2/29/24 Roundup: Dismantling Central Bank FUD

Onramp Weekly Roundup

Written By Zack Morris

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

And now, for the weekly roundup…

- European Central Bank doubles down on anti-bitcoin narrative

- Martti Malmi releases early email history with Satoshi

- MicroStrategy buys 3,000 more BTC

- Bitcoin ETF volume soars as price crosses $60,000

ECB FUD

Last week, the ECB published a blog post titled ETF approval for bitcoin – the naked emperor’s new clothes.

In it, the ECB doubles down on numerous critiques of Bitcoin in their blog post from November 30, 2022, published at the pico-bottom of the bear market.

I’ll give them credit for sticking their necks out in a less receptive market environment today, but, unfortunately, not much else.

The ECB levies several misleading or inaccurate claims that Bitcoin:

- is primarily used by criminals for illegitimate transactions

- transactions are inconvenient, slow, and costly

- is not suitable as an investment, since it has no cash flows or productive use

- is bad for the environment

- has sold out to Wall Street

Of course, their post on X got eviscerated in the community notes.

It is honestly exhausting to continue having to refute claims of this nature. I am reminded of Brandolini’s Law — the amount of energy needed to refute “FUD” is an order of magnitude bigger than that needed to produce it.

Alas, the very fact the European Central Bank is still espousing these claims is yet another reminder of how early we still are in most people’s journey to understanding and adopting Bitcoin.

I will briefly address the ECB’s claims one by one, with links to sources in the footnotes, should you wish to dive deeper.

“Bitcoin has failed on the promise to be a global decentralised digital currency and is still hardly used for legitimate transfers.”

The narrative that bitcoin is predominantly used by criminals is flawed and not supported by empirical data.

The fraction of bitcoin transactions associated with illicit activities has consistently been below 1% of all transactions since 2013, which was the year the Silk Road was shut down.1 This has equated to about $10-$30 billion per year.2

In contrast, the UN estimates that the annual amount of money laundered globally is 2-5% of global GDP, or $800 billion – $2 trillion.3

Bitcoin is open source, neutral, censorship resistant, and can be freely used by both good and bad actors. To criticize it for its use in criminal activity is akin to criticizing cash or the internet for the same and broadly misses the mark.

“Today, bitcoin transactions are still inconvenient, slow, and costly. Outside the darknet, the hidden part of the internet used for criminal activities, it is hardly used for payments at all.”

Bitcoin has a vibrant, layered approach to scaling transactions, anchored by the Lightning Network, whose speed and low cost enables micropayments that are not feasible on traditional fiat rails.

Bitcoin transactions settle every 10 minutes, in contrast to the fiat financial system standard of T+2 settlement.

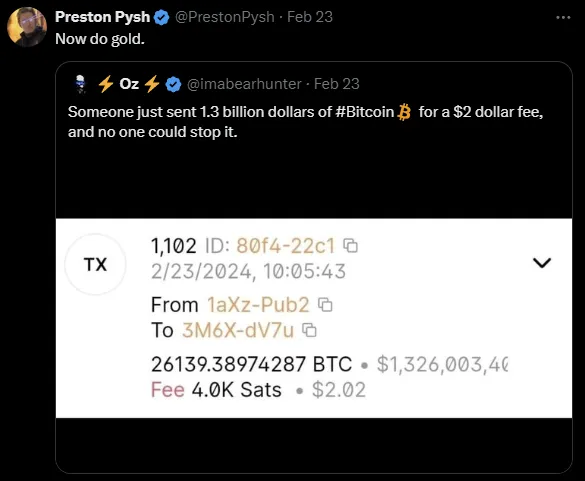

On the Bitcoin network, it costs a couple dollars to transfer an arbitrarily large amount of value. Compare this to the cost of shipping gold bars, the standard 6% transaction fee on buying or selling a house, the standard 10% commission on acquiring a piece of rare art, or the standard 5-10% fee on remittances.

Bitcoin is by far the cheapest way to transfer ownership of a significant amount of value globally.

“Bitcoin is still not suitable as an investment. It does not generate any cash flow (unlike real estate) or dividends (stocks), cannot be used productively (commodities), and offers no social benefit (gold jewellery).”

Bitcoin. Is. Money.

It is not a cash-flowing “productive asset.” You cannot analyze the discounted cash flows. You cannot eat it, and you cannot wear it.

Of course, money is notably absent from the ECB’s list, but surely not even they would deny the value of money.

As far as having no productive use, or offering no social benefit, myself, many Austrian economists, and empirical history would contend that having sound money at the economic base layer of society is indeed productive, and offers vast social benefit.

Bitcoin is open, accessible, permissionless, neutral, censorship resistant, global, digital, and scarce. If you’re not fortunate enough to live in a place where property rights, rule of law, and relatively low inflation are the norm, the social benefits of such an asset are quite apparent.4

“The mining of Bitcoin using the proof of work mechanism continues to pollute the environment on the same scale as entire countries.”

The conversation surrounding Bitcoin’s energy usage — like the conversation surrounding energy usage in general — is notably one-sided, always highlighting the costs but never considering the benefits.

It is easy to get baited into explaining how bitcoin mining utilizes a higher mix of sustainable energy than any country on earth,5 or how it’s providing an economic use for previously wasted natural gas that was being flared into the atmosphere,6 or how it’s helping to stabilize the grid and lower energy prices for consumers in Texas,7 or how it’s bootstrapping electrification efforts in Africa.8

And all of these things are wonderful, and true, and possibly make bitcoin the most environmentally friendly investment one can make.

But the larger point is that energy consumption is not bad. It is synonymous with human flourishing.9

Bitcoin provides a service that the world has decided is valuable. Like anything of value, it costs energy to produce or obtain.

Bitcoin’s energy usage is the very thing that keeps it decentralized and secure, which in turn are the very things that make it valuable. It is a feature, not a bug.

“It is incredibly ironic that the crypto unit that had set out to overcome the demonised established financial system should need conventional intermediaries to spread to a broader group of investors.”

When we say Bitcoin is open and permissionless, we mean it.

That means anybody can use it however they like, and nobody else can stop them.

Bitcoin does not have a board, or a CEO, trying to secure partnerships or designing a go-to-market strategy.

Bitcoin did not choose Wall Street. Wall Street chose bitcoin.

1 https://www.thecipherbrief.com/report-an-analysis-of-bitcoins-use-in-illicit-finance

2 https://www.chainalysis.com/blog/2024-crypto-money-laundering/

3 https://www.unodc.org/unodc/en/money-laundering/overview.html

4 https://bitcoinmagazine.com/culture/check-your-financial-privilege

6 https://crusoe.ai/energy/index.html

8 https://gridlesscompute.com/

9 Allen Farrington and Sacha Meyers, Bitcoin Is Venice, 222

Satoshi Emails Released

Bitcoin enthusiasts this week got perhaps the most significant addition ever to the archives of Bitcoin’s pseudonymous inventor.

Martti Malmi, an early collaborator on Bitcoin with Satoshi, released their email history on Github, covering a significant portion of their email correspondence between 2009-2011.

Pete Rizzo has a great thread on some of the most important findings. Some of the highlights include:

- Satoshi recognizing micropayments and spam denial as obvious, early use cases

- A comparison of bitcoin to gold

- Planning for the eventuality of the network scaling to 100,000 nodes

- Speculation that bitcoin would be less energy intensive than the banking system it could ultimately replace

- An unwillingness to label bitcoin an “investment” on the bitcoin.org website, for fear of sounding promotional

Saylor Buys More

MicroStrategy announced on Monday that it had purchased an additional 3,000 bitcoins for $155 million, bringing their total stack to 193,000 bitcoins worth about $10 billion.

After yesterday’s 10% rally in the stock, MSTR is now the 2nd largest stock in the Russell 2000 with a market cap of $16.3 billion.

The company had a market cap of $1.2 billion when it initiated its bitcoin strategy in August, 2020.

Record ETF Volume as Price Crosses $60,000

The US-listed spot bitcoin ETF complex traded $7.7 billion in volume yesterday, amid a surge in price to as high as $64,000.

The volume figure sets a new record, eclipsing the $4.7 billion in volume from the first day of trading.

BlackRock’s IBIT alone saw a record $520 million inflow on Tuesday, taking in the second most money of any ETF in the market, behind only their own S&P 500 ETF, IVV.

The daily inflows on Tuesday of ~10,000 BTC are over 11x current daily issuance to miners of 900 BTC.

Daily issuance to miners is set to fall to 450 BTC in April at the halving.

Chart of the Week

courtesy of Crypto Zombie on X

Investors are replacing gold ETFs with bitcoin ETFs in their portfolios.

Quote of the Week

“Until now, no scarce commodity that can be traded over a communications channel without a trusted third party has been available. If there is a desire to take up a form of money that can be traded over the internet without a TTP, then that is now possible.”

— Satoshi Nakamoto, Malmi email archives, May 3, 2009

Market Update

as of 2/28/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Bitcoin is the story of the week with the price surging over $60,000, now just 11% shy of all-time highs, after rallying nearly 20% in a week on the back of increasing ETF flows. It is by far the best performing asset class in our universe year-to-date and over the past year. Large cap equity indexes fell slightly while the small cap Russell 2000 rallied 1.3%, driven by a short covering rally and outperformance from MicroStrategy, which is now the 2nd largest stock in the index. Gold and bonds rose 50 bps; crude was flat.

Podcasts of the Week

The Last Trade E039: Institutionalizing Bitcoin with KPMG

In this episode of The Last Trade, Brian Consolvo & Seong-Kwan Hong from KPMG join hosts Marty Bent, Jesse Myers, and Michael Tanguma to discuss their report on bitcoin’s positive environmental and social impacts, innovations in accounting, custodial best practices, institutional adoption, & more.

Final Settlement E003: Rearchitecting the Internet with David King

In this episode of Final Settlement, technologist, entrepreneur & investor, David King joins hosts Brian Cubellis and Michael Tanguma to discuss the evolution of the internet, open vs closed systems, bitcoin as a foundational layer on which to build, the promise of protocols like Nostr, & more.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris