5/2/24 Roundup: Higher for Longer

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

Earlier this week, we published a report on the topic of bitcoin inheritance planning authored in collaboration with Amanda Kita, Attorney at Stradley Ronon. Bitcoin inheritance planning requires addressing both key management and legal title transfer to beneficiaries, necessitating comprehensive estate planning. This report provides a detailed overview of the intricacies associated with bitcoin inheritance planning, and the role of multi-institution custody in preserving bitcoin ownership across generations.

If you’re interest in learning more, we will be hosting a webinar on May 22 led by Amanda Kita & Cam Stromme (Head of Private Wealth at Onramp) to discuss these topics in detail; register here.

And now, for the weekly roundup…

- DOJ, FBI hit crypto headlines in busy week on regulatory front

- Fed says higher for longer, but begins QT taper

- Treasury QRA: issuance to remain flat, buyback to commence

DOJ, FBI Hit Crypto Headlines

The co-founders of bitcoin wallet and mixing service Samourai Wallet were arrested and charged with money laundering and unlicensed money transmitting by the Department of Justice last week.

Bitcoin transactions are publicly recorded on the blockchain, making it possible to trace the transaction history of a specific coin. A mixing service improves user privacy by taking bitcoins from multiple users, mixing them together, and then redistributing them to new addresses, thereby anonymizing the coins and breaking the traceability between transactions.

The DOJ alleges that the defendants “encouraged and openly invited users to launder criminal proceeds through Samourai.”

The arrests come as the government prepares for its case against developer Roman Storm, who was arrested last year for his work on the Tornado Cash mixing service, which has been used by North Korean hackers to launder funds.

According to CoinDesk, Storm’s legal team is arguing that the developer never aided these groups, but rather “just published code that anyone can use.”

In conjunction with the arrests, the FBI put out a Public Service Announcement warning Americans to not use non-KYC crypto wallets as they may not adhere to anti-money laundering requirements.

The one-two punch ignited concerns that the US government is attempting to criminalize financial privacy, leading the popular non-custodial lightning wallet Phoenix Wallet to immediately withdraw from the US.

Now, with respect to the arrests, obviously at issue here is the extent to which the defendants encouraged and aided criminal money laundering on their service versus the extent to which they were simply employees publishing open source code for anyone to use. Those details will be examined in court.

Beyond these specific cases, brewing is a larger battle for free speech, financial privacy, and property rights in the digital age that harkens back to the Cypherpunk movement of the 1990s, known as the Crypto Wars.

In 1995, Daniel Bernstein sued the United States over the publishing of an encryption algorithm he had developed called Snuffle. At the time, cryptography on the internet was a new technology, and the US was classifying encryption tools as munitions, meaning that publishing code, as it were, without a license was equivalent to arms dealing.

Bernstein v. United States affirmed that source code is a form of speech protected by the first amendment. The case led to the opening up of US export controls on encryption technology and led to the development and adoption of many widespread encryption standards that we rely on today for secure online communications.

If this week’s DOJ and FBI actions and warnings are an indication, it seems we may be edging closer to Crypto Wars 2.0 in a battle to define and protect constitutional rights in the digital age.

Fed Leaves Policy Rate Unchanged, Reduces Pace of QT

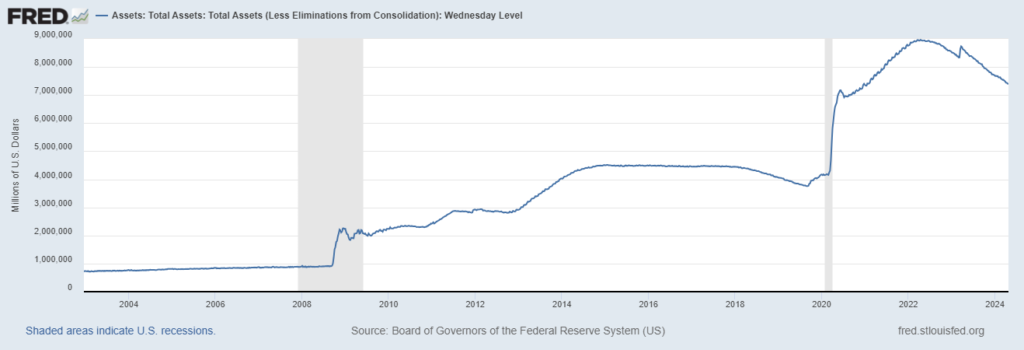

Yesterday we got the most significant change to monetary policy since the Fed last hiked rates in July 2023 when they announced they would slow the monthly pace of balance sheet reduction (i.e. quantitative tightening or QT) from $105 billion to $60 billion, beginning in June. The reduction was $5 billion/month more than expected.

Given that the Fed is already slowing the pace of QT well before we’ve gotten anywhere near pre-pandemic balance sheet levels of $4.5 trillion, it seems likely that higher highs and higher lows are forever in store for the future size of the Fed’s balance sheet.

In addition to formally announcing the QT taper, Fed Chair Jerome Powell said that while progress toward their 2% inflation target had stalled in recent months, he was still confident that it would get there over time and that current monetary policy was sufficiently restrictive. He committed to holding rates at current levels as long as needed to be more confident that inflation was headed toward 2%, but said it was unlikely that the next interest rate move would be a hike.

The message to markets: higher for longer.

When asked about the risks of stagflation, Chair Powell responded “I don’t see the ‘stag’ or the ‘flation,’ actually.”

Bitcoin, stocks and bonds all rallied on Fed’s announcement, possibly reacting to the surprise $5 billion shock to QT, before fading back to pre-announcement levels and ending largely unchanged on the day.

Treasury Holds Borrowing Steady

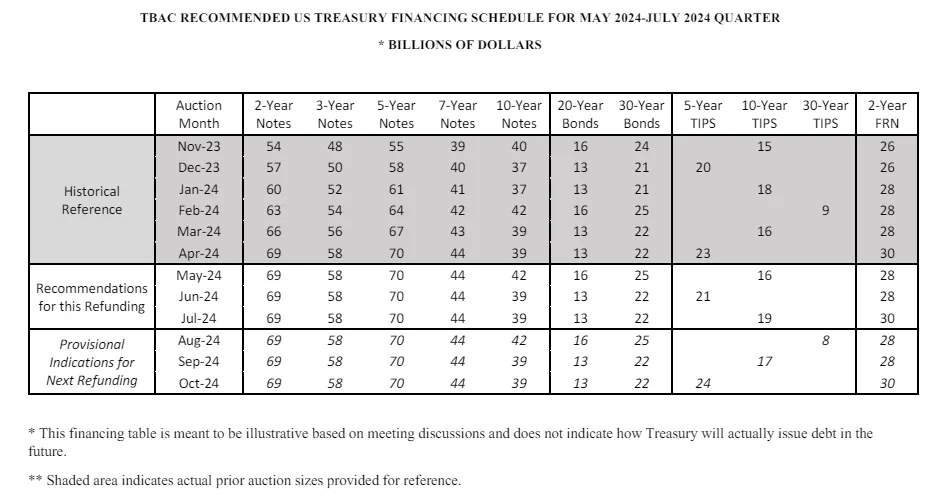

The Treasury Department offered the bond market some relief this week, communicating in their Quarterly Refunding Announcement (QRA) that they expect to hold debt issuance steady in the coming two quarters after increasing auction sizes for three straight quarters prior.

Total monthly issuance for May – October is projected to be ~$364 billion, in-line with April and in-line with market expectations coming into the event.

source: US Department of the Treasury

Make no mistake, even though the Treasury is holding coupon issuance flat, borrowing needs are still up significantly year on year and are hovering near pandemic era highs, as this chart from Andy Constan on X illustrates:

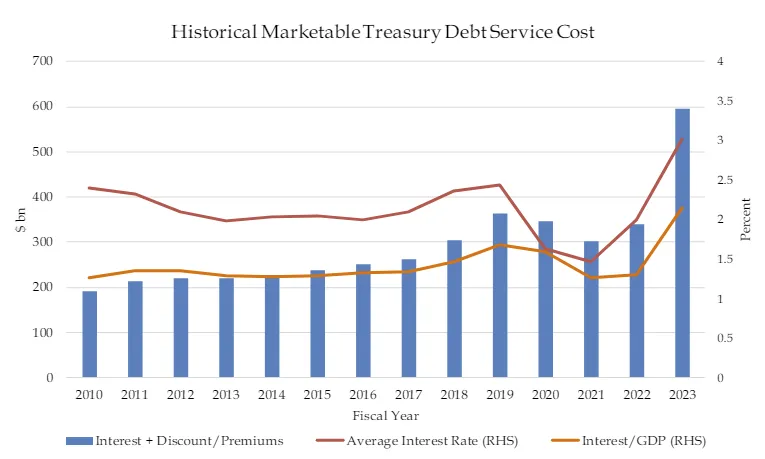

This chart in the Treasury Presentation to TBAC (page 49) shows how the cost of servicing our national debt has increased with the increase in debt as well as interest rates, and figures to go even higher in 2024:

The Treasury also announced it’s launching its first treasury buyback program since 2002, set to begin on May 29.

This will involve the US Treasury repurchasing its own securities, and is intended to improve market liquidity for the “deepest and most liquid market in the world.”

With the buyback operation, the Treasury can influence the yield curve by repurchasing securities at specific tenors, and also potentially reduce interest expense by retiring higher coupon debt by issuing lower coupon debt.

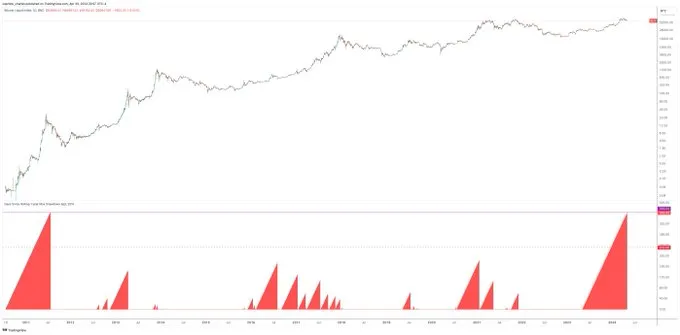

Chart of the Week

Courtesy of Charles Edwards on X:

As of April 30 bitcoin has gone 362 days without a 25%+ drawdown, one shy of the record 363 days set in 2011.

(As of May 1, the record has been tied. Bitcoin reached a low of $56,500 on May 1, 23% below the all-time high of $73,835.57 on Coinbase.)

Quote of the Week

“The availability and use of secure encryption may … play an important role in protecting privacy interests in the information age. Government attempts to control encryption thus may well implicate not only national security, but also individual privacy and free speech interests.”

— Judge Betty Fletcher’s opinion on Bernstein v United States.

Market Update

as of 5/1/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Risk assets sold off over the past week ahead of the May FOMC and Treasury QRA. Bitcoin led markets lower, down 9.8%. Bitcoin has typically been the most liquidity sensitive asset, leading other assets both lower and higher at turning points in the market. Despite the drawdown, bitcoin is still by far the best performing asset year-to-date.

The S&P, NASDAQ and Russell all fell 1% as the Fed said they were prepared to maintain the current level of interest rates until they were confident that inflation was headed toward 2%. Crude dropped 4.4%. Bonds were flat as the market digested the new issuance communicated in the Treasury QRA. Bonds have been the worst performing asset year-to-date as the market has had to absorb record amounts of new supply from the Treasury, a condition that doesn’t seem likely to change any time soon.

Podcasts of the Week

The Last Trade E047: The Dollar Endgame with Peruvian Bull

In this episode of The Last Trade, author and macro analyst Peruvian Bull joins the pod to discuss global liquidity, unsustainable debt, challenges facing Japan, the sound money imperative, game theory of bitcoin adoption, apolitical energy-backed money, & more.

Scarce Assets E009: Dan Tapiero – Legendary Macro Mind Turned Bitcoin Bull

In this episode of Scarce Assets, macro investor Dan Tapiero joins the pod to discuss bitcoin’s multidisciplinary nature, institutional investor sentiment, private market investing, the outperformance of scarce assets, & more.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris