6/1/23 Roundup: Bitcoin Price and Performance

Hi all,

This is Dylan LeClair. Welcome to your weekly roundup of key Bitcoin insights and macroeconomic developments.

Before we get started… If you’re looking for the best way to get exposure to bitcoin before you’re ready to take on self-custody, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

And now, here’s the weekly roundup…

Bitcoin Price and Performance

Current Bitcoin Price: $26,930

1-Month Returns:

DXY: +2.92%

S&P 500: -0.05%

Gold: -0.76%

Treasury Bonds: -2.68%

BTC/USD: -7.91%

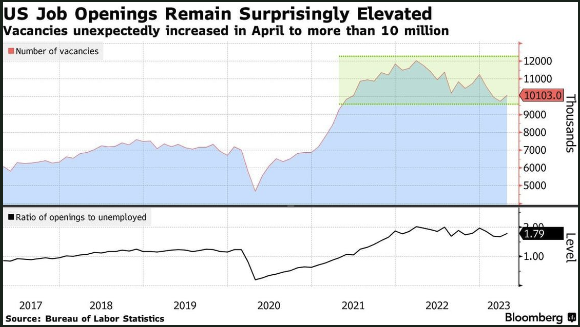

Job Openings Data Surprise to Upside, Upping Odds for Fed Hike

The US job market saw a surprising rise in openings in April, which could influence the Federal Reserve’s decision on raising interest rates.

The total number of positions available rose to 10.1 million, exceeding all previous estimates.

This development, combined with persistent inflation, may spur the Federal Reserve to implement another interest-rate hike soon. Despite challenges in the banking sector and the unfolding debt-ceiling situation, demand for labor remains high, signaling resilience in the job market, giving Powell further room to tighten the belt on the economy with additional rate hikes and/or a longer period of time at the terminal rate before cutting rates to ease monetary policy.

Consumer Confidence in the US Declines Ahead of Debt-Ceiling Deal

U.S. consumer confidence dropped to a six-month low due to uncertainties in the labor market and business conditions.

The Conference Board’s index fell in May as the share of consumers who believe jobs are “plentiful” hit a two-year low. The data showed that the expectation for more employment opportunities in the coming months dropped to the lowest level since 2016. Interestingly, this data was contrasted by the JOLT (Job Openings and Labor Turnover Survey) that was released on Wednesday.

While consumer confidence may have dipped in the most recent survey, the labor market is still historically tight, meaning that consumer sentiment and employment data will likely need to worsen further before Fed policy reverses in a meaningful way, with Jerome Powell and the Fed openly looking to raise the unemployment level domestically to combat inflationary pressures.

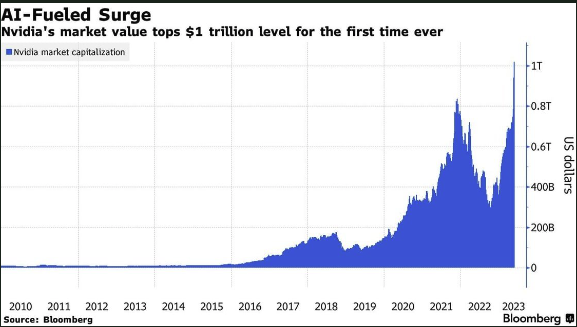

Nvidia Touches $1 Trillion Mark, Leading AI Driven Frenzy

Nvidia Corp.’s market valuation crossed the $1 trillion mark, propelled by its lead in the AI chip and software market.

Nvidia’s rise in market capitalization reflects its dominant position in the booming AI industry, establishing it as the world’s largest maker of specialized chips for AI products. This prominence emerged as businesses globally incorporate AI into their operations, spurred by successes such as ChatGPT.

This surge in Nvidia’s value underscores the increasingly dominant AI narrative amongst equity investors, while also highlighting the concentration risks building underneath the surface. Year-to-date performance in equity markets have been stellar so far to start 2023, but the breadth of said performance is historically pitiful, with indices being propped up by just a few mega-tech names, reinforced by the narrative of artificial intelligence creating a new secular bull market amidst rising multiples and deteriorating earnings estimates.

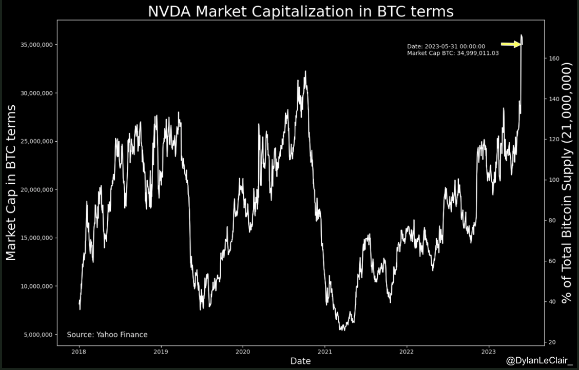

With Nvidia serving as the poster child for the AI narrative and subsequent rally in tech, we pose our readers and the investing community with a question:

In a world where artificial intelligence displaces hundreds of millions of jobs globally, where redundancy in the workplace is obsoleted by technology, what are the second and third order effects for society at large?

Does it result in more or less deficit spending and fiscal aid?

How does a Keynesian economic system combat the deflationary forces of AI?

What does a 2% inflation target and a full employment mandate look like in this world?

After contemplating all of these questions, is Nvidia worth 35,000,000 bitcoin? That’s what the market is pricing.

Mispricing = Information Asymmetry = Opportunity.

Podcasts of the Week

We’re biased, but we think that Onramp’s weekly “The Last Trade” podcast is one of the best Bitcoin podcasts out there.

If you haven’t seen the most recent episode, I happen to be the guest, joining Marty Bent, Jesse Myers, and Michael Tanguma to talk about Real Estate as a store-of-value asset and how it compares to Bitcoin. Check it out here.

In terms of other Bitcoin podcasts this week, this was my favorite…

Citadel Dispatch – CD102: Bitcoin is the Best Money with Adam Back and Jack Mallers

Matt Odell hosts Adam Back and Jack Mallers in a discussion that revolves around the significance of Bitcoin as a decentralized, scarce, global currency, with the underlying narrative of the show being the core role of money in society.

The conversation begins with an exploration of money’s original purpose, emphasizing the necessity of hard money like Bitcoin and gold, which are scarce and resistant to manipulation due to their unforgeable marginal cost of production.

The dialogue then deepens into the intricacies of Bitcoin, including its proof of work mechanism that ties it to the physical world, its volatility and potential future stability, and the benefits of a long-term holding strategy.

Lastly, they discuss the ongoing advancements in Bitcoin’s infrastructure, specifically the development of the Lightning Network, and the importance of simplicity and consensus in the Bitcoin network’s decentralized and permissionless nature.

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair