3/28/24 Roundup: 2Q24 Market Radar

Onramp Weekly Roundup

Written By Zack Morris

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

And now, for the weekly roundup…

2Q24 Market Radar:

- April 20: Bitcoin Halving

- May 1: Treasury Quarterly Refunding Announcement

- June 12: Fed Rate Decision

- April 10, May 15, June 12: CPI Reports

- April 5, May 3, June 7: Unemployment Reports

With an eventful Q1 — which saw the approval and launch of spot bitcoin ETFs and new all-time highs — now behind us, it’s time to take a look ahead to Q2 and make note of some important dates to keep in mind.

April 20: Bitcoin Halving

Subject to change as it depends on the time it takes to mine new blocks, the quadrennial bitcoin halving is currently projected to occur on April 20, 2024.

The halving marks the date (block) every four years (210,000 blocks) at which the block subsidy falls by half, decreasing the rate of new bitcoin supply to come onto the market. This April’s halving will see the block subsidy drop from 6.25 to 3.125, and thus the daily issuance of new supply to miners drop from 900 BTC to 450 BTC.

The halving has historically preceded bitcoin bull markets and the setting of new all-time-highs in price, and is the basis for the popular stock-to-flow pricing model. The current cycle is unique in that it is the first time a new all-time-high has been achieved before the halving event.

May 1: Treasury Quarterly Refunding Announcement

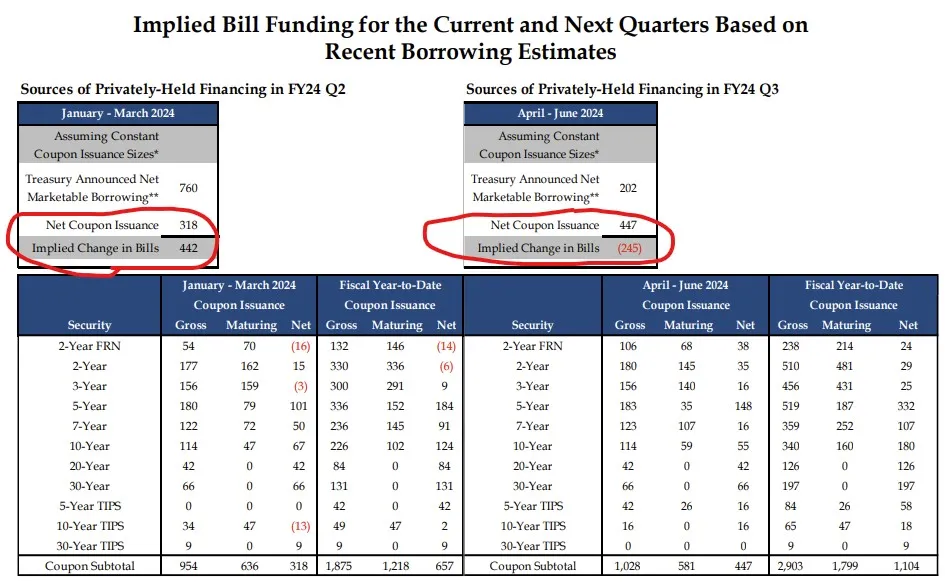

Everybody’s new favorite market liquidity catalyst is the Treasury’s quarterly announcement of the amount and mix of bills and coupons it will use to fund itself in the upcoming quarter.

All else being equal, a high mix of short-term bills to long-term coupons is positive for liquidity and for risk assets, as bills represent cash substitutes and compete for investment from money market funds and bank deposits. Coupon issuance, on the other hand, competes for investment with the more long-term oriented stock, bond, gold, and, increasingly, bitcoin markets. If more investment is needed to fund coupons, it can put upward pressure on long-term interest rates to attract that investment away from other asset classes, and suck money out of those other asset classes in a phenomenon known as “crowding out.”

Last fall, when the 10-year interest rate was above 5%, the Treasury surprised the market by dramatically increasing the mix of bills to coupons it would use to fund itself, sparking a rally in risk assets.

In January, the Treasury announced net negative bill issuance in Q2, as seasonal tax receipts would finance a majority of treasury operations. This was expected due to the April tax season and the market has shrugged it off.

This spring the market will be watching the Treasury’s forecast for summer borrowing needs. If the Treasury indicates they will stuff the market with bills again now that tax season has passed, it could be a near-term tailwind for risk assets.

However, with the 10-year at a more benign 4.25%, if the Treasury indicates they will again attempt to tap the long-end for a majority of new issuance, we could see a rise in long-end rates act as a headwind for risk assets.

June 12: Fed Rate Decision

While the FOMC has an earlier meeting and rate policy decision on May 1, all eyes are on June 12 as the meeting in which the Fed might implement its first rate cut and/or begin the tapering of balance sheet reduction, also known as quantitative tightening or QT.

While the market was previously expecting rate cuts to come before a reduction in QT, Fed Chair Jerome Powell surprised markets at the last FOMC on March 20 by suggesting that a reduction in QT could come as early as this June meeting. Risk assets cheered the news and rallied in the wake of the announcement.

QT effectively reduces financial market liquidity by reducing bank reserves. As banks have less reserves, they are forced to sell other balance sheet assets, often pushing the price down, to ensure they have adequate reserves. If they have excess reserves, they can effectively create new money in the economy by lending out those excess reserves to borrowers.

A reduction in the pace of QT would act as relief on bank reserves and be bullish for financial market liquidity.

April 10, May 15, June 12: CPI Reports

Whether or not the Fed raises rates, or reduces the rate of QT, at that June 12 FOMC meeting will likely be determined in large part by the three inflation readings we get between now and then.

In the last meeting, the Fed said it thought the recent bump in CPI was related to seasonal factors, and it remains confident inflation is on a downward trajectory to 2%.

If they’re right, and inflation comes down over Q2, we are likely to see more accommodative monetary policy from the Fed.

However, if it doesn’t and instead continues to tick upwards, the market and the Fed may need to reset their expectations for monetary policy altogether.

April 5, May 3, June 7: Unemployment Reports

The other half of the Fed’s dual mandate alongside price stability, full employment, may have seized the Fed’s attention as the half of the mandate to prioritize here in the short-term.

The unemployment rate has been ticking higher in recent months. If that path were to accelerate during Q2, expect the Fed to go ahead with rate cuts and a reduction in QT in an attempt to avoid something more sinister, even if inflation remains elevated.

Chart of the Week

Courtesy of Florian Kronawitter of The Next Economy:

The US stock market has been highly correlated with bank reserves since the COVID crisis. Bank reserves are expected to fall in Q2 due to tax payments and negative bill issuance.

Quote of the Week

“In the same way that any asset manager holds a portfolio of investments to diversify their risk, an ETF issuer can diversify their (bitcoin custody) risk by working with a range of trusted custody partners.”

— Sebastian Widmann, Forbes contributor

Sebastian rightly identifies the unique custodial considerations inherent to bitcoin, and highlights a concern we at Onramp share about the potential centralization of private key management.

While the majority of ETF issuers utilize a single custodian, Onramp has pioneered a different model of custody for our products – one that leverages the native properties of the bitcoin protocol, namely multi-sig, to distribute counterparty risk and eliminate single points of failure.

Market Update

as of 3/27/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Bitcoin rebounded after a week of significant net outflows from the ETFs. Other asset classes followed through on a post-Fed rally from last week and gained modestly, with the Russell 2000 small cap index outperforming.

Podcasts of the Week

The Last Trade E043: Bitcoin Fixes This with Larry Lepard & David Thayer

In this episode of The Last Trade, Larry Lepard & David Thayer (Executive Advisor to Blackstone) join the pod to discuss broken fiat incentives, the perils of centralization, how bitcoin restores economic sanity & more.

Scarce Assets E006: Robert Breedlove – What is Money?

In this episode of Scarce Assets, Robert Breedlove joins the pod to discuss the philosophical underpinnings of money, the nature of freedom, the ills of central planning & fiat inflation, bitcoin’s game theory & more.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris