5/9/24 Roundup: Corporate Bitcoin Adoption

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

Last week, we published a report on the topic of bitcoin inheritance planning authored in collaboration with Amanda Kita, Attorney at Stradley Ronon. Bitcoin inheritance planning requires addressing both key management and legal title transfer to beneficiaries, necessitating comprehensive estate planning. This report provides a detailed overview of the intricacies associated with bitcoin inheritance planning, and the role of multi-institution custody in preserving bitcoin ownership across generations.

If you’re interest in learning more, we will be hosting a webinar on May 22 led by Amanda Kita & Cam Stromme (Head of Private Wealth at Onramp) to discuss these topics in detail; register here.

And now, for the weekly roundup…

- Public companies make headlines investing in & building on bitcoin

Corporates Making Bitcoin Moves

In the last week, Marathon Digital, MicroStrategy, Coinbase, and Block (formerly Square), all made headlines in the public company bitcoin space.

S&P Dow Jones Indices announced that Marathon Digital would be added to the S&P 600 small cap index on May 8th. Shares of MARA jumped 18% on the news.

MicroStrategy announced plans to roll-out a Bitcoin-based decentralized identity service called MicroStrategy Orange. The service will leverage Ordinals-like inscriptions to put verification data on the bitcoin blockchain.

Potential use cases for Bitcoin-based decentralized IDs include verifying users on social media platforms, which would be useful in eliminating spam bots, or authenticating emails and text messages. Think of it as the digital-age version of signing a scroll with your seal in wax.

The first implementation of MicroStrategy Orange will be “Orange for Outlook” in partnership with Microsoft, which will allow email recipients to verify the identity of the sender.

Coinbase announced the adoption of Accounting Standards Update 2023-08, which allows for fair market value accounting of crypto assets held on the balance sheet for investment. As a result, Coinbase recognized a $737 million pre-tax mark-to-market gain on its balance sheet crypto assets in Q1.

As of March 31, Coinbase now holds $1.5 billion in crypto assets on their balance sheet at a cost basis of $675 million. Bitcoin is their largest allocation with 9,183 BTC valued at $655 million, or 43% of their crypto asset portfolio. Coinbase’s bitcoin holdings are currently equal to about 1.25% of total company market cap.

On April 30th, Coinbase announced support for the Lightning Network through a partnership with Lightspark, giving users the option to use Lightning for faster and cheaper transactions when sending/receiving bitcoin on or off the platform.

Block announced that going forward, they will be investing 10% of gross profit from bitcoin products into bitcoin purchases. The future purchases will add to Block’s bitcoin treasury holdings of 8,038 BTC, which were purchased for $220 million in 2020 and 2021. Block’s bitcoin gross profit was $80 million in Q1.

The announcement comes on the heels of a slew of bitcoin product releases from Block in 2024.

First, they launched Bitkey, a self-custody bitcoin wallet that leverages both a physical device and a smartphone app for security, and is integrated with their popular Cash App.

Next, they announced the development of bitcoin mining hardware, with the goal of decentralizing both the supply of bitcoin mining hardware and the distribution of hashrate.

Finally, they rolled out Bitcoin Conversions for Square sellers, enabling them to automatically convert 1-10% of their daily sales into bitcoin for a flat 1% fee.

In conjunction with the initiation of a dollar-cost-averaging bitcoin investment strategy, Block open sourced their Bitcoin Blueprint for Corporate Balance Sheets so other companies can do the same.

In it, Block has entire sections dedicated to the important considerations of custody and insurance. They detail the robust cold storage custody solution they have developed for themselves since 2018, which leverages the multi-signature feature enabled by bitcoin by requiring n of m signatures to move Block’s bitcoin out of cold storage. They also reveal that, despite custodying their bitcoin in cold storage, they nonetheless maintain insurance policies to protect themselves and their customers.

Aware that developing a robust in-house cold storage solution is not for everyone, Block concludes: “For those looking to outsource custody, there are several third-party providers readily available.”

Onramp is one of those providers, leveraging multi-institution custody to provide investors with direct exposure to bitcoin, leveraging the native properties of the protocol to distribute counterparty risk, minimize trust, and eliminate single points of failure.

Onramp also offers Onramp Insured Protection, giving bitcoin investors an additional layer of protection and insurance against unforeseen risks.

MicroStrategy, Marathon, Coinbase, and Block currently have the 1st, 2nd, 4th, and 6th largest bitcoin treasuries, respectively, among all publicly traded companies, as can be viewed on the Onramp Terminal:

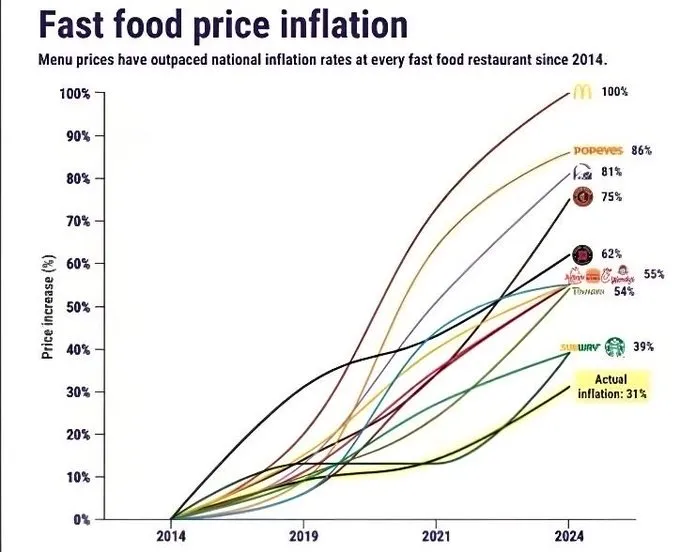

Chart of the Week

Courtesy of @BankerWeimar on X:

The sobering reflection comes amid a week in which several of the logos on the chart reported underwhelming earnings, citing an inflation-weary consumer and labor shortages.

Quote of the Week

“The real national security issue is the growth rate of the money supply going vertical.

Nigerians taking rational steps to protect their hard-earned savings by owning scarcer things like bitcoin or stablecoins, is not the national security issue.”

— Lyn Alden, on reports that a ban on crypto in Nigeria was imminent as the country calls it a national security issue.

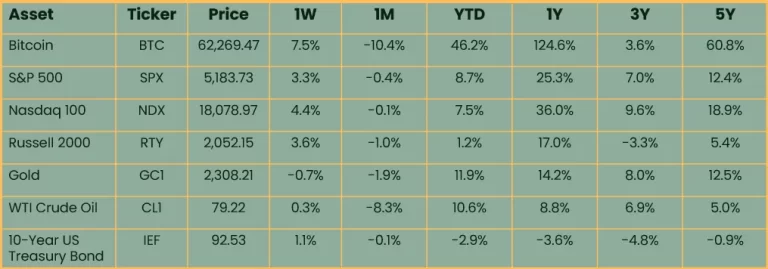

Market Update

as of 5/8/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Asset prices bounced back this week following a tough week, as markets continued to digest the Fed and Treasury actions from last week. Jobs data came in weaker than expected, perhaps influencing investors to think rate cuts may be on the table sooner than later. The weaker economic data caused bond yields to fall, providing a tailwind for risk assets. The Fed opened dollar swap lines with the Bank of Japan, giving the BoJ tools to defend the rapidly depreciating Yen, prompting expectations of a continued increase in global dollar liquidity.

Bitcoin was the best performing asset on the week gaining 7.5%. Stock indices all rallied as corporate earnings reports continued to pour in. Gold continued consolidating following a record setting start to the year, losing 0.7%. Oil is still looking to find a bottom amid a recent decline and fell 0.3%. Bond prices rallied commensurate with the fall in yields.

Podcasts of the Week

The Last Trade E048: Navigating the ETF Era with Hong Kim of Bitwise

In this episode of The Last Trade, Hong Kim, co-founder & CTO of Bitwise, joins the pod to discuss bitcoin advocacy, open-source development, ETF adoption & inflows, custodial tradeoffs, accessibility of exposure, reflexivity of demand, & more.

Onramp Webinar Series E001: Bitcoin’s Full Potential Valuation

In this session of the Onramp Webinar Series, Mark Connors, Head of Research at 3iQ, joins Jesse Myers and Brian Cubellis to discuss the investment case for bitcoin and how to contextualize its potential valuation.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris