6/13/24 Roundup: Political Game Theory Accelerates

Onramp Weekly Roundup

Written By Brian Cubellis

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

In this week’s Roundup, we dissect the trajectory of bitcoin adoption in the context of political positioning & associated game-theoretical dynamics…

Political Game Theory Accelerates

We’ve spoken about the game theory of bitcoin adoption on several occasions, as recently as a week ago, and it seems as though the situation is beginning to accelerate.

In a recent development, former President Donald Trump’s reelection campaign has openly embraced Bitcoin. This strategic pivot, highlighted by Trump’s acceptance of donations in digital assets and his most recent statement on Truth Social, reflects the increasingly intricate game theory dynamics influencing Bitcoin adoption on a global scale.

Trump’s Bitcoin Embrace: A Tactical Move

Regardless of personal views on the former president, his campaign’s endorsement of Bitcoin is a shrewd tactical maneuver designed to resonate with a segment of voters who prioritize bitcoin-related policy. These single-issue voters could significantly influence electoral outcomes, making Trump’s position a calculated bid for their support. However, his remarks also reveal a limited understanding of Bitcoin’s technical and economic realities.

Trump stated, “Bitcoin mining may be our last line of defense against a CBDC. Biden’s hatred of Bitcoin only helps China, Russia, and the Radical Communist Left. We want all the remaining Bitcoin to be MADE IN THE USA!!! It will help us be ENERGY DOMINANT.” While this rhetoric appeals to nationalist and anti-CBDC sentiments, it contains two critical misconceptions.

The Impossibility of National Hashrate Domination

Firstly, the idea of the United States monopolizing Bitcoin mining is fundamentally flawed. Bitcoin’s hashrate is inherently decentralized, distributed across the globe in a manner that no single nation can dominate. The decentralized nature of Bitcoin mining is one of its core strengths, ensuring the network’s security and resilience against centralized control and attacks.

Secondly, even if hypothetically possible, concentrating Bitcoin’s hashrate within one nation would be detrimental. Such centralization would undermine the very principles of decentralization that Bitcoin was built upon, making the network vulnerable to state-level attacks and regulatory pressures. This could contradict the ethos of Bitcoin as a borderless and censorship-resistant form of money.

A Positive Development Amidst Hostility

Despite these misconceptions, Trump’s endorsement marks a significant milestone in the political landscape of Bitcoin. His administration, if elected, is less likely to aggressively oppose Bitcoin relative to his opponent, whose regime has exhibited clear hostility towards the industry in recent years. This divergence in policy stances underscores the importance of political game theory in Bitcoin adoption.

Trump’s position, even if lacking in technical nuance, indicates a shift towards mainstream political recognition of Bitcoin. This shift aligns with the broader game-theoretical narrative where nations and political entities increasingly see Bitcoin as a strategic asset. In this context, Trump’s statement can be seen as part of a larger trend where political actors leverage Bitcoin to gain a competitive edge.

The Strategic Advantage of Energy Dominance

It’s worth noting that Trump’s comments on energy dominance through Bitcoin mining touch upon a crucial and accurate point. Embracing Bitcoin mining domestically can indeed help the United States stabilize its energy grids, incentivize the buildout of energy capacity, and monetize otherwise wasted or stranded energy sources. Bitcoin miners seek cheap and abundant energy, which can lead to increased investment in renewable energy projects and grid infrastructure.

In this respect, Trump is spot on. It behooves the U.S. to lean into Bitcoin mining, and we are already doing so organically, with approximately 38% of the global hashrate currently located in the U.S. This positioning allows the U.S. to leverage its vast energy resources, contributing to energy security and economic growth.

The Game Theory of Bitcoin Adoption

Bitcoin’s adoption can be viewed through the lens of game theory, where various stakeholders, including individuals, institutions, and nations, interact in a complex, strategic environment. Each player’s decision to adopt or oppose Bitcoin influences the decisions of others, creating a dynamic and evolving landscape.

In this game-theoretical framework, Trump’s endorsement of Bitcoin serves as a signaling mechanism. It signals to other political actors and nation-states that aligning with Bitcoin could provide strategic advantages, such as attracting a tech-savvy electorate or positioning the nation favorably in the global financial ecosystem.

Moreover, this development could prompt a response from other political figures and nations. As the embrace of Bitcoin by a significant political actor like Trump becomes more visible, it may incentivize others to reconsider their stance on the topic. This could lead to a domino effect, accelerating Bitcoin adoption on a global scale.

