7/27/23 Roundup

Hi all,

This is Dylan LeClair, presenting this week’s Onramp Weekly Roundup.

Before we get started… If you’re a HNWI or Institution looking for the best way to get exposure to bitcoin, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

And now, here’s the weekly roundup…

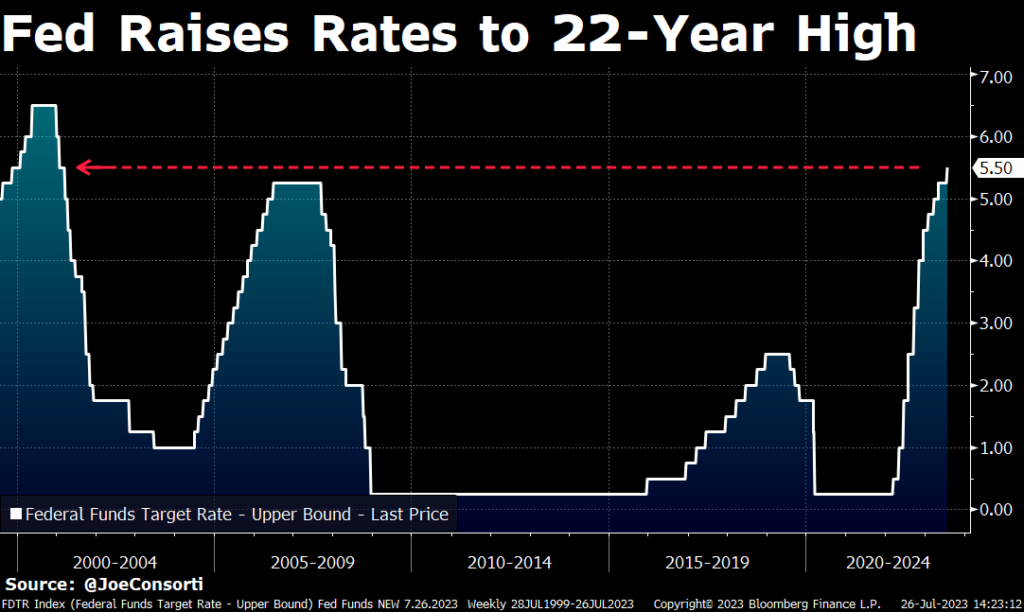

Fed Raises Rates to 22 Year High

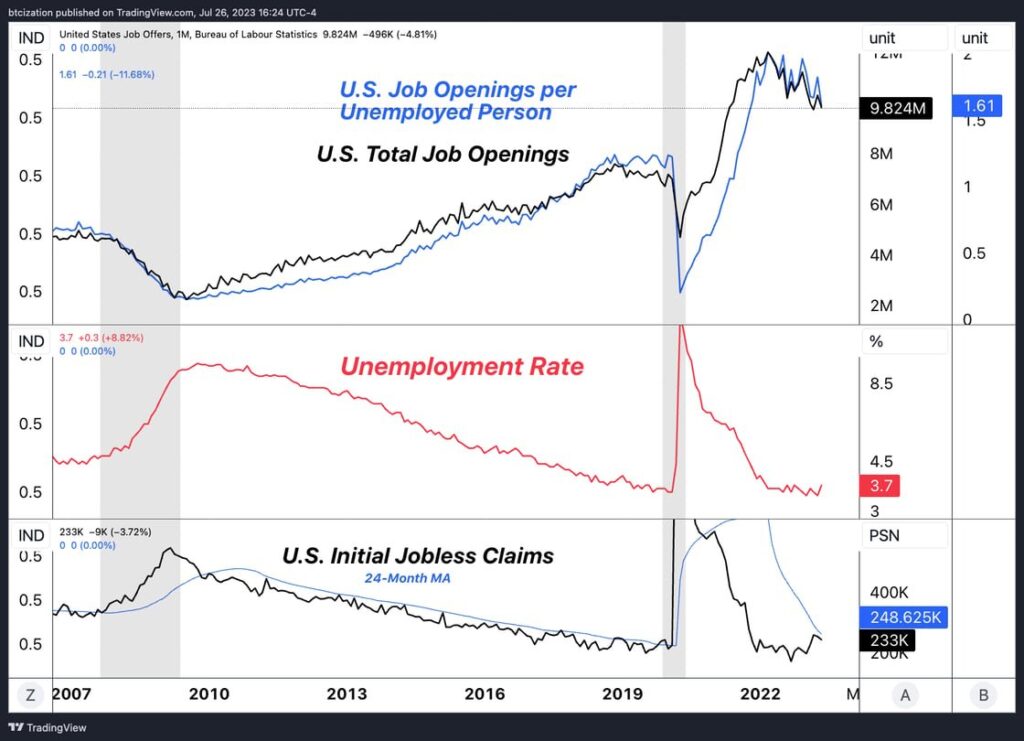

As anticipated, interest rates were boosted by a quarter point to a range of 5.25% to 5.5%. Despite this increase, Fed Chair Powell insists on a data-dependent approach to future decisions rather than adhering to a fixed rate-raising schedule. The next two jobs reports and consumer price reports will play a critical role in shaping the September meeting’s decisions.

Powell mentioned that officials welcomed the 3% inflation rise but are cautious about interpreting short-term data. He emphasized the need for further improvement in the labor market before inflation decreases and indicated that there’s still a long way to go to achieve the target of 2% inflation. This comes at a time when the labor market, albeit weakening, is still very strong amidst a historic tightening cycle.

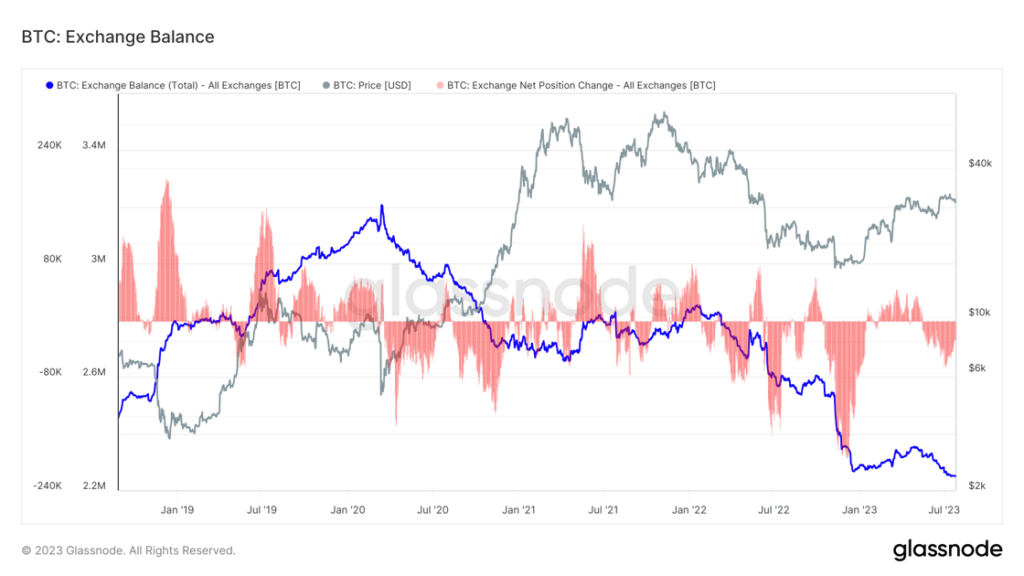

The Bitcoin Exchange Drain

Shifting our focus to the bitcoin market, the exchange bitcoin drain continues. Bitcoin balances on centralized exchanges continue to diminish, dropping to levels not seen since the beginning of 2018. A decline of approximately 32% from its March 2020 peak of 3.1 million BTC, leaving just 2.1 million BTC on exchanges – a mere 11% of circulating supply, as the post 2022 crypto crash continues to push holders of bitcoin to seek superior custody solutions that don’t rely on single points of failure.

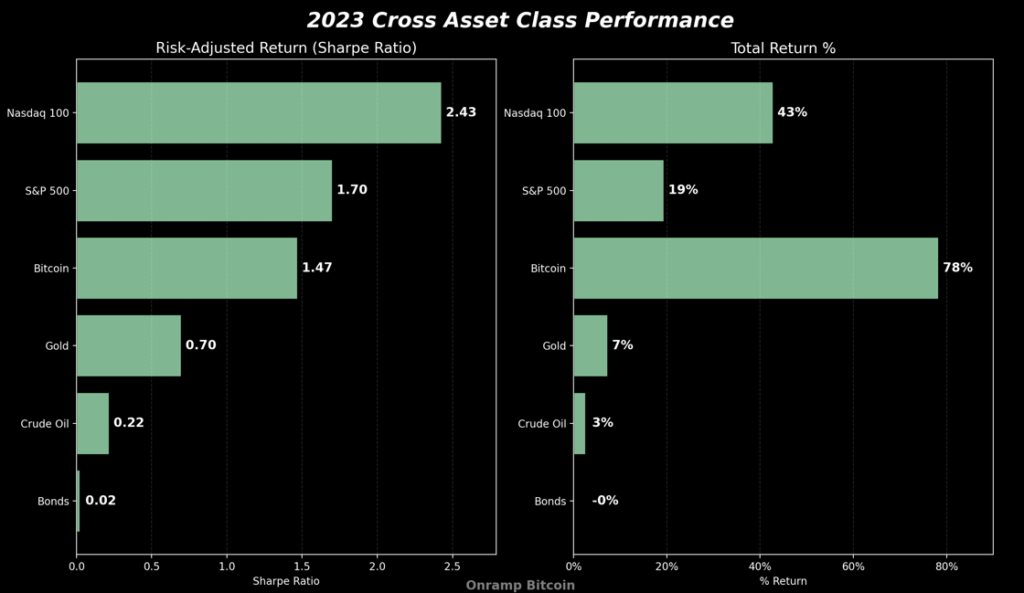

Cross Asset Class Comparison

Taking a look at the cross asset class comparison for 2023 so far, bitcoin has fallen behind equities in terms of risk adjusted returns due to its higher volatility, but is still far and away the best performer against equities, bonds, gold and oil.

Interestingly, a 2022 BlackRock research paper was leaked this week, which, contrary to the current trend, celebrated Bitcoin’s superior risk-adjusted return profile. It claimed that “Investors with a preference for positive skewness add substantial BTC holdings to their equity-bond portfolios. Even when BTC is expected to halve in value, an optimal 3% BTC allocation is suggested.”

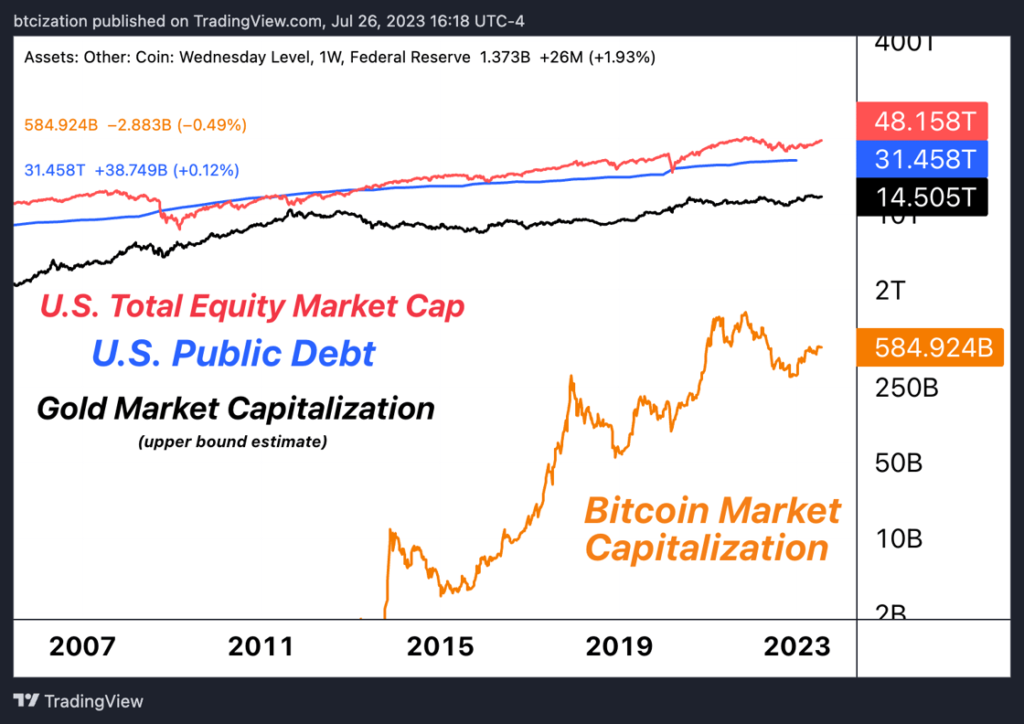

As we move towards 2024 amidst swirling rumors of Bitcoin ETFs, it’s important for all investors to remain open to the opportunity that bitcoin could present going forward, as well as its relatively tiny market valuation compared to legacy asset classes.

Podcast of the Week

E009: More Bullish Than Ever

I, Dylan LeClair, was delighted to once again join the Onramp Bitcoin cast to discuss the latest developments in the economy and Federal Reserve policy, the recent announcements from Presidential Candidate Robert F. Kennedy Jr. and the shifting of the Overton Window, as well the recently reignited debate on bitcoin’s stock-to-flow ratio, and so much more.

Check out the full episode here.

Closing Note

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair