3/21/24 Roundup: Parsing Policy Decisions

Onramp Weekly Roundup

Written By Zack Morris

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

And now, for the weekly roundup…

- Japan Ends Era of Negative Interest Rates

- Fed Holds Rates Steady But Strikes Dovish Tone

- MicroStrategy Accumulates >1% of 21 Million

BoJ Hikes Interest Rate For First Time in 17 Years

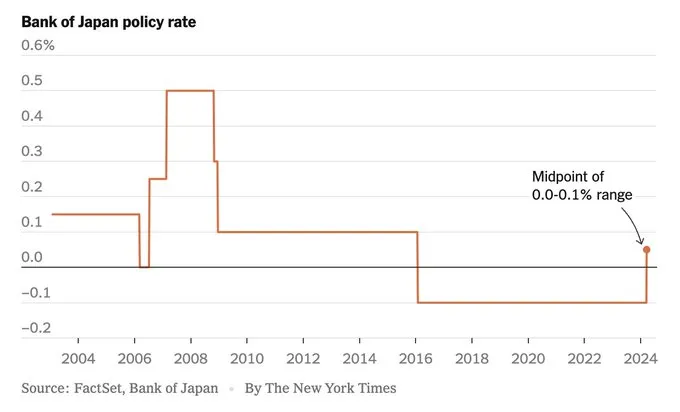

The Bank of Japan kicked off a busy week of global central bank policy announcements by raising its policy rate for the first time in 17(!) years.

The hike from -0.10% to a range of 0% – 0.10%, while perhaps more symbolic than impactful for markets, does signify the end of the last negative interest rate globally after a decade in which Japan and much of Europe had negative interest rates for extended periods.

The modest hike in interest rates by BoJ Governor Kuzuo Ueda comes amid signs of inflation in Japan returning to a 2% level, a target that led Japan to conduct the most aggressive monetary stimulus in history while trying to achieve. As of a year ago, the BoJ held greater than 53% of all outstanding Japanese Government Bonds (JGBs), and they also currently hold about 7% of the total Japanese stock market via ETFs.

In their latest policy decision, the BoJ said they would maintain buying JGBs but stop buying equities.

Japan’s largest labor union recently scored a 5.28% wage hike, the largest since 1991, and officials hope this kicks off a long sought after wage-price spiral. Wages have largely flatlined in Japan since the stock market bubble peak in 1989, which was finally just reclaimed this year after 34 years.

What might this all have to do with bitcoin?

For one, it’s a reminder that bitcoin is a global asset and is sensitive to global liquidity conditions, not just the actions of the Federal Reserve.

Secondly, studying Japan may prove to be a useful guide in anticipating the evolution of Chinese, European and US monetary policy. Japan’s demographic cliff leads China and Europe by maybe a decade or two, and it seems that all the monetary stimulus in the world was not enough to break them out of the deflationary bust that ensued after the 1989 stock market blow-off top. And while at home many think the US is on an unsustainable fiscal path, and they might be right, Japan’s debt-to-GDP of 247% is double that of the US’s currently, and the BoJ as mentioned holds more than half of Japan’s national debt, while the Fed “only” holds about 15% of the US’s $32 trillion national debt.

As such, Japan is an instructive study on how far certain measures in the economy can be stretched (at least in one instance) in practice and not just theory.

Finally, we can contrast Japan’s long sought after wage-price spiral with the Fed’s intense desire to avoid that very thing here at home. It is an example of how central bankers are always seeking to manipulate the economy in one way or the other, over-correcting for past errors, striving for some inflation (but not too much!).

Bitcoin’s monetary policy comes with no such oscillations and unpredictability. The only “manipulation” of the economy it comes with is to encourage savings, a low time preference, and thoughtful investment in growing the stock of capital. This is no manipulation at all, but rather the bottom-up natural state of an economy when individuals are left to their own machinations.

Fed Maintains Policy Rate But Strikes Dovish Tone

While the actions of other global central banks do matter in a global economy as discussed above, the Fed is nonetheless the tail that wags the dog.

Fed Chair Jerome Powell held the short-term interest rate steady at 5.5% yesterday, but the Fed maintained their forecast for three rate cuts in 2024. Powell also hinted at a slowing in the pace of balance sheet reduction (quantitative tightening or QT) in the near future, implying the Fed could begin to taper its QT program as soon as their next meeting at the end of April. Since June 2022, the Fed has been letting $95 billion of treasuries and MBS roll off its balance sheet every month in an effort to tighten monetary conditions. A reduction in the pace of run-off would typically be seen to be positive for stocks and other risk assets that are sensitive to liquidity.

Risk assets responded favorably to the announcement and the S&P 500 closed at a new all-time high. Bitcoin rallied 9% in the wake of the announcement from $62,000 to $67,500, reversing much of a 15% drawdown experienced over the previous week.

In his press conference, Chair Powell basically ignored the recent uptick in inflation readings, fueling market-wide speculation of monetary debasement.

MicroStrategy Accumulates 1% of 21 Million

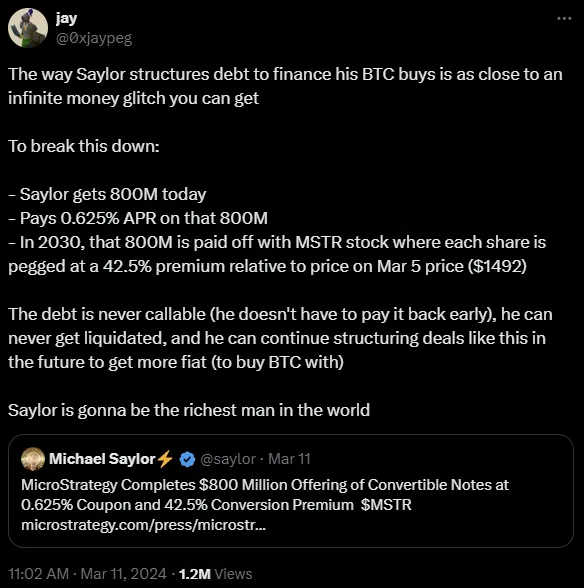

On Tuesday, MicroStrategy announced the completion of their latest offering of convertible notes, borrowing $603.75 million, and that they had acquired an additional 9,245 bitcoin with the proceeds, bringing their total stack to 214,216 BTC.

With the latest purchase, MicroStrategy has now accumulated more than 1% of the 21 million bitcoin there will ever be, primarily by borrowing fiat money at a sub-1% interest rate.

The latest borrowing came just a week after the company borrowed $800 million to fund the purchase of bitcoin:

Chart of the Week

2017:

- -41%

- -38%

- -29%

- -34%

- -41%

- -40%

- -27%

Markets don’t go up in a straight line!

Quote of the Week

“Powell has perhaps shown his cards: he needs a good reason not to cut rates, rather than a reason to cut rates. Markets perhaps couldn’t have asked for more from the Fed and equities will celebrate.”

— Seema Shah, Principal Asset Management’s Chief Global Strategist

Market Update

as of 3/20/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Bitcoin closed Wednesday down 10% from a week ago, but as of writing was continuing to rally on the dovish Fed press conference. Other risk assets responded to the Fed in the same manner, with the S&P 500 closing at an all-time high. Gold also broke out to a new all-time high. Oil rallied 2.2% on the week, and is now the second best performing asset class year-to-date behind bitcoin. The 10-year US treasury yield rose modestly as the Fed did not seem overly concerned about the recent uptick in inflation readings.

Podcasts of the Week

The Last Trade E042: Entering a New Paradigm with Mitch Kochman

In this episode of The Last Trade, Mitch Kochman, Director of Platform Sales at BitGo, joins the pod to discuss bitcoin ETF flows, the MSTR playbook, entering a new paradigm of bitcoin adoption, fiscal & monetary woes, mining news, & more.

Scarce Assets E006: Robert Breedlove – What is Money?

In this episode of Scarce Assets, Robert Breedlove joins the pod to discuss the philosophical underpinnings of money, the nature of freedom, the ills of central planning & fiat inflation, bitcoin’s game theory & more.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris