7/20/23 Roundup

Onramp Weekly Roundup

Written By Dylan LeClair

Hi all,

This is Dylan LeClair, presenting this week’s Onramp Weekly Roundup.

Before we get started… If you’re a HNWI or Institution looking for the best way to get exposure to bitcoin, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

And now, here’s the weekly roundup…

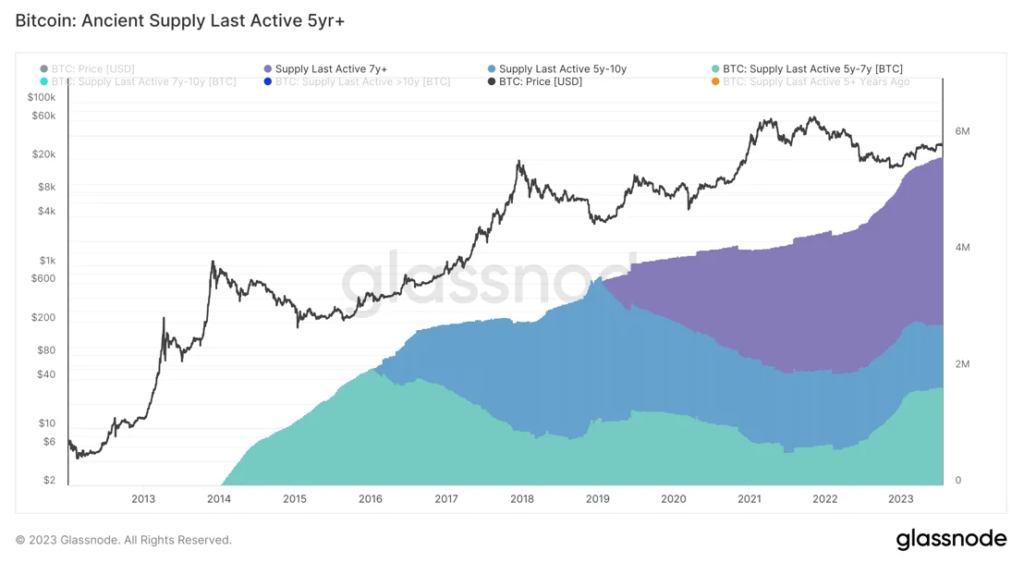

The Long Hodl Continues

Bitcoin held for 5 years+ continues to make daily highs, with 29% of circulating supply now having been dormant for at least as long. A simple yet powerful visual representation of bitcoin being acquired on the open market and held for the long term by its most convicted proponents.

As mentioned in the last Onramp Weekly Roundup, inflation is cooling, particularly wages, bringing the annual rate lower than the Fed Funds Rate, something that hasn’t been felt by the U.S. economy since pre-GFC.

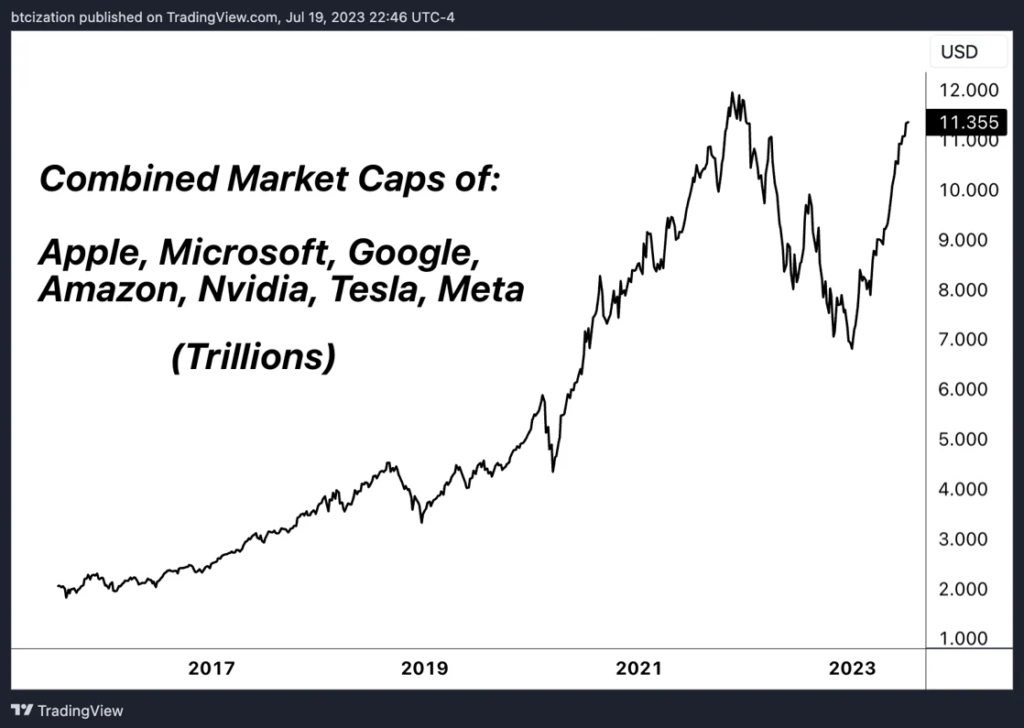

Mega-Cap Tech Stocks Back With A Vengeance

Impressively, U.S. mega-cap stocks have shrugged off a terrible 2022 year to come roaring back, with the aggregate market cap of the S&P 500’s largest seven tech names approaching it’s all time high market capitalization figure of $12 trillion.

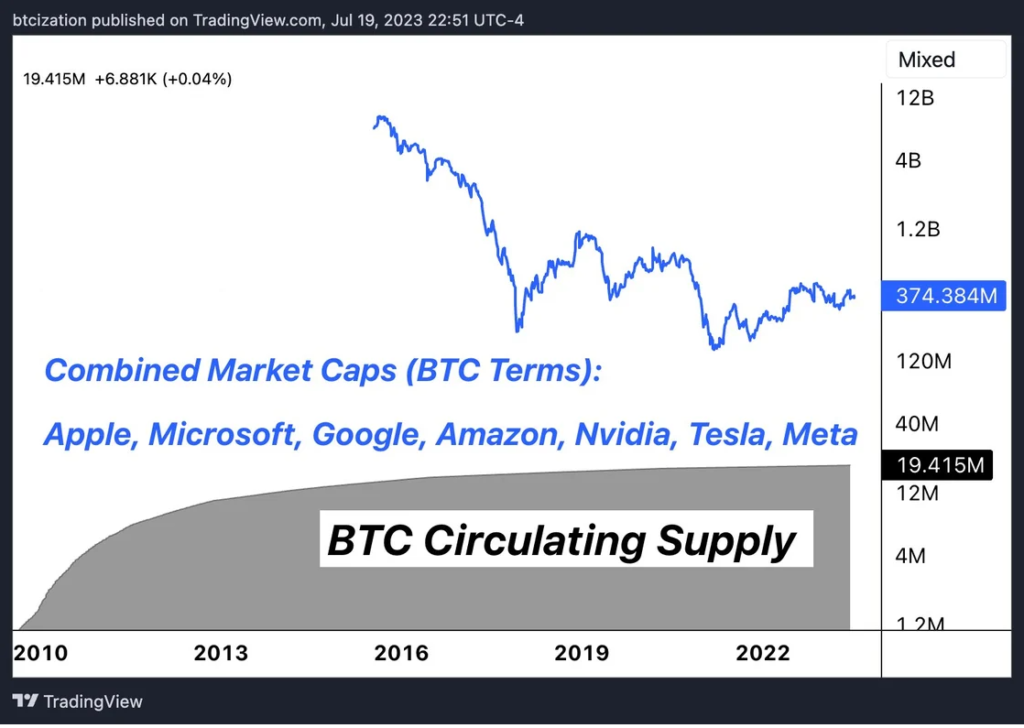

A fun thought and visual experiment is plotting the same phenomena in a different denominator:

374,384,000 BTC. Draw your own conclusions.

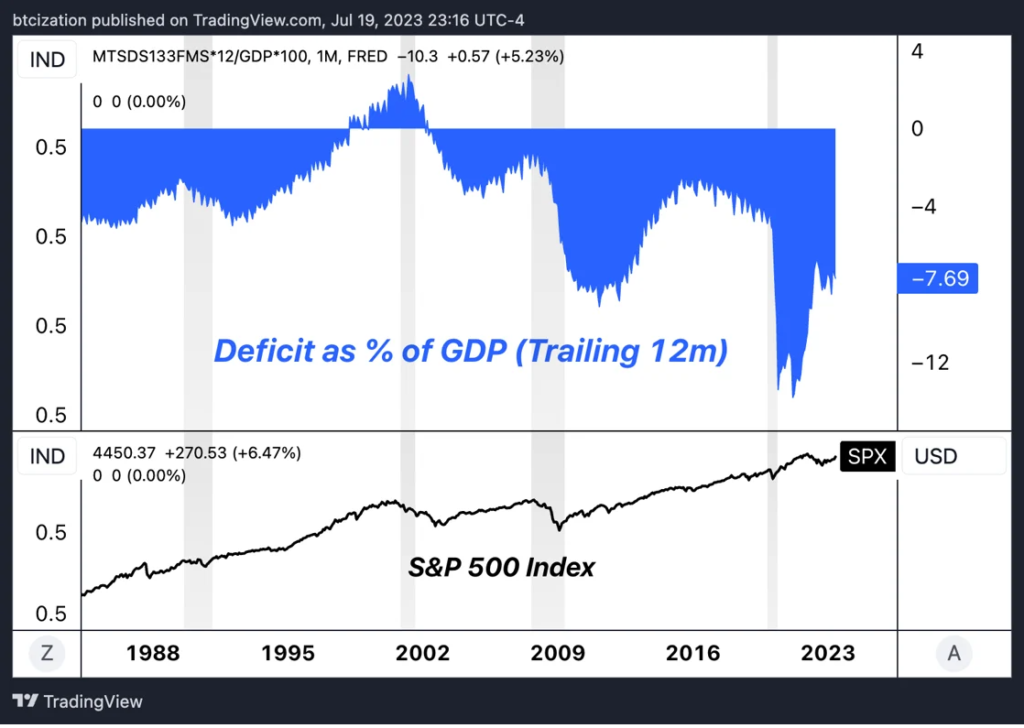

Not Your Typical Economic Cycle

One thing that should be mentioned to counter the points made about the recent disinflationary trend is deficit spending. Deficit spending by the U.S. Treasury is higher as a percentage of GDP than the previous three recessions before it (excluding COVID), before a recession has even taken place.

Congress spends is spending money like they have an unlimited credit card, because in theory they do, and they know it. Deficits as a percentage of GDP look to be increasing with each subsequent debt cycle, and if/when a recession does reach U.S. shores, expect fiscal outlays and subsequently deficit spending to ramp up in a serious manner, supporting asset markets and stoking inflation alike.

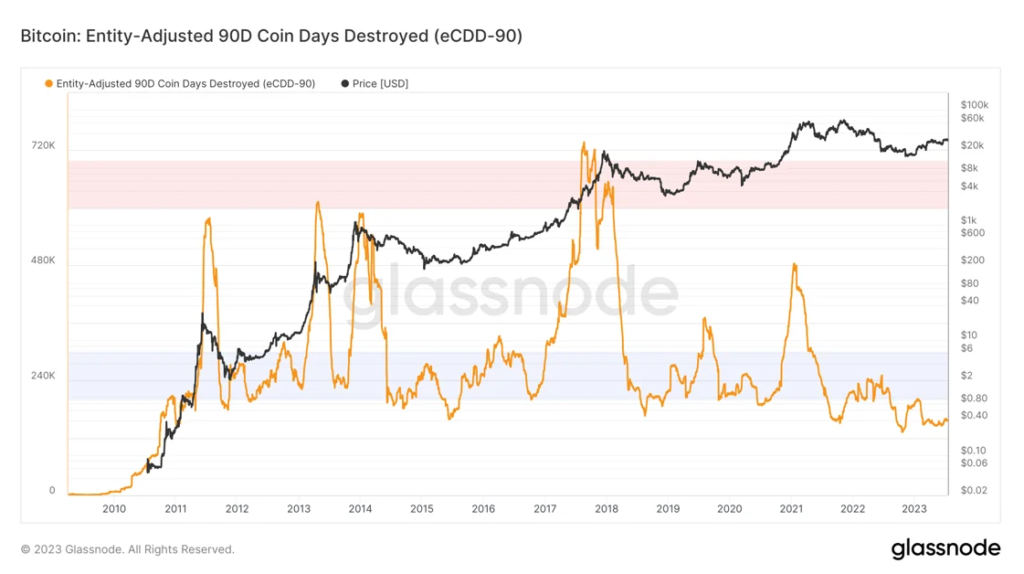

90-Day Coin Days Destroyed Near Historic Lows

Another interesting metric we can derive from the bitcoin blockchain is a concept of “coin days”, where 1 BTC will generate one “coin day” after not being spent for a full day. This follows true for any number of coins held for any number of days, with the product of the two generating the total amount of coin days aggregated. In our case, we find it useful to look at how many coin days have been destroyed over the recent period, which a 90-day rolling sum shows is near historic lows.

Once again, the HODL effect in action.

Podcast of the Week:

E008: Is Larry Fink A Friend Or Foe Of Bitcoin?, The Last Trade

Our own Marty Bent, Jesse Myers and Michael Tanguma sit down the discuss BlackRock CEO Larry Fink’s evolving stance on Bitcoin, the potential implications of increased institutional involvement, risks and opportunities presented by spot bitcoin ETFs, and some of the latest developments in the Lightning Network ecosystem and it’s convergence with AI.

Check out the full episode here.

Closing Note

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair