4/4/24 Roundup: Bitcoin 1Q24 Results

Onramp Weekly Roundup

Written By Zack Morris

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

And now, for the weekly roundup…

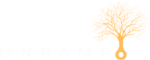

Bitcoin 1Q24 On-Chain Results

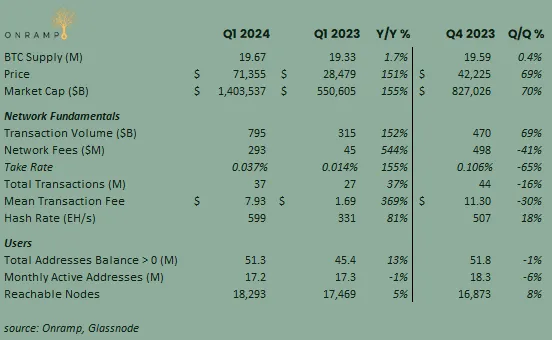

Adoption, as measured by total on-chain addresses with a non-zero balance, increased 13% year-over-year to 51.3 million:

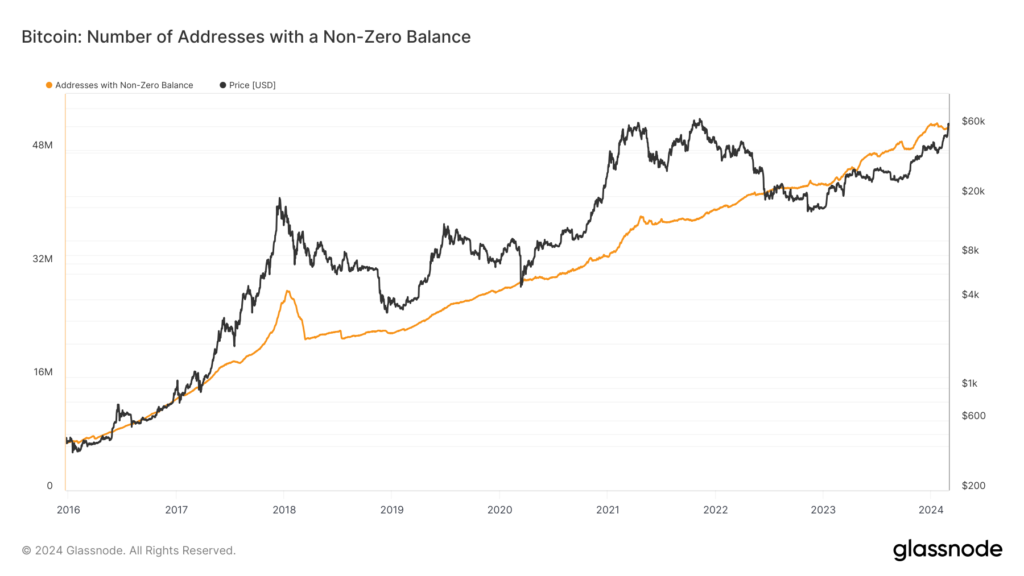

Decentralization, as measured by reachable nodes, increased 5% to 18,293. Reachable nodes hit an all-time high of 18,572 during the quarter:

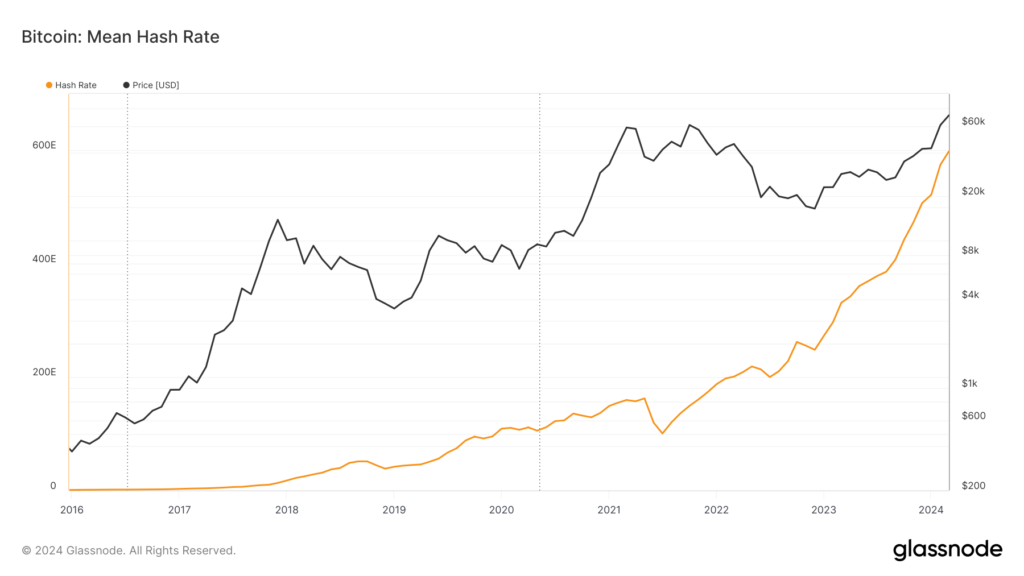

Security, as measured by hash-rate, increased 81% to an all-time high of 599 EH/s (exa-hashes per second) to end Q1:

Adoption, decentralization, and security are perhaps the three most important Bitcoin fundamental indicators to monitor. Bitcoin, like any monetary system, is a network, and the value of any network grows exponentially as users are added to the network.

As illustrated by the charts above, users and hash-rate have increased almost without interruption during Bitcoin’s 15 year history, through both bull and bear markets. Still, that we’ve only just crossed over 50 million addresses shows how early we still are on the adoption curve for a global monetary network.

So long as Bitcoin remains decentralized and secure, one can find confidence in continued future adoption.

Network Transaction Volume Picks Up Amid Price Rally

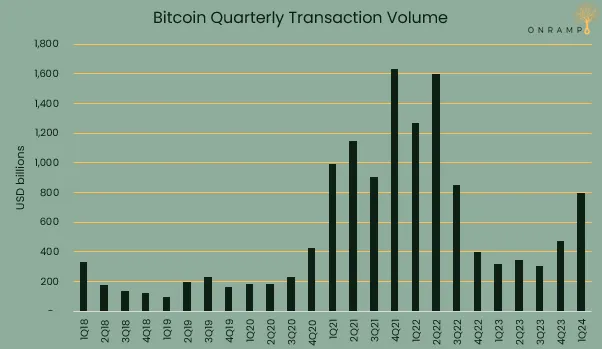

One noticeably lagging on-chain fundamental metric in 2023 was total transaction volume. In Q1, however, on-chain volume bounced back to $795 billion, an increase of 152% year-over-year and 69% sequentially. It was the largest quarter of on-chain volume since Q3 2022.

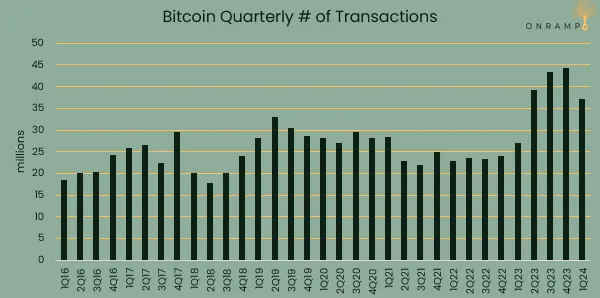

Total number of transactions fell sequentially, however, likely due to waning enthusiasm in ordinals and inscriptions, which drove the increase in on-chain transactions in 2023.

Despite the drop-off from last quarter, transactions still increased 37% year-over-year.

Chart of the Week

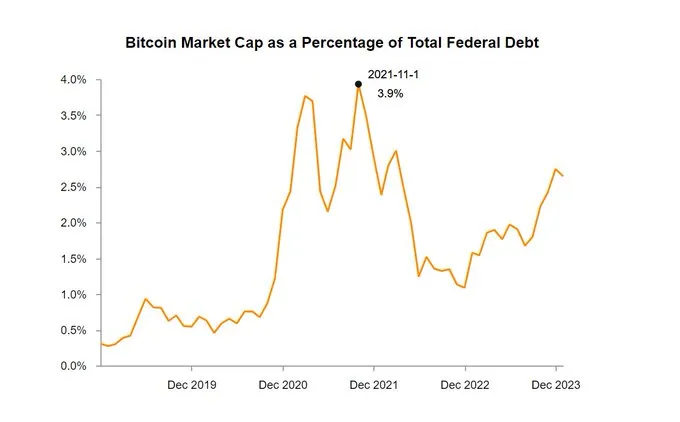

Courtesy of Pierre Rochard on X:

Similar to how bitcoin has not yet set a new inflation adjusted all-time high, nor has it yet set a new all-time high as a percentage of total federal debt. It is a reminder that while we use the USD as our unit of account, it is a measuring stick which is always changing in size.

Quote of the Week

“Most of the problems that people attribute to deflation, are instead about debt building up during periods of structural inflation and then experiencing one big catastrophic period of deflation as that all gets exhausted.

They then consider deflation itself to be bad.”

Market Update

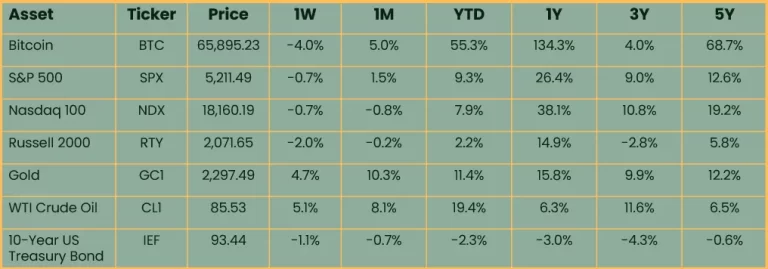

as of 4/3/24:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Bitcoin fell 4% on the week as the market continues to digest the Q1 rally to new all-time highs. Stocks fell as rates ticked higher. Gold continued its breakout to new all-time highs. Oil rallied above $85 a barrel, a level last seen last October. It is now the 2nd best performing asset class year-to-date behind bitcoin.

Podcasts of the Week

The Last Trade E044: Bitcoin Mining’s Next Epoch with Bob Burnett

In this episode of The Last Trade, Bob Burnett, Founder & CEO of Barefoot Mining, joins the pod to discuss advantages of small-scale bitcoin mining, capital efficiency & vertical integration, the scarcity & value of block space, the evolution of fee markets & more.

Scarce Assets E007: Alex Gladstein – Bitcoin is a Global Life Raft

In this episode of Scarce Assets, Alex Gladstein, Chief Strategy Officer of the Human Rights Foundation, joins the pod to discuss sound money & energy as the keys to freedom, the financial privilege of (relatively) stable currencies, incentivizing energy production, the undeniable societal benefits of bitcoin & more.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris