Jealousy and Fairness in Bitcoin Distribution

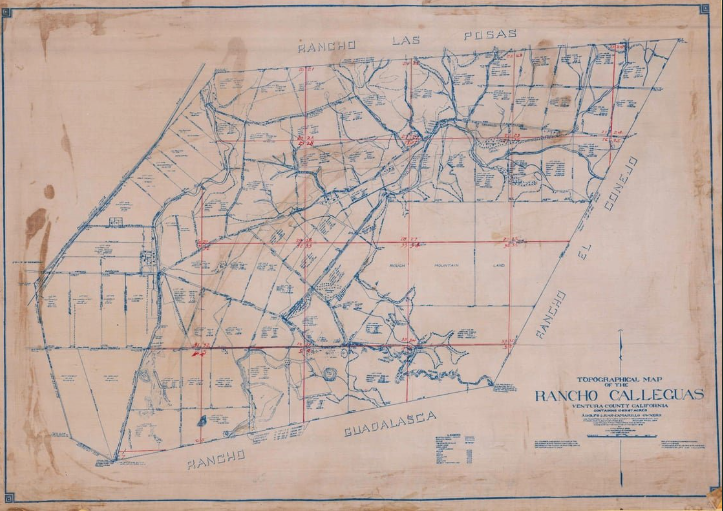

Juan Camarillo sold everything he had to purchase Rancho Calleguas, a 10,000-acre land grant in the undesirable Mexican province known as Alta California. This was distant, rugged country – more of a troublesome liability than anything else, in the eyes of the sophisticated elites in Mexico City. What the government needed was men to manage the land and maintain order in the surrounding areas. Just about anyone would do, so long as they were Mexican and capable.

This was the Rancho system, and it was how the Mexican government distributed its abundant supply of Californian land to individual citizens. Every piece of Southern California was parceled off this way – a patchwork quilt of 10,000-acre ranches implemented as the best means of maintaining order over this vast and unruly terrain.

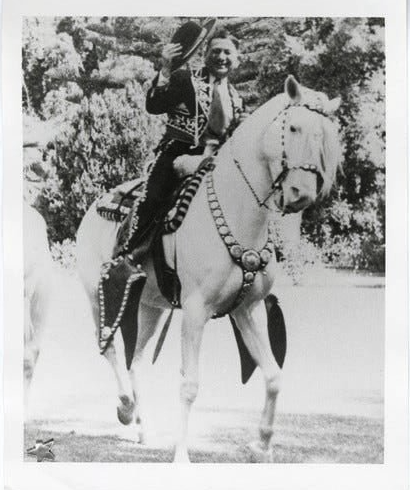

In the 150 years since, the Camarillo family has presided over the development of their raw land into productive farmland. They fostered a community that turned into a thriving town. They generously granted land to begin Ventura County’s school system, to connect Ventura to Los Angeles via highway, and to establish a theological seminary. The Camarillo family’s dedication to civic development even resulted in the patriarch being knighted by the Pope. Similarly, the family’s dedication to preserving and celebrating the region’s Mexican heritage and ranching roots led to the family’s horse breed being officially designated as the Camarillo White.

As the 20th century brought incredible change to Southern California, suddenly the Camarillo ranch became valued more for its real estate development potential than for its bountiful avocado crop. This tract of land that cost Juan Camarillo $3,000 in 1876 (150 ounces of gold) has grown to be worth ~$1m/acre – you can do the math.

It’s a story of enviable generational wealth (tarnished only by the inevitable family drama between dozens of direct descendants & the unwelcome toll reaped from each generation via U.S. inheritance tax). In fact, you should feel jealous of what Juan Camarillo secured for his family – you’d be crazy not to.

We feel that jealousy, and yet not for a second do we feel it unfair that Juan Camarillo acquired this Rancho while we did not.

Instead, we accept that Juan Camarillo was at the right place at the right time. More importantly, we recognize that he was of value to the Mexican government – they needed a steward, he was up for the task. It didn’t matter that the land would eventually become very valuable – what they needed was loyalty and order in the here and now, when the land was nothing more than a distant, undeveloped, and undesirable outpost of Mexican power.

It’s easy to see how early adopters of real estate on some forbidding frontier earned their wealth, even if it was only by being early and willing to risk ruin. We also have little trouble celebrating early investors in Amazon or Google or Apple for their foresight and daring to bet on a bold vision of the future. And yet, many people seem unwilling or unable to grant the same recognition to early Bitcoin adopters. When it comes to Bitcoin, the broader public is quick to label early adopters as somehow lucky for the riches they didn’t seem to earn. In truth, I think this is for three main reasons.

First, with Bitcoin, it’s hard to separate the jealousy we feel towards large holders from our judgments about what is fair and what is not. This is partly because the wealth gained by very early Bitcoin adopters is so painfully extraordinary, but also partly because it’s a new asset and so we have yet to learn to accept that some people have benefited more from it than others (as is the case with every existing asset class). But if we’re being honest, a great deal of this is because we are mad at ourselves – furious to have missed out on Bitcoin when we first ignored it at less than $100 per coin.

In order to get through this bitter regret, you have to forgive yourself. You have to forgive yourself for having been wrong when you wrote Bitcoin off, for missing out on buying earlier. Only then can you realize the scale of the opportunity that is still in front of you right now. Yes, you missed out on early Bitcoin mega-wealth, but don’t let that cause you to miss out on seizing ample financial freedom and family prosperity. We all miss it at first – forgive yourself, and then thank yourself for finding Bitcoin as early as you have!

Second, when it comes to Bitcoin fortunes, we too easily project our own notions of what it means to have fairly earned wealth. Bitcoin doesn’t care how we think wealth should be earned; it only cares about what it needs to survive. Early on when its success stood on a knife’s edge, what Bitcoin cared about was whether people decided to accumulate and hold Bitcoin (or contribute hashpower to the network). That was it. And early on, this meant putting in some time and energy to mine or otherwise acquire coins that were utterly without value. When the network effect was essentially nonexistent, Bitcoin desperately needed adopters to help bootstrap that network effect into existence. It was all-or-nothing for Bitcoin. And in that sense, those early Bitcoin adopters earned their handsome slices of Bitcoin’s total supply, even if from a casual observer’s point-of-view, they didn’t appear to do much at all.

Finally, some people have a misplaced worry that Bitcoin’s finite supply means permanent unfairness in terms of distribution of wealth. When I was deep in the Bitcoin rabbit hole and most of the way to the Bitcoin epiphany, the last major mental block that popped up was this fear and sadness that Bitcoin’s finite supply meant that the earliest adopters would be the new financial elite in perpetuity. This was a dark thought – a dystopian sci-fi trope that cast a grim shadow on this too-good-to-be-true digital currency. If I’m honest, I’m not sure how much of my concern was truly fear for what permanent centralization of wealth would mean for the world vs. fear that I had missed my chance to be in that permanent elite. At any rate, it spoiled my budding excitement about Bitcoin for months – it made Bitcoin feel unfair, not in its issuance of coins, but in the potential permanence of its wealth inequality.

Thankfully, this fear was naïve. The answer, for me, lay in the past – in the stories of frontier real estate fortunes like Juan Camarillo’s. When you look at the map of Southern California, how many 10,000-acre Ranchos do you see? They’ve all been parceled off over the generations into cities and towns and real estate developments. The owners and heirs of the California Ranchos traded in pieces of their kingdoms in exchange for other assets – some for portfolio diversification, but some for personal consumption. Inevitably, the wealth generated from these Ranchos was distributed in time, whether partly or entirely.

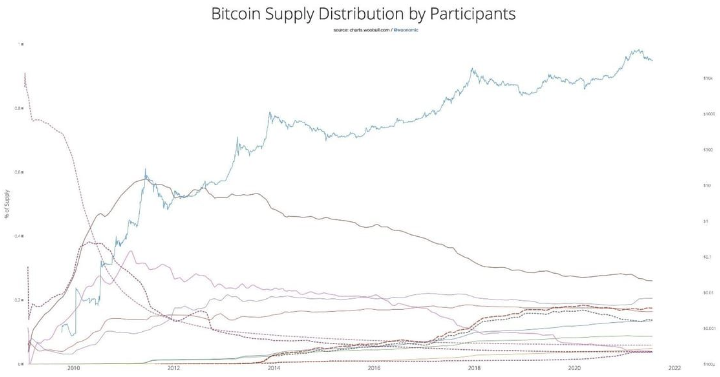

The same dynamics will play out on the Bitcoin frontier. Early holders will sell part of their holdings in order to purchase houses, fund businesses, or diversify their portfolios. In fact, there’s clear evidence that this trend is already underway.

Ultimately, it doesn’t matter whether you think Bitcoin’s wealth distribution is fair or not. All that really matters is whether you decide to secure some acreage for the benefit of your family and its future generations, as Juan Camarillo did. It’s the same story now as it was then – only this time, the frontier is digital value… and you’re here early.

Stake your claim.

Onramp provides guidance and solutions for HNWI and institutional-level Bitcoin buyers and holders. To learn more, visit onrampbitcoin.com or schedule a consultation to chat with us about your situation and needs.