4/25/24 Roundup: Halving Retrospective

Onramp Weekly Roundup

Written By Zack Morris

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

Last week, we unveiled our latest improvement in bitcoin custody; Onramp Insured Protection, a segregated insured custody solution with multi-institutional oversight, set to redefine the standards of asset safety for clients. To learn more, please schedule a consultation.

And now, for the weekly roundup…

- With the bitcoin halving complete, we look back at Epoch 4

- Bitcoin fees hit all-time high post halving

Bitcoin Halving: Remembering Epoch 4

At approximately 8:10pm New York time last Friday night, April 19th, the 840,000th bitcoin block was mined and bitcoin’s fourth halving event occurred.

Bitcoin price at time of each historical halving:

- November 28, 2012: $12.50

- July 9, 2016: $638.51

- May 11, 2020: $8,475

- April 19, 2024: $63,768

The halving refers to the 50% reduction in the block subsidy every 210,000 blocks, or roughly four years, and is a key event in the implementation of bitcoin’s programmatic monetary policy. This halving saw the block subsidy reduced from 6.25 BTC per block to 3.125 BTC per block.

A fun mathematical quirk of bitcoin’s supply release schedule is that the percentage of the total supply released in each mining epoch (the period of time between halvings) is equal to the block subsidy during that epoch. So, in Epoch 4 just completed, which had a block subsidy of 6.25, 6.25% of the total 21 million supply bitcoin was released. In the coming Epoch 5 with a block subsidy of 3.125, 3.125% of the total supply will be released.

With the 50% reduction in the block subsidy, the annual inflation rate for bitcoin drops from 1.7% down to 0.85%. This is an important milestone for bitcoin as the inflation rate is now below the long-term annual supply increase of gold, which is estimated to be ~1.7%. Bitcoin is now, officially, the hardest money on the planet.

As bitcoin has matured as an asset, each Epoch has been marked by lower total returns and less severe maximum drawdowns.

According to Glassnode:

- Epoch 2 Price Performance: +5315% with a max drawdown of -85%

- Epoch 3 Price Performance: +1336% with a max drawdown of -83%

- Epoch 4 Price Performance: +569% with a max drawdown of -77%

Bitcoin price performance off cycle lows at time of halving:

- Epoch 2: 337%

- Epoch 3: 190%

- Epoch 4: 301%

Epoch 4, however, is the first time price has ever reached new all-time highs before a halving event.

The halving event has historically led bitcoin bull markets. In the year following the previous two halvings, bitcoin has been up an average of 279%.

Bitcoin Fees Hit All-Time High

Fees paid to have transactions included in new blocks surged to all-time highs in USD terms in the immediate aftermath of the halving, as network participants sought to mint new fungible tokens created on Casey Rodamor’s new Runes protocol, which was launched in-line with the halving at block 840,000.

The fee spike surpassed the previous highs of the peak of the December 2017 bull market and the December 2023 rush to mint new Ordinals and Inscriptions, also protocols created by Rodamor.

Miner revenue from fees jumped to over $55 million on April 20th. The percent of miner revenue coming from fees, which has historically hovered between 2-5% during normal market regimes, spiked to 68% as demand for Runes increased fees and the other component of miner revenue, the block subsidy, was cut in half at the halving.

The novel demand for bitcoin blockspace emerging over the past year from Ordinals, Inscriptions, and now Runes has been a boon for miner revenues and has allayed the fears of some over bitcoin’s security budget potentially not being large enough to keep the network secure once the block subsidy is sufficiently diminished.

Chart of the Week

Courtesy of Luke Gromen on X:

“This is not the Argentine stock market in USD terms. This is the UK FTSE (which just hit “record highs” yesterday) … in gold terms, 1989-present.”

Quote of the Week

“I celebrate Christmas and my birthday, but in my heart, what I’m really waiting for is the Bitcoin halving. This event happens once every four years and its magnitude is hard to overstate.”

— Jesse Myers, Once in a Species

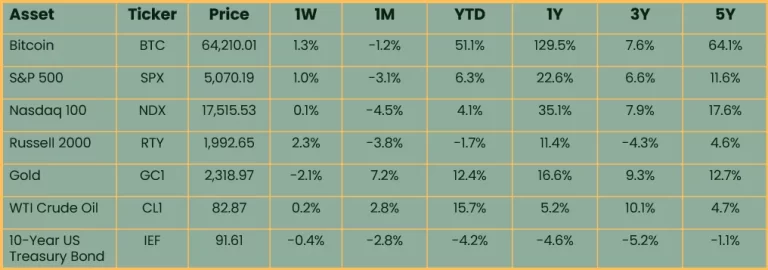

Market Update

as of 4/24/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Risk assets rebounded slightly after a tough month-to-date. Bitcoin bounced off the lows of a recent 19% drawdown from all-time highs as it completed its fourth quadrennial halving event. It is the best performing asset in our universe both year-to-date and on a 1 year lookback, and this is the first time it has ever set new all-time highs in the year before a halving. The yield-sensitive NASDAQ underperformed vs. the S&P 500 and small cap Russell 2000 index. Gold stopped to catch its breath after multiple weeks of new all-time highs, falling 2.1%. Crude was flat and bonds were down as interest rates continued to climb higher.

Podcasts of the Week

Final Settlement E005: Federated Systems with Tony & Ben from Mutiny

In this episode of Final Settlement, Tony Giorgio & Ben Carman from Mutiny join the pod to discuss the benefits of federated systems, limitations of Lightning, scalability, soft forks, the ecash design space, Mutiny Wallet’s vision & more.

The Bitcoin Halving: The Impact & Mechanics of Increasing Scarcity

(MIT Bitcoin Expo presentation by Jesse Myers; ~0:30 mark of Day 1 AM session)

(MIT Bitcoin Expo panel featuring Jesse Myers; ~2:01 mark of Day 1 PM session)

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris