Increasing Scarcity: Bitcoin's Value Appreciation Engine

Legendary Wall Street investor Bill Miller has 60% of his portfolio in it.

Stan Druckenmiller is bullish on it.

Paul Tudor Jones expects it will be “the fastest horse over the next 10 years.”

Jack Dorsey believes in it so much he resigned as Twitter CEO to focus on it.

Ray Dalio acknowledged “we might be missing something” about Bitcoin, months later his #2 in command left to join a Bitcoin company.

Bitcoin is complicated, I get it. Those of us who are fully immersed in Bitcoin do a poor job of explaining why Bitcoin is worthwhile – we too quickly get into the weeds and everyone gets lost. That’s why Bitcoin is still a confounding mystery to you, and almost everyone.

So let’s keep it simple: I’ll show you one thing you didn’t know about the investment case for Bitcoin.

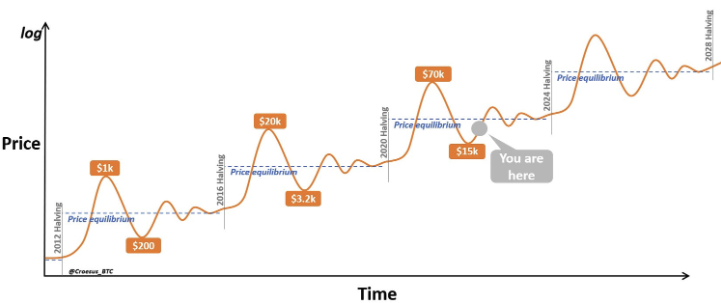

First, let’s set the stage. Right now, Bitcoin is at ~$25k/coin. It has “crashed” from a high of $70k. In the eyes of the broader public, Bitcoin is dead or dying.

The reason I’m writing this is because *now* is exactly the time that you should be most interested in Bitcoin, because Bitcoin has been in this exact place every four years for its entire existence. And if it does anything like what it did in the past, over the next ~2 years Bitcoin will 4-8x, meaning $100-200k/coin.

And here’s the crucial bit: this is not baseless hope, this is rooted in hard-and-fast supply/demand mechanics at the heart of Bitcoin’s design. These mechanics are the very reason that Bitcoin continues to rise from the ashes to spectacular new highs ever four years, and why it will continue to do so.

I’m going to let you in on a couple little secrets – things that 99%+ of people simply don’t know:

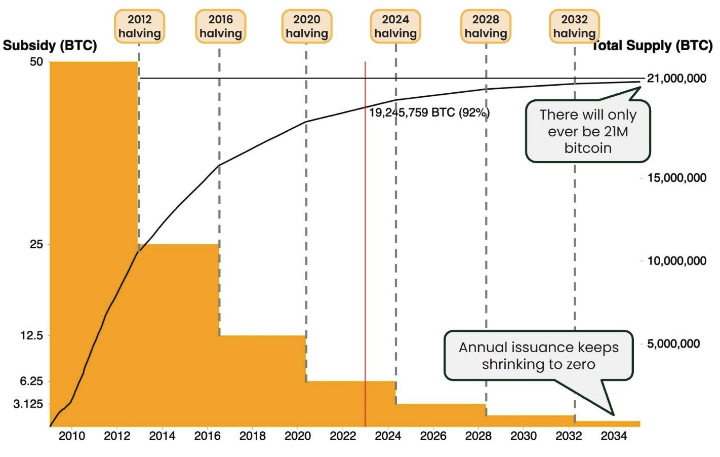

There will only ever be 21M Bitcoin.

Every four years, the amount of Bitcoin being released gets cut in half – events known as “halvings”.

These two characteristics don’t seem particularly important at face value, but they underpin everything about Bitcoin’s ongoing journey. Together, they create the engine for Bitcoin’s growth – a quadrennial supply shock precipitated by each halving. Guaranteed, set in stone.

That is why the halvings (and their impact) is the first thing you should know about the investment case for Bitcoin, so that’s what we’ll focus on here.

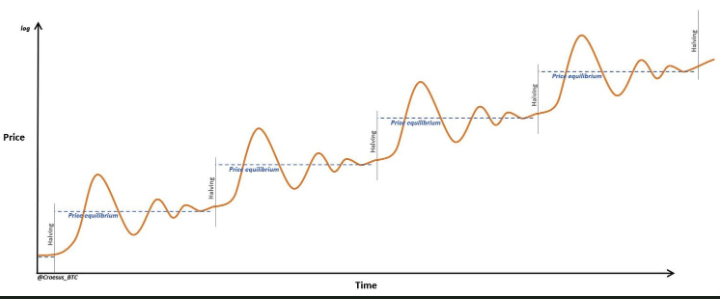

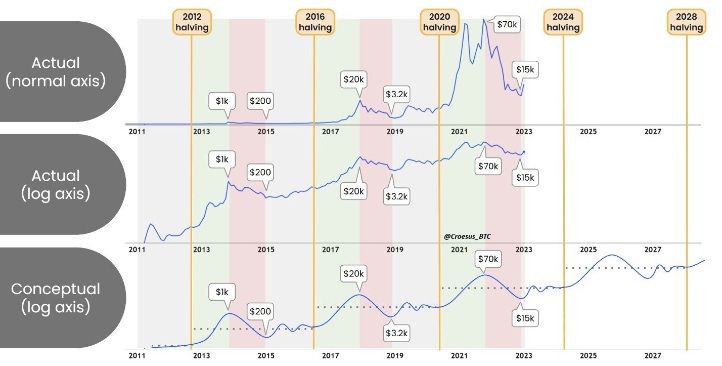

In ultra-simplified visual terms, here’s what we’re living through:

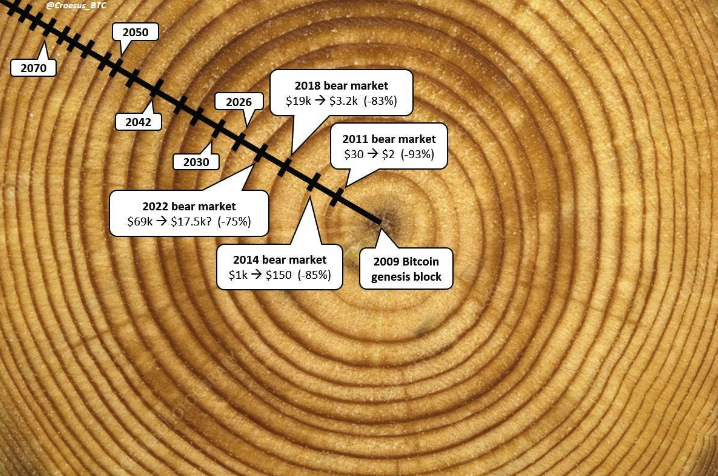

Bitcoin’s price action is a series of bubbles, a string of successive higher highs and higher lows, as this strange new asset bootstraps itself from nothing to being the world’s best store-of-value asset.

Bitcoin derives its value from people adopting Bitcoin because of its merits as a store-of-value. It’s a funny sort of circular logic, one that does resemble a Ponzi scheme at first glance (which is why you often hear that criticism from the uninformed). But that’s the nature of any upstart store-of-value asset: earlier adopters benefit because they got in before the masses showed up. True of pioneers staking a claim on the frontier of the American West, true of early collectors of Picasso’s paintings.

The reason Bitcoin is not a Ponzi scheme is because its merits as a store-of-value are real and lasting (finite supply, censorship resistant, borderless, zero cost of ownership, zero time decay – in essence, an asset that bestows the owner with perfect property rights).

But, in my opinion, Bitcoin’s most compelling merit as an investable asset is that every four years, the amount of Bitcoin being created every day gets cut in half. In other words, they will be making less Bitcoin in four years than they are today. And that increase in scarcity is permanent and compounding.

Here’s Bitcoin’s supply issuance schedule:

Seems like just a cute design, but the massive implications of this only become clear when you think about a “halving” event from a supply & demand perspective.

Organically, Bitcoin’s price finds an equilibrium during each “block reward era”. A consistent amount of Bitcoin is being produced each day, and that’s going into the market to meet a more-or-less steady rate of demand from everyone who has already determined that Bitcoin is an asset worth accumulating. The result is that a price equilibrium is established – prices stabilize, volatility diminishes, Bitcoin is boring.

But then, a halving comes along. Overnight, the amount of Bitcoin being created to go out into the market and meet demand is cut in half. This causes a supply shock. But demand doesn’t get cut in half. The result is free market price discovery – the only way to restore price equilibrium as demand competes for half as much new supply is for the price to drift upwards.

(For a visual representation of these supply/demand mechanics, here’s a thread I put together in October 2020 to illuminate why Bitcoin was about to experience a price spike in the wake of the May 2020 halving. It then did just that, like clockwork.)

Of course, while Bitcoin’s price drifts upwards in search of supply/demand price equilibrium, human nature steps in to complicate things. Several factors contribute to amplify that move to the upside:

Bitcoiners get excited and scramble to increase their positions before the supply shock takes effect. Demand for Bitcoin increases

The average investor is forced to watch as Bitcoin’s price chugs upward without them, causing many to start exploring Bitcoin, whereupon they learn of its merits and want a slice of that 21M hardcapped supply themselves. Demand for Bitcoin increases

Speculation takes hold. After months of Bitcoin’s price chugging upwards, everyone gets too confident that the trend will continue (myself included). Believers take on leveraged long positions, many in the broader public buy some Bitcoin with the intention of selling when it goes a little higher, etc. Demand for Bitcoin increases

What I’ve described above is a speculative bubble. It’s true! Bitcoin’s bull markets take the shape of speculative bubbles, which is part of why respectable investors have been wary of Bitcoin – nobody wants to get swept up in anything as shameful as Tulip mania.

But, what’s important to remember is the very real mechanics that precipitated that speculative bubble, and what they continue to do after the hype disappears. When a Bitcoin bull market pops, the speculative investments get washed out over a very painful year or so (what we went through from November 2021 peak to December 2022 low). Meanwhile, everyone who refused to let animal spirits entice them into Bitcoin when the FOMO raged feels delightfully vindicated and dances on Bitcoin’s grave (have you noticed the recent newspaper pieces proclaiming Bitcoin’s death?).

Despite the bad press, the halving is not undone. There is still half as much Bitcoin going out into the market to meet demand. (Before the 2020 halving, 1800 Bitcoin were being “mined” every day; now it’s 900 a day.)

What’s more, after the dumping of speculative Bitcoin positions subsides, there’s actually more demand for Bitcoin than there was before the halving. Why? Because some portion of the people that were lured in by Bitcoin FOMO do their homework enough to discover Bitcoin’s merits – most importantly, Bitcoin’s design feature of increasing scarcity. As these new adopters come to terms with Bitcoin’s value proposition, they also take stock of a head-spinning set of facts:

A desirable asset that increases in scarcity will increase in price (supply and demand)

No other asset in the investable landscape offers a reliable guarantee of increasing scarcity

99%+ of people have no idea that Bitcoin is designed to get more scarce (and more valuable as a result)

Faced with these facts, people invariably arrive at the same conclusion: it’s a good idea to accumulate Bitcoin now in order to front-run the next halving & the rest of the world slowly catching on.

Just like that, these new believers join the old believers, and collectively they all try to accumulate Bitcoin, paycheck by paycheck. Together, these adopters have reached the logical conclusion of how to engage with this fledgling asset – Bitcoin is a savings technology, one that allows individuals and entities to store value today, knowing that their nest egg will grow in purchasing power when held for 4+ years.

In this way, Bitcoin’s halving-driven speculative bubbles each onboard an incremental slice of the world to become Bitcoin savers. Like tree rings, Bitcoin adoption grows through successive cycles of expansion and hardening, summer and winter.

To sum up the net effect of each halving: new supply issuance gets permanently cut in half while demand experiences a violent swing but ultimately ends higher than before – price moves up-and-to-the-right. Okay fine, that’s all well and good for explaining Bitcoin’s past, but who cares?

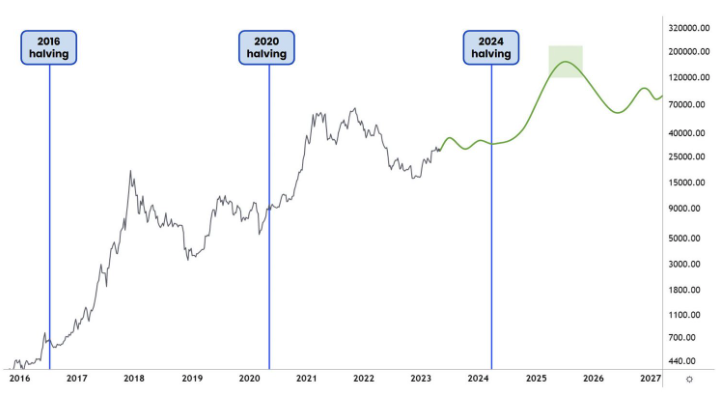

Well, the essential thing to know is that Bitcoin’s past is also its future. The next halving is coming – when the 840,000th Bitcoin block is mined in April 2024, the halving is automatically triggered. And when it happens, the supply shock mechanics will play out again. And again. And again, every four years for the next century. Nobody can stop it; nobody can change it.

Never before in history has there been an asset with a permanent halving of new supply built in to its design. That’s not possible in the physical world – it’s only possible in the digital realm. And therein lies one of the challenges that investors face when trying to understand Bitcoin. It sounds too good to be true, because surely if it was possible to harness the power of increasing scarcity to create a new store-of-value asset, someone would have done it by now? But the simple fact is that it was not possible to create a credibly immutable supply schedule without the decentralized consensus mechanism that is Bitcoin’s primary breakthrough.

There’s a lot more to be explored about what Bitcoin’s design implies for the future of this bizarre new asset and what that means for the broader financial landscape. However, for now, we must return to the central point of this piece: why I think Bitcoin could 4x in the next ~2 years.

Now that we’ve had a lightning-round overview of the remarkable supply/demand mechanics set in motion with each Bitcoin halving, your hearty skepticism at the outset of this article may have softened to quizzical wariness. If so, I’ll take it. Nobody can be convinced of Bitcoin’s investment thesis after a few pages of reading. It takes a lot of learning to get comfortable with the strange beauty of Bitcoin, but maybe this is a start.

If I’m right about the hard-and-fast supply/demand mechanics of Bitcoin’s halvings, here’s where we are:

If Bitcoin does just ¼ what it did over the same time frame last halving cycle, Bitcoin will 4x between now and mid-2025. This would put Bitcoin at $100k/coin, meaning $2T in total value. Given that there is ~$13T of value stored in gold – Bitcoin’s closest store-of-value competitor, this would put “digital gold” at 15% the value of physical gold.

Importantly, this would not be an end-state for Bitcoin – just a stepping stone on its continuing journey. Every four years for the next century, Bitcoin will halve its daily issuance. As the magnitude of each halving decreases relative to the existing supply of Bitcoin, the amplitude of the price shock will continue to decrease. But the psychology of the halvings will still play out, will still generate excitement, will still attract new entrants to learn about Bitcoin’s remarkable attributes as a store-of-value for the digital age. (My personal estimate is that Bitcoin could 50x over the next decade or so – meaning $1M/Bitcoin, and it still won’t be done absorbing value from assets with less attractive store-of-value properties – but these are bigger topics I will explore in future writings.)

You don’t have to believe it. In fact, most of you still won’t. But, unfortunately for everyone who would rather it just go away, Bitcoin is doing exactly what it’s designed to do. And it will continue riding waves of volatility (upside, and downside) as its supply issuance grows inexorably more scarce, making Bitcoin a more established and more valuable asset… one four-year-cycle at a time.

The problem you face is that these mechanics play out with or without you. If each halving onboards an incremental slice of adopters & simultaneously makes Bitcoin more valuable… and there’s a century of halvings approaching like waves on the horizon… eventually this asset onboards the whole world.

The question becomes what % of the world will you be ahead of when you recognize the opportunity at hand to just ride the Bitcoin wave? Right now, you’d be ahead of 99% – sorry, you’re not in the first 0.1% of adopters, but you still have time to be in the first 1% of the world.

And what a time to enter. In April 2024, the next halving sets in motion the next boom-bust cycle. In 2025, I expect we will be setting a new “higher high” – I could certainly be wrong, but I’m anticipating that next peak will be at least $100k/Bitcoin.

That’s a 4x in ~2 years. That’s +300% performance. What else in your portfolio is going to do that?