1/25/24 Roundup: ETF Flows & Recapping Davos

Onramp Weekly Roundup

Written By Zack Morris

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

And now, for the weekly roundup…

- Jamie Dimon discredits bitcoin, again

- Javier Milei shifts the Overton Window

- Bitcoin ETF complex takes in $1B as “Newborn Nine” inflows outpace GBTC outflows

- Price falls below $40k as FTX bankruptcy estate liquidates $1B of GBTC

Doubter Descends on Davos

JP Morgan Chase CEO Jamie Dimon discredited bitcoin while validating blockchain technology and smart-contract platforms in an interview with CNBC on the sidelines of the World Economic Forum in Davos:

“Blockchain is real. It’s a technology. We use it. It’s going to move money, it’s going to move data. It’s efficient.

Cryptocurrencies, there are two types. There’s a cryptocurrency that might actually do something, think of a cryptocurrency with an embedded smart contract in it. You can use it to buy and sell real estate and move data — tokenizing things that you do something with.

And then there’s one that does nothing. I call it the pet rock.”

Now, far be it for me to pretend to know Mr. Dimon’s subject matter knowledge or motivations. But he does get at something of substance, even if we disagree on the details — when it comes to cryptocurrencies, there are indeed two broad types.

There is bitcoin, which is apolitical money.

And there is everything else, including the aforementioned smart-contract platforms.

So what’s the difference?

Mr. Dimon’s comments illustrate that the use cases of much of crypto ex-bitcoin is to evolve the existing fiat financial system. Using public blockchains such as ethereum to tokenize assets, such as dollars (stablecoins) or equities, can unlock capital by reducing settlement periods and enabling reduced friction transfers of value across borders and platforms, eroding the countless silos our global financial system operates in.

Ever think about why you can’t send money between, say, Venmo and Cash App? It’s because they are siloed fintech platforms that can’t “talk” to each other. But if your balances in each app were to be held on-chain in stablecoins, the apps would be interoperable and you would be able to send money between the two seamlessly. This idea can be applied to bank accounts in different countries as well.

Considered through this lens, it is no wonder Mr. Dimon says he gets blockchain, but dismisses bitcoin. Smart-contract platforms offer purveyors of fiat financial products a technology they can leverage to expand the reach, speed and efficiency of their existing businesses.

Bitcoin offers a new, parallel financial system with a novel, hard monetary asset underpinning it.

Javier Milei Shifts Overton Window

Elsewhere at the WEF, newly elected President of Argentina Javier Milei, known for his strong libertarian ideals and free market advocacy, directly confronted the audience in Davos by delivering a stark warning to Western leaders about the perils of collectivism (transcript).

Milei criticized modern collectivist social movements, including environmentalism, claiming they do more harm to the world’s population than good.

“We’re here to tell you that collectivist experiments are never the solution to the problems that afflict the citizens of the world. Rather, they are the root cause. Do believe me: no one is in a better place than us, Argentines, to testify to these two points.

Thirty five years after we adopted the model of freedom, back in 1860, we became a leading world power. And when we embraced collectivism over the course of the last 100 years, we saw how our citizens started to become systematically impoverished, and we dropped to spot number 140 globally.”

Milei argued for an updated, broader definition of socialism, and called out money printing, debt, and interest rate policy as means by which Western governments exert control over their populations and disguise their collectivist agendas under the guise of free market capitalism. He singled out property rights numerous times as a core tenet of libertarianism.

Bitcoin can be viewed as the antidote to much of what Milei claims is ailing society today. As a credibly neutral, rules-based monetary system, it is not subject to money printing or interest rate policy. As a digital bearer asset, it is property that is nobody else’s liability and has no counterparty risk. As commodity money, it fosters an equity-based economy which facilitates ownership, rather than a credit-based economy which encourages debt.

Regardless of whether or not you agree with Milei’s views, his election in Argentina and stage at the WEF shows that the Overton Window for criticizing our current economic system is shifting.

Milei’s speech is receiving orders of magnitude more views on YouTube than other leaders’, indicating his message is resonating (courtesy of Samson Mow):

Bitcoin ETF Complex Takes in $1B

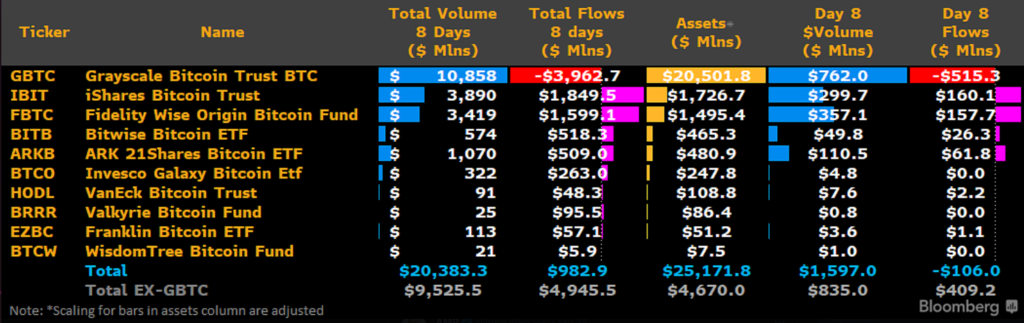

With a full eight trading days in the books through 1/23/24, the nascent spot bitcoin ETF complex has taken in a net of nearly $1B as $4.9B of flows into the “Newborn Nine” have outpaced $4B of flows out of GBTC.

source: Bloomberg, courtesy of James Seyffart

BlackRock’s IBIT and Fidelity’s FBTC have emerged as the early leaders of the newly launched products, both garnering over $1bn in assets thus far.

Bitwise’s BITB sits in third, differentiated both by pledging 10% of BITB profits to bitcoin core developers and by having the lowest fees on the market at 20 bps.

VanEck is also pledging 5% of HODL profits to bitcoin core devs.

Price Falls Below $40k as FTX Bankruptcy Estate Liquidates $1B GBTC

On Monday, CoinDesk reported that the FTX bankruptcy estate had liquidated 22 million shares of GBTC at a total value of close to $1B, taking their ownership down to near zero.

While it is difficult to know what portion of the $3.4B in GBTC outflows since conversion to an ETF have been recycled into lower fee competitors, we know this amount from FTX was not and represents true sell pressure on the market.

The liquidation could be the culprit for the bitcoin price falling below $40k.

Podcasts of the Week

The Last Trade E034: Building Better On-Ramps in MENA with Talal Tabbaa

In this episode of The Last Trade, we spoke with Talal Tabbaa, CEO of CoinMena, a leading cryptocurrency exchange in the Middle East. We discussed the growing interest in Bitcoin and cryptocurrency in the Middle East and North Africa (MENA) region, the importance of regulatory frameworks, and CoinMena’s mission to provide reliable on-ramps and off-ramps for fiat and cryptocurrency transactions. We also touched on the impact of bitcoin on different economies within the region and the potential for bitcoin to be considered Sharia-compliant money.

Scarce Assets E002: The Undeniable Logic of Bitcoin with Jeff Booth

The second episode of Scarce Assets, a podcast dedicated to exploring the concept of scarcity as a fundamental driver of economics and markets, features guest Jeff Booth, a professional investor, entrepreneur, and author of the book “The Price of Tomorrow.” Jeff shares his insights on deflation, the current economic system, investing in bitcoin companies, and the unique position of bitcoin as a solution to systemic issues.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris