week…

- UK Pensions Allocate 3% to BTC via Onramp

Podcasts of the Week…

- The Last Trade / Final Settlement / Wake Up Call

Trump Wins, Buffett Loses, & Bitcoin Hits ATH

From railroads & soda pop to Apple, Warren Buffett’s Berkshire Hathaway (BRK/B) has always endeavored to buy great companies at good prices. Now that BRK/B is dropping its Apple holdings, what investment will put Warren Buffett’s Berkshire Hathaway back into the Top 10? (Assets by Market Cap, shown below)

That task is becoming harder to achieve with companies like NVIDIA gaining 194% YTD, which is more than 10x that of Apple’s 16% return. This is one reason NVIDIA flipped Apple in the below list…and why Warren’s BRK/B is now sitting at #11. What few realize is that NVDA has been evolving to integrate software into their legacy hardware offering. This was over a decade in the making, but the gambit paid off handsomely.

Taking inventory of the below list, it looks like you need either a killer tech-based offering (NVDA, AMZN, META) or to be a commodity like gold, silver or bitcoin, in order to pierce the top 10. Notably, bitcoin happens to have both attributes.

Recognized as a commodity by the SEC and CFTC, bitcoin is an emergent store-of-value asset that rides upon on the largest, most decentralized, and secure computer network in the world.

Trump Trade & Inflation

Earlier today we shared on LinkedIn about the ‘Trump Trade’ relating it to his 2016 election and what it means for investors.

Just as the majority of pollsters missed the broad-based shift to Trump from Harris, we view the modest level of US CPI as misleading. Inflation is persistent and higher.

As our scorecard below shows, UST Treasury ETFs have underperformed for years, which we see continuing, potentially worsening given the debt and deficit dynamics shared in previous Roundups.

The Fed

Today’s equity rally and back up in the UST 10Y that pulled the USD (DXY) with it, SHOULD sideline a rate cut by the Fed. But it won’t. The Fed will still cut the overnight rate by 25bps as the interest expense is now the second largest line item for the U.S. after healthcare. This action chips away at the notion of Fed independence as Fed actions may be influenced by the fiscal needs of a profligate treasury and congress.

As we see with the second chart below with data from 2016 to present, the initial rise in rates also occurred in 2016, but remained modest at ~2.5% before being forced to emergency measures in September 2019 and again for Covid in 1Q20.

The debt and deficit situation has deteriorated since then, reducing options for ANY president as we shared in the previously mentioned LinkedIn post.

Bitcoin & Price Discovery

Just as market pundits appeared to be wading deep in uncharted waters this past election, we suggest allocators, portfolio managers, and individuals are likewise walking untrodden investment ground.

First, Trump’s winning of the popular vote was a first in 20 years for a republican. Second, Biden’s decision to not run was the first for an incumbent since Johnson’s decision in 1968. War and civil discord also characterized that period. But the U.S. did NOT have a 122% debt-to-GDP, an aging population, and a few other distractions that lay claim to our budget.

Nixon won in 1968 and chose to break the peg to gold on August 15th of 1971, in order to increase deficit spending to fund the Vietnam War. This unleashed the worst decade of inflation our country has ever endured. The price of gold and crude oil spiked 14x and 18x, respectively, during the 1970s.

Yesterday, we were also reminded by Senator Cynthia Lummis that Donald Trump has another option, namely a Bitcoin Strategic Reserve. Trump himself promised to create and fund such a reserve to address the rising debt load that imperils fiscal sustainability for the U.S.

On election night and into the morning, we saw bitcoin break out of a 7+ month period of consolidation, rising almost 10% to over $76,000, a new all-time-high. Just as the turning tide among voters was NOT in the data, we suggest that bitcoin’s upside potential is NOT fully priced in and therefore warrants a unique level of consideration.

Chart of the Week

“The vast majority of productivity gains and the added value created by human innovation is robbed by governments through #inflation.

That’s why we #Bitcoin.”

Quote of the Week

“Specialist consultancy Cartwright Pension Trusts advised on the allocation, which makes up approximately 3% of the £50m scheme’s investment portfolio. The allocation [bitcoin] is the first of its kind in the UK and took place in October after a rigorous training and due diligence process.

Rather than a traditional structure such as exchange-trade fund (ETFs), Cartwright said the allocation was held directly in ‘cold storage’ – meaning offline – with three institutional custodians. The assets are stored using a multi-signature approach to enhance security.”

Podcasts of the Week

The Last Trade E072: From Whitepaper to World Stage with Cam Doody & Bradley Chambers

In this episode of The Last Trade, Cam Doody (Founder of Brickyard) & Bradley Chambers (Onramp client & marketing advisor) join to discuss bitcoin whitepaper day reflections, bitcoin’s technological parallels, the evolution of custody, bitcoin’s impact on venture, & more.

Final Settlement E016: Assessing Custodial Threat Vectors with Guy Swann

In this episode of Final Settlement, Guy Swann, host of the Bitcoin Audible podcast, joins to discuss a recent bitcoin security incident in Lugano, the notion of apolitical money, implications of digital bearer instruments, the importance of multisig, custodial considerations, security threat vectors, & more.

Wake Up Call (11.4.24): The Hashpower Imperative with Lisa Hough

In this episode of Wake Up Call, hosts Rich Kerr & Mark Connors are joined by Lisa Hough to discuss the intersection of bitcoin & energy markets, highlighting the national security imperative of securing mining hashrate in the US.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Mark Connors & Brian Cubellis