The Paradox of Political Advocacy for an Apolitical Asset

Despite its apolitical foundation, Bitcoin has garnered attention and support from political figures who view it as a tool for combating the centralizing forces across the global financial system. Prominent advocates such as Javier Milei, the recently elected President of Argentina, and Robert F. Kennedy Jr., the leading independent candidate in the upcoming US presidential election, have found common ground in Bitcoin’s resistance to control and manipulation.

This development presents an interesting paradox – political figures championing an inherently apolitical asset. On one hand, Bitcoin’s design and philosophy stand in direct opposition to centralized control and politicization. On the other hand, Bitcoin has become a symbol for politicians seeking to demonstrate their commitment to the ideals of freedom and personal sovereignty.

The Groundswell of Bitcoin Advocacy

Whether they realize it or not, the growing groundswell of Bitcoin advocacy from politicians represents a promotion of Bitcoin’s core properties, which highlight freedom, autonomy, and resistance against the abuses of centralized power. While politicians can utilize Bitcoin as a tool to curry favor with a populace disillusioned by traditional financial systems, the reality is that their advocacy has no influence over the network or the asset itself. Regardless of whether these political endorsements are a function of genuine alignment with the ethos of Bitcoin or simply serve as strategic moves to garner support from marginalized segments of the population, the trend is both notable and likely to continue.

While Trump’s recent comments on Bitcoin reveal a limited understanding of its technical aspects, the strategic implications of his endorsement are profound. This development highlights the role of political game theory in Bitcoin adoption, where strategic decisions by influential players can significantly impact the broader adoption landscape. As Bitcoin continues to attract political attention, the inherent paradox of an apolitical asset gaining political champions underscores its transformative potential. Even if Trump’s understanding of Bitcoin is imperfect, his campaign’s stance represents a crucial step in the broader narrative of Bitcoin adoption, signaling a shift towards a more favorable political environment for the asset.

Chart of the Week

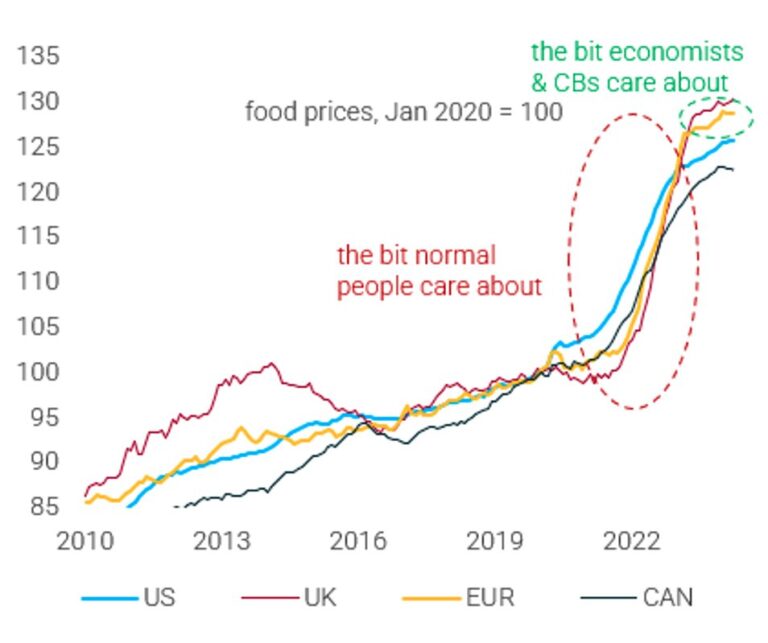

Courtesy of @darioperkins MD of Global Macro at @TS_Lombard:

“Normal people have a different way of looking at inflation compared to economists/central bankers.”

Quote of the Week

“Unlike anything we have seen before, Bitcoin is a true technological breakthrough, as there now exists an effectively unalterable, automated and transparent global ledger network with decentralized governance enabling the transfer of property rights through time and space without human permission or the possibility of confiscation. The promise of Bitcoin is simple – namely, that changes in someone’s purchasing power should not be controlled by an authority tied to the circumstances of one’s birth.”

Podcasts of the Week

The Last Trade E053: Educational Empowerment with Paul Nylen

In this episode of The Last Trade, Paul Nylen, accounting & tax professor at UW-Whitewater, joins to discuss educational empowerment, pensions allocating to bitcoin, adoption momentum, custodial tradeoffs, maturation & acceptance, & more.

Scarce Assets E012: Anthony Scaramucci – Conviction, Humility, & Resilience

In this episode of Scarce Assets, Anthony Scaramucci joins hosts Andy Edstrom and Jesse Myers to discuss navigating volatility, lessons from Wall Street, institutional adoption, psychology & career risk, cultivating resilience, & more.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Brian Cubellis