7/4/24 Roundup: Bitcoin 2Q24 Results

Onramp Weekly Roundup

Written By Zack Morris

Happy Fourth of July!

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

Also, the Onramp team is attending the Bitcoin Conference in Nashville and would love to meet with you! Schedule a meeting with us before the conference to hear the latest updates from Onramp and learn more about the private events we’re hosting during the conference week. You can book a call with our team to discuss our plans for Nashville. We look forward to seeing you there!

In this week’s Roundup we explore bitcoin’s 2Q24 results…

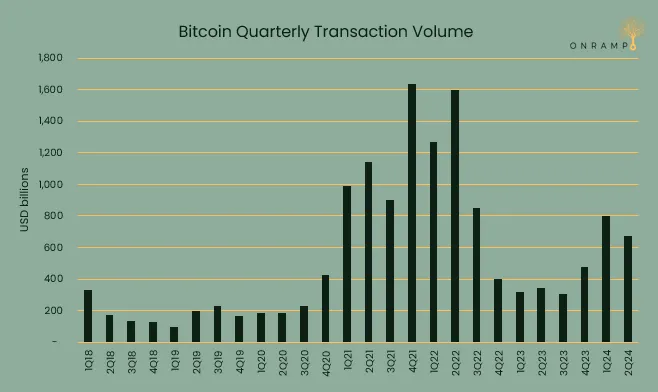

Bitcoin 2Q24 Results

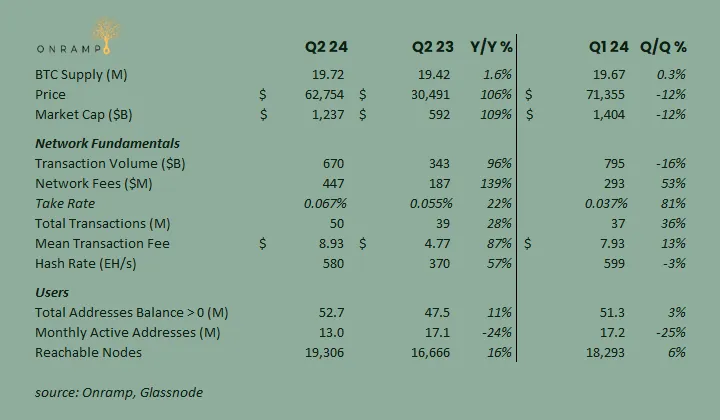

Adoption, as measured by total on-chain addresses with a non-zero balance, increased 11% year-over-year to an all-time high of 52.7 million:

Source: Glassnode

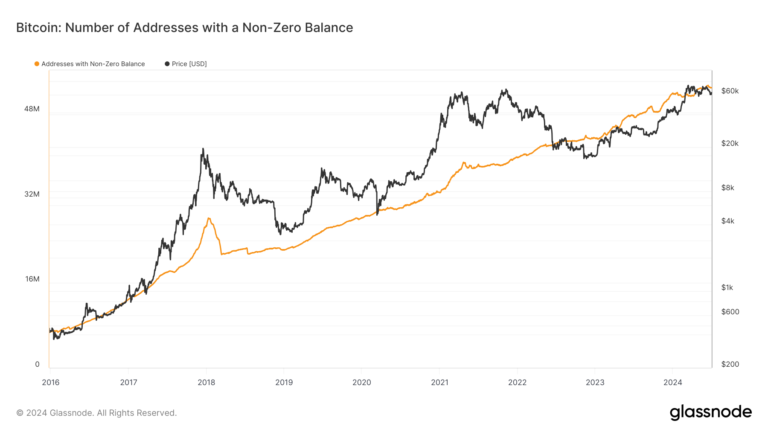

Decentralization, as measured by reachable nodes, increased 16% year-over-year to 18,293. Reachable nodes hit an all-time high of 19,785 during the quarter:

Source: Bitnodes

Security, as measured by hashrate, increased 57% year-over-year to 580 EH/s (exa-hashes per second) to end Q2. Hashrate hit an all-time of 657 EH/s during the quarter. Currently, hashrate is down from all-time highs as miners power down unprofitable operations post-halving, as has been a pattern for bitcoin after halvings historically. We analyzed post-halving miner capitulation in depth a few weeks ago here.

Source: Onramp Terminal

Adoption, decentralization, and security are perhaps the three most important bitcoin fundamental indicators to monitor. Bitcoin, like any monetary system, is a network, and the value of any network grows exponentially as users are added to the network.

So long as bitcoin remains decentralized and secure, one can find confidence in continued future adoption.

As illustrated by the charts above, users, nodes, and hashrate have increased nearly without interruption during bitcoin’s 15 year history, through both bull and bear markets. Still, that we’ve only just crossed over 50 million on-chain addresses shows how early we still are on the adoption curve for a global monetary network.

On-chain addresses are not a perfect measure of adoption, but historically served as a good proxy. However, the proliferation of layer-2s (e.g. Lightning Network), layer-3s (e.g. CashApp) and layer-4s (e.g. spot bitcoin ETFs) mean that people now have more ways than ever to adopt bitcoin as a peer-to-peer payment network and/or a long-term store-of-value asset without ever creating an address or making a transaction on the base chain.

Spot bitcoin ETFs in particular have taken in a significant amount of bitcoin since their launch in January, nearly a million in total as shown on the Onramp Terminal, or just under 5% of the total supply. As such, it is important to put the growth in on-chain addresses in its proper context, acknowledge its limitations as a measure of overall bitcoin adoption, and think of new and more useful ways to measure bitcoin adoption going forward.

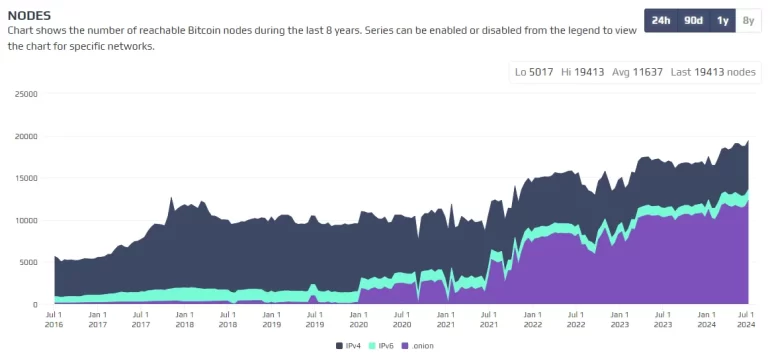

Volume, Fees, and Transactions Remain Elevated

After a lackluster 2023, bitcoin sustained elevated volumes in Q2 after a spike in Q1, processing $670 billion in on-chain network volume:

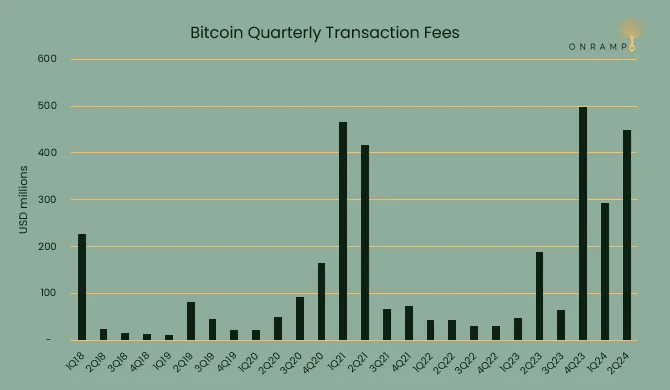

Transaction fees, paid out to bitcoin miners as revenue, nearly set a quarterly all-time high in Q2 as network participants sought to mint new fungible tokens created on Casey Rodamor’s new Runes protocol, which was launched in-line with the halving at block 840,000 on April 20.

The novel demand for bitcoin blockspace emerging over the past year from Ordinals, Inscriptions, and now Runes has been a boon for miner revenues and has allayed the fears of some over bitcoin’s security budget potentially not being sufficient to keep the network secure once the block subsidy has been substantially diminished.

The past year has seen a robust fee market in the absence of a euphoric run to new cycle tops, a first in bitcoin’s history:

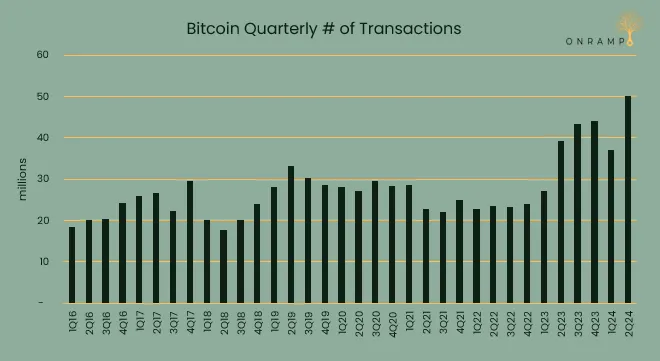

On-chain transactions hit a new quarterly high in Q2, illustrating the increasing demand for bitcoin blockspace:

Chart & Quote of the Week

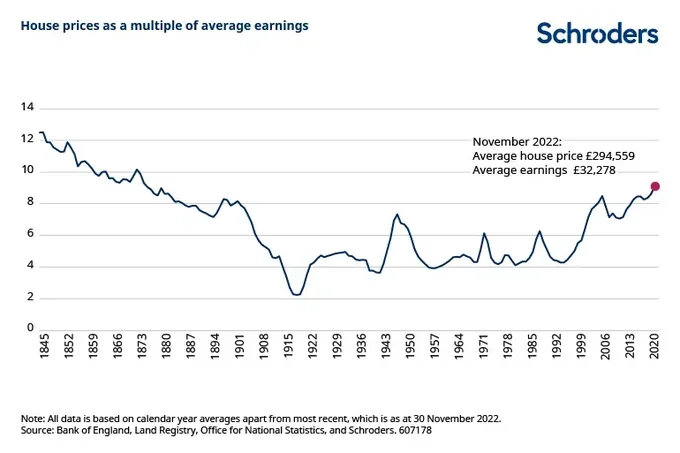

Courtesy of Saifedean Ammous on X:

“Going off the gold standard in 1914 stopped a centuries-long increase in affordability of homes by degrading the value of money, forcing people to use their homes as saving accounts, raising house prices beyond the rise in income.”

Market Update

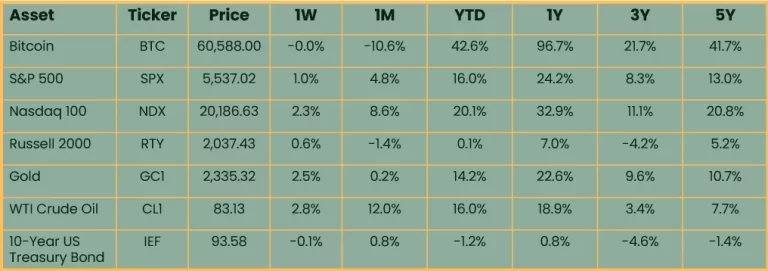

As of 7/4/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Assets mostly rallied on the week as markets priced in new election odds after the first Presidential debate last Thursday night. Increasing odds of a Trump Presidency buoyed stocks as it becomes more likely the corporate tax rate will remain at 21% through at least 2029. At the same time, bond yields rose modestly on concerns that low taxes might feed into a rebound in inflation. Bitcoin saw strong performance over last weekend fade over the last two days. Oil and gold were the best performing assets on the week, rising 2.8% and 2.5%, respectively.

Podcasts of the Week

Onramp Webinar Series E003: Bitcoin & Veterans – A Natural Alignment

In the latest installment of the Onramp Webinar Series, Onramp’s Head of Private Wealth, Cam Stromme, hosts an insightful discussion with current and former US service members Wes Lippman, David Thayer, & Lee Bratcher, about the alignment between bitcoin and military veterans.

The Last Trade E056: Dollar Uncertainty & the Remedy of Bitcoin with Mark Connors

In this episode of The Last Trade, Mark Connors, Onramp’s Head of Global Macro, joins to discuss the aimlessness of “crypto”, hype cycles & narratives, institutional biases, debt & broken money, bitcoin as a viable remedy, & more.

Final Settlement E010: A Nuclear Powered Bitcoin Standard with Ryan MacLeod

In this episode of Final Settlement, chemical technologist Ryan MacLeod joins the pod to discuss misconceptions around nuclear, power generation costs & benefits, synergies with bitcoin mining, headwinds for nuclear adoption, & more.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris