12/5/24 Roundup: Six Figure Bitcoin

Onramp Weekly Roundup

Written By Brian Cubellis

Before we get started…

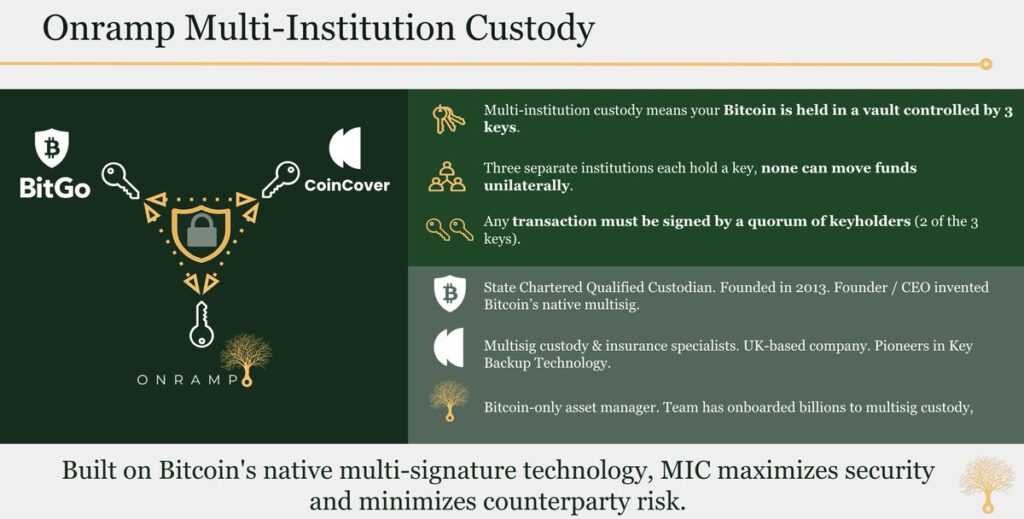

If you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations — connect with Onramp.

Be sure to join us next week (12/11 at 12PM EST) for the forthcoming session of the Onramp Webinar Series. Jesse Myers, Onramp’s co-founder, and Bram Kanstein, Onramp’s new Head of Growth, will lead an insightful discussion delving into bitcoin’s full potential and its critical role as a savings technology. We’ll explore bitcoin’s scarcity dynamics, market cycle positioning, and how it offers a solution to continued monetary debasement caused by unsustainable debt and money creation.

Register here to understand why bitcoin is the ultimate savings technology.

And now, for the weekly roundup…

Six Figure Bitcoin

Last night, the price of bitcoin broke through the technical and psychological barrier of $100,000 USD. While the past few weeks of price action in the high 90s may have made the moment feel anticlimactic for some, the milestone is historically significant and worthy of reflection.

The ~16 year technological and monetary experiment that is bitcoin has monetized before our eyes from zero to over two trillion dollars in market cap. This is nothing short of a remarkable feat. Throughout the past 16 years, bitcoin has repeatedly been proclaimed to be “dead” yet it continues to achieve higher highs and higher lows. While volatile in the short-term, the long-term trajectory is upwards, as increasing demand confronts a static finite supply.

While many described the approval and subsequent launch of bitcoin ETFs as the asset’s “IPO moment,” its crossing of the $100k barrier is perhaps a more apt landmark to focus on. Bitcoin can no longer be ignored, and the curiosity of the crowd is shifting from “can this asset go to zero?” to “how high can it go?”

Recent comments from some of the most powerful individuals in the world reflect bitcoin’s renewed positioning in the financial zeitgeist:

- Jerome Powell: “It’s [bitcoin] really a competitor for gold.”

- Donald Trump: “Bitcoin is the new oil.”

- Vladimir Putin: “Who can ban bitcoin? Nobody.”

- Larry Fink: “Bitcoin is an asset class in itself. It is an alternative to other commodities like gold.”

Moreover, nearly every member of the newly appointed cabinet of the incoming Trump administration either owns BTC themselves, or has publicly spoken positively about the asset. This coincides with multiple legislative bills at both the state and federal level advocating for the accumulation of bitcoin as a strategic reserve asset.

The Overton Window with respect to the perception of bitcoin as a legitimate asset with long-term value has shifted materially…

Bitcoin is now the 7th largest asset in the world:

Data as of market open on 12/5/24

At ~$109k per BTC, it will surpass GOOG.

At ~$116k per BTC, it will surpass AMZN.

At ~$165k per BTC, it will surpass MSFT.

At ~$180k per BTC, it will surpass NVDA.

At ~$186k per BTC, it will surpass AAPL.

After surpassing Apple, bitcoin will be the second largest asset in the world, behind only gold. At that point, it will become undeniably clear that bitcoin is competing directly with gold as a long-term store-of-value and reserve asset.

At ~$907k per BTC, it will surpass gold’s market cap. Because bitcoin improves upon the monetary properties of gold in every way (finite hard-cap, divisibility, portability, etc) it is reasonable to expect that over the long-term, bitcoin’s market cap could exceed that of gold by many multiples.

Said another way, we are indeed still very early.

Secure Custody is Paramount

As the price of bitcoin continues to appreciate, the mental and physical burden of securing meaningful wealth in the asset increases in tandem.

This is why Onramp exists.

Multi-Institution Custody eliminates single points of failure, providing unparalleled security and peace of mind. Six figure bitcoin necessitates a serious long-term approach to custody, one that allows clients to abstract away the complexity and burden of key management, plan for inheritance and access financial services, all while avoiding single-entity counterparty risk.

To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

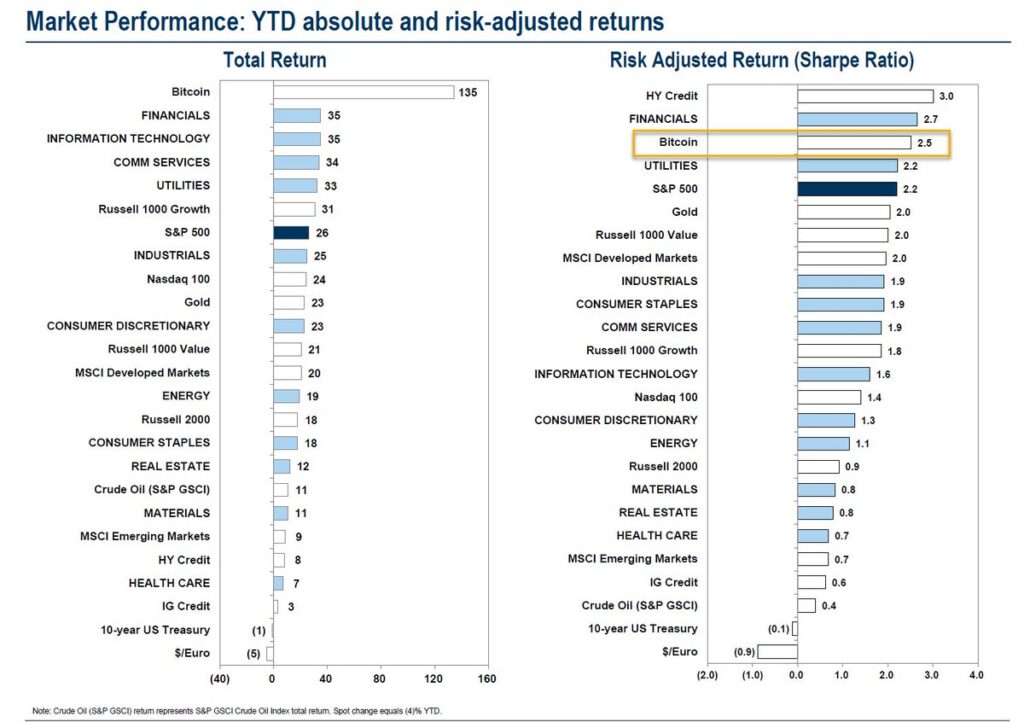

Chart of the Week

“Bitcoin is not only the best performing asset in history (and certainly in 2024), it has a HIGHER Sharpe ratio (risk-adjusted return) than the S&P, Treasuries and gold.”

Quote of the Week

“The purpose of Bitcoin isn’t to delete institutional trust. In a high functioning society we can trust institutions. The purpose is to give people the OPTION to not trust institutions, which actually makes institutions more trustworthy.”

Podcasts of the Week

The Last Trade E076: Bitcoin Enables Ethical Finance with Harris Irfan

In this episode of The Last Trade, Harris Irfan, CEO of Cordoba Capital Markets & Advisor to Onramp MENA, joins to discuss how bitcoin enables ethical finance, synergies with Islamic finance, low time preference, sound money incentives, adoption in MENA, & more!

Final Settlement E017: Countdown to Bitcoin Institutional Day with Allen Farrington & Harris Irfan

In this episode of Final Settlement, Managing Partner of Onramp MENA, Ralph Gebran, is joined by Onramp CEO Michael Tanguma, Allen Farrington, and Harris Irfan to discuss key topics that will shape the narrative at next week’s Bitcoin Institutional Day in Abu Dhabi, including Islamic finance meets bitcoin, bitcoin venture capital, & the future of custody.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Brian Cubellis