3/14/24 Roundup: Bitcoin ETF Inflows Accelerate

Onramp Weekly Roundup

Written By Brian Cubellis

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

And now, for the weekly roundup…

- Bitcoin ETF Inflows Accelerate

- The Game Theoretical Significance of ETFs

- Onramp’s Vision: Beyond ETFs

Bitcoin ETF Inflows Accelerate

This week, the financial realm has been abuzz with one of the most significant developments in recent times: new all-time highs for Bitcoin, catalyzed in part by unprecedented demand for the asset via inflows to the newly launched spot Bitcoin ETFs. These products have meaningfully broadened access to Bitcoin and represent an important shift in the asset’s integration into the broader financial ecosystem.

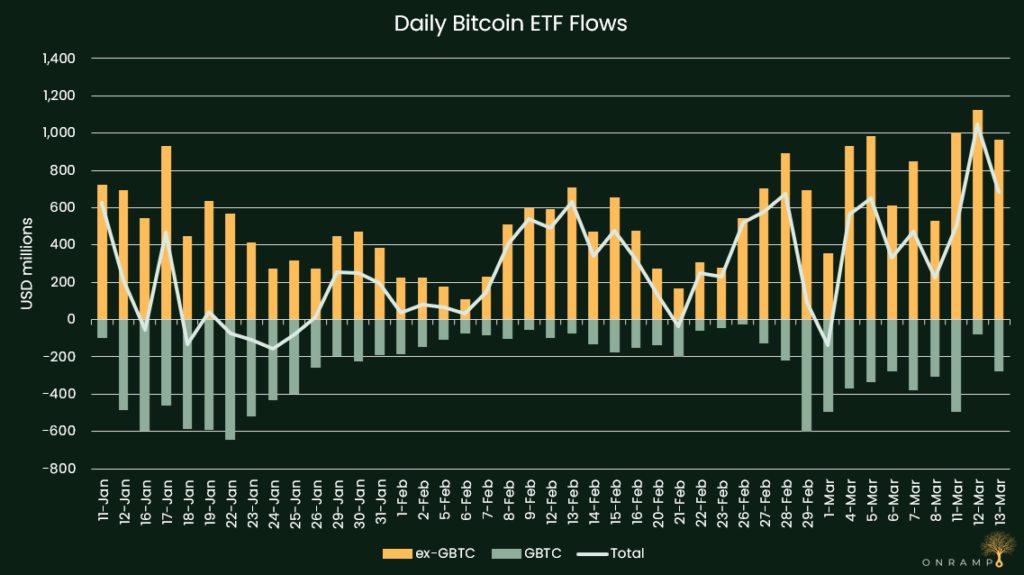

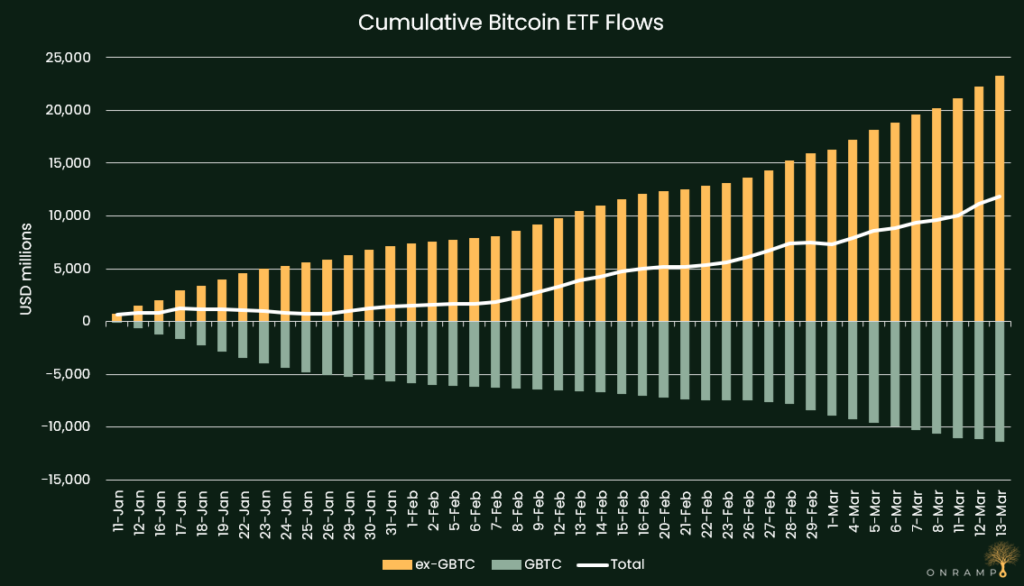

Tuesday witnessed a staggering influx of 14,612 BTC into the spot Bitcoin ETFs, setting a new daily record. Since their inception, these ETFs have amassed over 211K BTC in inflows, accounting for more than 1% of the circulating supply. The magnitude of this demand was underscored by a historic $1.045 billion inflow on Tuesday alone, marking the first instance of single-day inflows surpassing the $1 billion mark.

The significance of these inflows becomes even more pronounced when compared to the rate of newly issued (mined) Bitcoin, which currently stands at 900 BTC per day and is set to be programmatically cut in half in a little over a month. The charts below showcasing these record inflows highlight the magnitude of demand for Bitcoin, juxtaposed against its limited new supply, painting a vivid picture of the growing appetite for the asset and its supply/demand imbalance.

The Game Theoretical Significance of ETFs

The advent of Bitcoin ETFs represents a watershed moment in the asset’s journey towards universal adoption. Historically, the barriers to entry for gaining exposure to Bitcoin were substantial, particularly for institutions and regulated allocators. However, ETFs have meaningfully reduced these barriers, allowing anyone to gain price exposure to Bitcoin through their brokerage accounts.

From a game theoretical perspective, the trajectory of Bitcoin adoption is a classic example of collective decision-making, where each participant’s choice influences the overall outcome. Initially, Bitcoin’s acceptance as a universal form of money seemed risky and unlikely. However, as more individuals and institutions opt to store their economic energy in Bitcoin, it alters the dynamics of this theoretical framework. Every new individual or entity which adopts Bitcoin not only strengthens its network effect but also tends to become a vocal advocate for the asset, prompting others to reconsider their stance (e.g. Larry Fink).

ETFs are now playing a pivotal role in this dynamic, making it significantly easier for people to participate in these game theoretical dynamics and, by extension, bolster Bitcoin’s relevance and acceptance as not only an investable asset, but a new form of money or store of value.

Onramp's Vision: Beyond ETFs

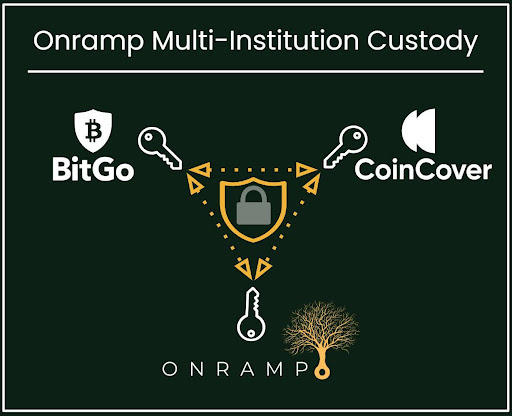

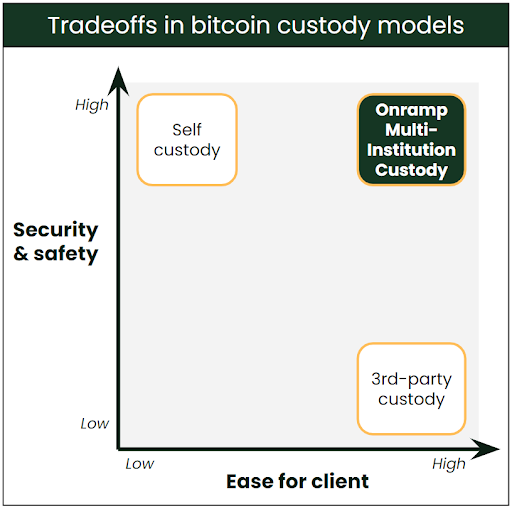

At Onramp, while we acknowledge the significance of ETFs in Bitcoin’s adoption curve, we believe there’s a more secure, direct, and beneficial way to engage with this revolutionary asset. Our offering focuses on multi-institution custody, which maximizes security while minimizing counterparty risk. Unlike ETFs, which offer a paper claim on Bitcoin, our solution ensures clients maintain control and ownership of their Bitcoin, while eliminating single points of failure. With Onramp Multi-Institution Custody, assets live in a multi-sig vault controlled by 3 distinct entities, none of which have unilateral control.

Our custody solution gives clients the ability to audit their funds on-chain and make withdrawals to self-custody at any time, without triggering taxable events – features not available with ETF shares. This distinction is crucial for those who view Bitcoin as money and anticipate its universal acceptance. True ownership means having the ability to use Bitcoin in the real world, whether for transactions, providing liquidity on the Lightning Network, or spending it as one would with traditional currency.

As Bitcoin continues to navigate its path towards being recognized as the best form of money humans have ever seen, the choice between indirect exposure through ETFs and direct ownership via multi-institution custody becomes increasingly significant. For those with a long-term belief in Bitcoin and its potential as a universal form of money, Onramp’s custody solution offers a superior alternative, ensuring more than just price exposure and providing real ownership of the underlying asset.

ETFs mark an important psychological shift in the game theory of Bitcoin adoption. However, for the discerning investor looking for more than just price exposure – seeking the assurances and benefits of actual ownership – Onramp stands ready with a solution that aligns with the core principles of Bitcoin, leverages its native properties (multi-sig), and decentralizes the control of funds across three distinct entities. Bitcoin is the most decentralized and trust-minimized asset humanity has ever encountered – the ideal form of custody should uphold those attributes and avoid centralization with singular counterparties.

Chart of the Week

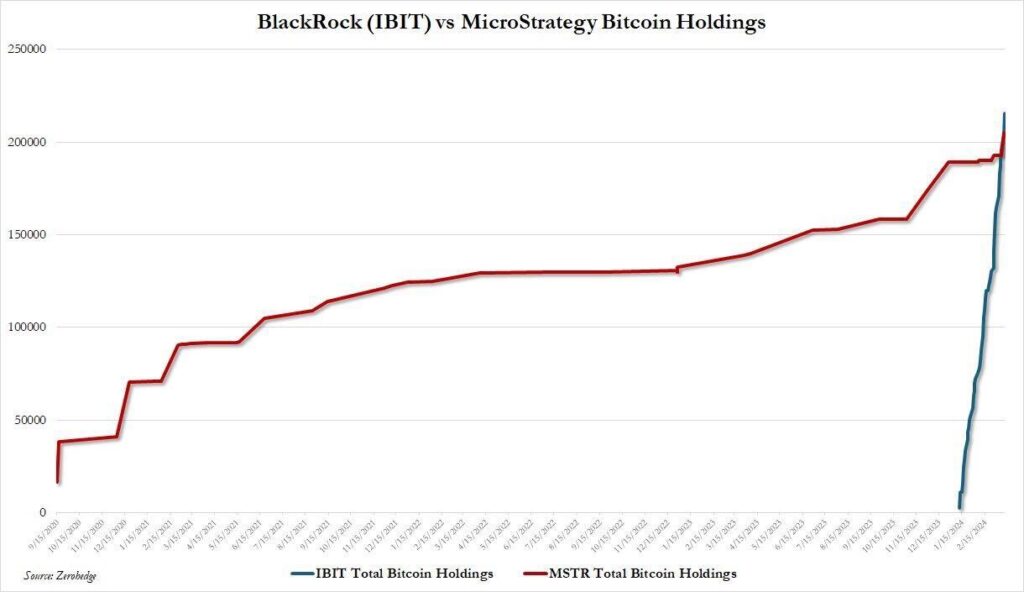

source: ZeroHedge

This incredible visual depicting the accumulation of Bitcoin from two of its largest current holders – MicroStrategy & BlackRock – demonstrates the rapid pace at which IBIT has amassed BTC. What took Michael Saylor nearly four years to accumulate, BlackRock has achieved in roughly two months.

Quote of the Week

“‘Bitcoin fixes this’ means ‘a properly designed accounting system incentivizes accountability.’ Money today can be created with the stroke of a pen; new units of Bitcoin require physical energy usage to create. As an accountability system, measuring units should not change.”

— Bill Miller IV, Miller Value Partners

Market Update

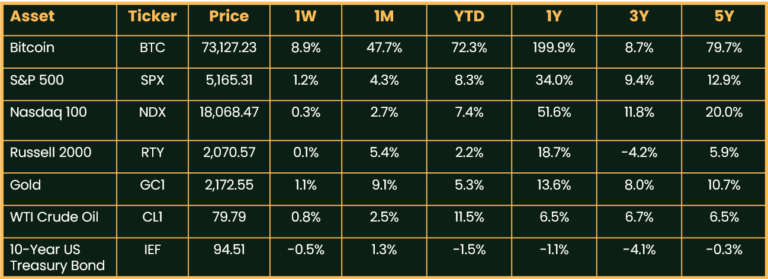

as of 3/13/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

After briefly setting a new all-time high last week, bitcoin definitively set new levels this week, piercing through $73,000 as bitcoin ETFs saw record inflows. Stocks were up modestly as we lapped the one-year anniversary of the Silicon Valley Bank crisis and the Bank Term Funding Program came to an end. The rate-sensitive Nasdaq and Russell underperformed the S&P as rates rose modestly after a slightly hotter than expected CPI reading showed that prices rose 3.2% year-over-year in February. Gold continued its own breakout to new all-time highs gaining another 1.1%, and is now the second best performing asset class over the past month behind bitcoin. Oil rose 0.8%.

Podcasts of the Week

The Last Trade E041: Nobody Puts Bitcoin in a Corner with Mark Connors

In this episode of The Last Trade, Mark Connors, Head of Research at 3iQ, joins the pod to discuss bitcoin ETF flows, centralization risks, the evolution of custody solutions, educating investors about bitcoin’s asymmetry & more.

Final Settlement E004: Bitcoin is the True Cost of Capital with Cam Doody

In this episode of Final Settlement, Cam Doody, founder of Brickyard, joins the pod to discuss the evolution of venture investing, harnessing deflationary tech, the power of AI, prudent capital allocation, bitcoin’s role as the true cost of capital & more.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Brian Cubellis