From Graham to Satoshi: A Value Investor’s Guide to Bitcoin

The Origins of Value Investing

The emergence of the “value investing” philosophy towards the end of the 1920s was not mere happenstance. The school of thought pioneered by Benjamin Graham and David Dodd at Columbia Business School (CBS) was in many ways a reaction to the unbridled financial exuberance that precipitated the Wall Street Crash of 1929, ultimately leading to the Great Depression. The Roaring Twenties were a period of post-war optimism, rapid industrial growth, urban expansion, and technological advancement. These transformative societal shifts were catalyzed, in part, by an increasingly financialized economy and the proliferation of stock market participation. With businesses booming and the common man experiencing unprecedented prosperity, the belief that “stocks only go up” became firmly embedded in the public consciousness.

Of course, this trajectory – fueled by easy monetary conditions and excessive leverage – was unsustainable. Moreover, the lack of regulations and standardized company financials precluded most investors from implementing disciplined investment strategies. Insider trading was legal and deceptive accounting practices went unchecked, making it exceedingly difficult to determine whether a particular stock was a wise investment. As a result, the predominant investment approach during that time was speculative in nature and driven by a herd mentality, ultimately leading to a massively overvalued market which eventually crashed in spectacular fashion.

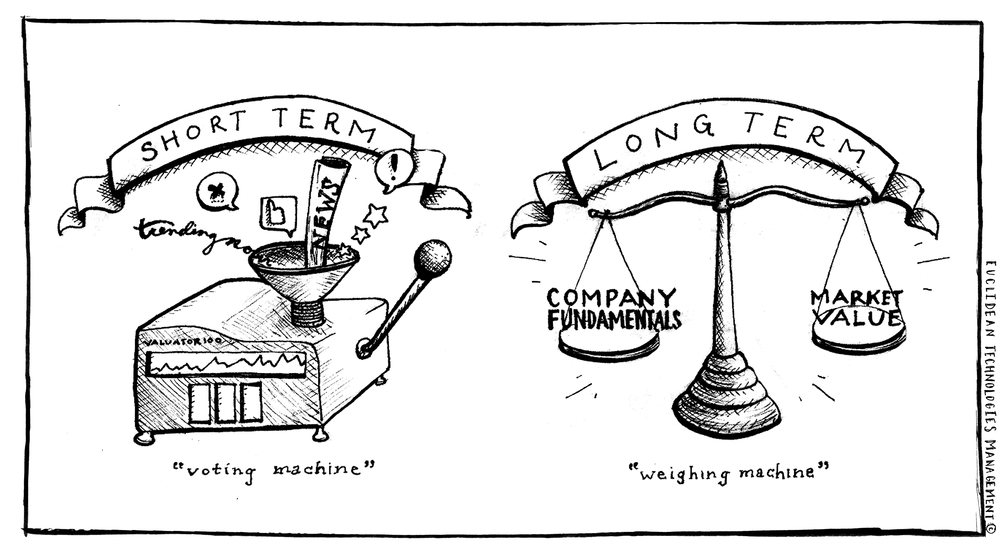

Graham – considered the father of value investing – observed this tumultuous period firsthand, suffering severe losses during the Great Crash, prompting him to rethink his investment methodology from first principles. In doing so, he created a detailed framework for determining the true worth – or intrinsic value – of a stock through fundamental research and analysis. A stark departure from the prevailing approach of the 1920s which wrought a speculative bubble, value investing was predicated on the idea that the market clearing price of a given asset was not always indicative of its true underlying value. Instead, Graham viewed the market as an erratic pricing mechanism driven by investors’ emotions, a concept encapsulated by his famous analogy framing the market as an investor’s business partner named Mr. Market, who’s willing to buy or sell company shares each day at different prices depending on his mood. Said another way, the market acts as a short-term voting machine, but a long-term weighing machine.

“Mr. Market’s job is to provide you with prices; your job is to decide whether it is to your advantage to act on them.” – Benjamin Graham, The Intelligent Investor (1949)

An Ever-Evolving Framework

Most simply, value investing entails buying something for less than it’s truly worth. This fundamental concept has endured as a core tenet of the professional investment community for nearly a century following Graham’s initial musings. His teachings inspired the likes of Warren Buffett, who was a student of Graham’s at CBS in the early 1950s, and went on to establish one of the most prolific track records in the history of investment management. Over time, however, elements of the value investing framework have evolved and been adapted to an ever-changing financial landscape. For instance, Buffett’s approach to value investing prioritized more qualitative factors – outside of purely quantitative metrics which Graham relied on – such as competitive moats, barriers to entry, and management excellence.

All these principles, rooted in long-term fundamentals, have most commonly been applied to the world of traditional stocks. However, it’s worth considering how these principles might apply to newer asset classes. Bitcoin, despite not being a conventional security, is a compelling case study for analysis under this framework. Through understanding the fundamental underpinnings of the asset and plausible trajectory of the network, there’s a strong argument to be made that bitcoin represents a deeply undervalued investment opportunity, and its thesis may be best understood through the lens of value investing.

Applications of the Value Investing Framework to the Bitcoin Thesis

In our view, buying and holding bitcoin for the long-term represents a logical modern interpretation of value investing. While counterintuitive to some, many of the foundational elements of value investing can be directly applied to the investment case for bitcoin. Let’s explore some of the ways in which value investing concepts are deeply aligned with the bitcoin thesis:

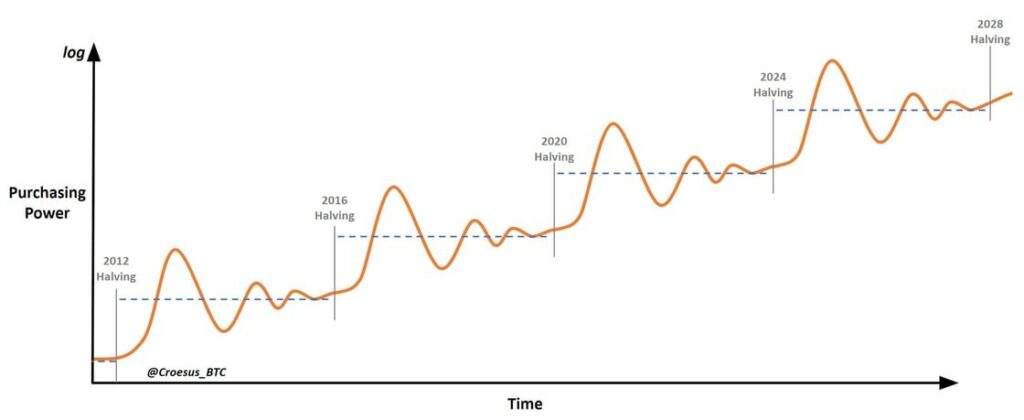

(1) Long-term investment horizon: Value investing necessitates an investor’s ability to ignore volatility and willingness to wait for the market to realize the asset’s true value. The best investments are those that can be held indefinitely. Within a value investing framework, the historically outsized volatility of bitcoin should be perceived not as a risk, but as an opportunity that can be captured by maintaining a long-term investment horizon and blocking out near-term noise.

“The stock market is designed to transfer money from the active to the patient.” … “Uncertainty actually is the friend of the buyer of long-term values.” – Warren Buffett

(2) Contrarian mindset: Following the herd and chasing performance are antithetical to the value investing ethos. Instead, investment decisions should be made from first principles by identifying information asymmetries. The rampant misconceptions and lack of understanding around bitcoin (as well as our existing monetary system) have perpetuated its standing as a contrarian investment.

“It is always easiest to run with the herd; at times, it can take a deep reservoir of courage and conviction to stand apart from it. Yet distancing yourself from the crowd is an essential component of long-term investment success.” – Seth Klarman

(3) The power of compounding returns: The concept of compounding in value investing is akin to a snowball rolling downhill; with time and patience, small gains can accumulate and exponentially grow an investment’s value. Importantly, this mathematical concept can also be applied to the often clandestine debasement of currencies – recognizing the slow and covert erosion of purchasing power via inflation is critical in understanding the value proposition of bitcoin.

“It is obvious that a variation of merely a few percentage points has an enormous effect on the success of a compounding (investment) program. It is also obvious that this effect mushrooms as the period lengthens.” – Warren Buffett

(4) Comfortability with concentration: A somewhat unconventional notion within value investing is that investors should embrace concentration, as opposed to subscribing to the widespread belief that portfolio diversification is paramount. When an investor truly discerns the intrinsic value of an asset, they should size their investments to reflect that conviction, even if it leads to a more focused portfolio. In the context of bitcoin, a deep understanding of the technology, its unique attributes as a digital store-of-value, and its overall adoption trajectory, may warrant an outsized investment.

“Diversification is protection against ignorance. It makes little sense if you know what you are doing.” – Warren Buffett

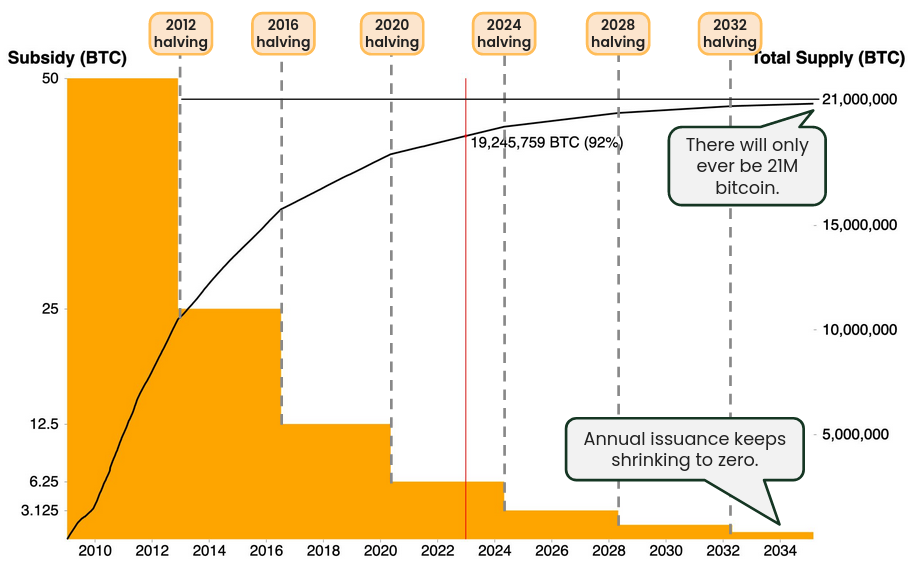

(5) Management excellence: A core tenet of value investing surrounds the excellence and integrity of a company’s management team. Investors should intensely scrutinize leadership to ensure the stewards of their capital are both competent and trustworthy. When this perspective is juxtaposed with bitcoin, an intriguing parallel emerges. Instead of a tangible team of executives, bitcoin’s foundation rests on meticulously crafted code and an immutable monetary policy. Trust is placed not in fallible humans but in the infallible mathematical principles governing the protocol. As such, bitcoin’s appeal in the realm of “management excellence” lies in its absence of human intervention, offering investors a transparent and deterministic financial instrument they can trust.

“Modern life creates successful bureaucracy and successful bureaucracy breeds failure and stupidity.” – Charlie Munger

(6) Competitive moats & barriers to entry: Value investing places a significant emphasis on the importance of competitive advantages, ensuring that a company retains its edge and safeguards its position in the market. Bitcoin’s origins, often referred to as an “immaculate conception,” represent a profound first-mover advantage in the creation of digital scarcity. Bitcoin’s growing network effect, combined with its unrivaled level of decentralization, supports its dominant market position. As a result, the hurdles for any new entrant trying to replicate or introduce a similar form of digital scarcity become insurmountable, reinforcing bitcoin’s inherent value proposition.

“The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.” – Warren Buffett

Value Investing is Not Dead

Similar to the often-proclaimed “death of bitcoin” from mainstream media outlets throughout its history, the “death of value investing” has been proclaimed countless times over the past few decades. Indeed, the mantra of “growth at any cost” has dominated markets in the 21st century and the persistent shift from “active” towards “passive” index investing has also played an important role in the perceived ineffectiveness of value investing, as equity market performance has been increasingly concentrated in a handful of mega-cap growth stocks. That being said, value investing will always inherently be somewhat out of favor simply due to the behavioral tendencies of humans to chase performance.

“Value investing does not appeal to the masses. If it did, you would never be able to buy a bargain.” – Arnold Van Den Berg

Moreover, the continued debasement of the currency via money printing and the artificially low cost of capital we’ve observed over the past few decades are contributing factors in growth being favored over value. However, despite the underperformance of “value” relative to “growth” strategies in equity markets, the fundamental tenets of value investing have timeless merit. Value investing represents the ability to foresee future growth before it manifests in the asset’s financials or before the market appreciates its true value potential.

“Opportunity arises when the gap between reality and perception becomes significant.” – Francois Rochon

Bitcoin Obituaries (Source: https://99bitcoins.com/bitcoin-obituaries/)

Much like bitcoin, value investing will never die. They both may appear to be out-of-favor for extended periods of time, but therein lies the asymmetric opportunity for investors who are willing to put in the work to deeply understand the full value potential of a digitally-native, energy-backed, cryptographically-secured, open-source, fairly-distributed, scarce commodity. Benjamin Graham, Warren Buffett and their many disciples may not realize it yet, but they’ve provided a useful toolkit in understanding the investment case for bitcoin.

Onramp provides guidance and solutions for HNWI and institutional-level Bitcoin buyers and holders. To learn more, visit onrampbitcoin.com or schedule a consultation to chat with us about your situation and needs.