5/30/24 Roundup: Market Structure & Corporate Bitcoin Adoption

Onramp Weekly Roundup

Written By Zack Morris

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

And now, for the weekly roundup…

- FIT 21 Act deep dive

- Semler Scientific adopts bitcoin treasury strategy

- Gemini Earn users recover 97% of assets in-kind

FIT 21 Act Deep Dive

Of all the progress made on the regulatory front for the crypto industry over the last two weeks, the Financial Innovation and Technology for the 21st Century (FIT 21) Act might end up having the most lasting impact.

Also known colloquially as the “Market Structure Bill,” the proposed piece of legislation seeks to clarify what makes a digital asset a commodity vs. a security.

This is important because securities come with stringent ongoing financial disclosure and reporting requirements for their issuers that are onerous and a poor fit for digital assets that either:

- Are used for everyday commercial purposes like payments or a transmission of value, or in settings like games.

- Do not grant their holders any claim or interest in an issuer’s business.

- It is not clear if an “issuer” exists in the first place.

Moreover, securities can only be traded on registered exchanges or through broker-dealers, which limits the venues where these assets can be bought and sold, reducing liquidity and access to the free market. The largest US-based digital asset exchange Coinbase, for example, claims that it does not list any securities.

Clarity is needed to enhance domestic: consumer confidence and protection; economic activity; global competitiveness; entrepreneurship, innovation, and small business formation.

In today’s Roundup, we aim to simplify exactly what the new framework proposes.

Overview

FIT 21 aims to classify non-stablecoin digital assets as either a “digital commodity” or a “restricted digital asset” (security) based on three factors, as described by law firm Davis Polk:

- the type of holder of the digital asset;

- the development status of the related blockchain system; and

- the type of distribution in which the holder receives the digital asset.

Holder

Source: Davis Polk

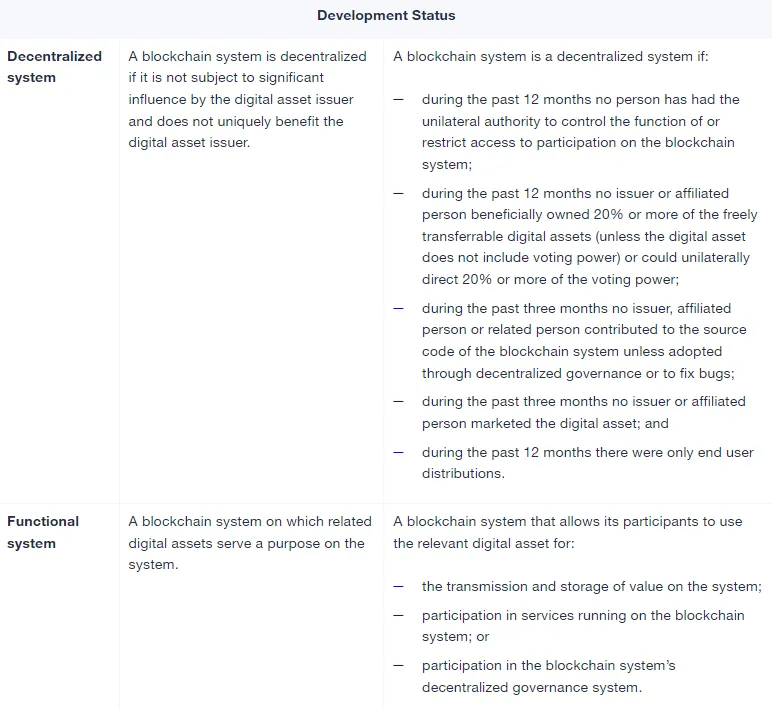

Development Status

Source: Davis Polk

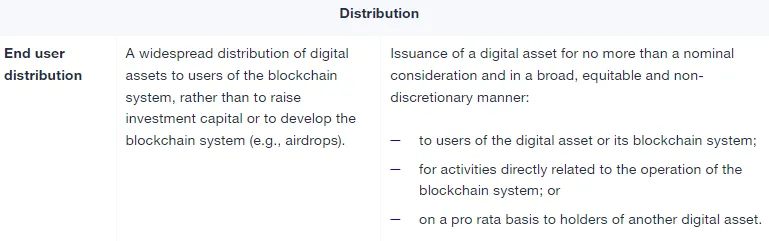

Distribution

Source: Davis Polk

If a digital asset falls into any of the three categories below, it is deemed a “restricted digital asset” and is subject to securities regulations. Otherwise, it is deemed a digital commodity.

- Category 1:

- Development Status: any

- Holder: digital asset issuer

- Distribution: any

- Category 2:

- Development Status: any period when any related blockchain system is not a functional system or is not certified as a decentralized system

- Holder: affiliated person or related person

- Distribution: any

- Category 3:

- Development Status: prior to the first date on which each related blockchain system is a functional system and is certified as a decentralized system

- Holder: not the issuer, a related person or an affiliated person

- Distribution: distribution other than an end user distribution or a transaction not executed on a CFTC-registered digital commodity exchange

As these factors can change over time, and a digital asset can check multiple boxes at once (i.e. multiple types of holders or methods of distribution), the Act as currently written both allows for the possibility of:

- reclassification from a commodity to a security (or vice-versa); and/or

- a single, fungible digital asset to simultaneously be classified as a commodity and and a security depending on who holds the asset and how it was acquired.

This is not ideal given the potential implications for market fragmentation. For example, if restricted digital assets and digital commodities are not allowed to trade on the same venue, you could have instances in which digital assets are forced to de-list from one venue and re-list on another as the transition from security to commodity, forcing non-technical end-users to potentially have to take self-custody and/or send their digital assets on-chain in order to access liquidity.

However, 15 years after the creation of bitcoin and almost a decade after the Ethereum Network went live, lawmakers may suddenly be in a mood to not let the perfect be the enemy of the good, or even the slightly better, when it comes to regulating digital assets.

Semler Scientific Adopts Bitcoin Treasury Strategy

From PR Newswire:

“Semler Scientific, Inc. (Nasdaq: SMLR), a pioneer in developing and marketing technology products and services to healthcare providers to combat chronic diseases, announced today that its board of directors has adopted bitcoin as its primary treasury reserve asset. In addition, Semler Scientific announced that it has purchased 581 bitcoins for an aggregate amount of $40 million, inclusive of fees and expenses.”

Semler becomes the third US publicly traded company to adopt bitcoin as a treasury asset prior to having any bitcoin-related businesses after MicroStrategy and Tesla.

Interestingly, all three of these companies are founder-led and controlled by Eric Semler, Michael Saylor, and Elon Musk, respectively.

Perhaps it is simply easier to make and implement the decision to adopt bitcoin as a treasury asset when one person has outsized influence and control over a company.

Or, perhaps when the leader of a business enterprise is an owner and not merely a paid steward, they are more likely to exhibit a low time-preference and take a long-term view on the growth and sustainability of their business, and implement a bitcoin standard.

Gemini Earn Users Recover 97% Of Asset In-Kind

In the latest bankruptcy resolution to come out of the great 2022 crypto-bust, Gemini Earn users yesterday received 97% of their stranded digital assets back in-kind.

Receiving the assets back in-kind is huge for Earn customers because of the price appreciation of the assets since Genesis, the lending desk the assets were lent out to, halted Earn customer withdrawals. Gemini claims the notional value of the recovery is 232% of the value of the assets from when Genesis halted withdrawals.

The total sum of assets returned to users was $2.18 billion. As these assets were previously illiquid, there is a possibility of some price pressure here in the short-term, but, that notwithstanding, this is a fantastic outcome for Gemini Earn users given the circumstances and given the outcomes of similar situations at FTX, Celsius, and Voyager.

It’s a brief reminder of the financial and emotional pain that so many endured in 2022 due to counterparty risk and poor custody solutions.

Never again.

Onramp strives to provide a better custody solution by eliminating single points of failure and distributing counterparty-risk across multiple institutions with Multi-Institution Custody.

Chart of the Week

Denominator matters. Courtesy of Luke Gromen on X.

Quote of the Week

“We don’t make trade-offs with American’s rights.

This week, we will pass our CBDC Anti-Surveillance State Act to prohibit unelected bureaucrats at the Fed from stripping the American people of their right to financial privacy.”

— GOP Majority Whip Tom Emmer, last week ahead of the House vote on his CBDC Anti-Surveillance State Act.

The bill would prohibit the Federal Reserve from issuing a surveillance-style central bank digital currency (CBDC) that could give the federal government the ability to monitor and control individual Americans’ spending habits.

The vote passed the House 216-192.

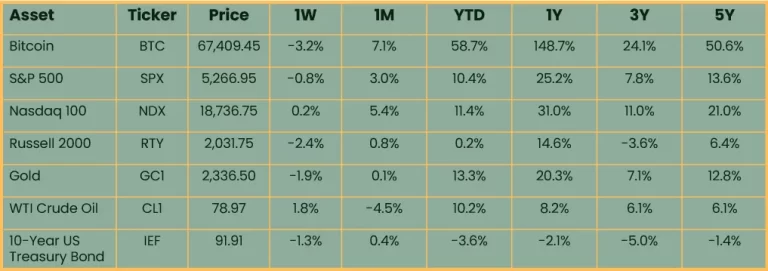

Market Update

as of 5/29/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Assets broadly traded down on the week as long-term treasury yields look to challenge year-to-date highs. The nervousness in the bond market ramped up after a weak treasury auction on Tuesday. Reports of 60/40 investors finally reclaiming their 2021 high-water mark made the rounds, driven largely by stocks at all-time highs. The underperformance of treasury bonds vs. all other assets over the past 5 years is staggering, as is the underperformance of small cap stocks as measured by the Russell 2000.

The exception to the weakness this week was the NASDAQ, which was lifted by Nvidia. The AI darling reported another quarter of stellar results and is now just a few ticks away from surpassing Apple as the 2nd largest company in the world.

Bitcoin lost 3.2% as it consolidated gains driven by the regulatory news from the previous week.

Podcasts of the Week

The Last Trade E051: From Charles Schwab to Bitcoin with Rich Kerr

In this episode of The Last Trade, Rich Kerr, former executive at Charles Schwab & 30+ year veteran of the managed wealth industry, joins to discuss his bitcoin journey, opportunities & threats for advisors, institutional adoption, 13F filings, bitcoin-native financial services, & more.

Onramp Webinar Series E002: Bitcoin Inheritance Planning with Amanda Kita

In this session of the Onramp Webinar Series, Amanda Kita, Attorney at Stradley Ronon, joins Cam Stromme, Head of Private Wealth at Onramp, for an insightful discussion about bitcoin inheritance planning.

Scarce Assets E011: James Lavish – How to Protect Your Purchasing Power

In this episode of Scarce Assets, James Lavish joins the pod to discuss financial education, inflation & debasement, fiscal & monetary abuses, bitcoin’s monetization, institutional capital flows, & more.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris