12/7/23 Roundup: Assessing Price Momentum & On-Chain Significance

Onramp Weekly Roundup

Written By Dylan LeClair

Hi all,

This is Dylan LeClair, presenting this week’s Onramp Weekly Roundup.

Before we get started… If you’re a HNWI or Institution looking for the best way to get exposure to bitcoin, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

And now, for the weekly roundup…

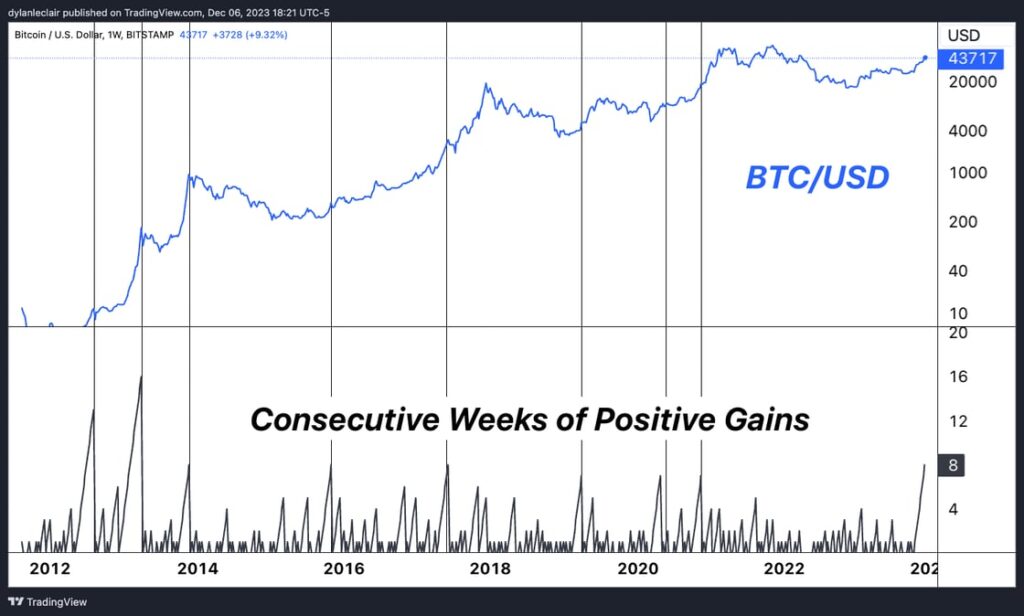

8 Consecutive Weeks of Gains

In an extraordinary display of resilience, bitcoin is on track for its eighth consecutive week of gains. An impressive run, when analyzing the previous five instances where bitcoin experienced consecutive weekly gains of similar or greater length, we observe that each was followed by considerable gains to come. On the contrary, the previous instance before that marked the peak of the 2013 cycle, underscoring the importance of cautious optimism when looking at historical performance. Nevertheless, the resilient climb higher is a sign of large demand for bitcoin as the asset is increasingly on the radar of institutional investors.

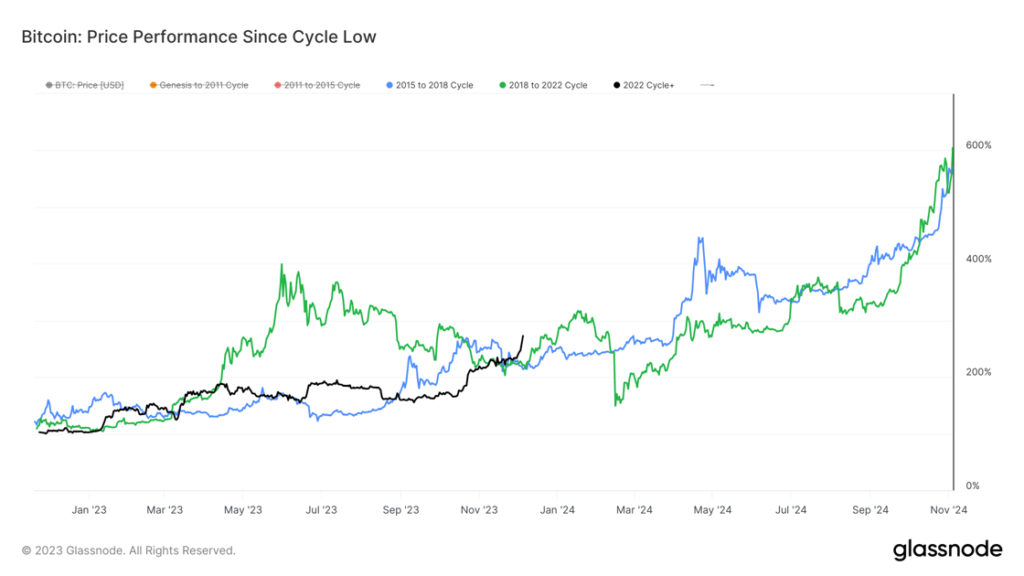

Performance Since Cycle Lows

Assuming that the $15,500 mark represented the cycle low for bitcoin, it has currently achieved an impressive +270% growth from that point. This growth trajectory closely mirrors the patterns observed before the 2017 and 2021 bull market surges in previous cycles. While it’s crucial to acknowledge that historical performance doesn’t guarantee future results, the cyclical nature of bitcoin’s capitalization and investor psychology offers insightful parallels. The resemblance of the current recovery to past transitions into robust bull markets is a promising indicator.

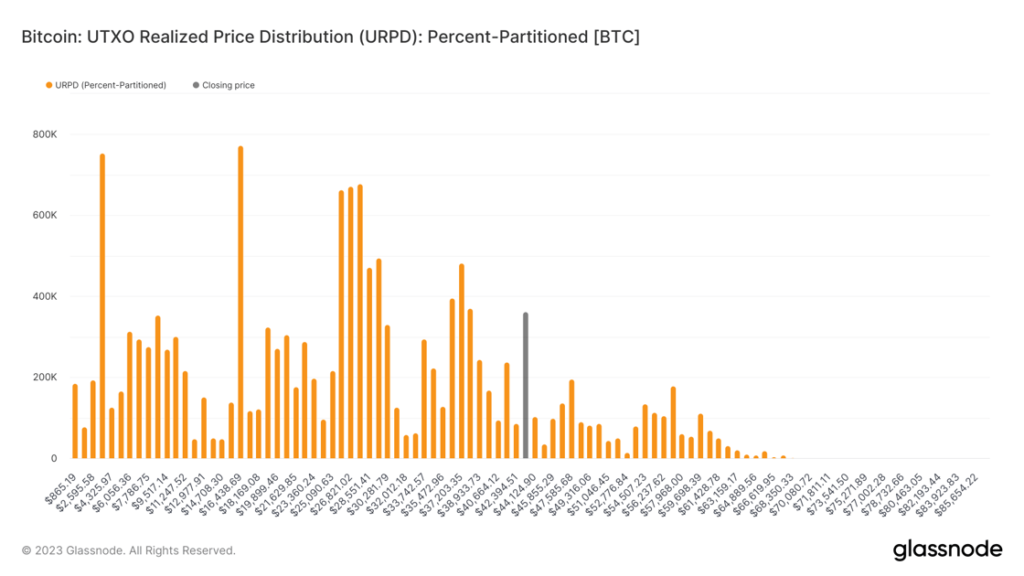

Bitcoin Approaching Area of On-Chain Significance

As bitcoin reaches the $44,000 mark, it revisits a pivotal level from the 2022 crypto turmoil, notably marked by the LUNA/UST debacle. This event, likened to a failed modern-day alchemy, saw a dramatic buying and selling of vast quantities of bitcoin, precipitating a crash from the $40,000 range. The accompanying chart illustrates the distribution of bitcoin supply based on the last on-chain movement prices, offering insight beyond the market to market exchange rate. The aftermath of the LUNA fiasco, combined with the dynamics observed in 2021, has imbued this price level with significant on-chain relevance, where a substantial amount of bitcoin changed hands. Consequently, this price point could serve as a natural juncture for market consolidation or a brief cooling-off period, considering the potential for a supply overhang at breakeven levels.

Podcast of the Week

E028: State-Led Legislative Innovation with Joel Revill

In the latest episode of The Last Trade, Joel Revill, CEO of Two Oceans Trust, discusses his involvement in shaping Wyoming’s progressive approach to digital asset regulation, a state at the forefront of creating a regulatory environment for bitcoin and digital assets. The conversation highlights the need for a balanced approach between state and federal regulations to foster innovation while protecting consumers. Joel also explores bitcoin’s potential as a global reserve asset and its unique opportunities and challenges for investors. The discussion emphasizes the importance of professionalization in the ascending bitcoin industry.

Don’t miss the full discussion — check out the entire episode here.

Closing Note

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair