6/22/23 Roundup

Written By Dylan LeClair

Hi all,

This is Dylan LeClair, presenting this week’s digest with critical highlights from the Bitcoin landscape and noteworthy macroeconomic updates.

Here’s the weekly roundup…

BlackRock Pursues Spot-Bitcoin ETF Through Latest Filing

World-leading $10 trillion asset manager BlackRock Inc., filed an application last week in an attempt to launch the first spot-Bitcoin exchange-traded fund (ETF) in the United States.

Coinbase would serve as the custodian for this ETF, which would trade on Nasdaq if approved.

Despite approximately 30 previous attempts for a spot-Bitcoin product, regulators have frequently blocked such endeavors, citing concerns about the market and insufficient investor protections.

BlackRock’s record of getting ETFs approved by the SEC is 575-1, with the only failure being a non-transparent ETF that proposed to keep it’s holdings opaque for long periods of time.

Given the prominence and historic record held by BlackRock in the legacy financial market with regards to SEC filings, many market participants speculate that an approval by the SEC is eventually likely.

Exchange Backed by Citadel Securities, Fidelity Going Live

Legacy financial powerhouses Citadel Securities, Fidelity Investments, and Charles Schwab have announced the launch of EDX Markets, a new entrant to the cryptocurrency exchange arena.

The announcement of EDX comes at a time when the incumbent crypto industry giants have been facing relentless pressure in the form of lawsuits filed by the SEC for non-compliance.

EDX will operate more akin to how the traditional stock market operates, where investors don’t directly access exchanges but submit orders through brokerages. EDX won’t directly serve individual investors but expects retail brokerages, potentially banks, to channel investor’s buy and sell orders to its marketplace while the counterparties hold custody of coins.

The exchange is essentially a multi-platform OTC desk between major traditional financial firms, with the platform claiming to be “non-custodial”. While this may sound appealing, in reality, the funds will be held by multiple centralized custodians, hardly “non-custodial” in the traditional sense in the bitcoin world.

Podcasts of the Week

The Dollar is Losing it’s Reserve Status with Parker Lewis, The Last Trade

Onramp’s podcast, The Last Trade, was in Nashville last week. Noted Bitcoin author, Parker Lewis, sat down at Bitcoin Park with hosts Marty Bent, Jesse Myers, and Michael Tanguma.

The conversation ranged from walking through how the dollar is losing its reserve currency status based on first principles, to a contentious conversation about gold’s merits. Check out the full episode here.

No One Understands Bitcoin with Allen Farrington, What Bitcoin Did

The podcast deeply examines the intrinsic problems in traditional fiat financial systems like inflation and capital misallocation, and highlights how Bitcoin, with its unique features and limited supply, presents a viable solution, all while debunking common economic misconceptions surrounding the concept of “growth” as we know it in a Keynesian economic system.

Farrington discussed the misallocation of capital, inflation, and the negative impacts of these issues on the economy, touching on the myriad of financial instruments and inflation hedge strategies that have arisen as a result of these conditions.

Bitcoin’s superiority over gold and other assets was highlighted, with Farrington also touching on the misconceptions surrounding growth in economics and finance.

Check out the full episode here.

Wading Through The Headlines

While BlackRock’s recent filing for a spot-Bitcoin ETF, along with the announcement of Fidelity/Citadel/Charles Schwab’s EDX has generated a certain level of excitement among crypto investors, these models also pose some risks that should not be overlooked.

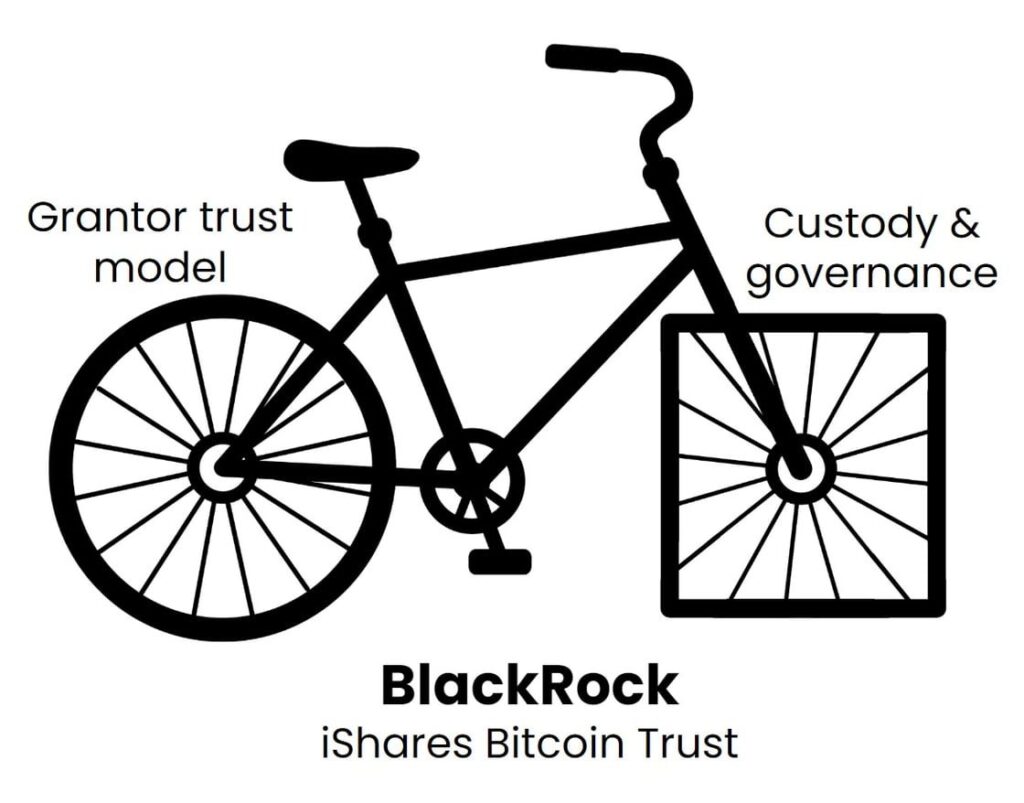

Regarding BlackRock’s filing, the proposed product uses the grantor trust model, allowing for in-kind redemptions of whole Bitcoin integers by authorized participants only, a provision that limits accessibility and maintains an inherent bias towards institutional investors.

When evaluating EDX, while the headlines advertise a “non-custodial model”, there is centralized custodianship occurring behind the scenes, with the potential for rehypothecation, a norm in the traditional financial landscape, which could jeopardize the actual ownership rights of its clients and generate a vast quantity of paper bitcoin, something the Bitcoin/crypto industry is all too familiar with.

Further, BlackRock’s proposed product allows them to define Bitcoin in the event of a fork, a discretion that could potentially politicize the asset. Such an arrangement might inadvertently trap investors within BlackRock’s subjective interpretation of what constitutes the “real” Bitcoin.

For more on BlackRock’s product (and how it compares to Onramp Bitcoin Trust), check out Onramp’s in-depth analysis, “BlackRock creates Bitcoin vehicle: half good, half terrible,” by Jesse Myers.

Closing Note

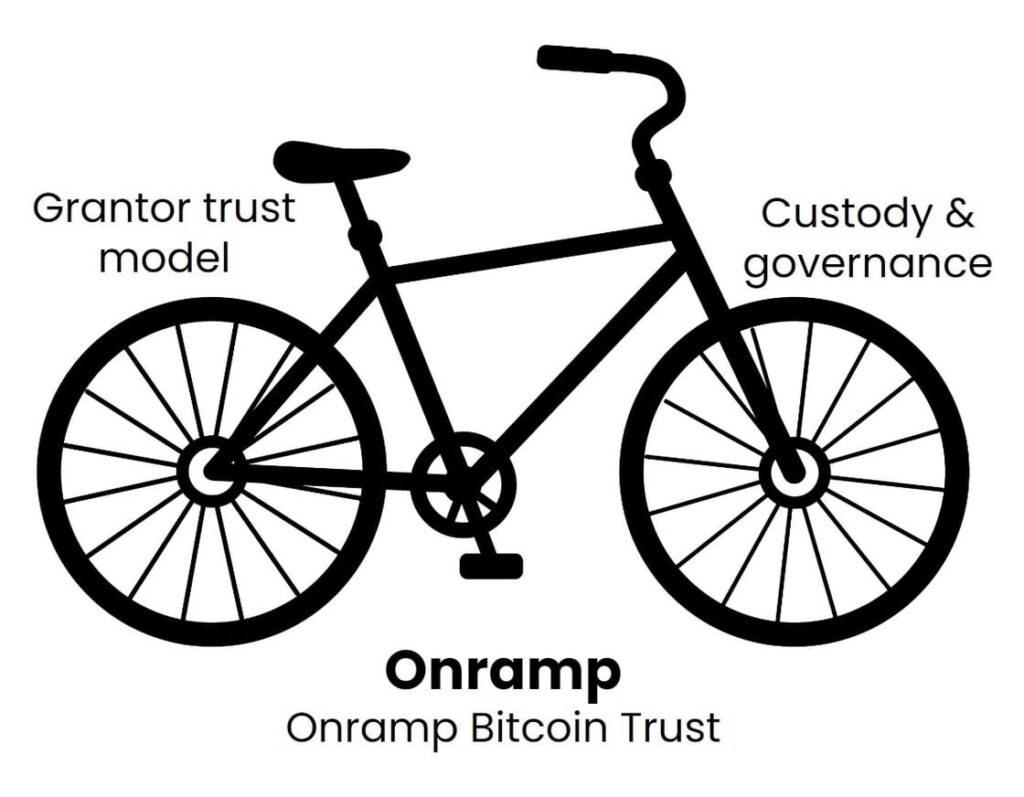

In stark contrast, our Onramp Bitcoin Trust empowers clients by providing unrestricted in-kind redemptions without triggering any taxable events. Our Trust prioritizes clients’ interests and their right to access and control their Bitcoin holdings.

We also champion the integrity of Bitcoin ownership through our multi-party custody model. This approach harnesses Bitcoin’s inherent properties, delivering protocol-native security assurances that protect our clients’ investments. It’s our mission at Onramp to offer a Bitcoin Trust that not only upholds the fundamental principles of the asset but also safeguards the rights and interests of our clients.

Onramp Bitcoin Trust allows Bitcoin withdrawals without inducing any taxable event, making it an optimal solution for High Net Worth Individuals (HNWI) and institutions seeking exposure to Bitcoin.

We welcome you to explore our offerings further on our website.

If Onramp’s approach sounds like it might be a solution for you or someone you know, please schedule a chat with us.

Onward and Upward,

Dylan LeClair