7/18/24 Roundup: Momentum Builds Ahead of Bitcoin 2024 in Nashville

Onramp Weekly Roundup

Written By Zack Morris

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

We are attending the Bitcoin Conference in Nashville next week and would love to meet with you! We’re hosting multiple private events and office hours, providing a unique opportunity to connect 1-on-1 with the Onramp team.

Please reach out to learn more, we look forward to seeing you there!

And now, for the weekly roundup…

- Trump selects pro-crypto J.D. Vance as VP

- Presidential candidates Trump, Kennedy Jr. to speak at Bitcoin 2024 in Nashville

- BlackRock CEO Fink touts bitcoin on CNBC

- German government done selling 50,000 BTC

Trump Selects Pro-Crypto J.D. Vance as VP

On Monday Donald Trump announced his pick of Ohio Senator J.D. Vance as his running mate.

Vance is best known for his book Hillbilly Elegy, which explores the challenges faced by working class Americans in the Rust Belt — the deindustrialized former manufacturing hubs of Northeast and Midwest states like Pennsylvania, Ohio and Michigan, all key battleground states in this November’s presidential election.

Vance is a former venture capitalist who started his career at Mithril Capital, a VC fund founded by Peter Thiel. In addition to his background in tech and finance, Vance has expressed pro-crypto views and been critical of SEC Chair Gary Gensler’s approach to regulating the industry. Vance disagrees with Gensler’s hostility towards utility tokens while taking a more lax stance on other tokens such as digital commodities and memecoins.

In particular, Vance thinks that the use of blockchain technology and utility tokens for verification will potentially be important for nascent social media networks to compete with incumbents. Vance has cited control of the flow of online information being largely in the hands of two companies (Facebook and Google) as one of the country’s largest threats and has championed pro-competitive policy to loosen their stranglehold on online media.

Vance is reportedly working on crypto legislation to be introduced in the Senate as soon as this month. The bill will likely serve as direct competition to the FIT21 Act which recently passed through the House with bipartisan support. However, some bitcoiners have urged caution in supporting FIT21 as it would grant sweeping new CFTC oversight to regulate the spot bitcoin market, potentially imposing enhanced KYC/AML requirements on all bitcoin companies and entrenching incumbents. Vance’s legislation is hopefully more thoughtful and robust than FIT21, and it will certainly have more juice now with the VP nomination.

I couldn’t find much Vance has said specific to bitcoin, but it has been reported that he owned between $100k-$250k of bitcoin in 2022. We will have to await the details of his legislation to see how it might impact bitcoin, although it seems the focus will be on a framework to regulate the rest of the crypto-industry.

It isn’t a surprise that most new crypto legislation is not focused on bitcoin, but rather the “rest,” as that is where there seems to be the most confusion and uncertainty. Bitcoin, in relative terms, is simple and easy to understand because it is unique among all cryptocurrenices. It is money, while arguably every other token is still searching for product-market fit.

On the macro and monetary front, Vance has cited the US dollar’s reserve currency status as a contributing cause to the hollowing out of America’s industrial base. This suggests a potential Trump Administration would be focused on a weaker dollar and increased re-shoring efforts which, all else equal, many would argue is a bullish environment for domestic inflation, commodity prices and hard-money assets.

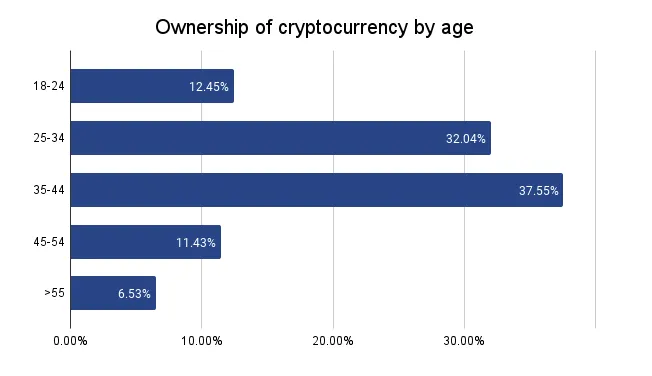

Vance, 39, is also the first Millennial to find themselves on a US Presidential ticket. As younger generations come into more leadership roles in government, it is likely that policy begins to reflect their culture and values. Multiple surveys have found that cryptocurrency ownership is concentrated among the age 18-44 cohorts:

Source: Triple-A US 2022 Crypto Report

Trump, RFK Jr. to Speak at Bitcoin Conference in Nashville

The two presidential candidates will both be giving keynote addresses at Bitcoin 2024, taking place in Nashville next week July 24-27.

It is likely that Trump will reiterate the 2024 Republican Party Platform party line:

“Republicans will end Democrats’ unlawful and unAmerican Crypto crackdown and oppose the creation of a Central Bank Digital Currency. We will defend the right to mine Bitcoin, and ensure every American has the right to self-custody of their Digital Assets, and transact free from Government Surveillance and Control.”

Trump has also long been an advocate for energy independence and indicated he’s aware of the positive impact bitcoin mining can have on the energy sector and the electrical grid when he posted in June that bitcoin miners will “help us be ENERGY DOMINANT!!!”

Finally, conference attendees may ask the former President to elaborate on his recent comments about Jamie Dimon’s potential candidacy for Treasury Secretary and that the notable bitcoin skeptic has “now all of a sudden (he’s) changed his tune a little bit” on bitcoin.

Kennedy Jr. will be making a repeat appearance at the Conference he first spoke at in 2023. Last year, he told the crowd that his aha! bitcoin moment came when he learned it was being used to circumvent the financial deplatforming of Canadian truckers during a protest in 2022:

“None of these lawful and peaceful protestors had violated any law… But suddenly, they found that they could not access their money, their bank accounts to pay their mortgages or feed their families. When I witnessed this … devastating use of government repression, I realized for the first time how free money is as important as free expression.”

RFK Jr. also hit on the right to self-custody, use-agnostic energy regulation, and potentially pardoning Ross Ulbricht.

Having two out of three Presidential candidates showing up to speak at a bitcoin conference this close to the election is the culmination of a tidal wave of pro-bitcoin rhetoric coming out of political campaigns in just the last month. Political game theory is asserting itself at both a domestic politics and nation-state adversarial level in real-time, before our eyes.

Bitcoin is a strange game where the only winning move is to play.

Onramp will be attending Bitcoin 2024 next week in Nashville and hosting Office Hours at our house from 9AM to 3PM on July 24th, 25th, & 26th. Please reach out if you’d like to meet with our team, learn more about Onramp, or network with like-minded sound money enthusiasts.

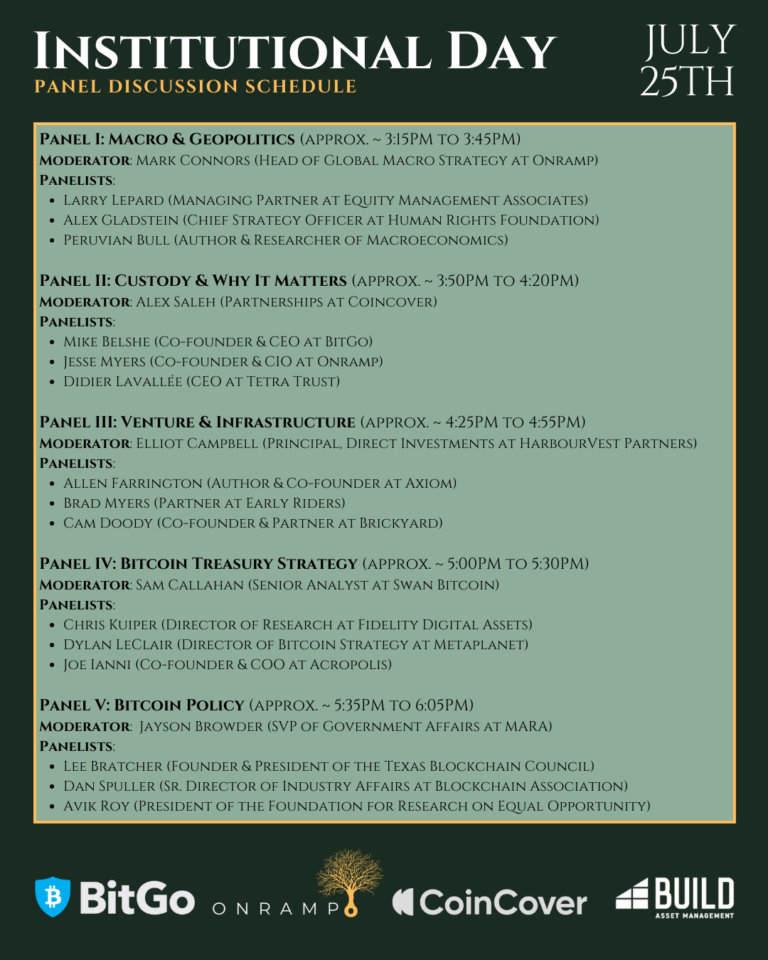

Onramp will also be hosting Institutional Day on July 25th in Nashville, featuring panel discussions & networking. Please register here if you’d like to attend.

BlackRock CEO Larry Fink: Bitcoin Skeptic Turned Believer

Speaking of titans of the financial industry who have changed their tune on bitcoin…

Larry Fink went on CNBC this week to discuss BlackRock’s second quarter results and the smashing success of their bitcoin ETF.

Among other points, Fink hit on bitcoin’s:

- uncorrelated returns relative to traditional asset classes

- staying power as an asset that deserves to be in traditional portfolios

- value as a hedge against currency debasement

- value as a tool for financial freedom in authoritarian regimes

Credit to Fink for doing the work and very publicly changing his mind. As the chorus endorsing bitcoin for everyday portfolios from BlackRock and other Wall Street firms grows, it will hopefully inspire others to study and learn about bitcoin as well.

German BKA Finishes Liquidating 50,000 BTC

Last week we mentioned that German law enforcement agency Bundeskriminalamt (Federal Criminal Police Office, or BKA) was in the process of selling 50,000 bitcoins seized in the shutdown of an illegal movie pirating website and likely weighing on price.

Many on social media derided the German government for selling and not holding the bitcoin, but we note that German law requires the sale of seized assets, so this was not an active choice but rather an adherence to procedure.

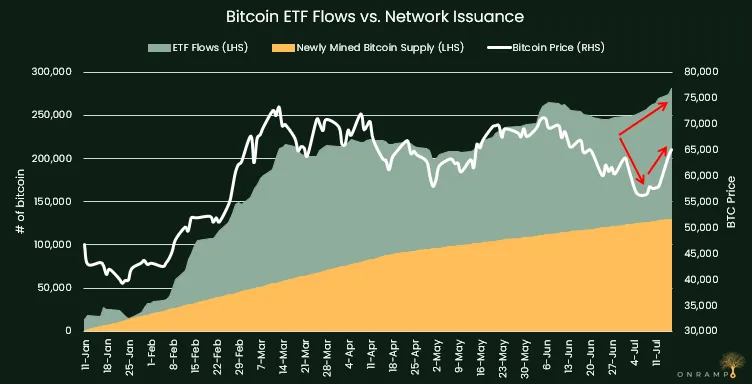

In any event, as of Friday, July 12 the sale was complete. US retail investors have been on the other side of the trade. Since July 4, when the BKA’s sell program became widely known, ETFs have seen eight straight trading days of inflows, taking in over 32,000 BTC or nearly $2 billion.

The recent snapback in price following the conclusion of the BKA’s sales ends a brief divergence between ETF flows and price, which have been tightly correlated since the launch of the ETFs in January:

Source: Farside, Onramp

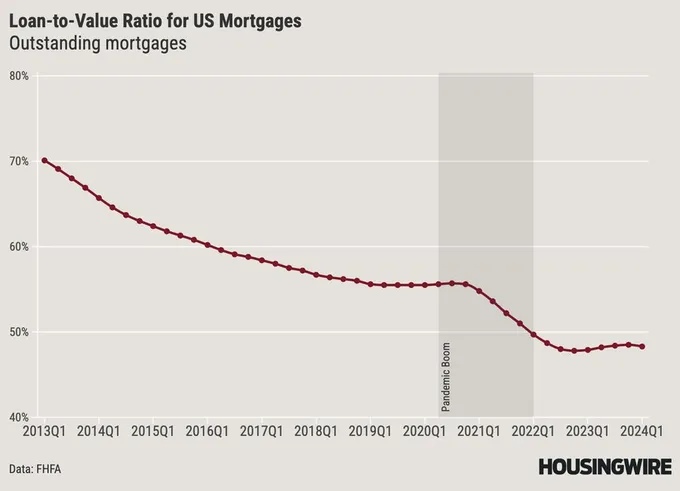

Chart of the Week

Courtesy of @beentherecap on X:

Home values have appreciated while many home owners remain locked in to pandemic era 2-4% fixed-rate mortgages, creating a boom in home equity and bolstering household balance sheets.

Quote of the Week

“As you know I was a skeptic. I was a proud skeptic! And I studied it, learned about it, and I came away saying okay, you know, my opinion five years ago was wrong.”

— BlackRock CEO Larry Fink on bitcoin during CNBC interview, July 15, 2024.

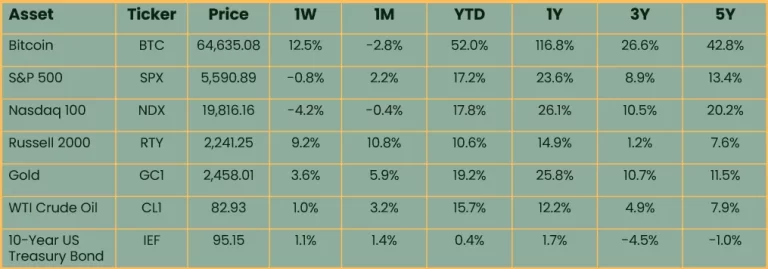

Market Update

As of 7/17/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Bitcoin rallied 12.5% as technical selling pressure from the German BKA subsided and Trump’s election odds jumped following a failed assassination attempt. Trump also selected pro-crypto J.D. Vance as his VP. Increasing odds of a Republican Administration come next year are seen to be positive for bitcoin as the GOP has been the more bitcoin friendly party.

In equities there was a violent rotation from the tech-heavy NASDAQ and into beaten up small caps. Reasons cited for the massive move are increasing odds of interest rate cuts, increasing odds of a pro-competition and anti-big-tech administration, and investor positioning being over-extended as large cap indices have trounced the Russell all year. Adding fuel to the unwind were Trump comments on being non-commital to defending Taiwan, hitting market darling semiconductor stocks such as Nvidia, which rely on Taiwan Semiconductor’s manufacturing capabilities, especially hard on Wednesday.

Gold gained 3.6% in sympathy with bitcoin as investors speculated that a Trump Administration might seek to devalue the dollar. Oil and bonds rallied 1%.

Podcasts of the Week

The Last Trade E057: Embracing Bitcoin with Former Schwab Executive Rich Kerr

In this epsiode of The Last Trade, Rich Kerr, Onramp’s new President of Managed Wealth, joins to discuss macro headlines, the realities of inflation, retail vs institutional adoption, unfunded liabilities, finding optimism in bitcoin, & more.

Wake Up Call (7.15.24): Introducing A New Show from Onramp Media

Wake Up Call is a weekly show that will be streamed live on LinkedIn every Monday morning. To catch the premier of each episode, follow Onramp’s LinkedIn page and add Wake Up Call events to your calendar. After the live premier on LinkedIn, we will distribute each episode across Onramp Media’s podcast channels and youtube page.

Wake Up Call aims to educate financial professionals on the merits of the bitcoin investment thesis, how this asset class represents both a threat to legacy financial service businesses and an opportunity to differentiate oneself to retain and attract new business.

Hosted by Mark Connors, Onramp’s Head of Global Macro Strategy, and Rich Kerr, Onramp’s President of Managed Wealth, this show seeks to provide financial professionals the “wake up call” they need, prompt them to have an open mind with respect to bitcoin, rethink their prior assumptions, become more educated on the topic, and learn from others who are already farther down this path.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris