Diversifying Bitcoin Wealth: Increasing Your Peace of Mind for the Next Cycle

Onramp is proud to bring you this report by Jackson Mikalic, VP of Business Development at Onramp and author of The Fiat Cave. This piece explores the concept of diversification as it applies to bitcoin custody, providing a framework for investors to protect their bitcoin in 2024 and beyond. Enjoy!

Diversification is a well-understood concept in traditional finance, aiming to enhance portfolio resilience and maximize risk-adjusted returns (Sharpe ratio).

Rather than investing in individual stocks, opting for an ETF of a broad-based or sector index is recommended. Instead of investing only in equities, modern portfolio theory says to own some bonds, real estate, or other uncorrelated assets.

Critical for financial survival, diversification guards against a single point of failure that could devastate your financial future.

This principle applies to bitcoin; however, I do not advocate for a “diversified” portfolio of “cryptocurrencies” or “digital assets.” Instead, I recommend diversifying bitcoin custody solutions.

Since the last bitcoin cycle, the bitcoin custody landscape has matured, offering a broader spectrum of feasible and secure options. As we approach the next halving in April, it’s crucial to assess the storage of your bitcoin wealth, especially considering the potential significant increases in its value.

At $100,000, $200,000, or even $500,000 per bitcoin, one’s net worth may change considerably. Even those who started with a smaller allocation would have a sizable portion of wealth in bitcoin at that point.

And although we’re excited for the next cycle pushing bitcoin prices to all-time highs, there is one downside worth considering. For most people, as the price of bitcoin increases, their peace of mind decreases.

Why is that? Because unlike traditional assets, for which custody is an afterthought, bitcoin custody matters tremendously, and most people are not entirely comfortable with how their bitcoin is secured.

Trusting a single third party to manage keys poses risks, as seen with the collapse of FTX and others in 2022. Bitcoin enthusiasts and professional investors alike should be hesitant to trust a single counterparty to safeguard material amounts of bitcoin.

On the other hand, self-custody, while offering unilateral control, demands technical proficiency and constant vigilance. This may only be feasible for some, especially as bitcoin becomes a significant portion of their wealth.

There's no perfect solution, only tradeoffs

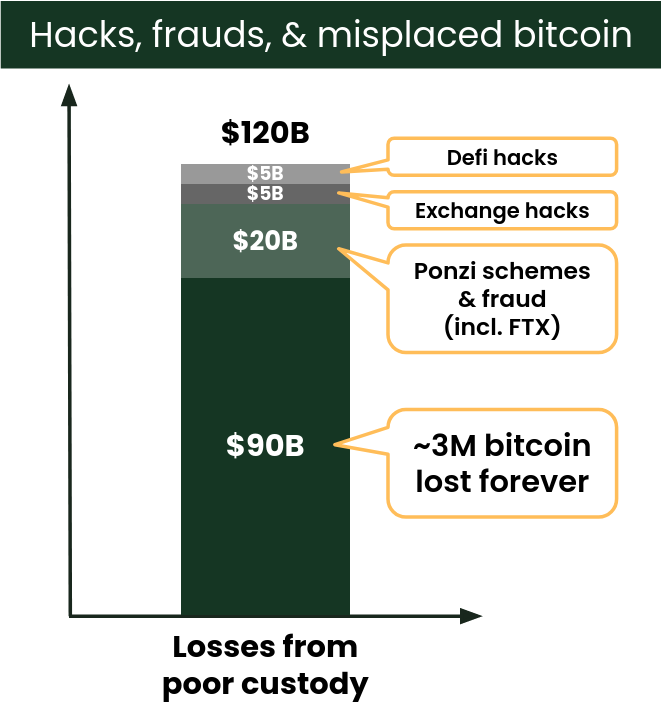

Bitcoin’s fifteenth birthday was last week, on January 3rd. In bitcoin’s fifteen-year history, custody has been a persistent challenge; poor custody has resulted in over $120 billion in losses from hacks, frauds, and misplaced bitcoin.

Custody has been a persistent pain point in the adoption of bitcoin because solutions have only existed at the two extremes of the spectrum:

Third-party custody: a convenient option, but introduces a single point of failure and a high amount of counterparty risk. Some custodians are more reputable than others, but it’s not an optimal way to store material amounts of bitcoin

Self-custody: control of your bitcoin, but requires technical and operational competency. While it’s not hard to purchase a hardware wallet and move bitcoin to it, it is hard to ensure that your wallet and seed phrase are correctly secured in perpetuity against any potential catastrophic consequence and then passed down to the next generation.

Don’t get me wrong, self-custody remains an excellent option for some. There are people who could see bitcoin’s price at $200,000 and have no concern over managing their own keys, but that’s a minority.

But many who self-secure all of their bitcoin today in self-custody have done so out of necessity. Instinctually knowing that trusting a single third party was not a viable option, they had to learn how to take ownership of the keys. But in the back of their mind, they are constantly thinking about whether their custody arrangement is adequate and how the wealth will get passed on to the next generation, and those thoughts increase with the price.

If this sounds like you, it does not necessarily mean you should entirely abandon self-custody, but it might mean you should diversify your bitcoin custody solutions. And of course, if you have bitcoin with a single institution, it’s in your best interest to correct that sooner than later.

Diversifying Your Bitcoin Wealth

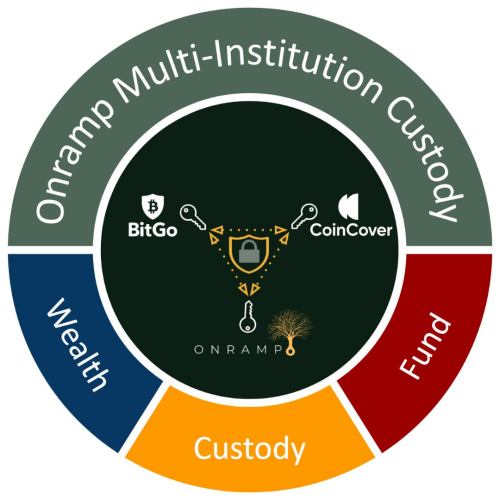

Custody solutions were few and far between for the first fifteen years of bitcoin, but amidst the challenges of custody, multi-institution custody emerges as a viable solution for most bitcoin wealth.

Bitcoin’s unique multi-sig capability allows multiple parties to participate in the custody of a single wallet, reducing counterparty risk for the client. Multi-sig was first implemented on the bitcoin protocol in 2013 by Mike Belshe, CEO of BitGo, and is now used to secure hundreds of billions of dollars of bitcoin by individuals and institutions alike. Simply, multi-sig uses an m of n scheme, where m of n keys are needed to access a bitcoin wallet; 2 of 3 is the most popular.

You can think of multi-institution custody as a digital vault, where keys are distributed among three reputable institutions utilizing industry best practices, eliminating a single point of failure and increasing the security of client assets. Notably, two of three keys must be signed to move bitcoin out of the vault, meaning any one institution cannot control the bitcoin, nor does it matter if the company goes under.

As Bitcoin becomes a more substantial portion of individuals’ wealth, a combination of self-custody and multi-institution custody may emerge as a balanced approach.

This could involve keeping a portion in a self-controlled wallet, the bulk in a multi-institution custody vault, and a small amount in a hot wallet for easy transactions.

Ultimately, each individual will decide to what degree they are comfortable with securing their keys, but it’s foolish to think that custodial options do not play a crucially important role in bitcoin adoption.

If you want to discuss your situation and learn more about multi-institution custody, you can book a time to discuss with me directly or check out Onramp.

About Onramp

Onramp is a bitcoin asset management platform built on multi-institution custody.

Multi-institution custody combines the respective benefits of self-custody and third-party custody, while minimizing their drawbacks. Learn more about what Onramp offers on our website.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.