6/15/23 Roundup: Bitcoin Dominance at Multi-Year Highs

Hi all,

This is Dylan LeClair, presenting this week’s digest with critical highlights from the Bitcoin landscape and noteworthy macroeconomic updates.

Before we get started… If you’re a HNWI or Institution looking for the best way to get exposure to bitcoin before taking on self-custody, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

And now, here’s the weekly roundup…

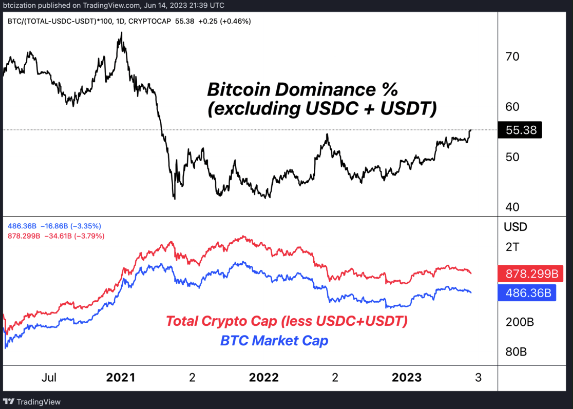

Bitcoin Dominance at Multi-Year Highs

Bitcoin dominance has surged to multi-year highs, surpassing 55% of the market cap of all cryptocurrencies (excluding major stablecoins USDT & USDC), following the SEC’s sweeping regulatory clampdown on major cryptocurrency exchanges.

While bitcoin dominance isn’t the best metric to cite given the vast amount of entirely illiquid altcoins, we believe the signal amidst the noise is bitcoin rising to the top amidst the regulatory worries.

We anticipate a revitalized interest in Bitcoin within the crypto sector as the distinction between unregistered securities and monetary commodities becomes increasingly clear, paving the way for legacy investors to focus on bitcoin focused approaches during the next major wave of TradFi adoption.

Bitcoin's Relative Performance in the Equity Markets

Bitcoin seems to have momentarily lost its momentum in the context of equity markets, as equity markets fly to year-to-date highs while bitcoin flirts with falling below $25,000 at the time of writing.

Despite current liquidity conditions and regulatory concerns, we expect Bitcoin to reestablish its positive correlation with equity markets, and once again return to offering superior risk-adjusted returns over the long haul after the dust settles.

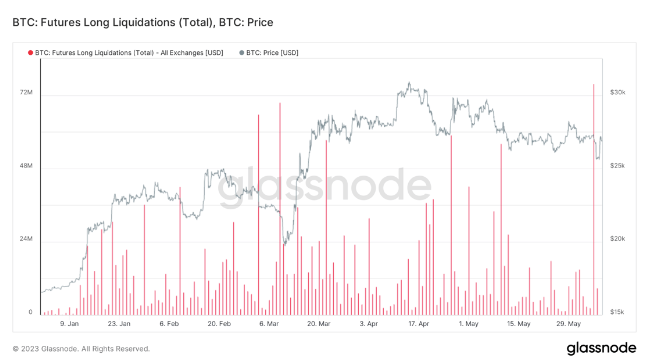

Bitcoin Bounces Back After Largest Futures Liquidation Event of 2023

Directly following the announcement of the lawsuit against Binance on Monday morning, there was a knee-jerk reaction from market participants, particularly in the offshore futures/derivatives, resulting in the largest liquidation of long positions in 2023 as short bets piled in.

In spite of the negative news flow, Bitcoin managed to fully retrace the move off the lows, with late short positions getting squeezed as follow-through selling in the spot market remained limited, a sign indicating a potential shortage of sellers in the market.

As highlighted in previous issues, the bitcoin supply remains extremely inelastic, particularly following a year in 2022 where vast amounts of indiscriminate spot selling occurred amidst industry contagion. With free float supply more constrained than ever before, zero-sum derivative trading is the dominant driver of exchange rate fluctuations, while long time preference oriented investors continue to take available supply off the market for the long haul.

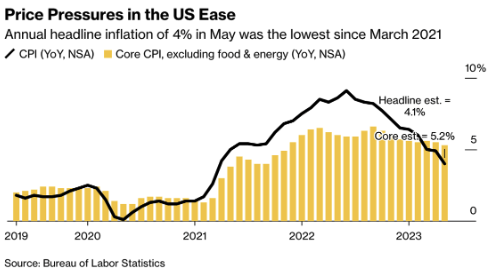

Cooling Inflation Dynamics

May’s annual Consumer Price Index (CPI) climbed by 4%, the slowest rise since March 2021, which provided the Federal Reserve an opportunity to pause interest-rate hikes in this week’s FOMC meeting.

Core services inflation, excluding housing, dropped to the slowest rate in 15 months, easing pressure on the Fed.

Core inflation, excluding volatile food and energy, remained high, rising 0.4% for a third month, but decreases in used car prices and slower rent increases are promising.

Federal Reserve's Rate Outlook

The Federal Open Market Committee (FOMC) maintained interest rates following ten increases, surprising markets by signaling two more quarter-point hikes this year. The majority of policymakers suggest further tightening to curb inflation.

The Fed’s statement hints at potential rate hikes resuming as early as July. Jerome Powell emphasized this meeting’s pause doesn’t signify a full stop, with each meeting being “live” for rate-hike discussions.

Powell noted the pause allows for deeper evaluation of incoming data and assessment of risks as they near the terminal rate.

The FOMC remains focused on managing persistent high inflation. Despite positive views on economic growth and labor market, the committee predicts unemployment to rise to 4.5% next year.

Podcast of the Week

On the most recent episode of The Last Trade, Tyler Campbell (VP of Concierge at Unchained) joined Marty Bent, Jesse Myers, and Michael Tanguma.

The conversation covered the latest SEC legal action against Coinbase and Binance, the incentives of Silicon Valley to exploit crypto investments, and differing perspectives about the merit of the Howey Test and the SEC’s mandate

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair