12/21/23 Roundup: Bitcoin ETF Mechanics & Tradeoffs

Onramp Weekly Roundup

Written By Zack Morris

Onramp is thrilled to introduce Zack Morris, our new Research Analyst, as a fresh voice of the Weekly Roundup.

Zack brings a wealth of knowledge from his seven-year tenure at BlackRock, where he excelled as an analyst and portfolio manager across various asset classes. In addition to his prior experience across investment management, private equity, audit and accounting, Zack has studied bitcoin since 2013.

You can find Zack’s past content and analysis on his Substack, or his X profile.

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

And now, for the weekly roundup…

Cash vs. In-Kind Model

As we draw nearer to the SEC’s January 8-10 approval window for a spot bitcoin ETF, it appears final details are being ironed out between fund sponsors and the SEC.

The detail that generated some buzz over the past week was fund sponsors capitulating to an apparently non-negotiable stipulation by the SEC that the ETFs allow only “cash” creations and redemptions initially, as opposed to the “in-kind” creation/redemptions the fund sponsors were previously seeking. BlackRock became the last of the fund sponsors to update their filing to allow for cash redemptions on 12/19/2023.

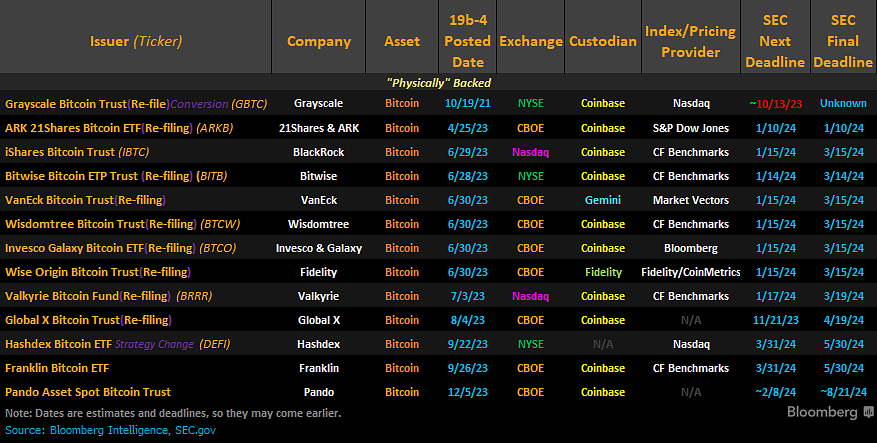

Here is the full list of fund sponsors seeking a spot bitcoin ETF approval, courtesy of James Seyyfart on X:

The cash vs. in-kind conversation highlights three questions for investors interested in bitcoin and the potential spot bitcoin ETFs:

- Why is the SEC demanding cash?

- Why do the fund sponsors prefer in-kind?

- What are the benefits and risks of holding shares of an ETF vs. self- or multi-signature custody?

SEC Wants “Cash”

When an ETF comes to market, Authorized Participants (APs) are able to either create new shares or redeem outstanding shares of the ETF, in exchange for either cash roughly equal to the Net Asset Value (NAV) of the fund, or an in-kind basket of securities or commodities which represent the fund.

When an ETF’s market traded price deviates from its NAV — the value of the underlying securities which make up a share of the ETF — the creation/redemption mechanism allows APs to arbitrage the difference. For example, if shares of the ETF are trading at a discount to NAV, an AP can go buy shares of the ETF in the market and sell them to the ETF sponsor at NAV (redeem them for the underlying securities), capturing the difference as profit.

This provides an economic incentive for APs to ensure the ETF always trades close to its NAV, and is one of many key features of the ETF wrapper that makes it an attractive, low cost investment vehicle for many investors.

It is assumed the SEC is requiring spot bitcoin ETFs to allow only cash create/redeems initially so that registered broker-dealers serving as APs don’t need to handle trading of bitcoin directly, which they’re currently unable to do given regulatory uncertainty on the matter.

Basically, it seems in-kind only would leave registered broker-dealers out of the game at this point due to their inability to trade bitcoin directly, but utilizing a cash only model allows them to participate and presumably strengthen the spot bitcoin ETF market microstructure and increase investor protections.

Sponsors Want “In-Kind”

ETF sponsors prefer in-kind creations/redemptions because it’s better for investors in terms of total cost of ownership.

Without getting too far into the weeds, a cash model requires fund investors to bear some costs that are borne by the APs and market makers under the in-kind model. Specifically, the trading costs of actually buying/selling the underlying bitcoin, as well as the price slippage in the time between when a creation/redemption is approved and then executed, will now be borne by investors under the cash model. This dynamic can cause the performance of the fund to deviate from the performance of the underlying asset(s), and compound over time.

Please read this thoughtful SEC comment letter or BlackRock’s own response to the SEC for more details on the investor benefits of the in-kind model.

Another key benefit of the in-kind model is tax efficiency for the APs. In-kind redemptions are a non-taxable event, whereas cash redemptions require the selling of spot bitcoin, creating a taxable event for the AP. In practice, this will effectively raise the discount to NAV that would entice an AP to redeem units, as the discount needs to be large enough to compensate them for timing risk and their tax burden.

Taken together, the various frictions inherent to the cash model will result in higher costs which will be passed along to the end investor in the form of higher fund fees, tracking error and a potentially larger discount to NAV.

Current Costs Associated With Acquiring Bitcoin

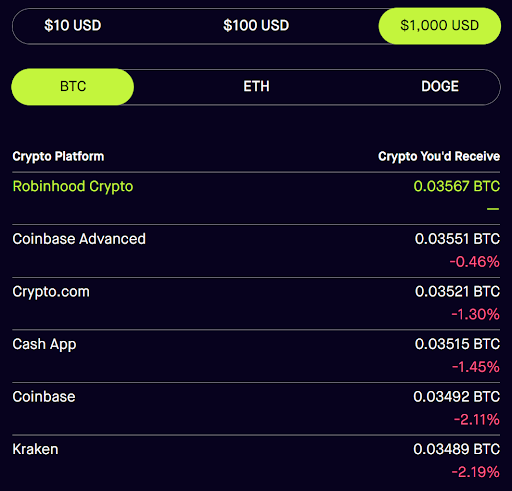

Even with an increase in costs associated with the cash model, the ETF is likely to be a lower-cost way to acquire bitcoin exposure than most of the options available to retail investors today.

The following graphic is from Robinhood’s website courtesy of Nate Geraci:

In addition, GBTC, the primary way today to get bitcoin exposure in a traditional brokerage account, has a 2% management fee and has traded at significant premiums and discounts to NAV in its history.

Despite the higher costs associated with the cash model, ETFs are still a low-cost wrapper, and a spot bitcoin ETF approval will bring more competition to the market for bitcoin exposure vehicles. With spot bitcoin ETF products available, the fees different platforms charge their customers for acquiring bitcoin will likely come down across the board.

Importantly, though, all of the options on the above graphic represent ways to acquire bitcoin with the option to send to an external address or take custody on-chain, while the ETF will only be a price exposure vehicle, with no way for end investors to take custody of their bitcoin.

Bitcoin ETF: What It Is, What It Isn’t

While some “bitcoin maximalists” will eschew and deride a spot bitcoin ETF, it is important to have some perspective on what it is and what it isn’t.

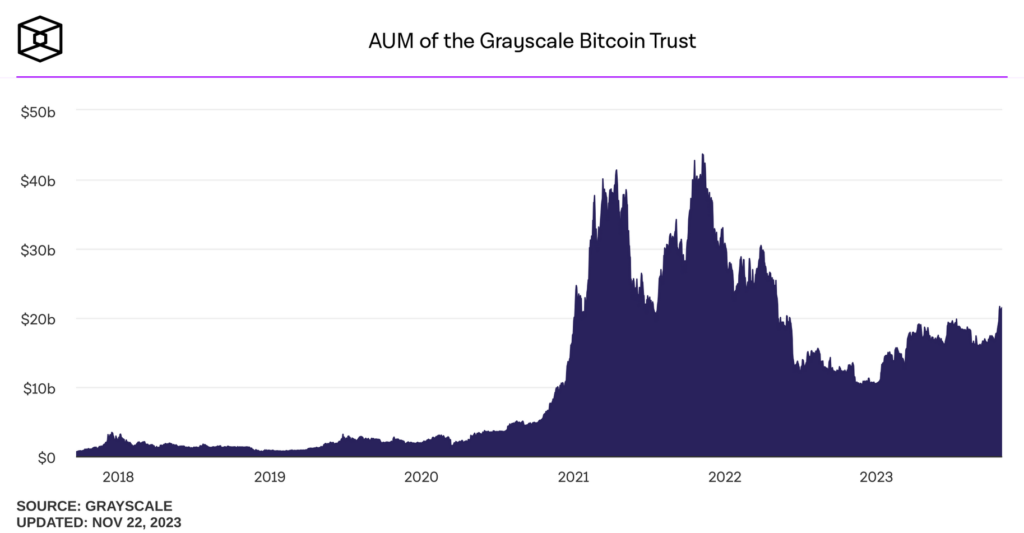

What it is is a relatively low-cost, accessible, price exposure vehicle for institutions and retail investors. It promises to be a far superior product to GBTC, a product that has amassed $24 billion in assets at current and over $40 billion at peak, proving the market demand for access to bitcoin in a fund wrapper.

Many investors’ primary or sole investment accounts are a traditional brokerage account and an IRA, and having access to a spot bitcoin ETF can be an important first step in their bitcoin journey.

With several ETFs on the market, bitcoin as an asset is going to have an army of investment advisors getting themselves up to speed, and in turn educating their clients. Public awareness and appreciation of bitcoin is likely to go up and to the right. This is a net good for the bitcoin ecosystem, and a necessary step on the long path to a potential global bitcoin standard.

Critics will point to the fact the ETF is just a paper claim on bitcoin, and choosing an ETF over self- or multi-signature custody centralizes custody of bitcoin among a few large institutions. Both of these are valid critiques.

Critics might also see the ETFs as potential honey pots managed by compliant institutions, able to be frozen and seized by threatened governments. Threat of government seizure is one risk factor among many for those who choose to hold bitcoin or bitcoin exposure, and each individual must assess the risks in relation to their own situation. For many, the risk of government seizure pales in comparison to the risk of mishandling their bitcoin while attempting to take custody on-chain, or losing their private key.

Like it or not, a bitcoin standard will require that bitcoin is integrated into every nook and cranny of our global financial system, and this includes being offered in an ETF wrapper.

What an ETF is not is a substitute for self- or multi-signature custody solutions, allowing individuals to assume direct ownership of, spend and use their bitcoin as they see fit.

Onramp’s multi-institutional custody solution and bitcoin investment fund offerings serve to bridge the best of both worlds.

With Onramp, clients get the low cost, ease of use and convenience of an ETF wrapper but with the ability to redeem and take custody of their bitcoin in-kind in a non-taxable way, along with the security and elimination of single points of failure that comes with multi-signature custody.

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris