4/19/24 Roundup: Bull Market Drawdowns

Onramp Weekly Roundup

Written By Zack Morris

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

And now, for the weekly roundup…

- An analysis of bitcoin bull market drawdowns

- Hong Kong spot bitcoin ETFs approved, launch imminent

- Ethereum debates change to monetary policy

Bitcoin Drawdowns During Bull Markets

After setting a new all-time high of $73,836 on March 13th, bitcoin recently fell as low as $59,648 for a peak-to-trough drawdown of 19.2%.

We take a look back at the last two bitcoin bull markets to see how common a 20%+ correction has been on the path from a break of previous all-time highs to the setting of new all-time highs.

In January 2017, bitcoin broke through its previous all-time high of $1,134 on its way to setting a new all-time high in December, 2017 of $19,892.

During that 11 month run, bitcoin experienced 8 drawdowns of 20% or more, including one immediately upon breaking the previous ATH as we are experiencing now:

In December, 2020, bitcoin broke through its previous all-time high of $19,892 on its way to setting a new all-time high in November, 2021 of $69,000.

During that 11 month run, bitcoin experienced 4 drawdowns of 20% or more:

So, as history shows us, 20%+ bull market drawdowns are not uncommon.

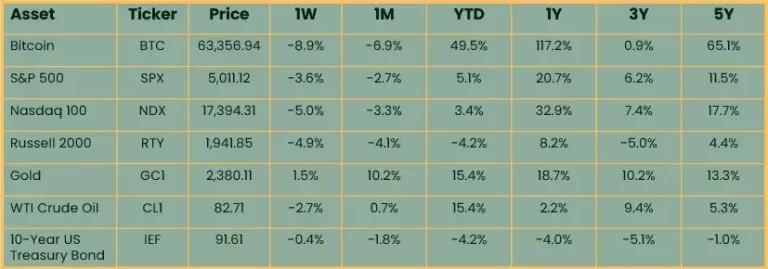

Bitcoin’s recent fall from fresh all-time highs has been accompanied by the same in stocks as the US 10 year yield has surged 72 bps year-to-date to 4.67%. Meanwhile, despite the rise in bond yields, gold and other commodities continue to hover around all-time highs as inflation expectations have increased.

This suggests that, in the short-term, bitcoin remains more correlated with financial liquidity conditions and long-duration risk assets, rather than traditional inflation hedges.

Spot Bitcoin ETFs Coming to Hong Kong

On Monday, Bloomberg Senior ETF analyst Eric Balchunas posted on X that Hong Kong listed spot bitcoin ETFs “have been approved to exist but not launch (yet). Rumor has it launching next wk so to not compete w the Dubai conf.”

Balchunas, however, cautions investors to not expect anywhere near the flows of the US ETFs, citing Hong Kong’s relatively small equity ETF market (only $50 billion, compared to $7.19 trillion in the US), and the fact that mainland Chinese locals are not expected to be allowed to purchase the funds initially. China and Hong Kong have a program called Stock Connect whereby mainland Chinese investors can access HK-listed securities and Hong Kong domiciled investors can access mainland China securities, subject to approvals and quotas.

In addition, the three ETF providers that have received approval (Bosera, China AMC, Harvest) are relatively small players; there are no large, global players such as BlackRock or StateStreet involved.

However, one can look at the gold ETF market in Hong Kong and China and possibly arrive at a different prediction for the success of HK-listed bitcoin ETFs.

The World Gold Council reports that Chinese gold ETFs ended 2023 with $4 billion in AUM, their highest ever. Additionally, the world largest gold ETF with $63 billion in assets, State Street’s GLD, is cross-listed in Hong Kong (2840 HK), is allowed to be purchased and held by mainland Chinese investors through Stock Connect, and it is indeterminable what percentage of the fund’s assets are accounted for by US investors vs. Hong Kong or China investors.

BlackRock’s IAU, the second largest gold ETF, has $29 billion in assets and is only traded in the US.

So, while the overall equity ETF market in Hong Kong and China is only a fraction of the size it is in the US, the gap in the size of the gold ETF market is much smaller, signaling a relative investor appetite for monetary store-of-value alternatives outside of the local currency. Indeed, there have been reports out of China recently of huge crowds of consumers lining up to buy gold jewelry every chance they get as Chinese stock and real estate markets suffer.

Is it possible that a country with strict capital controls and a failing stock and property market has given rise to a citizenry that understands the value of gold and bitcoin on a more visceral level than their western counterparts? We will get a peak into latent demand for bitcoin exposure in a country where bitcoin trading and mining is still illegal if and when the HK-listed bitcoin ETFs are approved for mainland Chinese investment.

Ethereum Debates More Changes to Monetary Policy

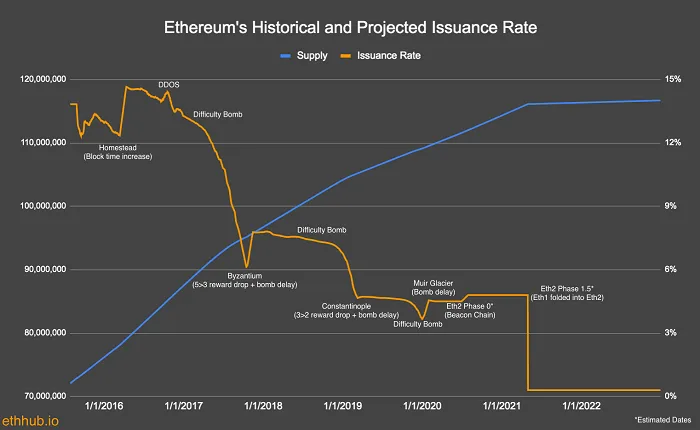

The Ethereum community is once again debating changes to ETH monetary policy amid concern over a growing issuance rate. ETH is the second largest cryptocurrency by market cap, behind bitcoin.

Various staking innovations enabled by Ethereum’s transition to proof-of-stake have led to increased demand to stake ETH. As new ETH is issued to stakers, this increase in the staking rate has led to an increase in new issuance. As a result, researchers from the Ethereum Foundation have proposed putting a limit on annual new ETH issuance.

ETH’s monetary policy has been altered several times in its history, most recently with the merge from a proof-of-work to proof-of-stake consensus model in 2022. The below chart illustrates the change in ETH’s annual issuance rate over time:

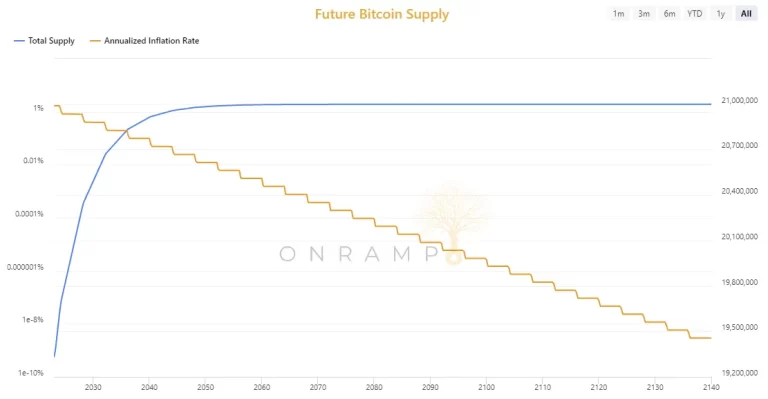

Compare this to bitcoin:

It remains to be seen if the current proposal will be accepted and implemented, changing ETH’s monetary policy once more, but it doesn’t really matter.

What matters is that it has been changed many times before, and the current proposal serves as evidence that it can again, like the Fed changing the interest rate based on employment and inflation.

ETH’s monetary policy is definitionally unpredictable, and is heavily subject to the whims and desires of their management team (The Ethereum Foundation) and their founder and CEO, Vitalik Buterin. It is not credibly neutral.

In contrast, bitcoin’s monetary policy has never changed, bitcoin is credibly neutral, and governance over the protocol is truly decentralized.

Decentralized, secure, predictable, apolitical. Bitcoin’s attributes are unique among cryptocurrencies.

Chart of the Week

Gold (left-hand side) vs. US 10 year real rates (right-hand side, inverted), courtesy of ZeroHedge:

Gold historically has been negatively correlated with real rates (nominal interest rate minus inflation). When real rates go up, gold goes down, and vice-versa. Before the current market, previous gold all-time highs have coincided with periods of zero nominal rates and negative real rates in the aftermath of the GFC and COVID.

Today, gold is surging to new all-time highs despite the highest real interest rates in 15 years, suggesting either the market is anticipating a crash in real rates, or the historical correlation has broken down for other reasons and we are in a new market regime.

Quote of the Week

“The reason that we have this failed fiat experiment that has impoverished our nation is because of the defects of gold. The fact that it’s not easily portable. It’s not easily verifiable. It doesn’t offer instant, final, global settlement. And so you know what? Centralized authorities hijacked it, they papered over it, and we have a system of leverage and rehypothecation that hurts the working class. Bitcoin is immune to all of that. It is the savings account for billions of people that we really need and can most rely on.

Gold is the analog version of sound money, but bitcoin is the digital version and that’s why it’s going to be the faster horse in this race.”

— Natalie Brunell, debating with Peter Schiff on Fox Business April 15, 2024.

Market Update

as of 4/18/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Bitcoin led all risk assets lower on the week as escalation between Iran and Israel over the weekend stoked fears of a larger conflict. The stock market continues to try and find its footing after a hot CPI print last week sparked concern of a second wave of inflation. Bank reserves likely fell as US taxes were due on April 15, removing liquidity from the system on net. Gold, up 1.5%, was the best performing asset on the week as it held all-time highs. Despite the conflict in the Middle East, oil fell as the Biden Administration announced they may further drain the Strategic Petroleum Reserve to keep a lid on gas prices. Bond yields continued their year-to-date ascent, with the US 10 year rising to 4.59%.

Podcasts of the Week

The Last Trade E046: Bitcoin Fixes Real Estate with Leon Wankum

In this episode of The Last Trade, author & investor Leon Wankum joins the pod to discuss bitcoin’s store-of-value properties, real estate’s eroding monetary premium, bitcoin’s role in real estate development, structured credit, pristine collateral & more.

Scarce Assets E008: Samson Mow – Why $1M BTC Could Happen This Cycle

In this episode of Scarce Assets, Samson Mow joins the pod to discuss nation-state bitcoin adoption, use cases for governments, ETFs & adoption in China, forecasting the “suddenly” phase, bull market factors, the decline of fiat & more.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris