12/12/24 Roundup: Bitcoin's Signal in a Sea of Noise

Onramp Weekly Roundup

Written By Brian Cubellis

Before we get started…

If you want to learn more If you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations — connect with Onramp.

And now, for the weekly roundup…

Bitcoin's Signal in a Sea of Noise

This week’s Consumer Price Index (CPI) print came in slightly above expectations at 2.7%, a modest but meaningful uptick from the forecasted 2.6%. Counterintuitively, market expectations of a 25 basis point rate cut at next week’s Federal Reserve meeting have increased, with probability rising from 88.9% to 94.7% according to the CME FedWatch tool.

These seemingly contradictory developments highlight how the Fed’s policy stance is being shaped more by the fiscal realities of a $36 trillion national debt—incurring over $1 trillion in annual interest expense—than by genuine progress in taming inflation.

In essence, the central bank faces a narrowing set of options. Continued rate cuts are emerging as the path of least resistance, given the structural constraints of financing the ever-growing federal debt load. Yet this accommodation does not solve the underlying inflationary trend. Official CPI metrics may indicate roughly 3% inflation, but anyone navigating today’s grocery aisles, tuition bills, healthcare premiums, or holiday shopping knows that prices are rising at a faster clip.

Moreover, CPI remains fundamentally a rate-of-change metric: even at 3%, prices remain perched on a decades-long upward slope, propelled by persistent currency creation and subsequent debasement of the underlying monetary unit.

In this environment, conventional metrics—CPI prints, Fed meetings, and interest-rate forecasts—represent “noise” in the broader market narrative. The structural forces at play render central-bank posturing less relevant for long-term wealth preservation. Instead, a more durable signal has emerged in the form of a finite, programmatically scarce digital asset—bitcoin. Immune to central authority, bitcoin’s hard-capped supply and transparent monetary policy stand in stark contrast to the policy-driven variability of fiat currencies.

With bitcoin recently surpassing the $100,000 mark and demand strengthening daily, its role as an “escape valve” for wealth is increasingly evident. In lieu of navigating the complexities and operational burdens of traditional asset classes, market participants are turning to a form of money that resists dilution and defers entirely to immutable code. The underlying message is clear: amidst a backdrop of escalating monetary distortion, the timeless appeal of scarcity and independence is resonating. The signal, in this case, is undeniable.

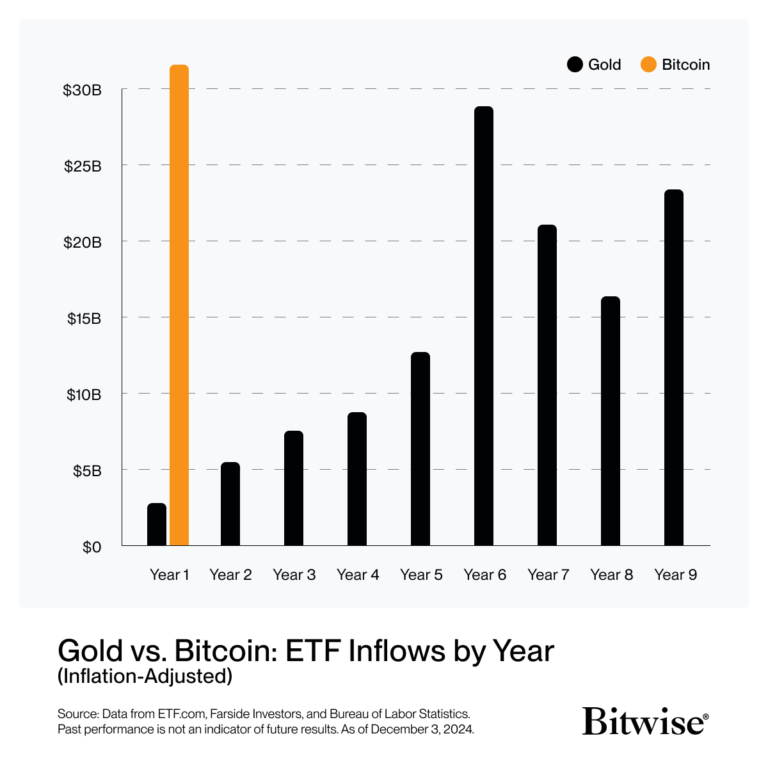

On the demand side, the momentum has been extraordinary. The bitcoin ETFs that launched earlier this year have been the most successful fund debuts in history—despite most traditional financial institutions not yet even offering these vehicles to their clients. Governments are now openly considering the strategic advantages of holding bitcoin in their reserves, corporations continue to adopt it on their balance sheets, and everyday savers are waking up to the realization that dollars are a steadily depreciating store of value.

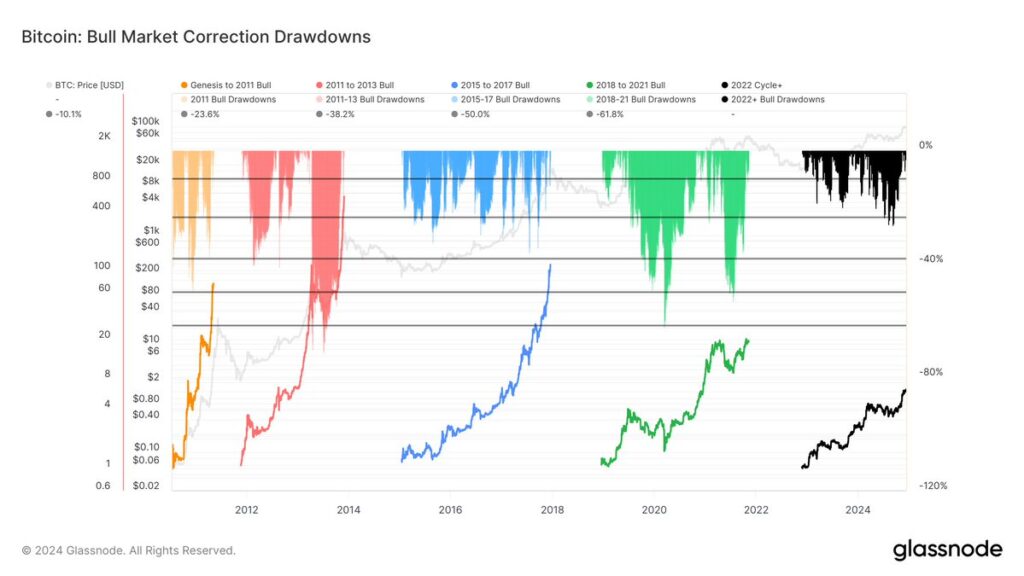

Although short-term volatility will persist, a long-term perspective reveals bitcoin’s ongoing monetization process. Its 200-week moving average provides a reliable compass, trending steadily upward over time. Historically, investors who have held bitcoin for four years or longer have fared exceptionally well relative to virtually all other asset classes.

Onramp Terminal

As the global macro backdrop grows increasingly complex, bitcoin’s durability as a store of value and its capacity to resist dilution offer a genuinely differentiated proposition. Cutting through the noise of policy pivots, distorted inflation measures, and currency debasement, bitcoin’s signal is clearer than ever.

Chart of the Week

“Comparing bull market corrections, the current cycle shows significantly reduced volatility. This is Bitcoin’s least volatile cycle so far.”

Quote of the Week

“I believe that there would likely be a pending debt money problem…I want to steer away from debt assets like bonds and debt, and have some hard money like gold and bitcoin.”

Podcasts of the Week

The Last Trade E077: The Institutional Case for Bitcoin with Daniel Batten & Samuel Roberts

In this episode of The Last Trade, Daniel Batten & Sam Roberts join to discuss the institutional case for bitcoin, the first UK pensions to allocate, bitcoin as the ultimate ESG asset, counterparty risk & custodial considerations, & more!

The Last Trade E078: Securing Six-Figure Bitcoin with Bram Kanstein

In this episode of The Last Trade, Onramp’s new Head of Growth, Bram Kanstein, joins to discuss, navigating near-term volatility, corporate vs. retail adoption, securing six-figure bitcoin, hidden risks of custody, & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Brian Cubellis