2/6/25 Roundup: Don't Trust, Verify

Onramp Weekly Roundup

Written By Brian Cubellis

Before we get started…

This week, we released the latest installment in Onramp Institutional’s research efforts:

“Bitcoin as a Strategic Asset for Sovereign Wealth Funds.”

Building upon our earlier analysis geared toward Family Offices, this new report provides a thorough examination of how Sovereign Wealth Funds can incorporate bitcoin into their long-term investment strategies. By analyzing the unique roles, mandates, and risk frameworks that sovereign allocators face, this report offers data-driven insights and practical guidance on the potential benefits—and key considerations—associated with bitcoin allocations.

Download the report to explore how this emerging asset could fit into a diversified sovereign portfolio. Please note this is an executive summary. For the full ~75-page report, please contact our team.

And now, for the weekly roundup…

Don't Trust, Verify

Gold Demand Surges…But Can It Deliver?

The price of gold continues to rocket upward—recently touching an all-time high of approximately ~$2,880 per ounce—as investors scramble for a safe haven from mounting global debt, rampant fiat currency debasement, and ongoing geopolitical turmoil.

Yet just as institutional buyers and central banks flock to gold, the precious metal’s market structure is revealing significant strains.

source: Onramp & Koyfin

Over the past week, liquidity gaps have emerged as the system grapples with heightened demand for physical settlement. Gold’s complex, custodial-heavy supply chain—which relies on banks, vaults, and futures markets—appears to be buckling under pressure. Among the red flags:

- Major breakdowns in gold arbitrage trades, hinting that liquidity and logistics are falling short.

- A widening spread between U.S. futures and spot gold, suggesting physical supply isn’t where it needs to be (spike in 1-month lease rates for gold shown below).

- Eroding trust in custodial gold markets, as a growing cohort of investors insists on direct, verifiable ownership.

These dysfunctions highlight the limitations of gold as a trust-minimized store of value. By contrast, bitcoin’s transparency, verifiability, and custodial optionality directly address the shortfalls that gold holders are now encountering.

source: Matthew Sigel on X

Gold’s Achilles’ Heel: Physical Constraints & Custodial Risk

For decades, gold’s liquidity has relied heavily on paper markets—contracts that rarely trigger physical delivery. One chief mechanism is Exchange for Physical (EFP) arbitrage, where traders take advantage of small price differences between London spot gold and U.S. futures, typically without having to move any metal.

Now, that once-simple trade is failing. Demand for actual physical delivery, paired with logistics hurdles, is halting this “easy money” practice. Physical gold is being hastily flown from Asia to the U.S. to fill supply gaps, while Comex gold futures premiums spike amid scarcity in the right locations. Investors, meanwhile, increasingly doubt vault-based custodial solutions—a sign that gold’s “paper promise” is wearing thin.

These dynamics strike at the core of gold’s settlement process, underscoring the fragility of a centuries-old system that depends on opaque custody arrangements and physical movement of metal.

Bitcoin vs. Gold: Transparency, Final Settlement & the Call Option on Custody

1. The Call Option on Custody

Bitcoin holders can self-custody at will—a game-changer that gold simply can’t match. Even allocators that opt for third-party custody can ideally:

- Audit their holdings instantly using on-chain proofs.

- Withdraw to self-custody without logistical hurdles.

- Transfer assets globally in minutes, sidestepping shipping or storage limitations.

Gold, by contrast, involves physical vaults, shipping, insurance, and a host of other frictions that become painfully obvious when delivery suddenly matters.

2. Bitcoin Could Have Paper Claims—But It’s Much Harder to Manipulate

Yes, in theory, bitcoin can be financialized through derivative products or unscrupulous custodians. However, its transparent, finite nature makes large-scale paper manipulation unsustainable in the long run.

- Bitcoin’s 21 million supply cap is enforced by math, not institutions.

- On-chain settlement is final and auditable, eliminating many counterparty risks.

- Paper claims on bitcoin are easier to expose, while gold’s off-chain opacity allows excessive claims to persist indefinitely.

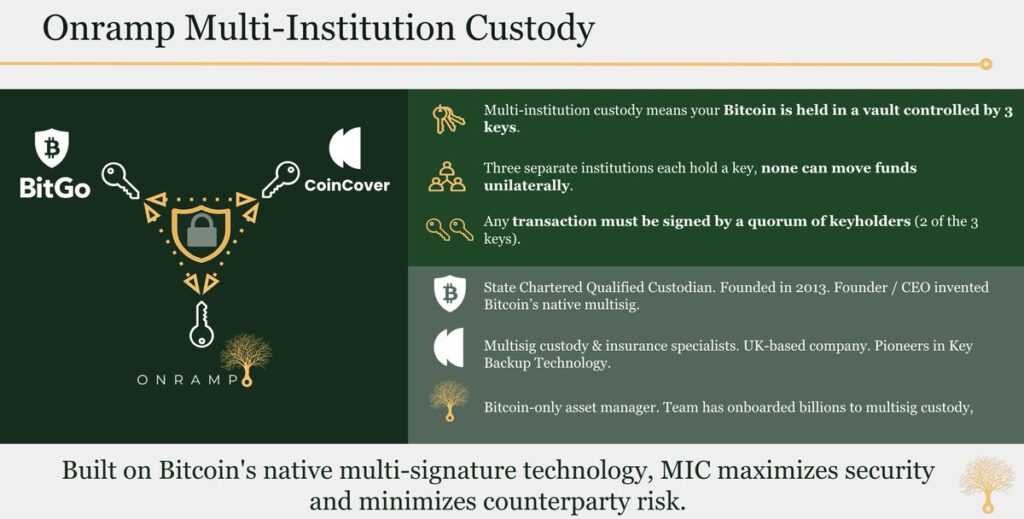

3. Onramp’s Multi-Institution Custody: Distributing Trust

Gold holders are limited to single-entity custody—one vault, one bank, or a handful of ETF issuers—each a potential point of failure. Bitcoin, however, opens the door to multi-institution custody models that mitigate centralized risk while maintaining secure, flexible storage.

Onramp’s multi-institution custody approach means:

- No single custodian exercises unilateral control over your assets.

- Institutions can verify their bitcoin holdings in real time.

- Near-instant final settlement is possible worldwide, bypassing the liquidity crunches and paperwork that plague gold markets.

Why Trust Is Failing—And Verification Is the Future

The tumult in gold markets is about more than spot prices and futures spreads. It’s about trust in custodians and the viability of financialized systems built on the assumption that no one ever really needs the underlying asset. As buyers demand physical gold, they discover the chain isn’t as robust as advertised.

Bitcoin, on the other hand, has no hidden corners. You can verify every coin’s existence on-chain. You can transfer custody at will. You can bypass third-party trust or, if you choose a custodian, move elsewhere at a moment’s notice. This level of verifiability and optionality stands in stark contrast to gold, which is struggling precisely because it can’t meet these requirements.

At Onramp, we’re committed to helping institutions navigate this transition by offering multi-institution custody solutions that preserve the best of bitcoin’s decentralization while providing the operational security and transparency investors demand.

As gold’s supply chain strains under the weight of renewed demand, bitcoin continues to demonstrate what a truly digital, trust-minimized asset looks like. The failures in gold’s settlement system are a warning: in an era of mounting debt and global uncertainty, reliance on paper promises and antiquated logistics is no longer sufficient.

Bitcoin fixes this by combining transparency, custodial optionality, and absolute scarcity—ultimately reshaping our understanding of sound money in the digital age.

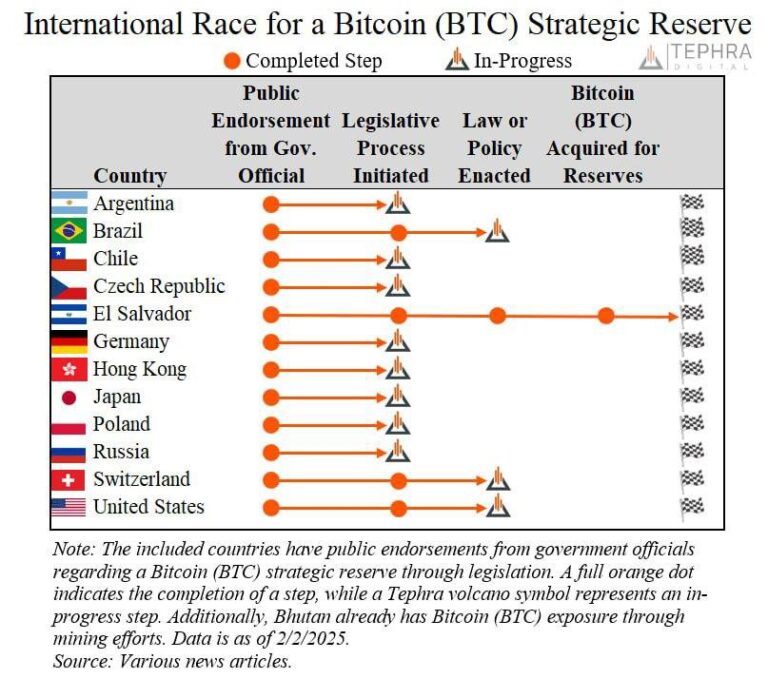

Chart of the Week

“Nation-States are adopting Bitcoin. You can legally front-run entire countries!”

Quotes of the Week

“[Bitcoin] is an excellent store-of-value.”

— David Sacks, White House AI & Crypto Czar

“[Bitcoin] is a better version of gold.”

Podcasts of the Week

Fed Speak, Gold ATHs, DeepSeek, State-Level Adoption, & BTC Dominance

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, Brian Cubellis, & Tim Kotzman discuss FOMC & Fedspeak, gold ATHs, DeepSeek aftermath, state-level adoption, BTC Dominance, & more!

The Scarcity Paradigm: Wealth Preservation in an Era of Debasement

In this episode of Scarce Assets, hosts Jackson Mikalic, Glenn Cameron, & Tim Kotzman debut a new format, exploring the increasingly critical role of scarcity across investing, capital allocation, & portfolio construction.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Brian Cubellis