1/11/24 Roundup: 1Q24 Market Radar

Onramp Weekly Roundup

Written By Zack Morris

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

And now, for the weekly roundup…

1Q24 Market Radar

Now that the Current Thing — the spot bitcoin ETF — is finalized, investors can turn their attention to what lies ahead in Q1.

Here’s what’s on my radar, and what dates I’m marking on the calendar.

1/31: Treasury Quarterly Refunding Announcement

Arguably the reason for the market rally to end 2023 was the surprise contained in the Treasury’s last QRA released on November 1.

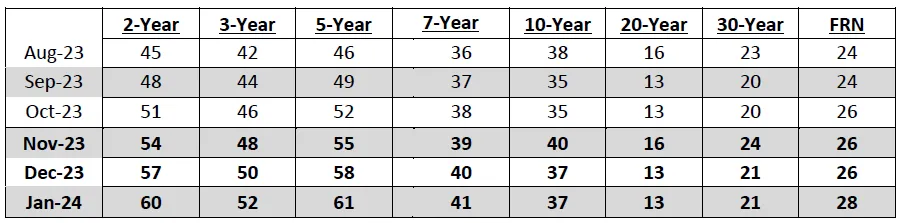

In it, the Treasury surprised the market by reducing expected coupon issuance for the next quarter in favor of increased bill issuance. The announcement came as a surprise because the Treasury deviated from its historical policy of targeting bill issuance in the 15-20% range of total issuance, and instead increased bill issuance to a whopping 58% in Q1 (Nov-Jan). The Treasury was already above target at 18% funded by bills coming into the QRA.

This came against the backdrop of the 10-30 year tenors of the yield curve breaching 5% for the first time this cycle, and some market participants took this extraordinary policy measure as a signal that the Treasury has a “red line” at 5% long-term interest rates. Reducing (expected) coupon issuance pushes long-term rates lower and bond prices up, all else equal, as it effectively represents a negative supply shock to the bond market.

Importantly, the rate of coupon issuance is still increasing to fund expanding government deficits…just more slowly than the market expected headed into last quarter’s QRA.

The table below presents, in billions of dollars, the actual auction sizes for the August to October 2023 quarter and the anticipated auction sizes for the November 2023 to January 2024 quarter that were released at the November QRA:

In shifting issuance from coupons to bills, the Treasury is able to tap sources of liquidity such as the Reverse Repo Facility (RRP — more on this later) to fund the government.

With 10-30 year yields now sitting around 4%, market participants will be watching this announcement eagerly to see if the Treasury reverts to historical policy and indeed attempts to tap the long-end for funding in the next quarter. If they do, it could effectively reverse the effects of the previous QRA, with a surprise to the upside in coupon issuance causing bond yields to rise, which would be a headwind for other financial assets.

My view is that the risks are to the downside for asset markets in the wake of the January 31 announcement.

3/12: Expiration of the Bank Term Funding Program

On March 12, 2023, the Bank Term Funding Program (BTFP) was created in order to support the banking system in the wake of the failures of Silicon Valley Bank and Signature Bank.

The new lending facility enabled banks to pledge US government bonds and MBS as collateral at par and obtain cash loans from the Fed at SOFR+10 bps, and had a term of one year.

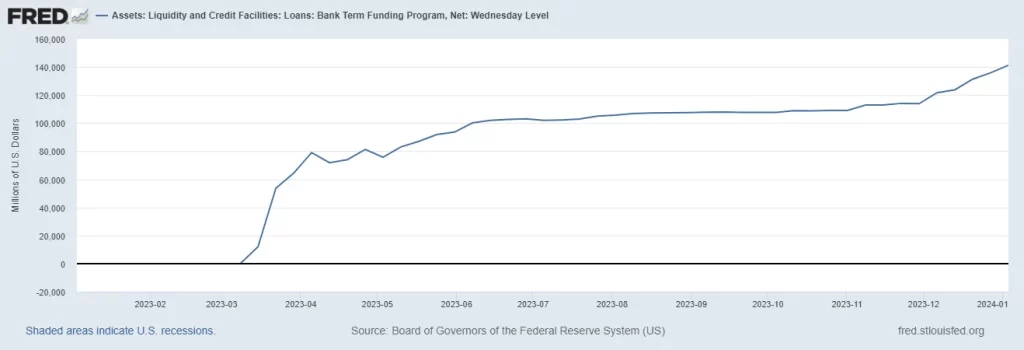

Since then, bank borrowings from the facility have only gone in one direction:

As of January 3, banks are collectively borrowing $141 billion from the BTFP.

As of March 12, banks are going to need to come up with $141 billion to repay the Fed, unless the program is extended.

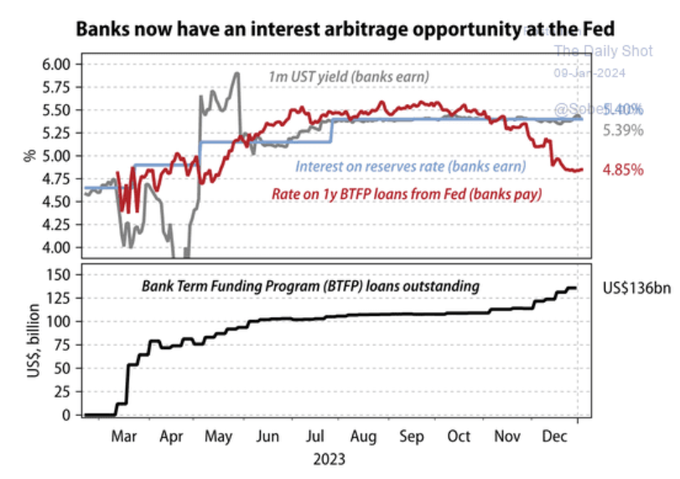

The recent uptick in bank borrowing from the BTFP, though, is probably not due to any increasing stress in the banking system. This chart, courtesy of Bob Elliott, shows that banks can now arbitrage the BTFP by borrowing at a lower rate than they can earn on reserves parked at the Fed:

Yes, banks are now arbing the emergency lending facility set-up to keep them afloat.

To the Fed’s credit, the program did work last year to stem the short-term banking panic, and bank equities found a bottom in May and rallied through the remainder of the year as the problems of March were largely forgotten.

Time will tell if investors have renewed fears about the stability of the banking system as attention turns to the pending expiration date in Q1.

If they do, if last year is any indication, bitcoin might sniff it out first.

If we take a look back, bitcoin was a leading indicator for equities through the banking woes in Q1 2023, falling 23% from 2/23 – 3/10, a period where the KRE regional banking index fell 18%.

By Saturday, 3/11 as we entered the weekend uncertain about the future of SVB, bitcoin had already bottomed and was front running the coming Fed liquidity.

On Monday, 3/13 when equity markets re-opened, bitcoin was in the process of putting in its third consecutive massive green candle on the way to new year-to-date highs, while the KRE fell another 12%.

We all know what happened the rest of the year after that.

Time and time again, bitcoin has sniffed out the turn in liquidity conditions before all other assets. If the price action turns negative in Q1, watch for equities to follow, and be on alert for potential problems in the banking sector to re-emerge.

3/20: Fed Rate Decision

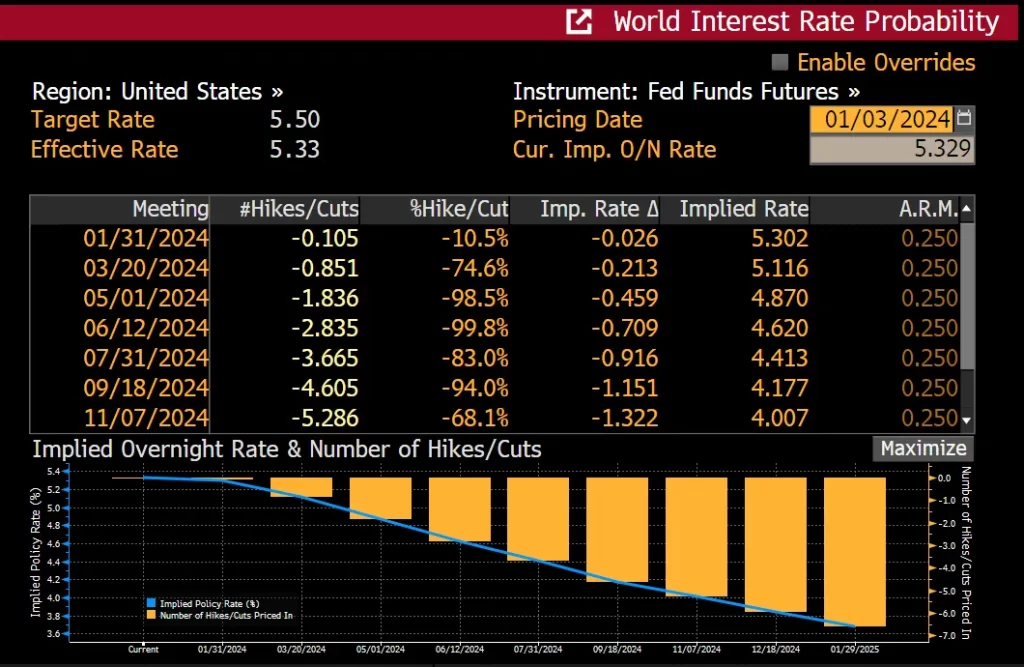

While the FOMC has an earlier meeting and rate policy decision on 1/31, all eyes are 3/20 as the meeting in which the Fed is expected to implement its first rate cut.

The below screenshot from Bloomberg, courtesy of Arthur Hayes, shows the market is pricing in a 75% chance of a 25 bps cut at the 3/20 meeting:

Moreover, the market is pricing in a whopping 6 rate cuts in 2024, and implying a ~4% fed funds rate by year’s end.

The confluence of this meeting and the expiration of the BTFP a week earlier make mid-March a time for investors to be especially prepared for volatility.

January Schedule of Quantitative Tightening

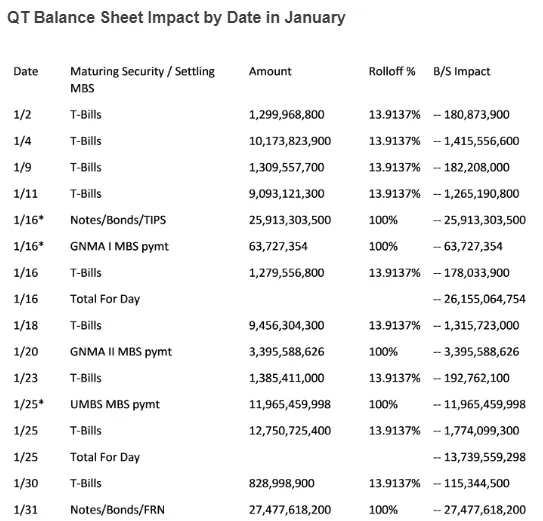

The Fed’s $95 billion a month QT program is scheduled to unfold as follows in January (courtesy of John Comiskey):

As these figures represent liquidity drains from the market, all else equal, the bigger drains have heightened risk of volatility on that day.

In January, the biggest days to watch out for are 1/16 (day after MLK day, -$26 billion) and 1/31 (-$27 billion). Note that the $27 billion 1/31 runoff corresponds with the QRA announcement at 8:30am ET.

Reverse Repo Facility (RRP) Drain

Finally, we get to the RRP.

The RRP represents cash parked at the Fed earning the Fed funds rate (currently 5.5%). A big chunk of this cash is coming from money market mutual funds.

Remember, the Treasury’s surprise increased issuance of bills was (likely) done with the (at the time) $1 trillion parked in the RRP in mind, designed to tap this source of liquidity to fund government issuance. Money markets are able and willing to swap out of the RRP for short-term bills, as short-term bills are cash-like instruments offering a little bit extra yield.

Since the November QRA, the RRP has been drained from $1 trillion to $676 billion, and at that rate of decline is set to fall below $200 billion — a level where it historically sat before the 2018 reverse repo crunch — around mid-March.

Many market participants are eyeing this piggy bank as the last remaining source of liquidity for US financial markets and anticipating volatility if and when it runs out, the timing of which should be on every investor’s radar given the potential to coincide with the expiration of the BTFP and the Fed’s 3/20 rates decision.

Plenty of fiat games to be played in Q1.

Podcasts of the Week

Scarce Assets E001: Value Investing via Bitcoin with Preston Pysh

In the inaugural episode of “Scarce Assets,” host Andy Edstrom and co-host Jesse Myers kick off the podcast with guest Preston Pysh, a prominent figure in both traditional finance and the Bitcoin space. They delve into the world of Bitcoin, its value as an investment, and the broader implications of its adoption. The episode covers a range of topics from Bitcoin’s scarcity and growth potential to the current state of Bitcoin mining and the recent regulatory proposals that could impact the industry.

Final Settlement E001: The Power of Open Protocols with Matt Odell

In the inaugural episode of the Final Settlement podcast, co-hosts Brian Cubellis, Head of Strategy & Research at Onramp, and Michael Tanguma, co-founder & CEO of Onramp, are joined by guest Matt Odell. This new podcast from the Onramp Media umbrella aims to explore Bitcoin not just as a financial instrument but as a foundational piece of technology with real-world utility. The discussion delves into Bitcoin’s protocol layer, its use as open-source software, and the various ways it can be leveraged to better society.

The Last Trade E032: New Year Narratives: AI & ETFs with Matt Dines

In this episode of the podcast, we delve into the latest developments in Bitcoin and the broader financial markets, as well as the impact of AI on the economy. We’re joined by Matt Dines from Build Asset Management, who shares his insights on these topics. The episode also features a discussion on the potential approval or delay of a Bitcoin ETF, which has the investment community on edge.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris