Bitcoin Financial Services Built on Multi-Institution Custody

Onramp Is Your Trusted Bitcoin Partner

Where Security Meets Simplicity

Multi-institution custody

A fault-tolerant security model for protecting your Bitcoin for generations.

Learn moreMulti-Institution Custody

Secure, simple and always in your control

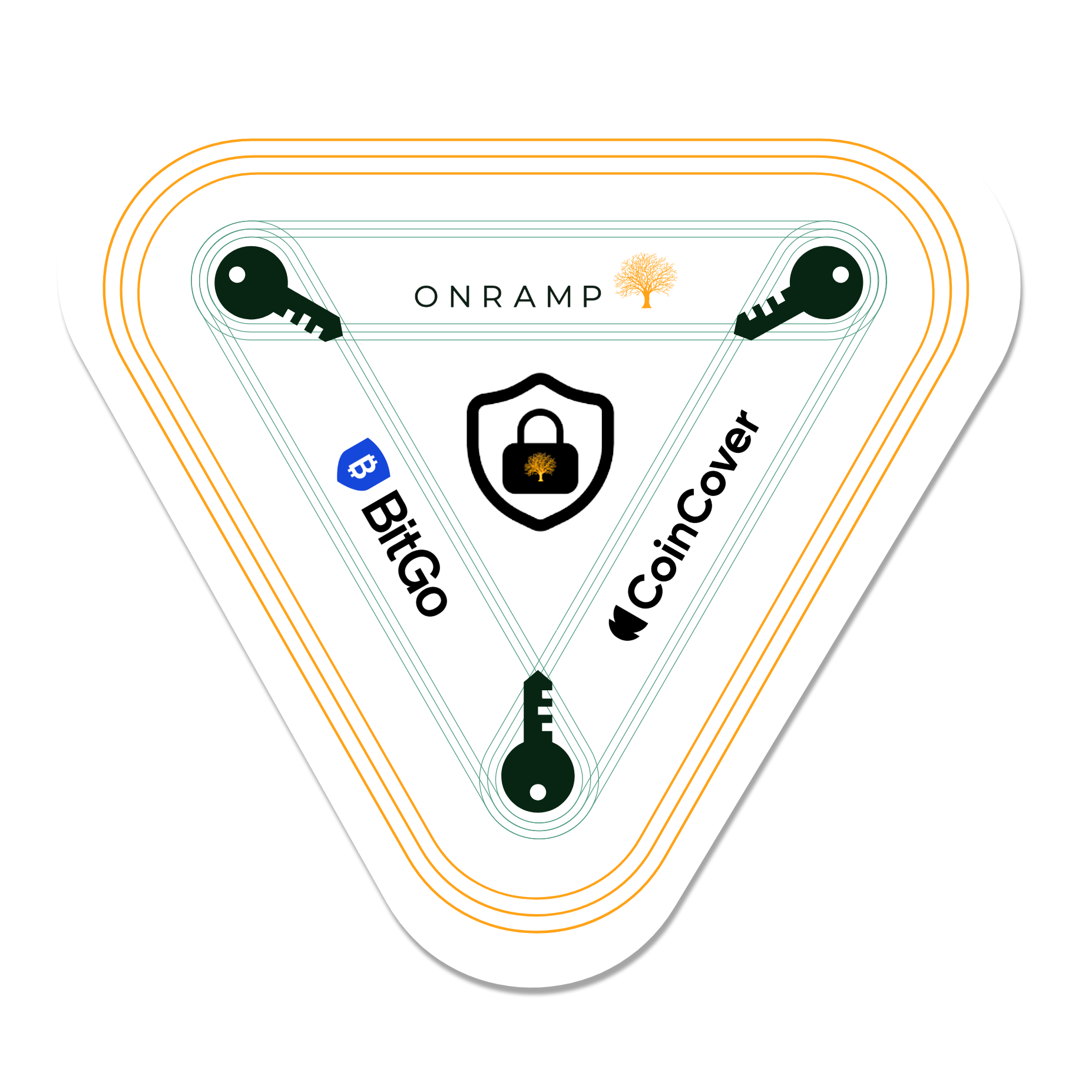

Multi-Institution Custody ensures your Bitcoin is securely stored in a vault protected by three separate keys secured by three separate institutions.

- Each key is held by a different institution, ensuring no single entity can move funds independently

- Transactions require approval from a quorum of keyholders (2 out of 3 keys)

- You maintain full control, as only you can authorize the keyholders to sign

- This structure provides enhanced security and autonomy over your assets

A best in class user experience

Buy, sell, deposit, or withdraw—all from one secure, intuitive dashboard. Track vault, trading, and cash balances in real time. Set up your inheritance plan to protect your wealth for generations.

Products and services

Onramp offers a comprehensive set of financial solutions

Multi-institution custody

Secure, fault-tolerant custody solution offering transparency, control, & no single point of failure.

Bitcoin trading

Seamlessly buy & sell bitcoin with access to industry-leading rates & liquidity.

Lending

Unlock liquidity through non-rehypothecated lending options with competitive terms.

Inheritance & estate planning

Plan for the future with comprehensive inheritance & estate planning, ensuring your assets are passed on securely.

Bitcoin IRA

Unlock the long-term potential of bitcoin within tax-advantaged IRA accounts.

Investment fund

Security-like exposure to bitcoin through Onramp's trust vehicles built on Multi-Institution Custody, offering in-kind subscriptions & redemptions.

Our trusted clients

Account tiers

Accounts scale based on your needs and goals

Still unsure?

Schedule a consultation with our team to discuss the options.

Subscribe to get Onramp's research and insights

Subscribers get access to Onramp's weekly Bitcoin research and insights from industry experts.

Are you ready?

The best security available for your Bitcoin without the technical burden. It’s time to upgrade.