7/6/23 Roundup

Onramp Weekly Roundup

Written By Dylan LeClair

Hi all,

This is Dylan LeClair, presenting this week’s Onramp Weekly Roundup.

Before we get started… If you’re a HNWI or Institution looking for the best way to get exposure to bitcoin, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

And now, here’s the weekly roundup…

History Doesn’t Repeat, But it Often Rhymes

The start of today’s issue will show the historical symmetries in the bitcoin market cycle. Currently, the price of bitcoin is +312% since the 2020 halving. While clearly diminishing returns are a factor the larger the bitcoin market cap grows, the pattern of its return profile should be noted.

Similarly, looking at the price performance since the last all time high, we notice a distinct trend. Boom, bust, recovery, repeat. Currently still in the stealth recovery phase, the stars appear to be aligning as 2024 approaches for the bitcoin market to shine.

Lastly, the analogs to previous bitcoin market cycles also can be drawn from the point of the cycle low. Assuming the roughly $15,500 price was the low in the market, the next 18-24 months signal significant upside.

While past performance is no guarantee of future results, as well as bitcoin being more interconnected to legacy financial market dynamics than previous cycle epochs, bitcoin’s native cycle and supply dynamics (as shown briefly in last week’s Onramp Roundup) align in signaling a repeat of previous bull market cycles in the coming years.

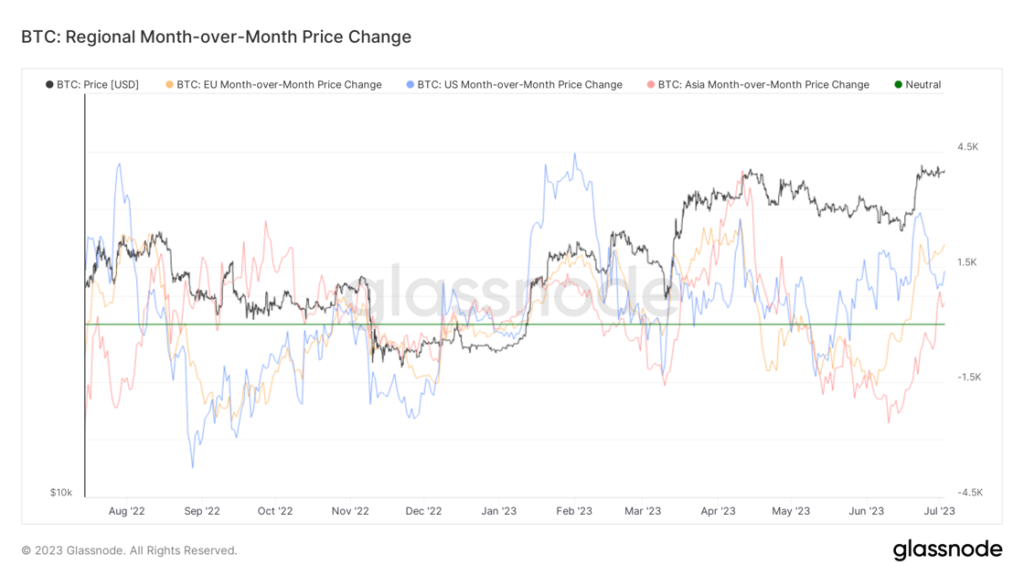

U.S. Market Hours Driving Market Amidst ETF Applications

With ETF applications flying from giants in the traditional finance industry, bitcoin’s performance on the rise past $30,000 was driven primarily during U.S. market hours. While obviously being a 24/7/365 global market that trades across jurisdictions, the outperformance in June during U.S. market hours while performance waned during European and Asian hours speaks to the bullish catalysts delivered in June and the general sentiment amongst U.S. market participants in the bitcoin market.

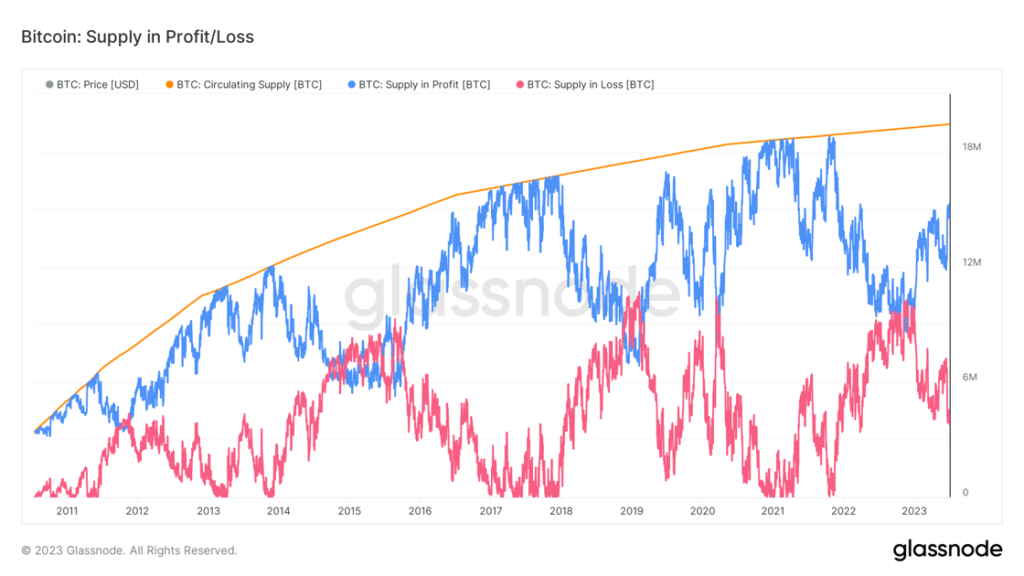

80% of Bitcoin Supply In Profit

Using bitcoin’s immutable ledger, you can see the exact moment each unit of supply last moved across the blockchain, and with the recent thrust to $31,000, 80% of the bitcoin supply is in profit. More specifically, 15,301,915 BTC out of the 19,419,193 BTC in circulation at the time of writing were last moved below the current price level.

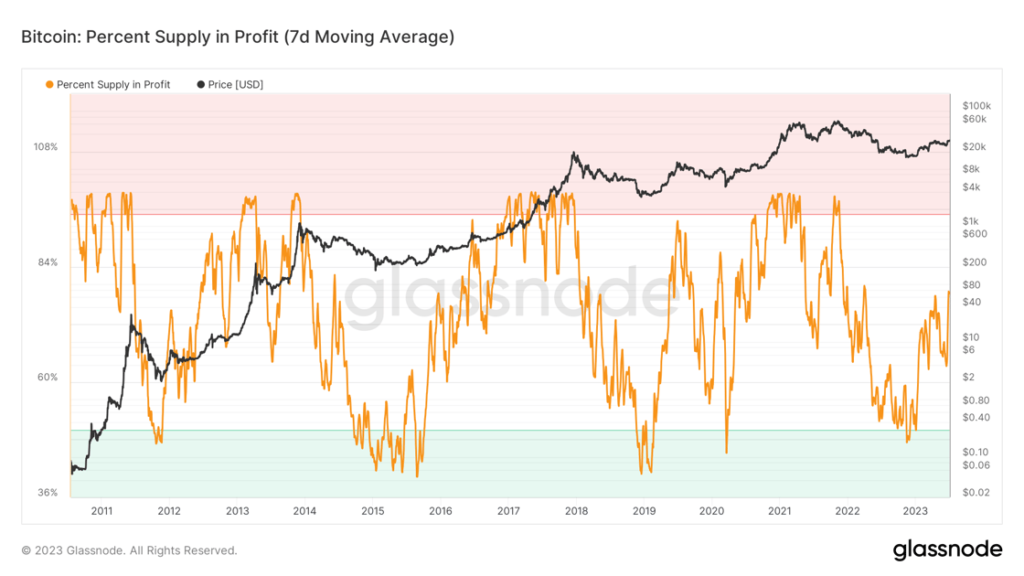

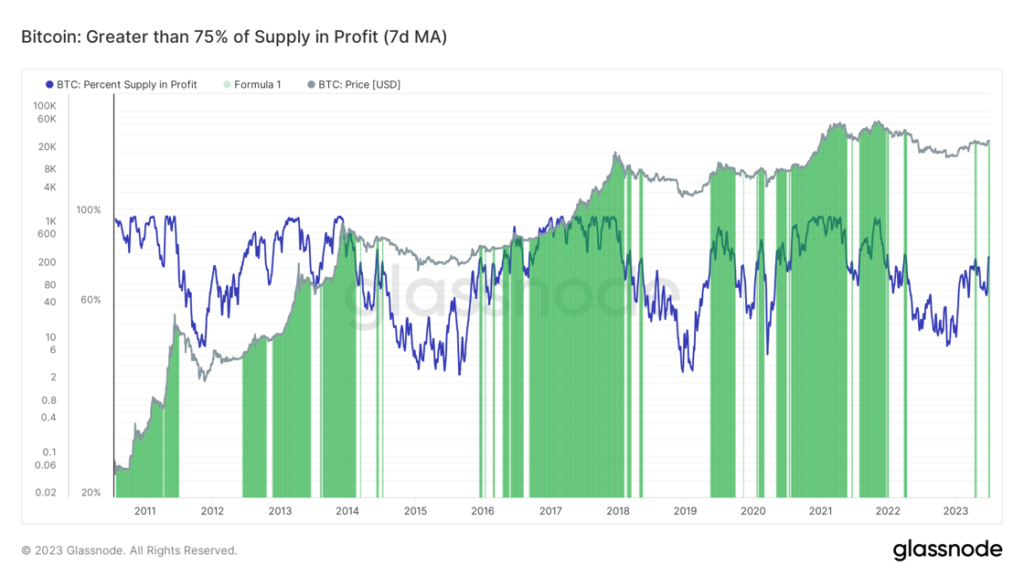

If we apply a weekly moving average to supply in profit data to eliminate some of the noise of daily fluctuations, the boom/bust profitability pattern of the cycle is clearly visible. For the sake of demonstration, periods where greater than 75% of supply is in profit (with a weekly moving average applied) are highlighted in green.

Now that’s an early bull market signal if you’ve ever seen one.

Podcast of the Week

Drivers of Institutional Adoption and Understanding Custodial Risk, with David Thayer, The Last Trade

On this week’s episode of The Last Trade, Executive Advisor to Blackstone and Bitcoiner, David Thayer, sat down with hosts Marty Bent, Jesse Myers, and Michael Tanguma.

This conversation provided a window into the perspectives and priorities of institutional allocators and how they are currently thinking about bitcoin, what their reservations are, and what will drive them to adopt in increasing numbers.

Check out the full episode here.

Closing Note

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair