5/25/23 Roundup:Volatility Rises from 2023 Lows for Bitcoin, Equities

Hi all,

This is Dylan LeClair. Welcome to your weekly digest of key Bitcoin insights and macroeconomic developments.

Before we get started… If you’re looking for the best way to get exposure to bitcoin before you’re ready to take on self-custody, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

And now, here’s the round-up for the week…

Volatility Rises from 2023 Lows for Bitcoin, Equities

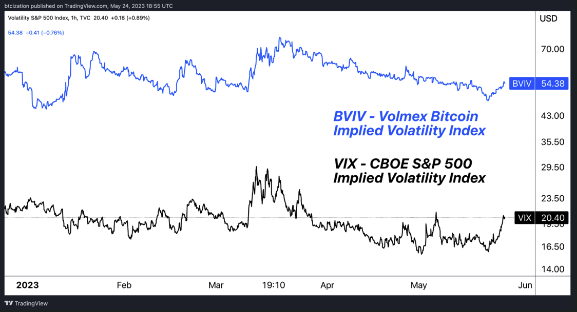

The 1-month implied volatility for Bitcoin and equities has seen a significant rise off its 2023 lows, indicating increased market uncertainty.

Implied Volatility Jumps for Risk: Implied volatility for these two asset classes is measured by the BVIV (Volmex Bitcoin Implied Volatility Index) and VIX (CBOE S&P 500 Implied Volatility Index). These indices serve as fear gauges for the market and are currently pointing to increased volatility.

Bitcoin & Equities: While Bitcoin has retreated from its local highs and is trading at $26,200, equities have fallen -0.90%, and BTC/USD stands at -3.40%. However, the tech-centered Nasdaq index has outpaced Bitcoin in terms of risk-adjusted returns for 2023.

Future Considerations: With downside pressure persisting on the bond market leading to equity market recent in recent days, look for the historically significant correlation between equities and bitcoin to potentially manifest once again, with the uptick in implied volatility across both assets a sign of a return of market turbulence after a calm recent couple of months

Bitcoin’s Beta: Bitcoin has traded with much more volatility than equity markets and other risk assets. This dynamic remains prevalent today, with the implied volatility for BTC/USD at 2.7x the implied volatility for equities at the time of writing.

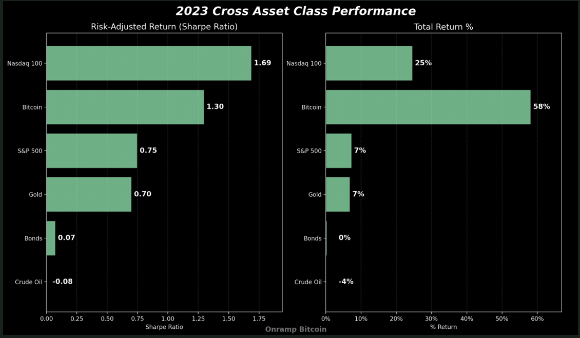

2023 Asset Class Performance

As Bitcoin has retreated from its local highs and is currently trading at $26,200, its year-to-date return has receded to a still impressive figure of +58% following a tumultuous 2022. However, the Nasdaq 100 index has recently outpaced BTC/USD in terms of risk-adjusted returns for 2023, posting a Sharpe ratio of 1.69 compared to Bitcoin’s 1.30.

If the recent uptick in volatility and selloff in the legacy system’s fixed-income markets persist, expect this dynamic to shift. The tech-centered Nasdaq index is heavily correlated to long-duration bond markets.

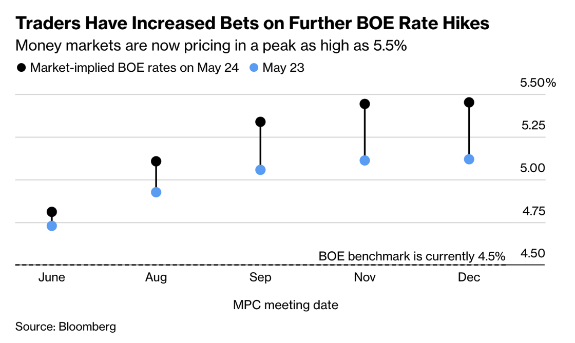

UK Inflation Remains Strong, Fueling Speculation for More Rate Hikes

The UK’s inflation rate persisted much stronger than anticipated, with the swiftest increase in services and core prices in over three decades inciting speculation on further Bank of England interest rate hikes.

Persistently High Inflation: The Consumer Prices Index in the U.K. logged an 8.7% rise in April, significantly surpassing the highest estimates from economists and the central bank’s 8.4% projection. Core prices, excluding food, energy and tobacco, accelerated to 6.8% last month from 6.2% in March, leading to increased bets on more Bank of England interest rate hikes, with core inflation surging to new highs, a poor sign for fixed income markets and confidence in the Bank of England’s policies.

Macroeconomic Impact: These inflation numbers mark a critical point for the Bank of England’s stance against inflation. The UK holds the highest inflation rate among the Group of Seven nations, putting pressure on the Bank of England to maintain its aggressive interest rate hiking cycle. This could have significant implications for domestic markets and currency valuation in the near term.

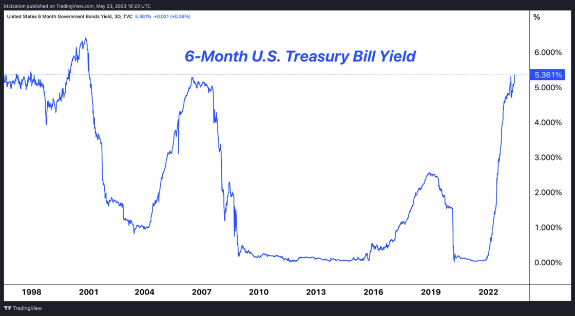

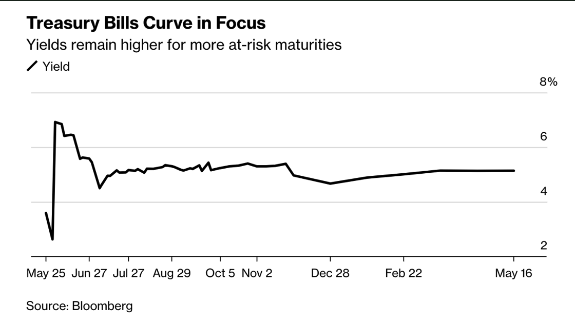

6-Month Treasury Yields at levels not seen in 22 years

The 6-month US Treasury yield has surged to 5.35%, surpassing its 2006 peak and reaching a level unseen since early 2001, potentially affecting lending standards, housing market activity, and bank deposits.

Impact on Lending Standards: The spike in Treasury yields signifies tighter lending standards. Obtaining new loans and refinancing existing ones has grown increasingly expensive and challenging, which could lead to a higher default rate among companies as the U.S. trends towards an economic downturn in the second half of 2023.

Pressure on Bank Deposits: There’s sustained pressure on bank deposits due to the short-end rates on Treasuries. In the banking sector, the story of 2023 has been about deposits fleeing low rates in favor of higher yields offered in Treasuries and money market mutual funds. With another rate hike domestically still possible, expect the market to sniff out more weakness in the banking system before too long, with the inverted yield curve placing immense pressure on the weakest names in the sector.

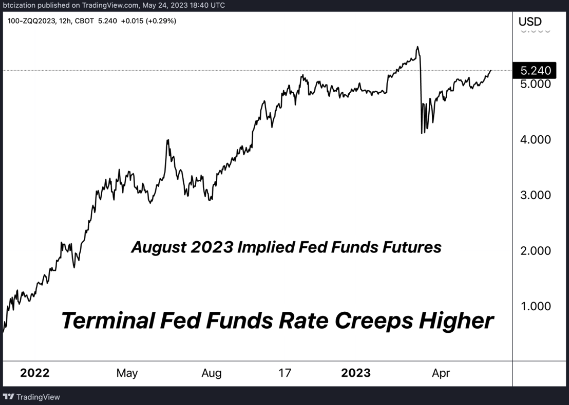

Bond Traders Wager on US Interest-Rate Hike Amid Debt Ceiling Threats

Bond traders are raising bets on an interest-rate increase by the Federal Reserve by July, spurred in part by surging UK policy-rate expectations and despite concerns over unresolved US debt ceiling issues.

Increased Rate Hike Wagers in U.S. Market: Bond traders are pricing in as much as 12 basis points of tightening in June and 17 basis points of tightening in July. The increasing bets are driven partially by the recent surge in UK policy-rate expectations.

Debt Ceiling Concerns: Despite the optimistic bets, the US debt ceiling remains a significant risk factor to the outlook. If lawmakers fail to raise the debt ceiling in time, a financial crisis could occur, affecting not only US markets but global financial stability as well. The Treasury General Account has reached dangerously low levels, and both scenarios of a resolution or a technical default will likely result in a net negative for market liquidity, with Yellen’s Treasury having to raise hundreds of billions of capital through new issuance in the debt markets.

Short end yields hit 7%: Yields on the short-end of the curve have been making waves in financial circles, due to the potential for default, with an all time record gap in annualized yields for Treasuries expiring in the next two weeks. However, the gap in annualized yields amounts to a mere 0.14% difference in principle returned to investors, far less than one might be led to believe when viewing the difference in yields.

Bitcoin 2023 Conference Highlight: Zoltan Pozsar's Panel Discussion

In a thought-provoking discussion at the Bitcoin 2023 conference, Zoltan Pozsar, former managing director of Credit Suisse, shared his insights into the shifting dynamics of global financial markets and the future role of Bitcoin.

Financial Markets and US Dollar Dominance: Pozsar shed light on the challenges faced by US banks, such as interest rate risks and the need for resilient loans. He critiqued the Federal Reserve’s responses to banking failures as being partial and temporary fixes. Pozsar underscored the factors undermining the dominance of institution-backed currencies like the US dollar.

Bitcoin’s Evolving Role: While Pozsar does not own Bitcoin, he acknowledged its growing significance in a world of weakening institution-backed currencies. However, he expressed skepticism about Bitcoin’s potential to function as a traditional currency, as he believes that money should be directly linked to a government.

Global Market Trends: Pozsar pointed out that global market trends, such as China’s rising economic power, are posing a threat to the US dollar’s position as the dominant reserve currency, impacting its share in commodity finance, trade finance, and reserve assets.

That’s it for this week’s Bitcoin news digest. If you’re interested to learn more about Onramp Bitcoin, check out our website here.

Onramp combines best-in-class multi-party custody & the option to withdraw your bitcoin without a taxable event. Together, this makes Onramp the best way for HNWI and institutions to get exposure to bitcoin before they’re ready for self-custody.

If you think Onramp could be the right fit for you or someone you know, schedule a chat with us here.

Onward and Upward,

Dylan LeClair