The Digital Gold Rush

This week, we have the pleasure of presenting you with a piece by rising Bitcoin author, Jackson Mikalic, which originally appeared in The Fiat Cave.

Onramp strives to deliver high quality Bitcoin education content that will resonate with our audience of sophisticated professionals. We look forward to continuing to bring you the best minds in Bitcoin, straight to your inbox.

Now, grab your pickaxe and washpan for a thought-provoking historical parallel.

-Jesse Myers

A Brief History on the California Gold Rush

The California Gold Rush began on January 24, 1848, when gold was discovered at Sutter’s Mill in Coloma, CA. The news of the discovery spread rapidly, and people worldwide migrated to CA in search of the shiny yellow metal.

It may seem obvious, but why did the Gold Rush occur? Scarcity.

By the mid-1800s, precious silver and gold metals had been used as money for thousands of years. The monetary properties of gold led to its adoption as money – a medium of exchange, store of value, and unit of account. Chief among these properties is gold’s scarcity, unrivaled among monetary metals.

So, of course, when stories of gold deposits in California began making their rounds, there was excitement but also much skepticism – it’s a rare metal. Californians were first to hear of the discovery. It’s said that when the news broke in San Francisco, many didn’t believe it at first. It took American settler, businessman, and journalist Samuel Brannan walking through town with a vial of gold to convince the people of the discovery – not long after, stores were empty as people flocked to the mines in search of the shiny metal.

The news then made its way to Mexico, South America, and the Pacific Northwest. It wasn’t until summer, 6 months later, that the news made it to the East Coast of the United States. Again, there was a high degree of skepticism, and it wasn’t until President Polk shared Colonel Richard B. Mason’s report of the gold discoveries at his State of the Union address in December 1848 that America was convinced there was gold in them there hills.

In 1849, the non-native population in California boomed to 100,000, a 10x increase from a few years prior. Few things were more compelling than staking a claim and striking it rich.

The earliest prospectors gained the most during the 1848-52 California Gold Rush. As time progressed and more dreamers arrived, it became more challenging to find deposits, and speculators moved to other regions of the US, such as the Rockies.

Over a few years, billions of dollars were pulled out of the ground (in today’s dollars) – a truly rare opportunity for generational wealth creation for those daring enough.

And I believe an even more compelling opportunity is on the horizon.

Understanding the Case for Digital Gold

It’s not often that these circumstances present themselves – a chance for life-changing wealth to be secured on a new frontier, yet bitcoin presents that exact opportunity for all of us.

What is bitcoin? It’s complicated, but to keep it simple, it’s best to think of it as digital gold.

Using the digital gold lens to assess bitcoin is effective, as we all innately understand the value of gold derives from its scarcity. Thousands of years of history give us confidence in the value of gold and its ability to store wealth for the long term despite economic turmoil, currency devaluation, war, and social upheaval.

If we apply that same framework to bitcoin, we can make a strong case for it as a savings technology or as an allocation in a broader investment portfolio.

So what makes bitcoin “digital gold?”

First and foremost, similar to gold, bitcoin’s value derives from its scarcity. You’ve likely heard that there’s a hard-capped supply of bitcoin of 21 million. To achieve the 21 million bitcoin, bitcoin is mined (issued) at a predetermined rate. At the time of this writing, 19.4 million bitcoin have been mined.

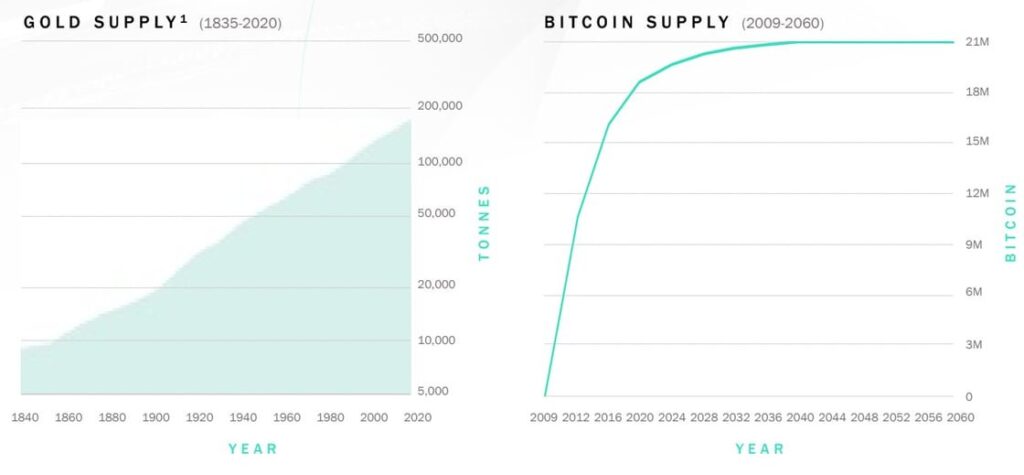

Due to gold’s relative scarcity, it’s been a great asset to own for decades and even generations to preserve purchasing power against devaluing paper currencies. The total amount of above-ground gold has grown at 1.5-2% annually for the last 200 years. That’s pretty good – relatively scarce.

Gold’s relative scarcity should be compared to bitcoin’s absolute scarcity, achieved by the finite supply.

Bitcoin improves on the scarcity of gold by introducing a finite amount that can ever exist. Not only is there a fixed number of bitcoin that will ever exist, but the issuance of bitcoin rate decreases over time.

Over the last two centuries, gold’s supply has increased by 20x.

Bitcoin stands in stark contrast to the steadily increasing supply of gold. Bitcoin not only exhibits absolute scarcity but also increasing scarcity. If you want an excellent primer on “increasing scarcity” I recommend this piece by Jesse Myers.

To summarize, increasing scarcity is driven by the “halving” event that happens every four years – when the amount of bitcoin issued in each block decreases by half. Since bitcoin’s inception, there have been three “halving” events: 2012, 2016, and 2020.

Thus, bitcoin becomes increasingly scarce every four years as the amount of new supply decreases until 2140 when no more bitcoin will ever be created. Just as gold’s scarcity has determined its value for thousands of years, bitcoin’s absolute scarcity and increasing scarcity are the key drivers of long-term value. While there’s no denying that volatility exists in bitcoin’s price relative to the dollar, these two factors have contributed to outstanding returns for adopters to-date.

The Digital Gold Rush Begins

With that established, what might a “digital gold rush” look like? Digital in nature, it wouldn’t represent a mass migration of picks and shovels, but there would still be many parallels, including the opportunity to create generational wealth.

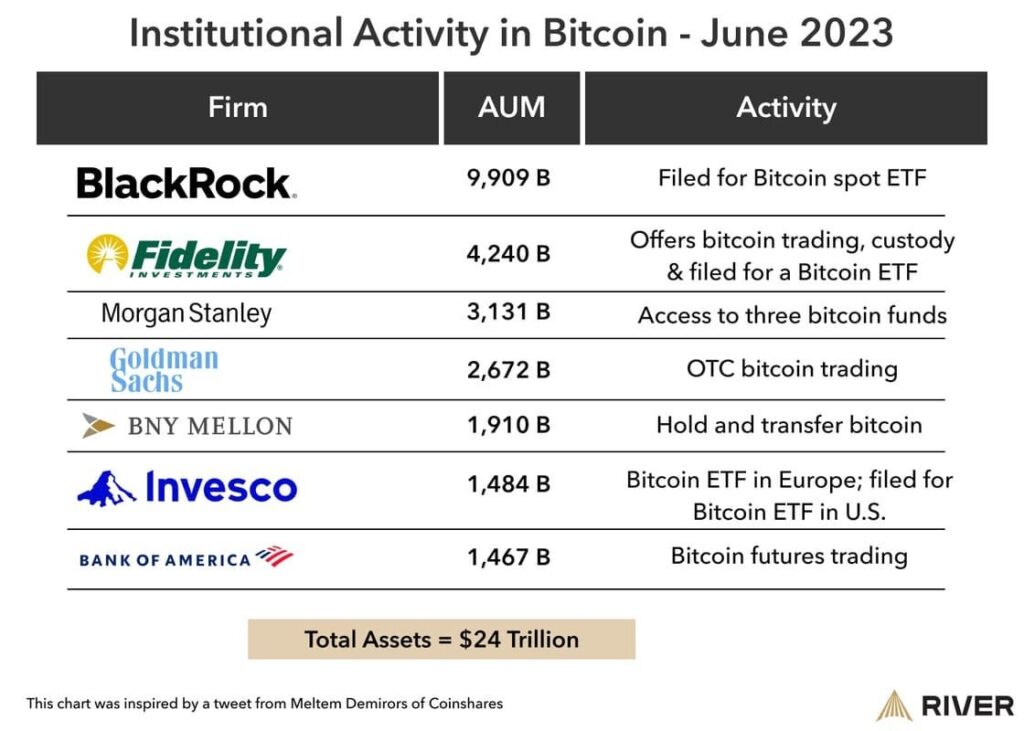

A few weeks ago, Larry Fink, CEO of the world’s largest asset manager, BlackRock, appeared on Fox Business. He shared his current thinking on bitcoin, given BlackRock’s recent filing for the “iShares Bitcoin Trust.”

During a segment that went viral, Fink makes the following comments (emphasis added): “I do believe the role of crypto is digitizing gold. Instead of investing in gold as a hedge against inflation, a hedge against the onerous problems of any one country, or the devaluation of your currency in whatever country you are in [you can invest in bitcoin]. Let’s be clear, bitcoin is an international asset.”

While I am no fan of Mr. Fink for many reasons, that doesn’t matter; bitcoin is for everyone. His recent comments on the asset are a seismic shift in his view [Wall Street’s view] of bitcoin.

Similar to the initial skepticism of the gold deposits found in California 200 years ago, Wall Street and Mr. Fink have long been skeptics and even denouncers of bitcoin.

It was only in 2017 that Fink said, “Bitcoin just shows you how much demand for money laundering there is in the world.”

After years of naysaying and attempts to discredit bitcoin with no success, it’s becoming clear to the old world of Wall Street that bitcoin adoption is happening with or without them.

Admittedly, I wish we could leave Fink behind in the coming digital gold rush; however, it’s clear that he and many others are realizing the potential of bitcoin as a savings technology and investable asset in a broader portfolio.

At a minimum, the Finks of the world see bitcoin as an opportunity to make fees on the increasing client demand for the asset.

In June 2023, Wall Street firms collectively representing $24 trillion+ of AUM have filed for bitcoin and crypto ETF products. This has also come with a change of tune regarding bitcoin’s merit as an asset.

Wall Street, led by BlackRock, has signaled that bitcoin is a legitimate asset. Not that bitcoin needed their approval, but it certainly accelerates the next wave of adoption.

These are all signs that the digital gold rush is here – the only question is will you stake your claim early or wait until everyone else does first.

A Comparison: The CA Gold Rush & The International Digital Gold Rush

To tie this all together, let’s consider the similarities and differences between the California Gold Rush and the Digital Gold Rush.

Asset history

At the time of the California Gold Rush, gold had a proven track record as a reliable store of value, spanning thousands due to its scarcity.

The digital gold rush is coming. It’s only fourteen years since bitcoin’s inception. To some, that may seem like a short track record, but the reality is the digital world progresses much faster than the analog world. Bitcoin has undergone several cycles of extreme appreciation and subsequent crashes. Yet, it continues to make higher highs and higher lows, highlighting its ability to store value on 4+ year timeframes.

Supply elasticity

Gold’s supply grows at 1.5-2% annually. The Gold Rush led to an uptick in supply growth as deposits were found and gold was brought to market. The supply growth of gold ebbs and flows with demand and discoveries of deposits.

Demand for bitcoin is growing exponentially – bitcoin adoption is happening at a rate faster than internet adoption. Despite the current demand and how much it may accelerate from Wall Street’s entry into the digital gold rush, bitcoin’s supply will continue on its predetermined issuance scheduling – halving every 4 years. In this sense, bitcoin’s supply is perfectly inelastic, not reacting to shrinking or growing demand at any given time.

Scarcity

Gold exhibits relative scarcity when compared to other assets. Its supply growth of ~ 2% is much less than other assets/goods and currencies. That has made it a reliable store of value for thousands of years.

Bitcoin exhibits absolute scarcity and increasing scarcity. With the next halving coming in 2024, bitcoin’s issuance rate will be reduced, making it 2x more scarce than the present time. Unlike gold, there will be no future discoveries of more “bitcoin deposits.” All bitcoin that will ever exist is known, and we are on a predetermined path to 21 million.

Ease of participation in the gold rush

Participating in the Gold Rush was no walk in the park. People traveled hundreds or even thousands of miles, uprooting their lives in hopes of partaking in the massive opportunity in California. A challenging endeavor, especially as the initial deposits were depleted, and it became harder to find gold. The labor was intense and arduous, and many people suffered injuries or even died in search of gold.

Bitcoin is easily accessible to nearly everyone in the world. There’s no need to uproot one’s life and undertake a journey across the world to participate in the digital gold rush. The barriers to entry are substantially lower. Bitcoin can be purchased from exchanges and bitcoin ATMs globally and earned by delivering a good/service and being paid in bitcoin by anyone in the world. Ease of participation is set to increase with the coming Wall Street products.

Social Proof

There was a high degree of skepticism when the public was first made aware of gold deposits in California. It took President Polk’s State of the Union address, where he cited a verified report of the gold findings, for the American public to believe the news.

Similarly, while many individuals and even some institutions have been adopting bitcoin for fourteen years now, most people need the validation and acceptance of bitcoin by “trusted” institutions to consider participating in the opportunity.

In either case, an authoritative figure needs to make a public statement of endorsement for many people to cement their conviction.

Generational wealth opportunity

In the mid-1800s, most wealth was either earned through labor or entrepreneurship. While there were opportunities to create generational wealth through these avenues, as evidenced by the success of the Rockefellers and others, they were few and far between.

Similarly, it’s a challenging environment to create generational wealth today. People are battling the debasement of currencies by global central banks and governments, making it difficult to allocate capital and preserve wealth for the long term. For most, wages have been relatively stagnant for decades while prices of all goods and services have increased dramatically.

Both the Gold Rush and the Digital Gold Rush present an opportunity for generational wealth creation. While there have been many millionaires and even some billionaires minted by bitcoin already, it remains a mere $600 billion asset in a $900 trillion global asset landscape. It’s still early.

Get the picks and shovels. The Digital Gold rush is here.