5/11/23 Roundup: Moderating Inflation and Mixed Stock Performance

Hi all,

This is Dylan LeClair. Today’s email is the first Onramp Bitcoin weekly digest – a compilation of all the main trends that I’m seeing in the market & think you should be aware of.

If you haven’t already, make sure you’re signed up to receive future weekly emails from Onramp here.

And if you’d like to learn more about Onramp’s best-in-class spot bitcoin fund, schedule a call with us.

Moderating Inflation and Mixed Stock Performance

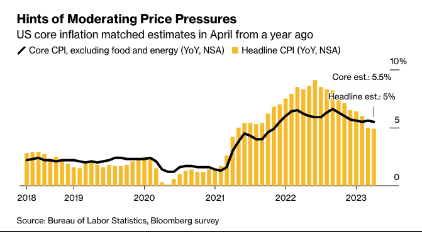

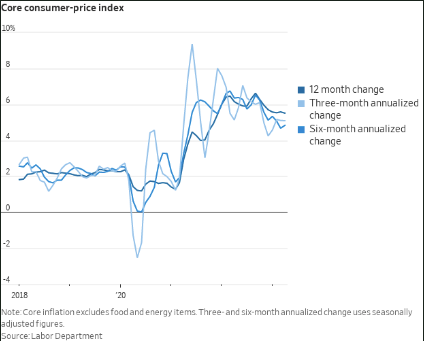

April’s Consumer Price Index (CPI) data came in yesterday, with the result being a slight moderation in inflation. The data revealed a 0.4% increase in consumer prices in April, with headline CPI up 4.9% YoY, marking the first reading below 5% in two years.

The YoY CPI was cooler than expected at 4.9%, representing the smallest increase since April 2021. Energy and gasoline prices primarily drove this decrease, despite high shelter costs. Core CPI rose 0.4% MoM in April, in line with predictions, while YoY was up 5.2%.

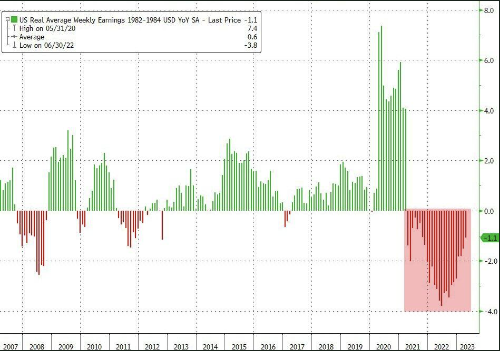

Amidst these inflation trends, Americans’ wages have been lagging for the 25th consecutive month in year over year terms.

Corporate America's Diminishing Buyback Enthusiasm

Corporate America has started to pull back on stock buybacks, as dropping profits, banking stress, and recession fears encourage companies to preserve cash. The number of announced buybacks has decreased 8% YoY, with Goldman Sachs forecasting a 15% decline for the entire year. Concurrently, the S&P 500 has witnessed a 21% YoY drop in actual buybacks, while cash balances have sunk to their lowest since 2010.

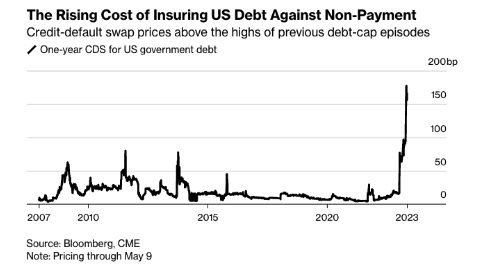

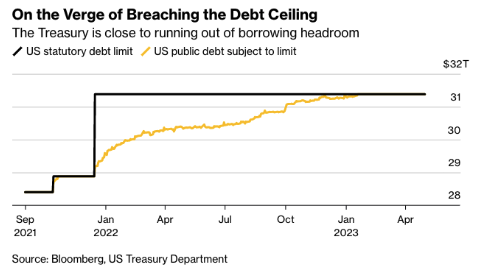

Debt Ceiling Crisis Still Ongoing

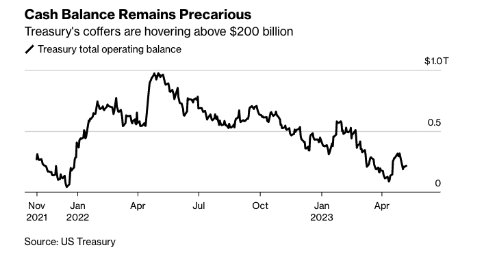

Despite the ongoing US debt ceiling crisis and the limited time to prevent a potential default, some market players remain optimistic, and with history as a guide, it is easy to see why. While the debt ceiling debate goes on, it mostly remains a political game of chicken, with an inevitable resolution guaranteed to occur before too long. The “debt ceiling” is merely a temporary one, and while markets stress about the potential for a technical default, the inevitability of perpetual credit expansion in the incumbent monetary system remains.

In the interim, the waning Treasury General Account (TGA) balance in tandem with the reduced ability to borrow could lead to some fits in risk asset markets that have been supported by TGA outflows for much of the Fed’s quantitative tightening program.

Druckenmiller Weighs In

Legendary investor Stan Druckenmiller recently shared his insights on pressing economic issues during a keynote speech at USC Marshall. Arguably one of the greatest macro investors of all time, Druckenmiller compounded his portfolio at around 30% per year from 1986 to 2010 – his thoughts carry significant weight in the financial world.

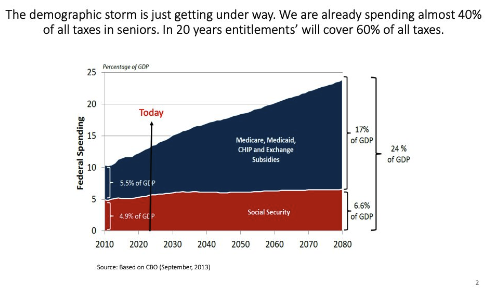

One of the key points he raised was the looming demographic crisis in the United States. Druckenmiller emphasized the growing strain on pensions and healthcare bills as entitlements for older Americans continue to rise, while younger generations aren’t generating enough revenue to cover these costs.

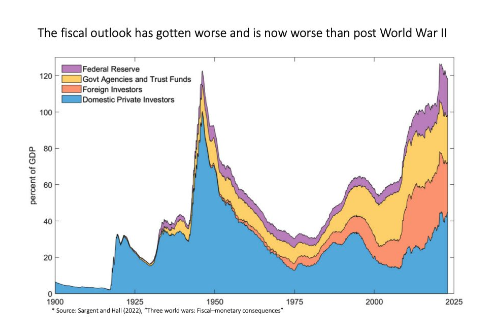

He highlighted the unprecedented Debt/GDP ratio of the United States, and how a rising interest expense along with retirement of the boomer generation who owed tens of trillions of dollars in off balance sheet entitlements, means the U.S. fiscal position is in a precarious position.

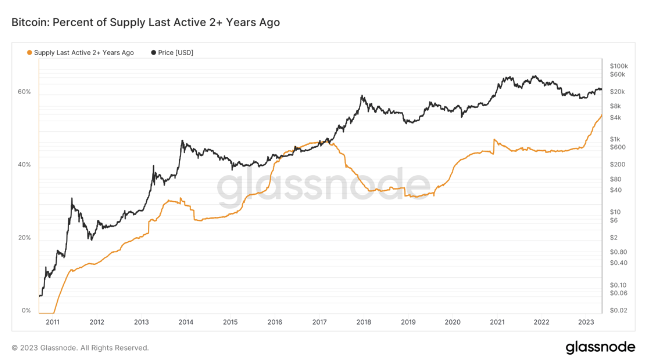

Bitcoin Holders Unbothered

Perhaps the strongest signal amidst the ongoing economic uncertainty is the conviction of a majority of bitcoin holders. In spite of more than a 70% fall in exchange rate occurring since May of 2021, 54% of the bitcoin circulating supply has not budged over the last two years. In the face of historic inflation, dramatic bubble valuations, and crypto contagion, bitcoin is being accumulated for the long-term by a majority of the holder base.

What do these people know…

We can help you Onramp to Bitcoin. Schedule a time to discuss whether our product is right for you or your network: Schedule Time Here.

Until next week,

Dylan