6/27/24 Roundup: The Corporate Embrace of Bitcoin

Onramp Weekly Roundup

Written By Zack Morris

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

Also, the Onramp team is attending the Bitcoin Conference in Nashville and would love to meet with you! Schedule a meeting with us before the conference to hear the latest updates from Onramp and learn more about the private events we’re hosting during the conference week. You can book a call with our team to discuss our plans for Nashville. We look forward to seeing you there!

And now, for the weekly roundup…

- The steady drumbeat of corporate bitcoin adoption continues

- Bill introduced to allow federal income tax to be paid in bitcoin

- The steady drumbeat of corporate bitcoin adoption continues

Corporates Continue to Hodl and Buidl

Dell Technologies

We start with the news, or cryptic set of tweets, rather, that garnered the most attention this past week. Michael Dell, CEO and founder of Dell Technologies and the world’s ~15th richest person depending on the day, with a net worth of over $100 billion, stoked speculation of a potential bitcoin treasury strategy for his company when he tweeted “Scarcity creates value” and retweeted a reply from Michael Saylor that read “Bitcoin is Digital Scarcity.”

DELL stock has been on fire this year on the back of growth in their AI-server business, and as of their latest earnings report had over $6 billion of cash on the balance sheet.

What most of the frenzy over Dell’s recent tweets missed, however, is that he is no stranger to bitcoin. Dell announced in July 2014 that his company now accepted bitcoin. A month later, he announced that the company had received a server order for 85 bitcoin, at the time $50k or $588 per coin.

Dell’s website now displays an update from October, 2017 which says “Due to low demand, Bitcoin is no longer available as a form of payment.”

Whether or not Mr. Dell intends to adopt a bitcoin treasury strategy for his company, given his adoption as early as 2014 and his recent activity on X it is reasonable to speculate that he might hold bitcoin on his personal balance sheet.

As we explored a few weeks ago in the wake of Semler Scientific adopting a bitcoin strategy, corporate treasury allocation to bitcoin remains a tricky proposition. Do shareholders want to own DELL for exposure to their booming AI-server business, and would they prefer the decision to allocate to bitcoin be left to them individually? Or would they celebrate a bitcoin treasury strategy, as they have for MicroStrategy and Semler Scientific?

One thing Dell Technologies has in common with MicroStrategy and Semler Scientific is they are controlled, or at least heavily influenced, by their founders. In the case of Dell and MicroStrategy, Michael Dell and Michael Saylor have full voting control over the company and serve as Chairman of the Board. In the case of Semler Scientific, Eric Semler serves as Chairman of the Board, and combined with fellow board member William Chang they collectively own over 20% of the company.

This is to say that, if Dell wanted to adopt a bitcoin playbook at his company, he could.

If not, he’s in the process of selling a third of his economic stake in the company for $1.3 billion, so he has plenty of personal balance sheet to play with as well.

It remains to be seen if a non-founder controlled public company will want, or be able to, adopt a bitcoin treasury strategy.

Semler Scientific

Speaking of Semler, a few weeks ago we wondered aloud about the motivation behind their new bitcoin strategy. Did they intend to use their stock and debt to conduct their own speculative attack and turn their securities into bitcoin vehicles, a la MicroStrategy? Were they simply seeking a long-term store of value for cash on hand, as they awaited the opportunity to invest in their core business?

We got some more information when a week after their original bitcoin announcement they announced the sale of $150 million of debt securities and $50 million of stock.

For now, their actions suggest it is more the former than the latter, and I wouldn’t be surprised to see them tapping the capital markets and buying more bitcoin with the proceeds going forward.

Lightspark x Nubank

That covers the hodl. Now the buidl.

While it didn’t garner as much attention as Dell’s tweets, Tuesday’s announcement from Nubank and Lightspark might prove, with time, to be the biggest bitcoin-related news of the week.

Nubank is partnering with Lightspark to bring Nu’s 100 million digital banking customers to the Bitcoin Lightning Network and Universal Money Address (UMA) standard.

UMA is like an email address but for money. It’s an open-source standard, developed by Lightspark, for sending fiat money or bitcoin over the Lightning Network to a human readable address like $me@nubank.com or $you@yourbank.com. By virtue of being an open-source protocol, banks, exchanges, or digital wallets can integrate with UMA to enable their customers to send and receive real-time money transfers to- and from- any fiat currency. For example, when sending money to a friend’s UMA in Mexico, dollars get debited from your checking account in the US and pesos get credited to their banking account in Mexico. In between, the dollars are converted to sats, sent over the Lightning Network, and converted back to fiat when they’ve reached the recipient’s UMA.

Nubank is a fast-growing digital banking platform that serves 100 million customers, primarily in remittance-heavy Brazil (85%), Mexico (15%) and Colombia (5%). If Nubank’s customers adopt UMA for remittances and peer-to-peer payments, it would result in a substantial increase in Lightning Network usage and liquidity.

Bill to Allow Bitcoin Payments for Federal Income Tax

Representative Matt Gaetz (R-Florida) introduced legislation on Tuesday that would require the IRS to accept bitcoin as payment for federal income tax. Gaetz recently attended the inauguration of President Nayib Bukele in El Salvador, where no doubt bitcoin was discussed.

If your initial reaction to this news (like mine) was “nice try, I’m not sending you my coins” a closer look at the bill doesn’t even seem to suggest bitcoin received as payment for taxes would be held by the US Treasury. Rather, it would “require the immediate conversion of any bitcoin amount received to its dollar equivalent at the conclusion of any transaction.” The bill in its current form also does nothing to change capital gains accounting for bitcoin, meaning most tax-payers would be incurring tax to pay tax if paying in bitcoin.

While this probably isn’t happening any time soon, it is further evidence that bitcoin is on the mind of politicians. The concept of legal tender is the government enforcing merchant acceptance of a particular form of money in exchange for goods or services, and the government itself requiring that taxes be paid in that money as well. Even if this legislation seems like a solution in search of a problem that probably won’t be adopted by many bitcoiners at this point in time, ultimately, nation-state adoption of bitcoin as legal tender is one of many milestones on the long, winding path to a bitcoinized economy.

Right now, El Salvador and the Central African Republic are the only two countries where bitcoin is legal tender, and Colorado is the only state that allows for payment of state income tax with bitcoin.

Chart of the Week

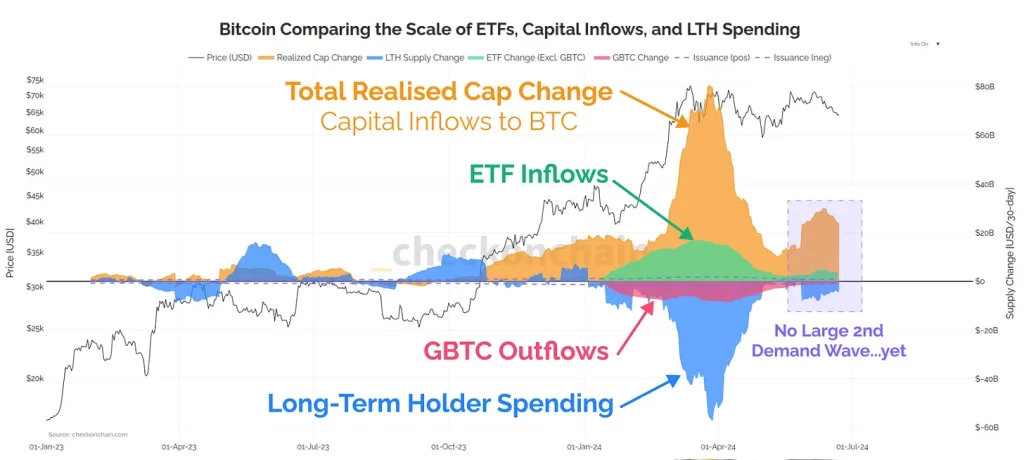

Courtesy of @_Checkmatey_ on X:

The dramatic change in realized cap, long-term holder supply, and ETF holdings earlier this year paint a picture of massive capital flows which drove price higher, enticing long-term holders to sell.

Quote of the Week

“The same place it always does, people realising that Bitcoin is a superior system to paper money.”

— @_Checkmatey_, when asked where the liquidity for a second wave of demand this year will come from.

Market Update

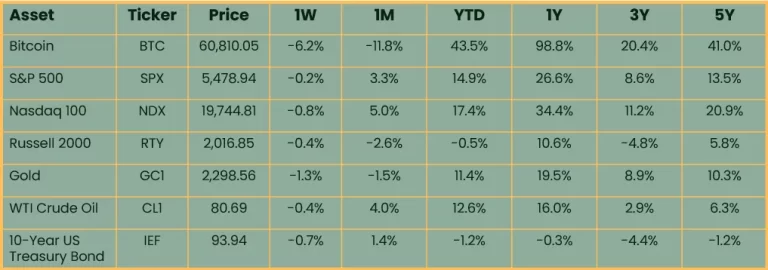

As of 6/26/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Assets trended down modestly across the board this week as traders fled the desk for summer vacation. Bitcoin was the biggest dropper, losing 6.2% on the week and dropping below the $60k level at one point. Stock indices were down a few tenths of a percent, but under the hood there was some rotation. Nvidia dropped 16% from its intraday high last Thursday before regaining some ground, and gave up its briefly held title as world’s most valuable company. At the same time, forgotten Magnificent 7 constituents Amazon and Tesla rallied 6%. Gold ticked below $2,300/oz as it searches for a bottom after a big rally to start the year. Oil fell 40 bps and bond yields ticked higher.

Podcasts of the Week

The Last Trade E055: Financial Infrastructure for the Digital Age with Shalin Madan

In this episode of The Last Trade, Shalin Madan, co-founder of Formidium, joins to discuss building financial infrastructure, the disruptive potential of AI, deflationary technology, mainstream bitcoin adoption, & more.

Scarce Assets E013: Natalie Brunell & Sam Callahan – The Flywheel of Bitcoin Education

In this episode of Scarce Assets, Natalie Brunell & Sam Callahan join Andy Edstrom & Jesse Myers to discuss the importance of education, reaching new audiences, shifting bitcoin narratives, economic incentives, & more.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris