4/11/24 Roundup: GBTC Outflow Analysis & Gold's Breakout

Onramp Weekly Roundup

Written By Zack Morris

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

And now, for the weekly roundup…

- A closer look at GBTC structural selling & impact on bitcoin price

- Gold now outperforming S&P 500 over last 5 years

GBTC Outflow’s Impact on Price

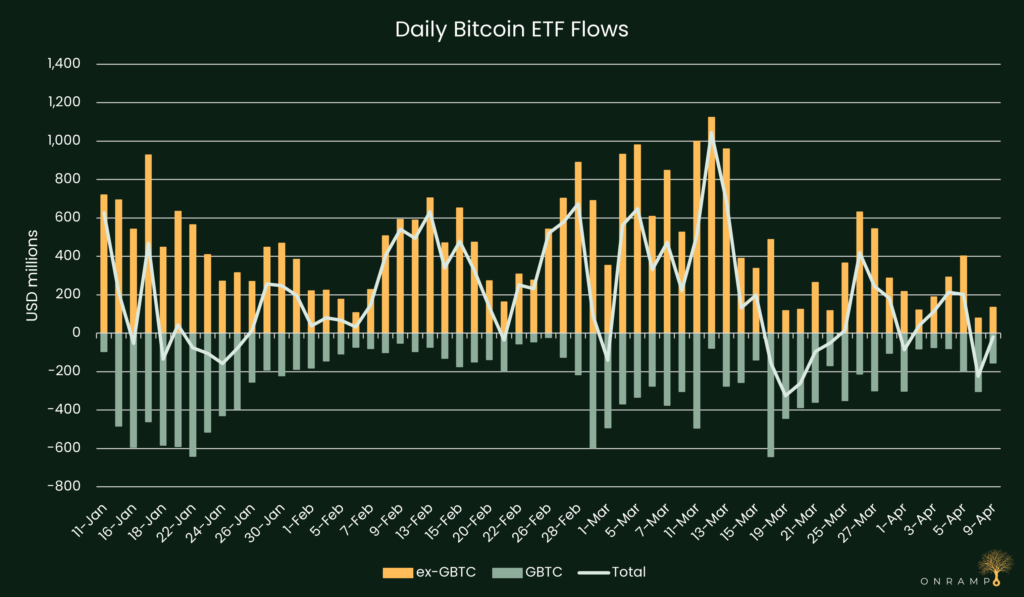

We are now 90 days post launch of spot bitcoin ETFs, and GBTC has seen a net outflow on every single day:

This begs the question, how long can it continue?

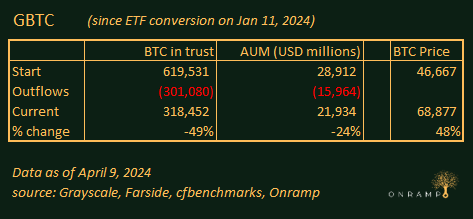

Amazingly, despite losing 49% of bitcoin in trust since ETF conversion, GBTC’s AUM in dollar terms has only fallen by 24% given the 48% rally in the bitcoin price:

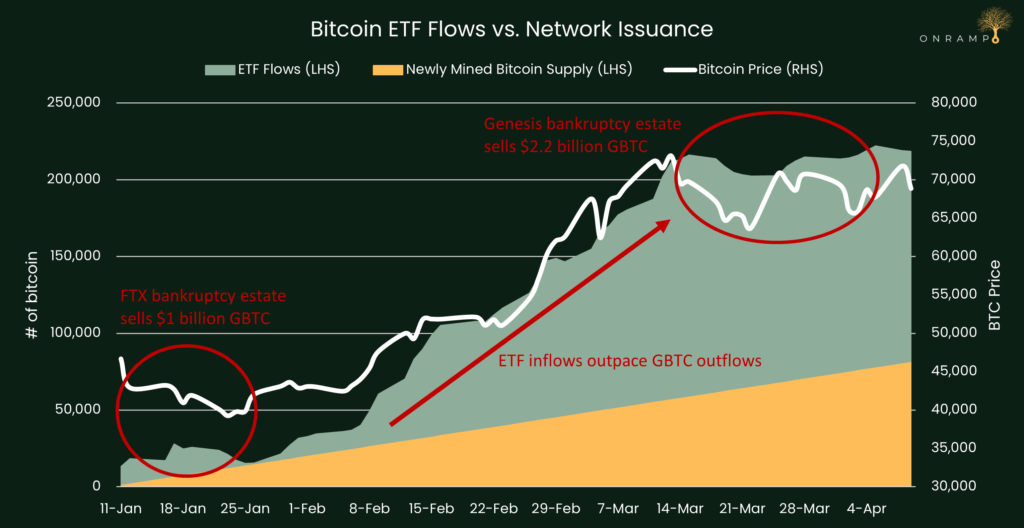

We can’t know how much of the net selling in GBTC is turning around and buying the other ETFs.

But, we do know that there have been two large, structural sellers of GBTC that were not turning around and buying the other ETFs — the FTX and Genesis bankruptcy estates.

Coindesk reported on Jan 22 that FTX had finished selling about $1 billion in GBTC, and more recently on April 5 that Genesis had finished selling $2.2 billion in GBTC.

A closer look at the chart of net bitcoin ETF flows suggests that these periods of GBTC bankruptcy liquidations have coincided with the weakest periods of total bitcoin ETF complex net inflows:

These periods have also coincided with weakness in the bitcoin price (although, it is worth noting that Genesis reportedly bought bitcoin with the proceeds from the GBTC sale, which ought to be price neutral to bitcoin).

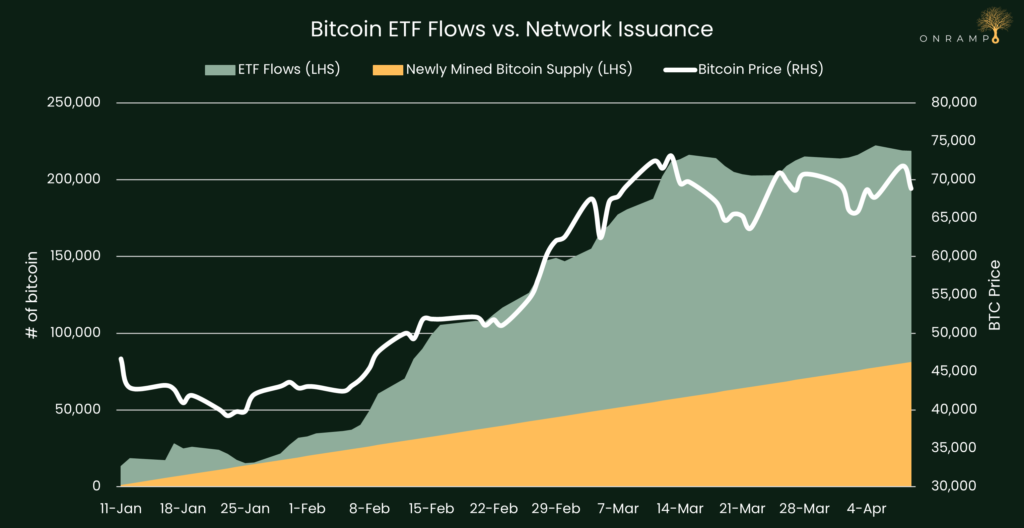

Can most of the bitcoin price performance be explained by net ETF fund flows?

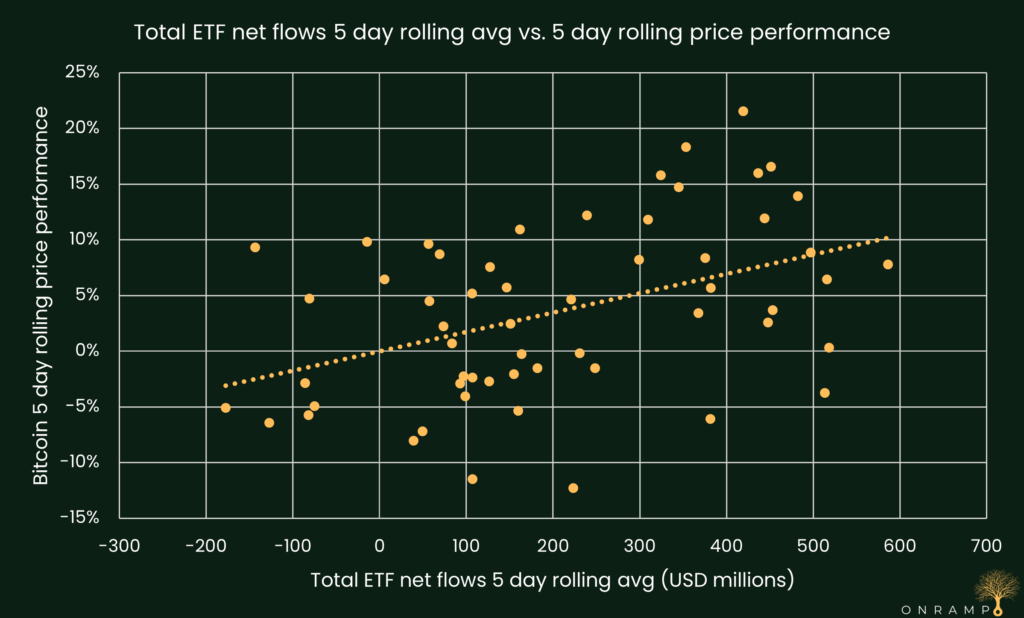

We took a look at the correlation between 5 day rolling average ETF flows and 5 day rolling bitcoin price performance:

The data have a modest positive correlation r = 0.43 and a coefficient of determination r-squared = 0.19, suggesting that about 19% of the variation in the rolling 5 day price performance of bitcoin can be explained by the trailing 5 days of ETF flows.

There are certainly other factors at play here, but with no more known structural sellers of GBTC, we will see if net ETF flows pick back up and with them, price performance.

Gold Now Outperforming S&P 500 Over 5-Year Period

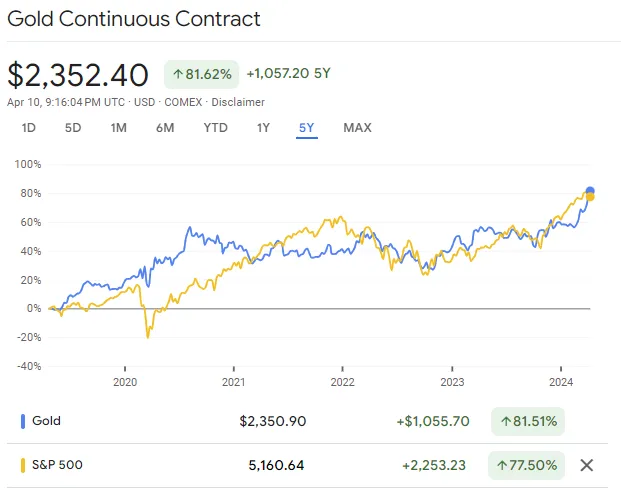

A symbolic threshold was passed this week when gold’s 5-year performance eclipsed that of the S&P 500:

Significantly, gold’s outperformance over the past 5 years didn’t come during a bear market for stocks.

Both asset classes are up handsomely over the period, which spans the March 2020 covid crash, subsequent easy-money rebound, and the interest rate hiking cycle of the past two years.

Since Nixon left the gold standard in 1971, there have been two market regimes where gold has outperformed the S&P 500 over a rolling 5-year period: 1972-82 and 2002-12.

The 1970s were marked by stagflation and were the last time we battled high inflation in the US. The gold price was also playing catch up after being pegged at $20.67/oz since the Gold Standard Act of 1933.

The ‘02 – 2012 period was marked by the dot-com crash and global financial crisis, a period during which the S&P 500 went nowhere for 13 years.

Today, gold’s 5-year outperformance vs. stocks comes even as the S&P 500 sits at an all-time high.

If the outperformance continues and history repeats, gold is signaling either that high inflation is here to stay, stocks may be setting up for an extended period of low returns, or both.

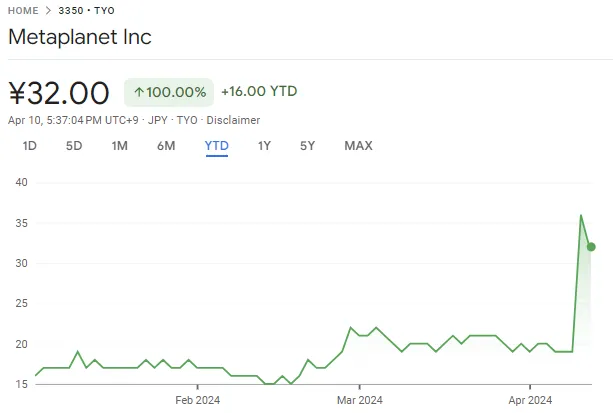

Chart of the Week

Japanese microcap stock Metaplanet — a former budget hotel operator turned web3 software developer — rallied 89%, tacking on $13 million of market cap on Tuesday, after announcing they had acquired $6.5 million in bitcoin as part of a new bitcoin strategy.

Quote of the Week

“We’ve had banks reach out to us to try to buy our Bitcoin because of the supply shortages on these different exchanges … the largest banks you can think of.”

— Asher Genoot, CEO of Hut 8

Market Update

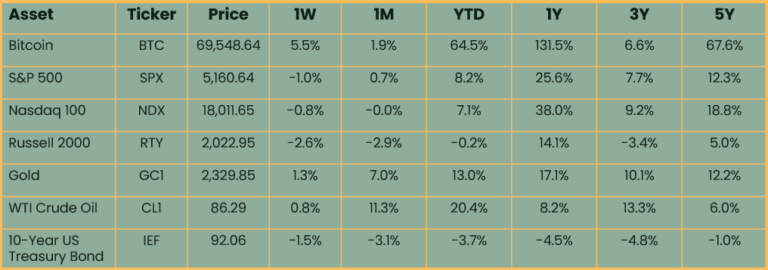

as of 4/10/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Hard assets bitcoin, gold and crude rallied on the week while stocks and bonds fell. Bitcoin was the best performer, staging an impressive rally on Wednesday after initially falling in reaction to a hotter-than expected CPI print which weighed on all assets. CPI was a reported 3.4% year over year vs. expected 3.3%, stoking fears of a rebound in inflation and contributing to the weekly decline in stock indices. Gold gave back some recent gains but still sits near new all-time highs and held on to a 1.3% gain for the week. As mentioned, gold has now performed in-line with the S&P 500 over a 5-year period for the first time since 2012. Bonds sold off as the 10-year US treasury yield rose back above 4.5%.

Podcasts of the Week

The Last Trade E045: A Generational Reckoning with Jackson Mikalic

In this episode of The Last Trade, Jackson Mikalic, Onramp’s VP of Business Development joins the pod to discuss gold ripping to all-time highs, the looming debt spiral, bitcoin as a generational reckoning, bitcoin versus crypto, & more.

Scarce Assets E007: Alex Gladstein – Bitcoin is a Global Life Raft

In this episode of Scarce Assets, Alex Gladstein, Chief Strategy Officer of the Human Rights Foundation, joins the pod to discuss sound money & energy as the keys to freedom, the financial privilege of (relatively) stable currencies, incentivizing energy production, the undeniable societal benefits of bitcoin & more.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris