8/22/24 Roundup: A Tale of Two Symposiums

Onramp Weekly Roundup

Written By Brian Cubellis

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

Last week, we released a comprehensive report — “The Evolution of Bitcoin Custody” — detailing the origins of financial asset custody, bitcoin’s unique custodial properties, the various tradeoffs associated with existing forms of bitcoin custody, and the ongoing maturation of solutions in the marketplace. Download the full report here.

We will hosting a webinar on September 10th at 4:15PM EST to discuss this report in detail, delving into the intricate world of bitcoin custody, highlighting its origins, technological advancements, and the disruptive potential of multi-institution custody. Register to attend here.

And now, for the weekly roundup…

- Jackson Hole hosts two divergent symposiums

- Takeaways from the Wyoming Blockchain Symposium

- Bitcoin, not blockchain

A Tale of Two Symposiums

This week, two distinctly different cohorts of financial professionals converged upon Jackson Hole, Wyoming, which played host to two pivotal gatherings, each projecting divergent visions of our economic future.

On one side, the Jackson Hole Economic Policy Symposium, orchestrated by the Federal Reserve Bank of Kansas City, is a mainstay in the traditional finance and monetary policy arena. On the other side, the inaugural Wyoming Blockchain Symposium, hosted by SALT and Kraken, emerged as a beacon for blockchain technology advocates. As both parties descended on Jackson Hole this week, they offered a striking juxtaposition: the established order of centralized banking versus the radical promise of decentralized financial systems epitomized by bitcoin.

Members of team Onramp were present at the Wyoming Blockchain Symposium, absorbing concepts and ideas that were in stark contrast with the key themes expected from the Federal Reserve’s meeting. This provided a unique opportunity for comparative analysis that underscored the dichotomy of these financial realms.

The Federal Reserve Economic Policy Symposium represents a standard annual barometer for the Fed’s future policy directions. This year’s gathering occurs amid growing speculation about potential interest rate cuts – a topic that will undoubtedly dominate discussions given the current economic backdrop marked by a quagmire of conflicting data and mounting fiscal pressures.

Economic Uncertainties & Fiscal Realities

The U.S. economy currently presents a mixed bag of indicators. On one hand, recent unemployment figures have missed expectations, coupled with downward revisions suggesting a cooling labor market. On the other, inflation remains stubbornly high, with consumer prices still significantly elevated compared to four years ago. This sticky inflation, in the face of a supposedly slowing economy, creates a challenging scenario for the Fed, which has traditionally raised rates to curb inflation but now faces calls to lower them to support economic growth.

The Pressure to Cut Rates

The increasing likelihood that the Fed will cut rates in September, and possibly multiple times by year-end, is driven not just by domestic economic indicators but also by broader fiscal sustainability concerns. With the government grappling to service an overwhelming $35 trillion in national debt, the current environment of elevated interest rates is unsustainable. Lowering rates would alleviate some of the immediate fiscal pressures but at the risk of further fueling inflation unless accompanied by other monetary tightening measures.

The Inevitability of Monetary Expansion

In the backdrop of these economic discussions, there lies a deeper systemic issue rooted in the credit-based fiat system. The incentives built into this system nearly guarantee continued monetary expansion – not merely as policy choice but as a necessity. The inevitability of rate cuts coupled with potential new rounds of quantitative easing highlights the cyclical dilemma of needing to stimulate the economy while simultaneously managing fiscal deficits and inflationary pressures.

Contrasting Bitcoin’s Promise

Juxtaposed against this traditional monetary conclave is the Wyoming Blockchain Symposium, where the discussion centers on bitcoin and blockchain technology as alternatives to the central banking model. Here, the narrative shifts from reactive monetary policy to the proactive redesign of financial systems, aiming to create a more decentralized, transparent, predictable, and resilient monetary framework.

Implications for the Future

As these two symposiums unfold, the contrast between the established monetary policies and the transformative potential of bitcoin could not be starker. The discussions at the Fed’s gathering will likely reflect deep-seated concerns about the path forward for traditional finance, while the blockchain symposium explores the radical possibilities of a decentralized future.

This week’s events will set the tone for future monetary policies and potentially reshape public perceptions about the viability and necessity of alternatives like bitcoin in an increasingly uncertain global economy.

Key Takeaways from Panel Discussions

The Future of Bitcoin Mining: Inside the Energy Infrastructure Boom

- Bitcoin mining is increasingly seen as an integral part of the energy sector, with significant implications for energy infrastructure. As noted in discussions involving companies like MARA, Iren, Cleanspark, and Terawulf, the industry is moving towards greater energy efficiency and integration with broader energy markets.

Banking Crypto: Inside the Digital Assets Industry’s Fight for Equal Access

- Caitlin Long, Founder & Chief Executive Officer of Custodia Bank, highlighted the challenges faced by digital asset banks under the current dual banking system, criticizing the regulatory hurdles that disproportionately affect smaller entities and stifle innovation. She stated begrudgingly, “the de-bankings will continue until morale improves.” Caitlin also contends that the Democratic party must do more than just avoid an anti-crypto stance; they need to actively support the industry to build credibility.

Institutional Adoption of Crypto: Inside the Growth of Bitcoin ETFs and Tokenized Funds

- Amy Oldenburg, Head of Emerging Markets Equity at Morgan Stanley, and Joseph Chalom, Head of Strategic Ecosystem Partnerships at Blackrock, guided a discussion on the growing institutional adoption of bitcoin and other digital assets. Chalom highlighted that on August 5th (post Yen carry trade unwind), IBIT saw net inflows despite the broader market panic, a signal that not only is demand for bitcoin strong, but it’s behavior is unique. Oldenburg mentioned that there is little institutional interest outside of BTC, ETH and stablecoins, and that Morgan Stanley is considering ways to provide clients with more direct exposure to bitcoin.

The Future of Crypto Asset Management: Inside the Industry’s Next Cycle

- Cynthia Lo Bessette, Head of Fidelity Digital Asset Management, emphasized the importance of education and specialized domain expertise in digital asset management, indicating significant growth potential as traditional asset managers and advisors become more knowledgeable about the space.

The Future of Bitcoin: Going Beyond Digital Gold

- Jeff Garzik, Co-Founder of Hemi and former bitcoin developer, highlighted bitcoin’s strength as the most secure blockchain, and the need for more development focus on bitcoin’s scalability layers. The discussion focused on bitcoin’s potential to evolve beyond just a store-of-value to underpin various financial instruments and applications.

Creating a Global Standard for Digital Asset Regulation

- Deepa Raja Carbon, Managing Director & Vice Chairperson of the Virtual Assets Regulatory Authority (VARA) in Dubai, stressed the need for new regulatory frameworks that understand the unique nature of digital assets, moving away from traditional financial models to better cater to innovation and inclusivity in financial services.

Bitcoin is a Powerful Tool for Human Rights

- Alex Gladstein, Chief Strategy Officer of the Human Rights Foundation, presented a powerful case for bitcoin as a tool for human rights, emphasizing its role in circumventing government control and providing financial inclusion to billions under authoritarian regimes. His message underscored bitcoin’s utility in fostering economic freedom and energy sustainability, positioning it as the most ‘ESG’ asset available.

Keeping Financial Innovation in America: A Conversation with Senators Cynthia Lummis and Tim Scott

- Senators Cynthia Lummis and Tim Scott discussed the legislative environment for digital assets in the U.S., highlighting the need for clearer regulations that support innovation and provide access to financial services for all Americans, especially the underserved. Notably, if the GOP were to achieve a Senate majority this fall, Senator Scott noted that as the chair of the Senate Banking Committee he would look to establish a Digital Asset Subcommittee, with Senator Lummis as the chair.

Bitcoin, Not Blockchain

“Every protocol is a rube goldberg machine to produce more sats.” – CFO of an altcoin protocol with a ~$2B market cap

The agenda at the Wyoming Blockchain Symposium unfolded with a notable, but perhaps unsurprising, underemphasis on bitcoin. Despite bitcoin’s commanding 56% dominance of the total market capitalization of cryptocurrencies, the discussions predominantly centered around altcoins like Ethereum, Solana, and various stablecoins – assets which fail to match bitcoin’s robust level of decentralization, global recognition, and regulatory clarity.

Over the two-day conference, a mere 5 panels out of 24 – a scant ~20% – directly addressed bitcoin or featured it prominently in their discussions. This discrepancy highlights the cognitive dissonance among many participants and speakers. While they advocate for these alternative blockchains, they often struggle to articulate compelling use cases beyond the realms of speculation and gambling.

The most substantial argument presented in favor of such technologies was the development of stablecoins, which, though a significant innovation, predominantly seek to digitalize existing fiat currencies rather than exploring the more disruptive aspects of blockchain technology. Not to mention, stablecoins also currently exist, and are beginning to proliferate, on layers of the bitcoin blockchain.

This focus seems misaligned when considering the foundational purpose of blockchain – a technology meant to facilitate the creation of a decentralized, new form of money, rather than merely emulating traditional currencies on a faster database. Such alternatives, though touted for their efficiency, still rely heavily on centralized issuers, thereby diluting the very essence of decentralization that blockchain seeks to uphold.

The symposium’s few bitcoin-centric discussions shed a clear light on the asset as a fundamentally distinct asset in the space, increasingly recognized for its store-of-value properties and potential in promoting financial freedom. A standout presentation was Alex Gladstein’s keynote, one of the select bitcoin-focused panels.

Gladstein eloquently articulated the significant, tangible use cases for bitcoin, particularly as freedom-enhancing technology, a stark divergence from the speculative narrative surrounding many altcoins. His insights underscored a critical dialogue about the core utilities of blockchain technology, emphasizing bitcoin’s role in advancing financial sovereignty.

As the landscape of digital assets continues to evolve, the symposium’s focus perhaps reflects a broader industry trend (ex-bitcoin) – searching for legitimacy and clarity in a space that remains largely unregulated and speculative. Yet, the clarity with which bitcoin is viewed as a commodity, contrasted with the ongoing identity crisis among many altcoins, poses fundamental questions about the future directions of blockchain technology and the true essence of decentralization.

Charts & Quotes of the Week

“In a debt-based fractional reserve financial system, the money supply must continually expand to support the outstanding debt. Otherwise, everything will collapse. This is the natural state.”

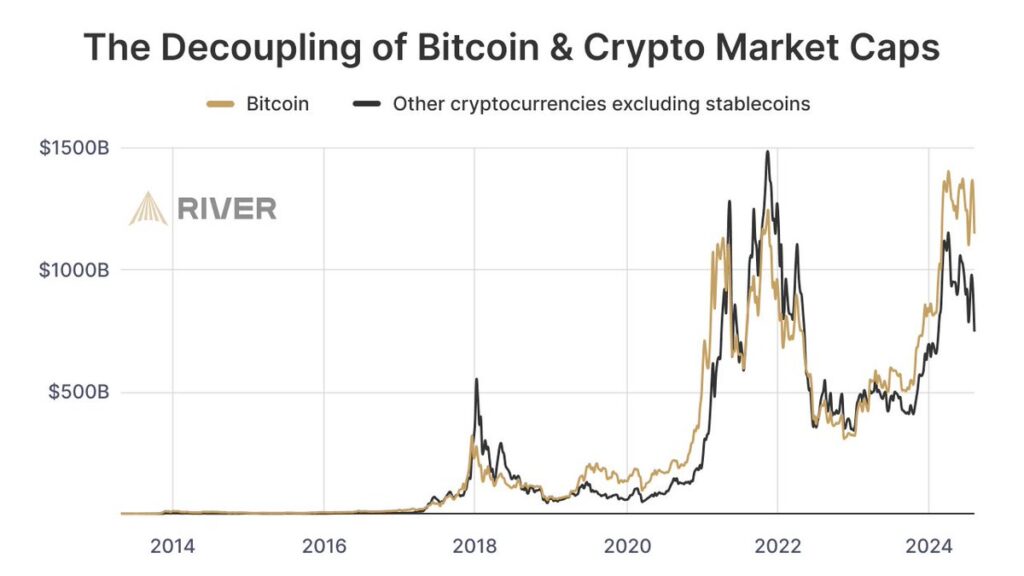

“3 years ago, Bitcoin’s market cap was ~$835B.

Same for all the crypto stuff w/o stablecoins.

Today, Bitcoin’s market cap is up 37% ($1.15T)

And the other stuff? -11% (not adjusted for inflation)

It’s an insightful statistic to present to people who blindly diversify.”

Podcasts of the Week

The Last Trade E061: The Great Deleveraging with Sam Callahan

In this episode of The Last Trade, Sam Callahan, prolific bitcoin researcher & analyst, joins to discuss, market instability, fiscal & monetary policy, global liquidity, counterparty risk, bitcoin adoption, & more.

Scarce Assets E016: Bitcoin is King with Alex Thorn

In this episode of Scarce Assets, Alex Thorn, Head of Research at Galaxy Digital joins to discuss political advocacy, challenges facing ETH, market cycles & memecoins, collateralized BTC, volatility, ETF options, & more.

Wake Up Call (8.19.24): Fred Pye, Founder & Director of 3iQ Digital Holdings

Wake Up Call is a weekly show that will be streamed live on LinkedIn every Monday morning. To catch the premier of each episode, follow Onramp’s LinkedIn page and add Wake Up Call events to your calendar. Hosted by Mark Connors, Onramp’s Head of Global Macro Strategy, and Rich Kerr, Onramp’s President of Managed Wealth, this show seeks to provide financial professionals the “wake up call” they need, prompt them to have an open mind with respect to bitcoin, rethink their prior assumptions, become more educated on the topic, and learn from others who are already farther down this path.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Brian Cubellis