11/21/24 Roundup: Markets Stall, Bitcoin Stands Tall

Onramp Weekly Roundup

Written By Mark Connors & Brian Cubellis

Before we get started…

If you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations — connect with Onramp.

And now, for the weekly roundup…

Mark Connors’ Macro Corner…

- Markets Stall, Bitcoin Stands Tall

Chart of the Week…

- Contextualizing bitcoin’s outperformance

Quote of the Week…

- Holding bitcoin reduces uncertainty

Podcasts of the Week…

- The Last Trade / The New Frontier / Wake Up Call

Markets Stall, Bitcoin Stands Tall

Key Highlights…

- Appetite for bitcoin, bitcoin spot ETF options, and MicroStrategy stock continue to ramp up, a function of bitcoin’s unique volatility profile

- The broader market rally moderates in the face of sticky inflation and geopolitical uncertainties

- Refer to our recently published report, The Macro Case for Bitcoin, to examine the drivers of these divergent outcomes

The Market Thinks…

The Fed will cut the overnight rate by 25bps at their December meeting.

- But longer term U.S. rates (2YR and longer) will remain elevated

Microsoft will NOT vote in favor of adding bitcoin to their balance sheet (13% chance via Polymarket).

- But in our opinion, they may revisit the decision after seeing the impact on MSTR performance (more on this later)

NVIDIA could have done better.

- NVIDIA stock trades 1-3% lower after announcing better than expected revenue/EPS, but only modestly better Q4 revenue guidance

To the Scorecard…

The ‘Trump Bump’ in US and Chinese equities flattened over the past 5 days as markets digest longer term impacts amidst cabinet picks and stubborn inflation being priced into the term structure of the US Yield curve. Bitcoin punched to a new all time high of $99,073 today on reports of renewed buying by MicroStrategy and the potential for a newly created digital assets department in Trump’s administration (which would likely implement a Bitcoin Strategic Reserve).

The market appreciates the Fed may control the front end of the curve, but is likely to cut again in December (~58% probability), with subsequent cuts pushing the overnight rate lower over the next year to below 4%…

…but the UST 2Y lifts above 4%, remaining in a post hike range of 3.5% to 5% by a market convinced that inflation is more sticky than a dovish Fed thinks.

Sticky U.S. rates are destabilizing for other markets as we see another surge in the Japanese Yen. We are reminded that the last time the Yen breached 160 in late July, the Nikkei dropped over 9%, forcing Bank of Japan intervention.

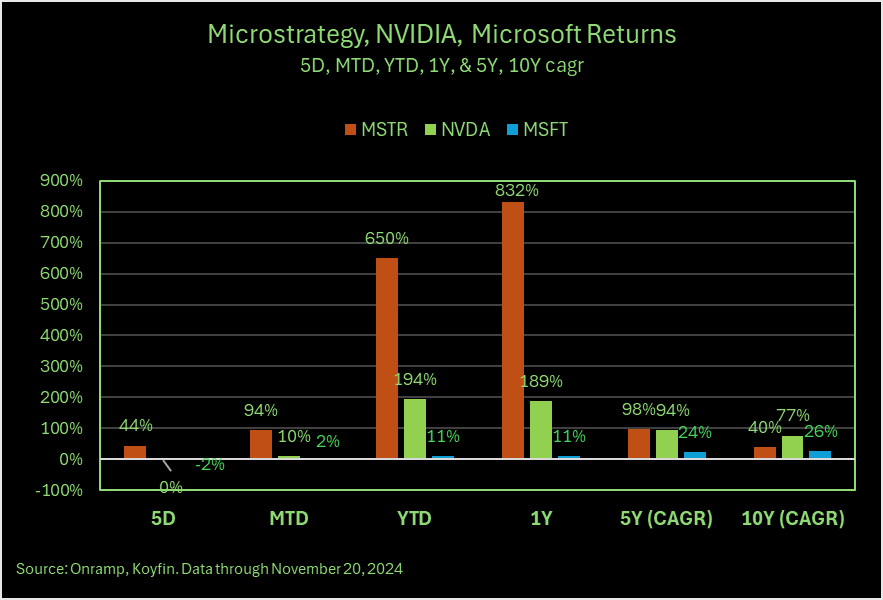

MicroStrategy’s dedicated effort to buy bitcoin by issuing equity, convertible bonds and high yield bonds has resulted in an 8.3x increase in its equity over the past year.

MSTR’s stock was the most traded stock in any U.S. Market earlier this week. The question for companies now is whether or not MSTR’s embrace by the market is a short lived parlor trick, or an enduring scheme to drive performance.

MSFT should take notice as it considers whether or not to add BTC to its balance sheet given both NVDA and MSTR post returns that dwarf MSFT’s over the past year.

Chart of the Week

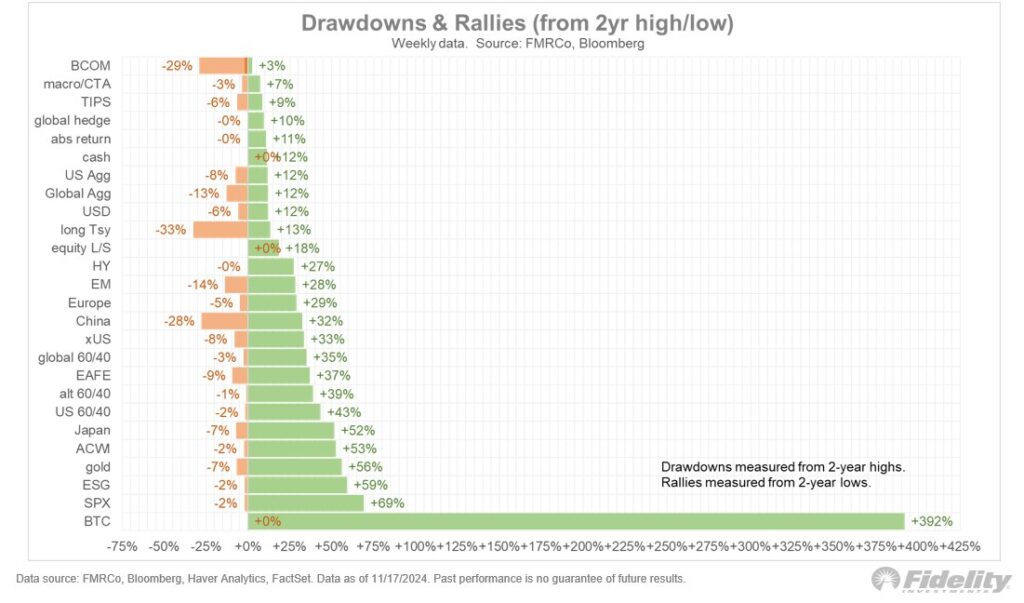

“Bitcoin is in a world of its own, as illustrated by the drawdowns and rallies of all asset classes.”

Quote of the Week

“The ‘bitcoin is useless’ skeptics focus too much on the speculative trading and not enough on why reserve demand grows and sustains the exponential price increases.

To understand reserve demand, you need to understand the purpose of holding a cash balance at all. Holding money is about reducing uncertainty, by holding the most marketable good.

The finite supply is key: increased reserve demand against a fixed supply means a higher purchasing power. For any other good, this would increase production. With bitcoin it can’t.

A higher purchasing power in turn makes it more marketable. Number go up begets number go up. Far from useless, bitcoin is the greatest monetary technology in history.

Bitcoin has exactly the properties it needs to attract reserve demand. As the price goes up, it only becomes more attractive. Speculators simply profit from anticipating and accelerating the inevitable.”

Podcasts of the Week

The Last Trade E074: Reunderwriting America with David Thayer

In this episode of The Last Trade, David Thayer, Executive Advisor to Blackstone, joins to discuss election recap & ATHs, reunderwriting America, signal from bitcoin & prediction markets, refocusing on government efficiency, institutional & nation-state adoption, & more!

The New Frontier E007: Navigating Faith & Finance with Abubakar Nur Khalil

In this episode of The New Frontier, hosts Harris Irfan & Ralph Gerban are joined by Abubakar Nur Khalil, a bitcoin Core contributor & CEO of Recursive Capital, to explore bitcoin’s transformative impact on Islamic finance and financial freedom.

Wake Up Call (11.18.24): Noelle Acheson, Author of The ‘Crypto is Macro Now’ Newsletter

In this episode of Wake Up Call, hosts Rich Kerr & Mark Connors are joined by Noelle Acheson, author of the ‘Crypto is Macro Now’ newsletter to discuss bitcoin’s evolving role in the financial landscape & its intersection with macroeconomics.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Mark Connors & Brian Cubellis