10/26/23 Roundup: Bonds Collapsing & BTC Surging

Hi all,

This is Dylan LeClair, presenting this week’s Onramp Weekly Roundup.

Before we get started… If you’re a HNWI or Institution looking for the best way to get exposure to bitcoin, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

And now, here’s the weekly roundup…

Just last week, the Onramp Weekly Roundup issue again spent time focusing on the performance of bonds. We pointed out that bitcoin’s decline from its all-time high was nearing the current drawdown experienced by long-duration government bonds—traditionally considered the ultimate “risk-free” asset.

Now, merely a week later, history has been made. As of this writing, bitcoin is trading closer to its previous all-time high than TLT (BlackRock’s dominant ETF for government bonds with maturities of 20+ years). While bitcoin has often experienced lesser drawdowns from its highs compared to bonds, these instances occurred just 10-20% off the highs. At those times, bitcoin was far more volatile than it is today, and bonds were largely inversely correlated with stocks during equity market downturns.

The script has flipped. Bonds are now down 51% from their all-time highs, a historic and catastrophic decline affecting everyone from pension funds following the 60/40 strategy to insurance companies and the banking industry. Meanwhile, the once “too-risky-to-touch” bitcoin is up 30% over the last month, even as the S&P 500 and the Nasdaq have declined by 4% and 3.3%, respectively.

Talk about a narrative violation. So, what’s behind this massive move?

The Catalysts Behind Bitcoin's Price Surge

The “seemingly random” explosion in bitcoin’s price isn’t random at all and can mainly be attributed to activities in the options market. The first thing to clarify, as is always the case with derivative dislocations in any market, is that cash/spot markets are the ultimate source of truth. This truth cannot be artificially suppressed indefinitely, whether up or down.

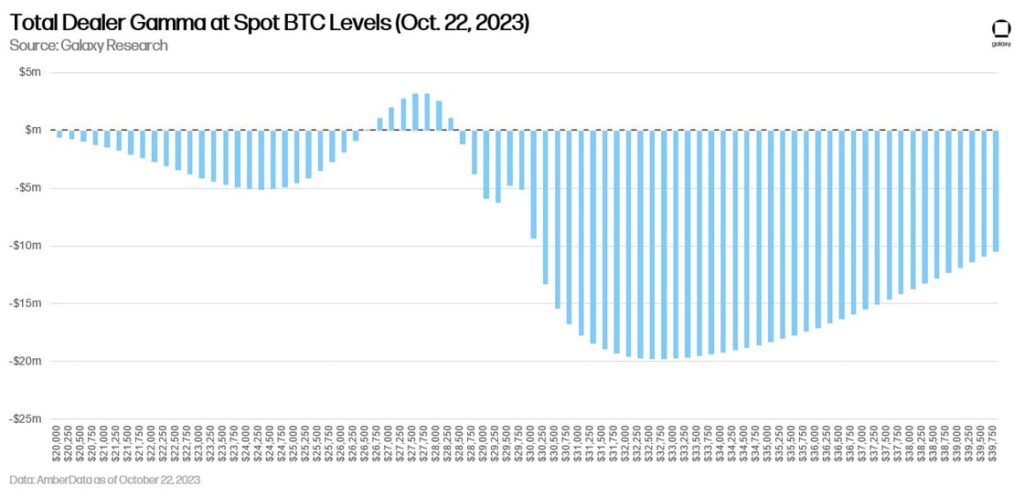

The rapid pump that added approximately $80 billion in market cap to bitcoin in the span of 24 hours was a classic gamma squeeze. In simple terms, ‘gamma’ indicates how quickly an option’s price changes relative to the asset it’s tied to—in this case, bitcoin. Being “short gamma” means traders must buy more bitcoin as its price rises to hedge their positions. This buying activity can snowball, leading to even higher prices for bitcoin. To provide further clarity, a growing market dynamic throughout much of 2023 involved selling bitcoin call options as a form of income generation. While long-term bitcoin investors and savers were accumulating and pulling supply off the market, certain entities were selling call options, effectively pinning the market and future expected volatility (IV) in the process. This was one of the larger drivers of record low realized and implied volatility for bitcoin throughout the year, a point we have noted on numerous occasions in this newsletter.

Gamma Squeeze

Coupled with increased chatter and speculation about possible approvals for spot ETFs, the price began creeping toward a pain point for entities that had sold upside options on bitcoin’s performance (short call options). This trend accelerated as volatility spiked, and the price continued to rise, culminating in an explosion to highs surpassing $35,000—even amidst downside pressure in equities and bond markets.

With this massive move came a realization for many underexposed investors globally:

Historically tight supply-side dynamics for an absolutely scarce asset, combined with the impending reality of a large amount of expected future inflows into the asset class, are likely to produce optimal future results. This holds whether one views it as a macro trade, speculation, or begins to entertain the increasingly plausible idea that the story could be much larger after all…

Podcast of the Week

E022: A New Custody Standard with Mitch Kochman from BitGo

In this week’s episode of The Last Trade, Mitch Kochman of BitGo explores the intersection of traditional finance and Bitcoin, highlighting the importance of secure custody solutions as institutional interest grows. Kochman shares insights from his work at BitGo, where he focuses on building trust with counterparties, especially those involved in onboarding new Bitcoin users. He details BitGo’s multisig and custody features as essential components of asset security, acknowledging lessons learned from the failures of exchanges like Mt. Gox and FTX. Kochman underscores the need for collaborative, multi-institutional custody solutions to prevent similar setbacks.

Check out the full episode here.

Closing Note

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair